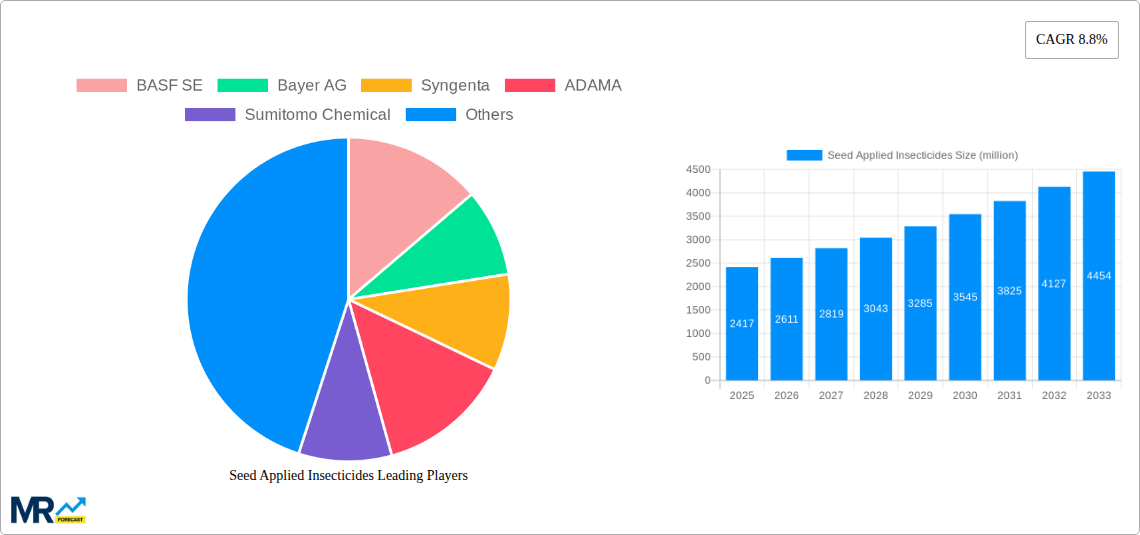

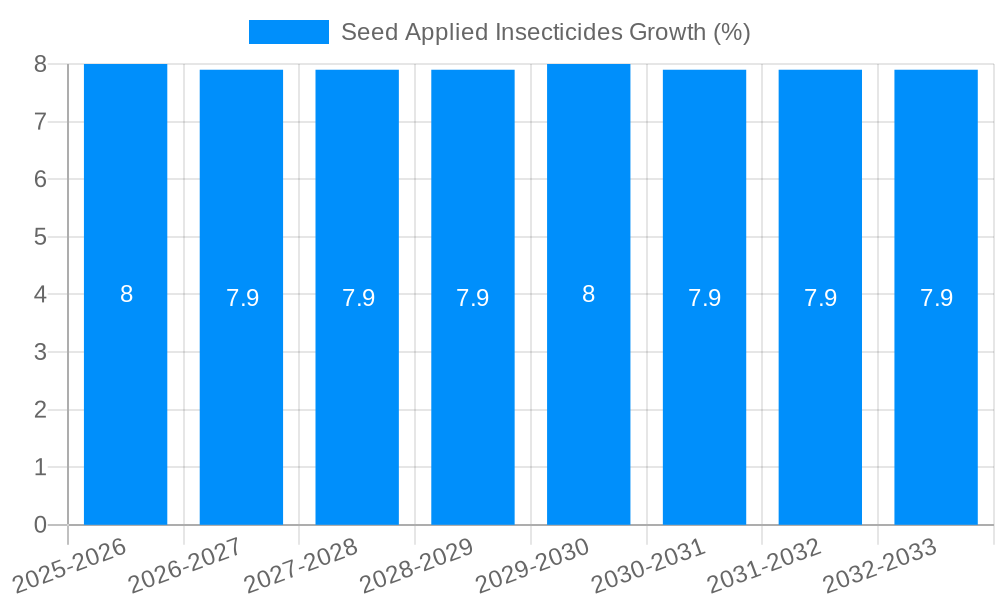

1. What is the projected Compound Annual Growth Rate (CAGR) of the Seed Applied Insecticides?

The projected CAGR is approximately 8.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Seed Applied Insecticides

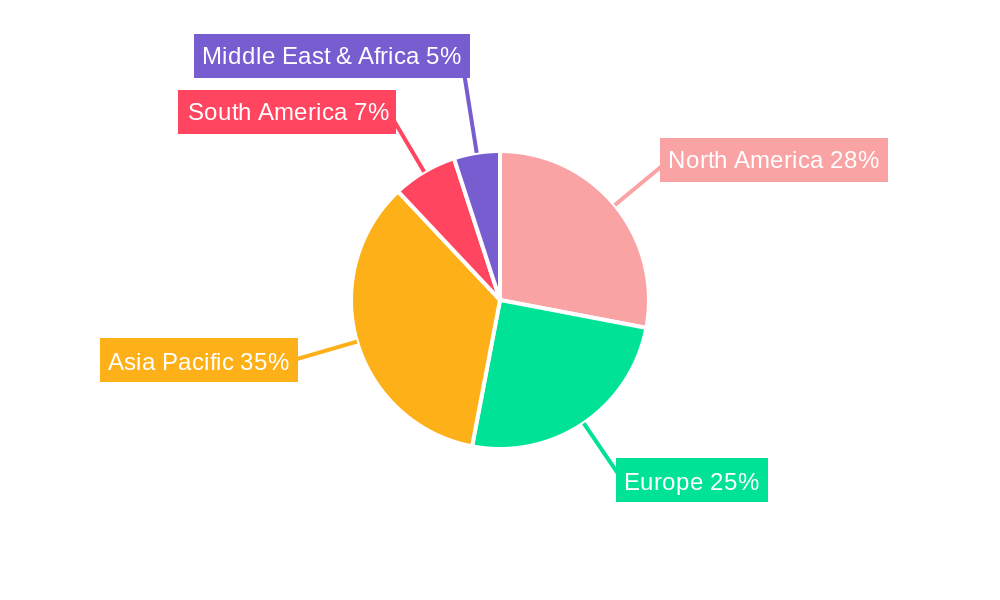

Seed Applied InsecticidesSeed Applied Insecticides by Type (Chemical, Biological, Others), by Application (Row Crops, Vegetables and Fruits, Ornamental Plants), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Seed Applied Insecticides market is poised for substantial growth, projected to reach an estimated market size of approximately USD 2417 million by 2025. This impressive expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 8.8% from 2019 to 2033, indicating a strong and sustained demand for advanced crop protection solutions. The primary drivers fueling this market surge include the increasing global population, necessitating higher agricultural output, and the growing adoption of precision agriculture techniques. Seed treatment offers an efficient and targeted method to protect young plants from early-season insect pests, thereby reducing overall pesticide usage and minimizing environmental impact. Furthermore, the rising awareness among farmers about the benefits of seed treatments, such as enhanced germination rates, improved plant vigor, and reduced labor costs, contributes significantly to market penetration. The market is also witnessing innovation in the development of novel chemical and biological insecticide formulations, catering to a wider range of pests and crop types.

The market segmentation reveals a dynamic landscape, with the Chemical segment expected to dominate due to its established efficacy and broader application range. However, the Biological segment is anticipated to experience a remarkable growth trajectory, driven by increasing consumer demand for organic produce and stricter regulatory environments for conventional pesticides. In terms of applications, Row Crops, particularly corn and soybeans, will continue to be the largest segment, owing to their widespread cultivation. Vegetables and Fruits, along with Ornamental Plants, represent high-growth sub-segments as growers seek to protect high-value crops from insect damage. Geographically, the Asia Pacific region, led by China and India, is projected to emerge as a key growth engine, fueled by expanding agricultural land, government initiatives supporting modern farming practices, and a large farmer base. North America and Europe will remain significant markets, driven by technological advancements and the adoption of sustainable agricultural solutions. Major players like BASF SE, Bayer AG, and Syngenta are actively investing in research and development to offer innovative and eco-friendly seed treatment solutions, further shaping the market's future.

The global Seed Applied Insecticides (SAI) market is poised for significant expansion, projected to surge from an estimated $5,800 million in the Base Year of 2025 to a remarkable $8,500 million by the Estimated Year of 2033. This robust growth trajectory, spanning a comprehensive study period from 2019 to 2033, is a testament to the increasing adoption of these advanced crop protection solutions. The historical period from 2019 to 2024 has laid a strong foundation, witnessing steady market penetration driven by the inherent advantages of seed treatments over traditional foliar applications. A key insight for the forecast period of 2025-2033 is the intensifying focus on biological insecticides. While chemical insecticides continue to hold a dominant market share, the demand for sustainable and environmentally friendlier alternatives is steadily growing. This shift is fueled by evolving regulatory landscapes and heightened consumer awareness regarding pesticide residues and their impact on biodiversity. The market is also witnessing innovation in delivery mechanisms, with advancements in seed coating technologies enhancing the efficacy and precision of insecticide application. For instance, advancements in microencapsulation techniques allow for a more controlled release of active ingredients, extending their protective duration and minimizing off-target effects. The increasing integration of digital technologies, such as precision agriculture platforms and data analytics, is further optimizing the use of SAIs, enabling farmers to make informed decisions based on real-time pest pressure and crop needs. This data-driven approach is expected to drive efficiency and reduce the overall environmental footprint of agricultural practices. Furthermore, the expanding portfolio of crops benefiting from SAI applications, beyond traditional row crops to include high-value vegetables and fruits, is a significant trend. This diversification reflects the versatility and adaptability of seed treatment technologies to various agricultural systems. The development of novel insecticidal compounds with improved safety profiles and efficacy against a broader spectrum of pests will also be a crucial driver in the coming years. The market is expected to see a gradual increase in the adoption of integrated pest management (IPM) strategies, where SAIs play a pivotal role as a foundational element, complementing other control methods. The ongoing research and development efforts by key players are focused on creating synergistic formulations that combine multiple modes of action, thereby mitigating the risk of insecticide resistance.

Several compelling factors are propelling the growth of the Seed Applied Insecticides market. Foremost among these is the escalating global demand for food security, driven by a burgeoning population and the need to maximize crop yields. SAIs offer a highly efficient method of protecting seeds and young seedlings from early-season insect pests, which can cause significant damage and reduce crop establishment, ultimately impacting harvestable yields. This proactive approach to pest management is particularly attractive to farmers seeking to secure their investments and ensure consistent crop production. Furthermore, the inherent advantages of SAIs over conventional spraying methods represent a significant driving force. Seed treatments allow for the precise application of insecticides directly to the seed, ensuring uniform distribution and targeted delivery to the developing plant. This significantly reduces the amount of active ingredient required compared to broadcast applications, leading to lower overall pesticide usage and reduced environmental exposure. The improved safety profile for applicators and the surrounding environment is a crucial benefit that resonates with both farmers and regulatory bodies. As environmental stewardship and sustainable agricultural practices gain prominence, the appeal of SAIs as a more eco-friendly pest management solution is amplified. This alignment with sustainability goals positions SAIs as a key component in modern, responsible agriculture, encouraging their wider adoption across diverse farming systems. The increasing incidence of insect resistance to older classes of insecticides also necessitates the development and adoption of novel pest control solutions. SAIs, often formulated with newer chemistries or biological agents, provide an effective means to overcome existing resistance challenges and protect crop health.

Despite the promising growth trajectory, the Seed Applied Insecticides market faces several significant challenges and restraints that could temper its expansion. One of the most prominent concerns revolves around the development of insecticide resistance in pest populations. As SAIs are applied to a vast proportion of seeds, particularly in major row crops, the continuous exposure of pests to specific active ingredients can accelerate the evolution of resistance, diminishing the long-term efficacy of these treatments. This necessitates ongoing research and development into new modes of action and rotation strategies. Regulatory hurdles also pose a considerable challenge. The approval process for new insecticide active ingredients and formulations can be lengthy, costly, and subject to stringent environmental and health assessments in different regions. Evolving regulations concerning pesticide residues in food, water, and the environment can lead to restrictions or outright bans on certain chemistries, impacting market access and product portfolios. The high initial investment cost associated with seed treatment technology and the specialized equipment required can be a barrier for smallholder farmers, particularly in developing economies, limiting widespread adoption. Furthermore, a lack of awareness and understanding regarding the benefits and proper application of SAIs among certain segments of the farming community can hinder market penetration. Misconceptions about potential risks, particularly concerning non-target organisms or the impact on beneficial insects, can lead to hesitancy in adopting these technologies. Public perception and consumer demand for conventionally grown produce, free from any seed-applied treatments, can also influence farmer choices and indirectly restrain the market for SAIs, especially in niche markets or organic agriculture.

Dominant Segments within Seed Applied Insecticides:

Dominant Region/Country:

The Seed Applied Insecticides industry is experiencing robust growth propelled by several key catalysts. The increasing global demand for food security, driven by a growing population, necessitates maximizing crop yields, and SAIs play a crucial role in achieving this by protecting seeds and seedlings from early-season pests. The undeniable advantages of SAIs over traditional spraying methods, such as reduced pesticide usage, targeted application, and enhanced safety for applicators, are significant drivers. Furthermore, the escalating incidence of insecticide resistance in pest populations is compelling farmers to seek novel and effective solutions, a role that SAIs are increasingly fulfilling. The growing emphasis on sustainable agriculture and environmental stewardship is also a significant catalyst, as SAIs offer a more eco-friendly approach to pest management, minimizing off-target environmental impacts.

This comprehensive report on Seed Applied Insecticides offers an in-depth analysis of the global market, covering a detailed study period from 2019 to 2033, with the Base Year and Estimated Year set at 2025. It provides a robust market overview, including current market valuations and future projections, with the global market estimated to reach $8,500 million by 2033. The report delves into the intricate market dynamics, exploring the driving forces behind its growth, such as the imperative for food security and the inherent advantages of seed treatments. Simultaneously, it critically examines the challenges and restraints, including the pervasive issue of insecticide resistance and stringent regulatory landscapes. The report meticulously identifies and analyzes the key regional and segmental contributions to market dominance, highlighting North America's leading position and the significant roles of chemical insecticides and row crop applications. Furthermore, it illuminates the critical growth catalysts propelling the industry forward and provides a comprehensive list of leading global players. The report also features a timeline of significant industry developments, offering insights into recent innovations and strategic moves. Ultimately, this report serves as an indispensable resource for stakeholders seeking a thorough understanding of the Seed Applied Insecticides market's current state and future trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.8% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.8%.

Key companies in the market include BASF SE, Bayer AG, Syngenta, ADAMA, Sumitomo Chemical, Certis USA, Nufarm Australia, DuPont, Element Solutions Inc, Novozymes A/S, FMC Corporation, Valent BioSciences LLC, Croda International Plc, KENSO New Zealand, Gowan Company, Corteva, UPL, Germains Seed Technology, Plant Health Care.

The market segments include Type, Application.

The market size is estimated to be USD 2417 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Seed Applied Insecticides," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Seed Applied Insecticides, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.