1. What is the projected Compound Annual Growth Rate (CAGR) of the Security Product Integration Services?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Security Product Integration Services

Security Product Integration ServicesSecurity Product Integration Services by Type (/> Hardware, Software, Services), by Application (/> Transportation and Logistics, BFSI, Consumer Electronics, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

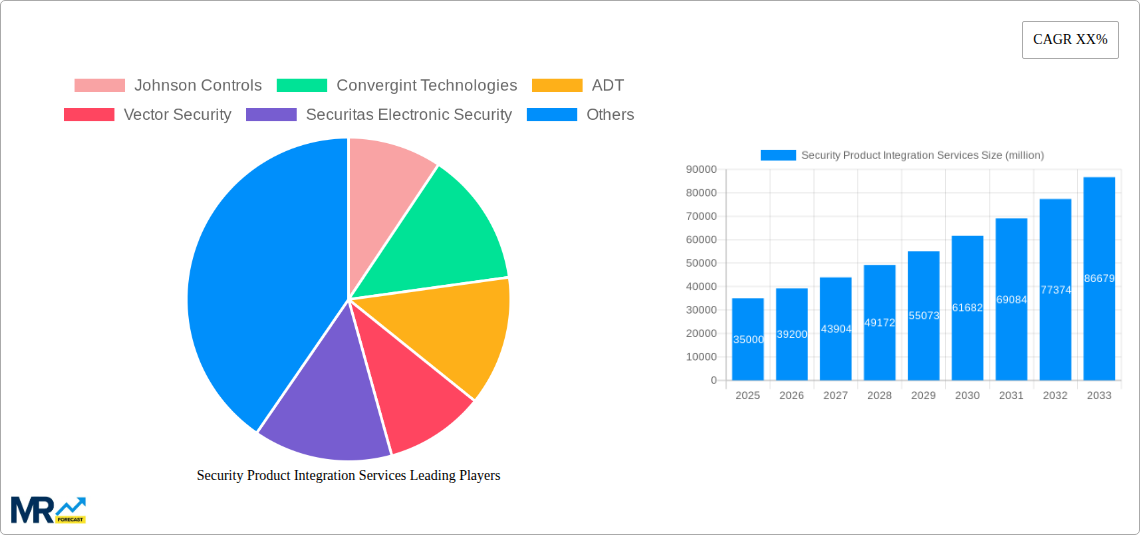

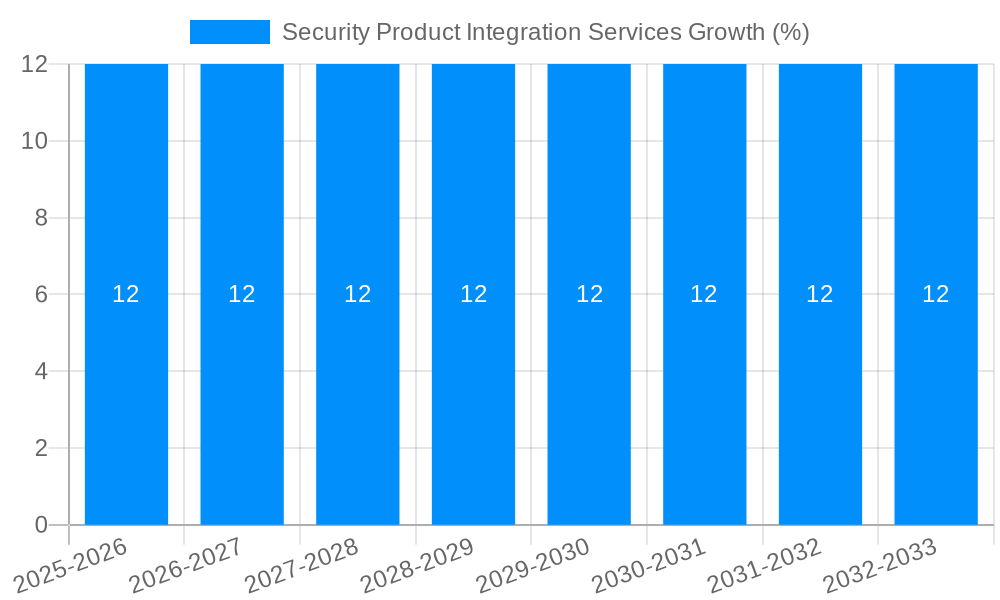

The global Security Product Integration Services market is poised for substantial expansion, projected to reach approximately $35,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 12% anticipated to continue through 2033. This significant growth is primarily fueled by an escalating demand for advanced security solutions across diverse industries, driven by the increasing sophistication of cyber threats and the growing need for comprehensive physical and digital security integration. Key drivers include the rising adoption of IoT devices that necessitate seamless security integration, stringent regulatory compliance requirements, and the growing awareness among businesses and individuals about the importance of safeguarding assets and data. The market's expansion is also being propelled by the increasing complexity of security systems, which often require specialized expertise for effective installation, configuration, and ongoing management, thus creating a sustained demand for professional integration services.

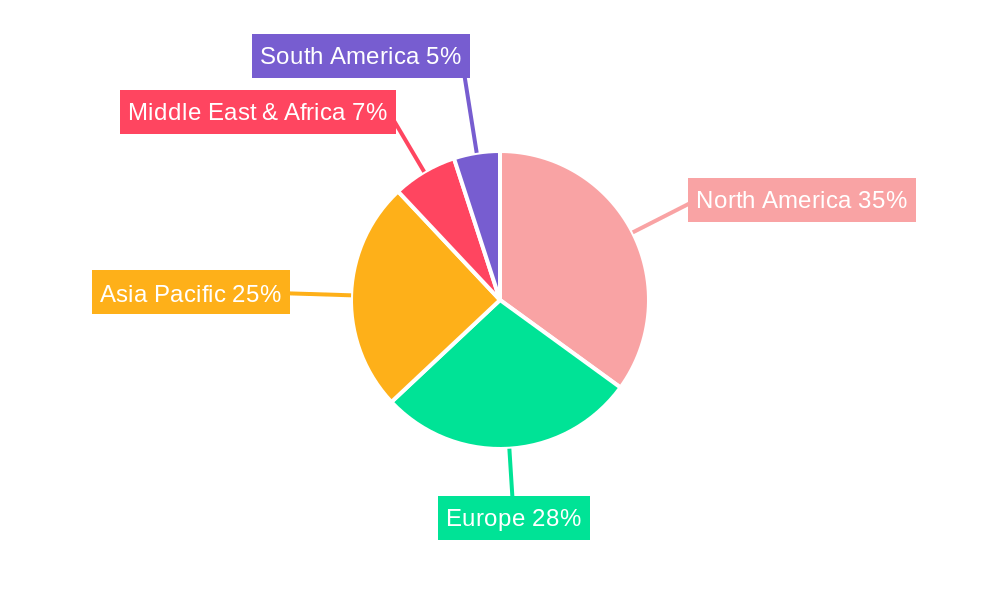

The market is segmented by type into Hardware, Software, and Services, with each segment experiencing its own growth trajectory. Application-wise, the Transportation and Logistics and BFSI sectors are demonstrating particularly strong adoption rates, owing to critical infrastructure and high-value asset protection needs. Consumer Electronics is also emerging as a significant growth area. Geographically, North America currently leads the market, driven by a mature security infrastructure and high adoption of advanced technologies, followed closely by Europe. The Asia Pacific region is exhibiting the fastest growth, spurred by rapid economic development, increasing urbanization, and a burgeoning demand for sophisticated security solutions in emerging economies. Restraints such as high initial investment costs for integrated systems and a shortage of skilled professionals could pose challenges, but the overwhelming benefits of enhanced security, operational efficiency, and risk mitigation are expected to outweigh these concerns, ensuring a positive market outlook.

This comprehensive report delves into the dynamic and rapidly evolving landscape of Security Product Integration Services, providing an in-depth analysis of market trends, growth drivers, challenges, and key players. Covering the historical period from 2019 to 2024 and forecasting the market's trajectory through 2033, with a base year of 2025 and an estimated value for the same year, this research offers invaluable insights for stakeholders seeking to navigate this critical sector. The report quantifies market values in millions of units, presenting a clear picture of financial opportunities and investment potential.

The global Security Product Integration Services market is experiencing a robust expansion, driven by an increasing awareness of sophisticated security threats and the growing complexity of IT infrastructures. The study period, spanning from 2019 to 2033, with a significant focus on the forecast period of 2025-2033, reveals a market poised for substantial growth. The base year of 2025 is estimated to represent a market valuation of [Insert Estimated Value in Millions] million. A key trend is the escalating demand for converged security solutions that seamlessly integrate physical and cybersecurity measures. This convergence is necessitated by the rise of hybrid work models, the proliferation of IoT devices, and the interconnectedness of operational technology (OT) with information technology (IT) systems. Organizations are increasingly recognizing that siloed security approaches are no longer sufficient to protect against multifaceted threats. Consequently, there is a heightened need for specialized services that can orchestrate the deployment, configuration, and ongoing management of diverse security products, including hardware (e.g., access control systems, video surveillance), software (e.g., threat intelligence platforms, security information and event management - SIEM), and overarching security services.

Furthermore, the report highlights a significant shift towards managed security services (MSS) as businesses seek to offload the complexities of security operations to expert providers. This trend is fueled by a persistent cybersecurity talent shortage and the escalating costs associated with maintaining in-house security expertise. Integration service providers are thus increasingly offering end-to-end solutions, encompassing everything from initial risk assessments and solution design to deployment, monitoring, and incident response. The adoption of cloud-based security platforms is another prominent trend, enabling greater scalability, flexibility, and cost-effectiveness for security integration. As organizations migrate their operations to the cloud, the demand for cloud-native security solutions and the integration services required to secure these environments will continue to surge. The market is also witnessing a growing emphasis on proactive threat hunting and predictive analytics, moving beyond reactive incident response to anticipate and neutralize threats before they can cause significant damage. This necessitates the integration of advanced AI and machine learning capabilities into security ecosystems, a domain where specialized integration services play a pivotal role. The estimated market size for the Security Product Integration Services in the base year of 2025 is projected to reach [Insert Estimated Value in Millions] million, with significant year-on-year growth anticipated throughout the forecast period. The historical period of 2019-2024 has laid a strong foundation for this expansion, marked by a steady increase in the adoption of integrated security solutions.

Several potent forces are collectively propelling the growth of the Security Product Integration Services market. Foremost among these is the relentless evolution of the threat landscape. Cybercriminals and malicious actors are continuously developing more sophisticated attack vectors, ranging from advanced persistent threats (APTs) and ransomware to sophisticated social engineering tactics. This escalating threat environment compels organizations across all sectors to invest in robust and integrated security measures to safeguard their critical assets, sensitive data, and operational continuity. The increasing adoption of digital transformation initiatives, including the migration to cloud computing, the proliferation of IoT devices, and the widespread implementation of remote work policies, has dramatically expanded the attack surface. These interconnected environments create numerous vulnerabilities that can be exploited by attackers, making comprehensive security integration a paramount concern.

Moreover, the growing regulatory compliance mandates are a significant catalyst. Industries such as BFSI (Banking, Financial Services, and Insurance), healthcare, and government are subject to stringent data protection regulations (e.g., GDPR, CCPA, HIPAA). Non-compliance can result in substantial fines, reputational damage, and loss of customer trust. Security product integration services help organizations meet these complex compliance requirements by ensuring that their security systems are aligned with regulatory standards and that data is adequately protected. The expanding cybersecurity skills gap also plays a crucial role. Many organizations struggle to find and retain qualified cybersecurity professionals. This deficit makes it challenging for them to manage the intricate integration and ongoing maintenance of complex security solutions in-house. Consequently, they increasingly rely on specialized integration service providers to leverage their expertise and resources, thereby ensuring effective security posture management.

Despite the robust growth trajectory, the Security Product Integration Services market faces several significant challenges and restraints that could temper its expansion. One of the primary obstacles is the sheer complexity of integrating diverse security products from various vendors. Organizations often deploy a multitude of security solutions, each with its own architecture, protocols, and management interfaces. Achieving seamless interoperability and unified management across these disparate systems requires specialized expertise and can be a time-consuming and resource-intensive undertaking. This complexity can lead to integration failures, misconfigurations, and gaps in security coverage, undermining the intended benefits of an integrated approach. The escalating cost of advanced security solutions and the associated integration services can also be a significant restraint, particularly for small and medium-sized enterprises (SMEs) with limited IT budgets. While the long-term benefits of enhanced security are undeniable, the upfront investment can be prohibitive, forcing some organizations to opt for less comprehensive or piecemeal security strategies.

Furthermore, the rapid pace of technological innovation in the cybersecurity domain presents a challenge in itself. Security vendors are constantly releasing new products and updating existing ones, creating a moving target for integration service providers. Keeping up with these rapid advancements and ensuring that integrated solutions remain compatible and effective requires continuous learning, adaptation, and significant investment in training and development for integration professionals. Vendor lock-in is another concern, where organizations can become overly dependent on a specific vendor's ecosystem, making it difficult and expensive to switch to alternative solutions or integrate products from competing vendors. This can limit flexibility and stifle innovation. Finally, the lack of standardized integration protocols and APIs across the security industry exacerbates these challenges. The absence of universally accepted standards makes interoperability more difficult to achieve, often necessitating custom integration efforts that can be costly and prone to errors.

The Security Product Integration Services market is poised for dominance by specific regions and segments, driven by distinct factors of adoption and technological maturity.

Dominant Regions/Countries:

Dominant Segments:

The Security Product Integration Services industry is fueled by several key growth catalysts. The escalating sophistication and frequency of cyberattacks globally compel organizations to adopt more robust and interconnected security strategies. The rapid expansion of digital transformation initiatives, including cloud adoption and IoT deployments, creates complex attack surfaces that necessitate integrated solutions. Furthermore, stringent regulatory compliance mandates across various sectors are driving the demand for comprehensive security integration to ensure data protection and avoid penalties. The persistent cybersecurity talent shortage pushes organizations to rely on expert integration services for effective security management.

This report provides a comprehensive and holistic view of the Security Product Integration Services market, spanning the historical period of 2019-2024 and forecasting market dynamics up to 2033. With a base year of 2025, the analysis includes detailed market size estimations in millions of units for the base year and projected values throughout the forecast period. The report meticulously examines the interplay of various market segments, including Hardware, Software, and Services, and their application across diverse industries such as Transportation and Logistics, BFSI, and Consumer Electronics. It offers in-depth insights into prevailing market trends, the driving forces propelling market growth, and the inherent challenges and restraints that stakeholders need to navigate. Furthermore, the report identifies key regions and countries poised for market dominance and pinpoints critical growth catalysts. Leading companies in the sector are profiled, alongside significant industry developments and a thorough analysis of the competitive landscape. This comprehensive coverage empowers businesses, investors, and policymakers with the knowledge necessary to make informed strategic decisions within this vital and evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Johnson Controls, Convergint Technologies, ADT, Vector Security, Securitas Electronic Security, Incorporated, Red Hawk Fire & Security, VTI Security, G4S, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Security Product Integration Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Security Product Integration Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.