1. What is the projected Compound Annual Growth Rate (CAGR) of the Semiconductor Grade Nitrogen?

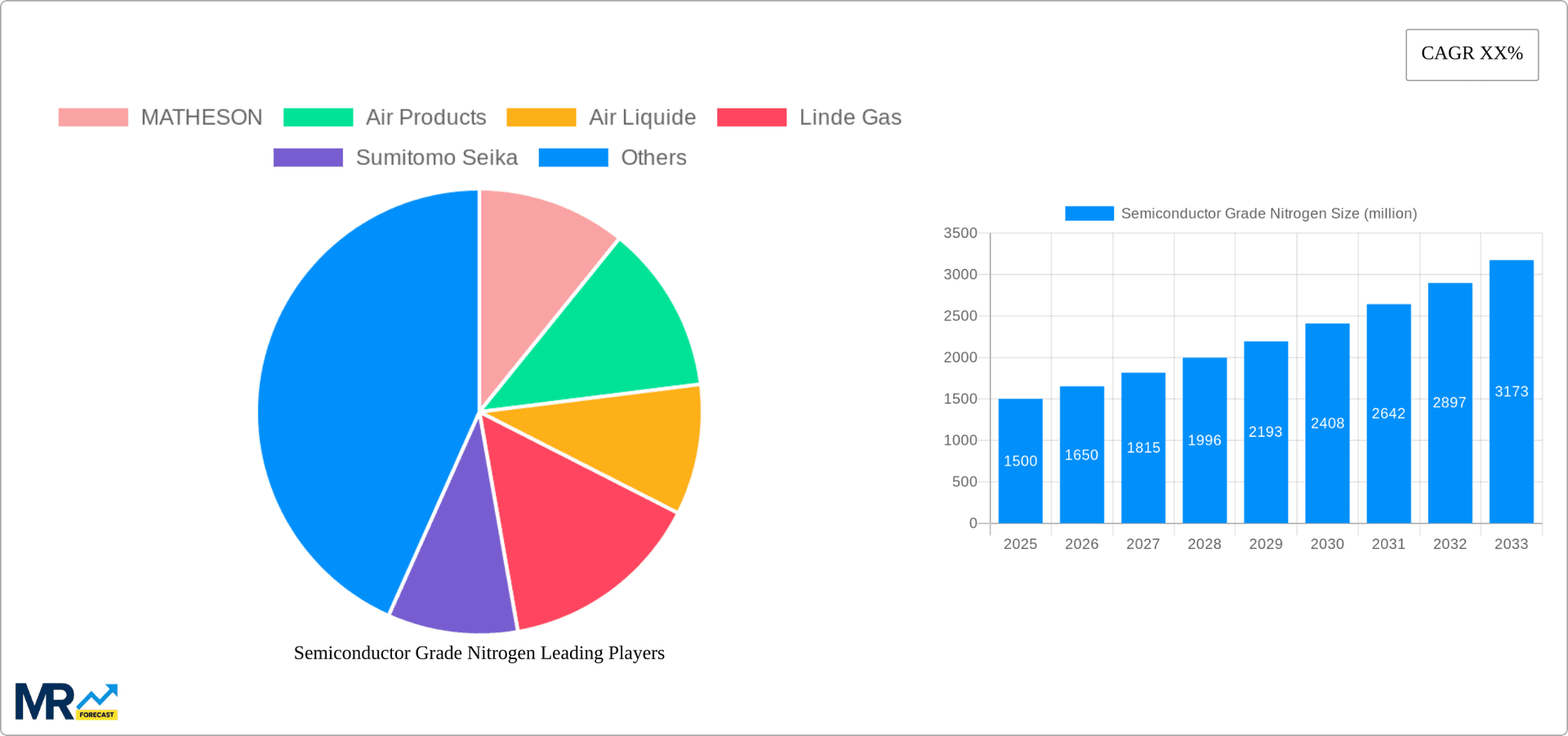

The projected CAGR is approximately 6.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Semiconductor Grade Nitrogen

Semiconductor Grade NitrogenSemiconductor Grade Nitrogen by Type (5N, 6N), by Application (Atmosphere Control and Protection, Chemical Vapor Deposition (Cvd) and Physical Vapor Deposition (Pvd), Packaging and Welding, Temperature Control, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

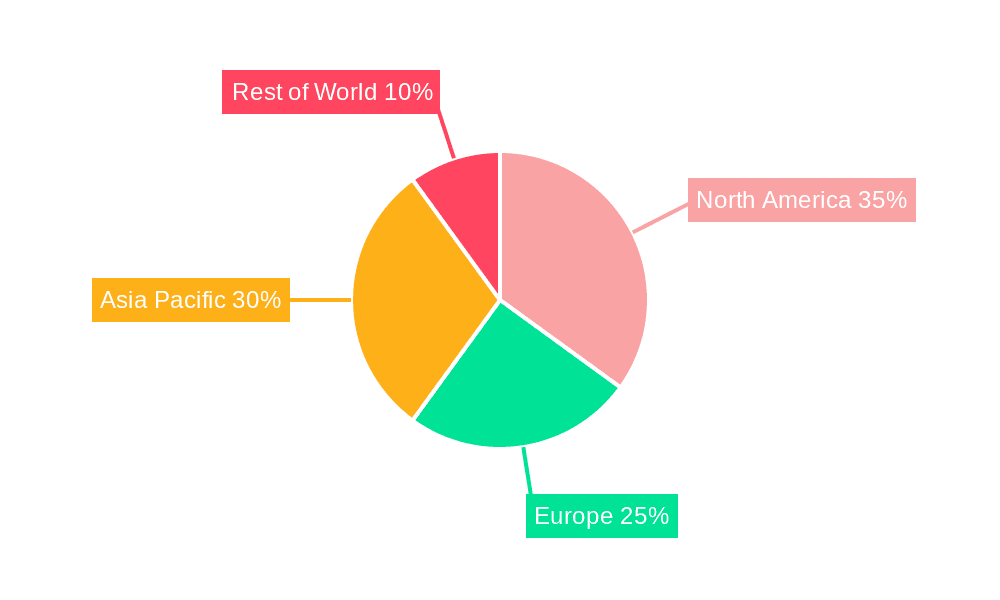

The global semiconductor grade nitrogen market is experiencing robust growth, driven by the burgeoning semiconductor industry and its increasing demand for high-purity nitrogen in various manufacturing processes. The market's expansion is fueled by the proliferation of electronics across numerous sectors, including automotive, healthcare, and consumer electronics. Advancements in semiconductor technology, such as the rise of 5G and the Internet of Things (IoT), are further stimulating demand for advanced semiconductor grade nitrogen with higher purity levels (5N and 6N). Major applications include atmosphere control and protection during manufacturing, chemical vapor deposition (CVD) and physical vapor deposition (PVD) processes, packaging and welding of semiconductor components, and temperature control. Leading players like Matheson, Air Products, Air Liquide, Linde Gas, and Sumitomo Seika are strategically investing in capacity expansion and technological advancements to meet this escalating demand. While the market faces potential restraints from fluctuating raw material prices and stringent regulatory compliance requirements, the long-term outlook remains positive, largely due to sustained growth in global semiconductor production and the development of more sophisticated semiconductor devices. Geographical analysis reveals a strong presence across North America and Asia-Pacific, reflecting the concentration of major semiconductor manufacturing hubs in these regions. The market is expected to witness considerable growth across all application segments, especially in areas like advanced packaging and the production of high-performance computing chips.

The competitive landscape is characterized by a mix of large multinational corporations and specialized gas suppliers. The market is relatively consolidated, with the leading players commanding a significant share. However, niche players focusing on specific applications or regions are also emerging. Future market developments are likely to include an increased focus on sustainability, with companies adopting eco-friendly production methods and exploring alternative nitrogen sourcing options. Furthermore, innovations in nitrogen purification technologies will play a crucial role in driving further improvements in purity levels and reducing production costs. The continued miniaturization of semiconductor devices will require ever-higher purity levels, which will further propel the demand for semiconductor-grade nitrogen in the coming years. This market is poised for substantial growth across the forecast period, presenting significant opportunities for established players and new entrants alike.

The global semiconductor grade nitrogen market is experiencing robust growth, driven by the surging demand for advanced semiconductors across various applications. The study period from 2019 to 2033 reveals a significant upward trend in consumption value, exceeding several billion USD by 2033. The market is characterized by a strong preference for higher purity grades, with 6N nitrogen witnessing particularly rapid adoption due to its critical role in cutting-edge semiconductor manufacturing processes. This trend is fueled by the increasing complexity and miniaturization of semiconductor devices, demanding ever-higher levels of purity to prevent defects and ensure optimal performance. The estimated year 2025 shows a market value exceeding several hundred million USD, reflecting the continued investment in advanced semiconductor fabrication facilities globally. The forecast period (2025-2033) projects continued strong growth, driven by factors such as the expanding 5G infrastructure, the proliferation of IoT devices, and the rising adoption of advanced technologies like AI and high-performance computing. Market players are strategically focusing on expanding their production capacities, enhancing product quality, and developing innovative solutions to meet the growing demand. The historical period (2019-2024) established a baseline of market behavior which the current growth is building upon, indicating consistent and substantial market expansion. Furthermore, technological advancements in nitrogen purification and delivery systems are contributing to increased efficiency and cost-effectiveness, fostering further market expansion.

The semiconductor industry's relentless pursuit of miniaturization and performance enhancement is the primary catalyst for the growth of the semiconductor grade nitrogen market. The fabrication of advanced semiconductor devices requires an extremely pure environment to prevent contamination and defects. Nitrogen, with its inert properties, plays a crucial role in maintaining such environments during various manufacturing stages. The increasing demand for high-performance computing, artificial intelligence, and 5G technology is fueling the expansion of semiconductor production facilities globally. This directly translates to a higher demand for ultra-high purity nitrogen to support these advanced manufacturing processes. The automotive and consumer electronics sectors, key consumers of semiconductors, are also experiencing rapid growth, further accelerating the demand for semiconductor grade nitrogen. Moreover, stringent regulatory requirements concerning environmental protection and safety standards within the semiconductor industry encourage the use of nitrogen in various applications, promoting its market adoption. The expansion of research and development activities related to advanced semiconductor materials and technologies also drives the demand for higher-purity nitrogen.

Despite the positive growth trajectory, the semiconductor grade nitrogen market faces certain challenges. The fluctuating prices of raw materials and energy can impact the overall production cost and profitability for manufacturers. Maintaining the extremely high purity levels required for semiconductor-grade nitrogen necessitates advanced purification technologies which represent a significant capital investment. Competition among major players is intense, requiring companies to continually innovate and improve their product offerings to maintain market share. The geographic concentration of semiconductor manufacturing facilities can create regional supply chain bottlenecks impacting availability and potentially leading to price fluctuations. Furthermore, stringent safety regulations and environmental concerns associated with nitrogen handling and transportation add to the operational costs. Lastly, the cyclical nature of the semiconductor industry can lead to periods of slower growth or even decline, affecting the demand for semiconductor-grade nitrogen.

The Asia-Pacific region, particularly countries like Taiwan, South Korea, and China, is expected to dominate the semiconductor grade nitrogen market due to the high concentration of semiconductor manufacturing facilities in these regions. North America and Europe also hold significant market share, driven by robust semiconductor industries and ongoing investments in advanced technologies.

Dominant Segment: Application - Atmosphere Control and Protection: This segment is crucial in preventing oxidation and contamination during wafer fabrication, accounting for the largest portion of the overall consumption value. The demand for this application is intrinsically linked to the overall growth of the semiconductor industry, and the increasing complexity of chip manufacturing processes necessitates advanced atmosphere control solutions using high purity nitrogen. This application's reliance on consistently high volumes of ultra-pure nitrogen guarantees its continued dominance throughout the forecast period.

Dominant Segment: Type - 6N Nitrogen: The demand for 6N nitrogen is rising exponentially as it becomes increasingly critical in the fabrication of leading-edge chips. The higher purity minimizes defects and ensures superior performance, making it indispensable for the production of advanced semiconductor devices. The higher cost of 6N nitrogen is outweighed by the benefits of increased yield and reduced scrap, driving its market share upward. 5N nitrogen maintains significant use, though the trend clearly points toward a larger market share for 6N in the coming years.

Several factors are driving the growth of this industry: The expanding adoption of 5G and other high-speed communication technologies fuels demand for high-performance chips. The increasing use of semiconductors in diverse applications, from automotive to healthcare, is expanding the overall market size. Continued innovation in semiconductor manufacturing processes and materials leads to increased demand for higher-purity nitrogen. Stringent environmental regulations encourage the use of safer and cleaner inert gases like nitrogen.

This report provides a comprehensive analysis of the semiconductor grade nitrogen market, encompassing market size, growth drivers, challenges, and key players. It offers valuable insights into the future trends of the industry, assisting stakeholders in strategic planning and decision-making. The report’s detailed segmentation by type (5N, 6N) and application allows for a granular understanding of the market dynamics, providing a valuable tool for investors, industry professionals, and researchers. The detailed regional analysis enables the identification of high-growth areas and potential investment opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.2%.

Key companies in the market include MATHESON, Air Products, Air Liquide, Linde Gas, Sumitomo Seika, Praxair, Mitsui Chemicals.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Semiconductor Grade Nitrogen," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Semiconductor Grade Nitrogen, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.