1. What is the projected Compound Annual Growth Rate (CAGR) of the Signal and Data Line Surge Protective Device?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Signal and Data Line Surge Protective Device

Signal and Data Line Surge Protective DeviceSignal and Data Line Surge Protective Device by Type (AC Surge Protective Devices, DC Surge Protective Devices), by Application (Residential, Commercial, Industrial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

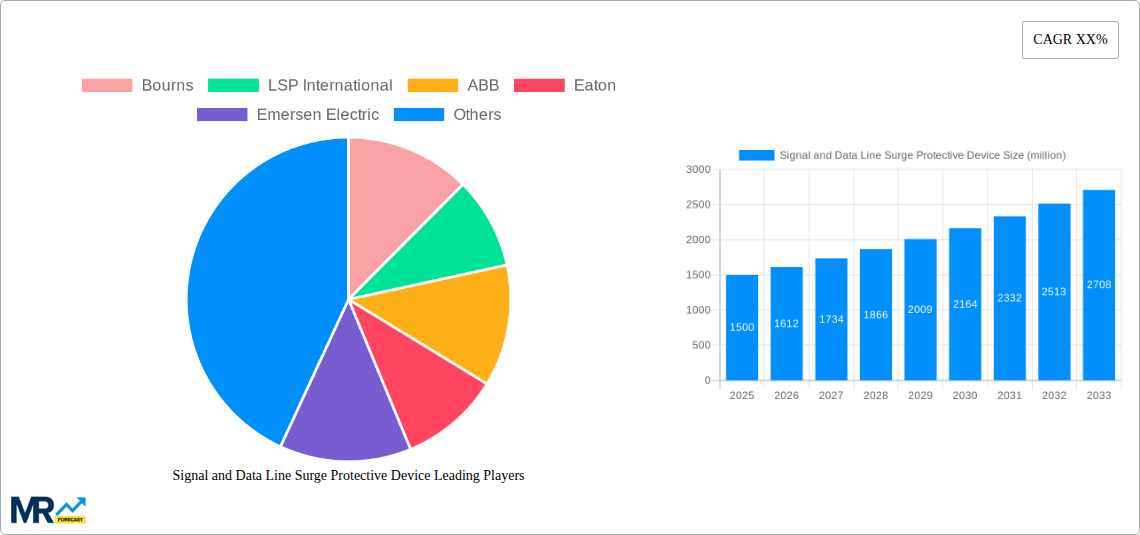

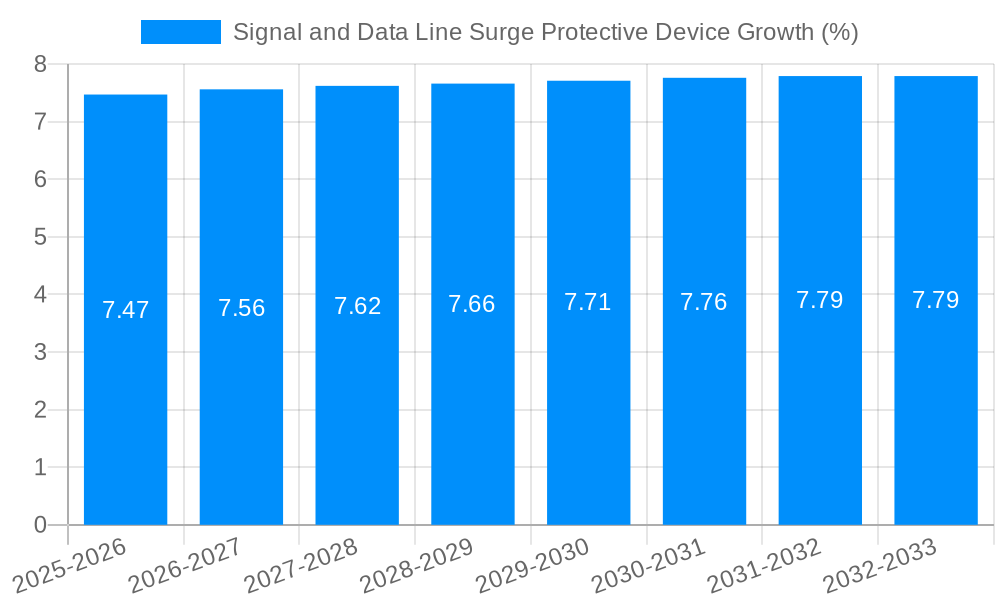

The Signal and Data Line Surge Protective Device market is poised for substantial expansion, projected to reach approximately $1,500 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of around 7.5% anticipated through 2033. This growth is primarily propelled by the escalating integration of sensitive electronic equipment across residential, commercial, and industrial sectors, all of which require robust protection against transient overvoltages. The increasing adoption of smart technologies, the Internet of Things (IoT), and high-speed data networks further fuel demand, as these systems are inherently vulnerable to data corruption and hardware damage from power surges. Furthermore, stringent safety regulations and the growing awareness of the financial implications of equipment downtime are compelling end-users to invest proactively in surge protection solutions. The market’s trajectory is further bolstered by continuous innovation in device technology, leading to more compact, efficient, and intelligent surge protective devices.

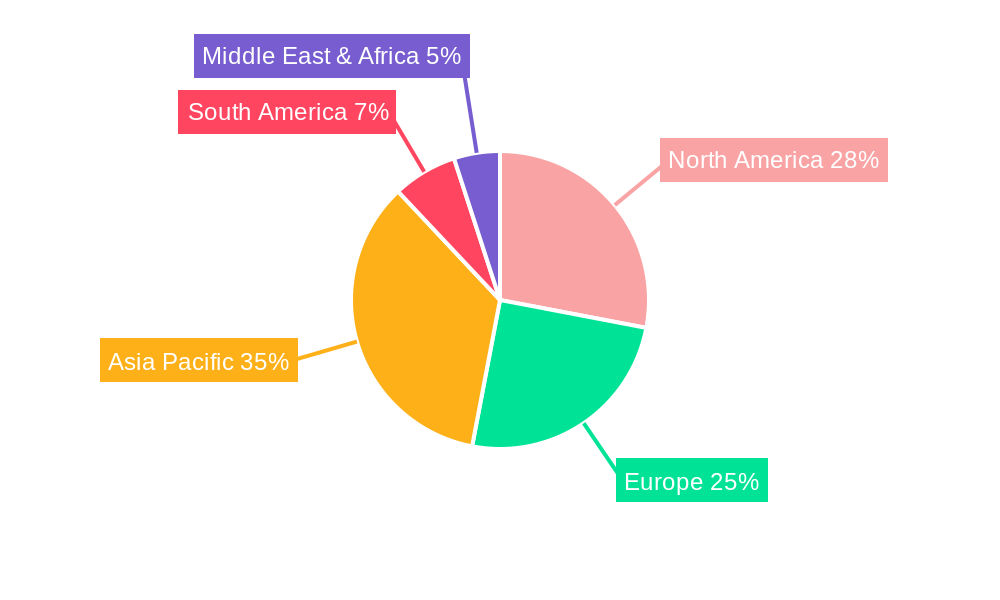

The market is segmented into AC Surge Protective Devices and DC Surge Protective Devices, catering to diverse power and signal requirements. Geographically, Asia Pacific, led by China and India, is emerging as a significant growth engine due to rapid industrialization, increasing digitalization, and substantial investments in infrastructure development. North America and Europe, mature markets with high adoption rates of advanced technologies and strong regulatory frameworks, continue to represent significant market share. However, the market is not without its challenges. High initial investment costs for advanced surge protection systems and a lack of awareness in certain developing regions can act as restraints. Despite these hurdles, the persistent need for safeguarding critical infrastructure and data integrity, coupled with technological advancements and favorable governmental initiatives, ensures a robust and upward market trend for signal and data line surge protective devices.

Here's a unique report description for a Signal and Data Line Surge Protective Device market analysis, incorporating your specific requirements:

The global Signal and Data Line Surge Protective Device (SPD) market is projected to witness robust expansion, with an estimated market valuation in the tens of millions of units by 2025, and is expected to grow exponentially through 2033. This upward trajectory is underpinned by a confluence of factors, including the ever-increasing reliance on sophisticated electronic equipment across all sectors, the escalating incidence of destructive lightning strikes and power surges, and a growing awareness of the significant financial and operational disruptions caused by unprotected systems. The historical period from 2019 to 2024 has seen a steady adoption rate, driven by nascent awareness and early-stage regulatory mandates in select regions. However, the base year of 2025 marks a pivotal point, where proactive surge protection is transitioning from a niche concern to a standard component in system design and maintenance. The forecast period of 2025-2033 is anticipated to witness a surge in demand, fueled by advancements in SPD technology, such as increased clamping efficiency, miniaturization, and the integration of smart monitoring capabilities. This evolving landscape indicates a shift towards more intelligent and resilient infrastructure, where SPD's are no longer an afterthought but an integral part of ensuring the longevity and operational integrity of sensitive electronic assets. The market's expansion will be characterized by an increasing penetration of higher-performance SPD's capable of handling more extreme surge events, mirroring the increasing complexity and value of the systems they protect.

The relentless digital transformation across industries is a primary engine driving the demand for signal and data line surge protective devices. As businesses integrate an ever-greater number of interconnected devices, sensors, and communication networks, the vulnerability to transient overvoltages amplifies. The proliferation of the Internet of Things (IoT), smart grids, and advanced telecommunications infrastructure necessitates robust protection mechanisms to safeguard these critical data pathways. Furthermore, the increasing frequency and intensity of extreme weather events globally contribute to a higher incidence of power surges and lightning strikes, thereby elevating the perceived risk and the urgency for effective SPD deployment. Regulatory frameworks are also playing a crucial role, with an increasing number of standards and certifications mandating the use of surge protection in various applications, particularly in sectors like industrial automation, telecommunications, and transportation. The economic imperative to minimize downtime and prevent costly equipment damage further fuels market growth, as organizations recognize that the upfront investment in SPD's offers a significantly higher return in terms of operational continuity and reduced repair expenses.

Despite the promising growth outlook, the signal and data line surge protective device market faces several inherent challenges. A primary restraint is the initial cost of implementing comprehensive surge protection solutions, especially for smaller businesses or in cost-sensitive applications. This can lead to a perception of surge protection as a discretionary expense rather than a critical investment. Moreover, a lack of widespread awareness regarding the specific threats posed by transient overvoltages and the nuanced differences between various SPD technologies can hinder optimal product selection and deployment. This knowledge gap can result in the use of inadequate or mismatched protection, leading to system failures. The rapidly evolving nature of electronic components and communication protocols also presents a challenge, as SPD manufacturers must continuously innovate to ensure their products remain compatible and effective against new types of surge phenomena. Finally, the global supply chain complexities and potential price volatility of raw materials used in SPD manufacturing can impact production costs and lead times, posing a potential restraint on market expansion.

The Industrial segment, coupled with the Asia Pacific region, is poised to dominate the signal and data line surge protective device market during the forecast period. The Asia Pacific region's dominance stems from its rapid industrialization, burgeoning manufacturing sector, and extensive investments in infrastructure development. Countries like China, India, and Southeast Asian nations are witnessing a significant surge in the deployment of advanced manufacturing facilities, smart factories, and robust telecommunications networks. These environments are inherently data-intensive and reliant on continuous operational uptime, making them prime candidates for advanced surge protection.

Within the Industrial segment, the application of SPDs is critical for safeguarding highly sensitive and expensive equipment. This includes:

The sheer scale of industrial operations and the high cost of potential failures in these sectors make them the most significant adopters of both AC and DC surge protective devices, as well as specialized data and signal line SPDs. As these industries continue to expand and integrate more digital technologies in the Asia Pacific region, their demand for these protective devices will be unparalleled.

The continuous advancement in semiconductor technology and the increasing miniaturization of electronic components are key growth catalysts. As devices become smaller and more sophisticated, they also become more susceptible to even minor voltage fluctuations. This necessitates the development and adoption of highly efficient and compact SPD solutions. The expanding digital infrastructure, including the proliferation of data centers and the rollout of 5G networks, creates a significant demand for reliable data line protection. Furthermore, growing governmental initiatives and smart city projects worldwide are driving investments in resilient infrastructure, where surge protection is a fundamental requirement.

Here are some of the leading players in the Signal and Data Line Surge Protective Device sector:

Here are some significant developments in the Signal and Data Line Surge Protective Device sector:

This comprehensive report delves into the intricate dynamics of the Signal and Data Line Surge Protective Device market, spanning a study period of 2019-2033. It provides an in-depth analysis of market size, segmentation, and growth drivers, with a base year estimation of 2025 and a detailed forecast for 2025-2033. The report meticulously examines the role of key industry players, such as Bourns, LSP International, and ABB, and evaluates the impact of industry developments and emerging trends. Furthermore, it addresses the challenges and restraints influencing market expansion, offering strategic insights for stakeholders to navigate the evolving landscape and capitalize on future opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Bourns, LSP International, ABB, Eaton, Emersen Electric, Schneider Electric, Raycap, Phoenix Contact, Legrand, Saltek, Citel, Stabil, Pepperl+Fuchs, Transtector, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Signal and Data Line Surge Protective Device," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Signal and Data Line Surge Protective Device, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.