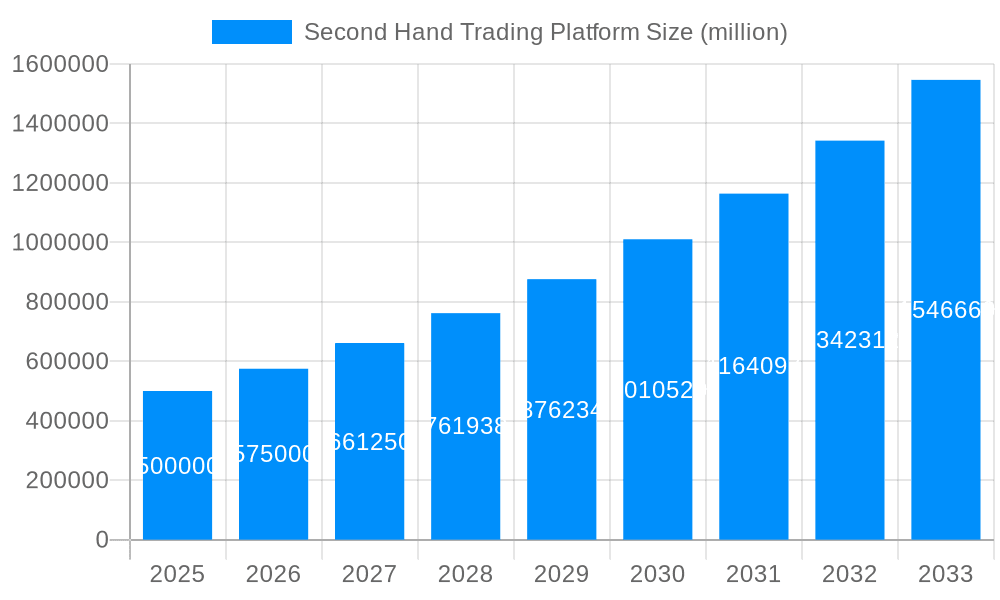

1. What is the projected Compound Annual Growth Rate (CAGR) of the Second Hand Trading Platform?

The projected CAGR is approximately 13.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Second Hand Trading Platform

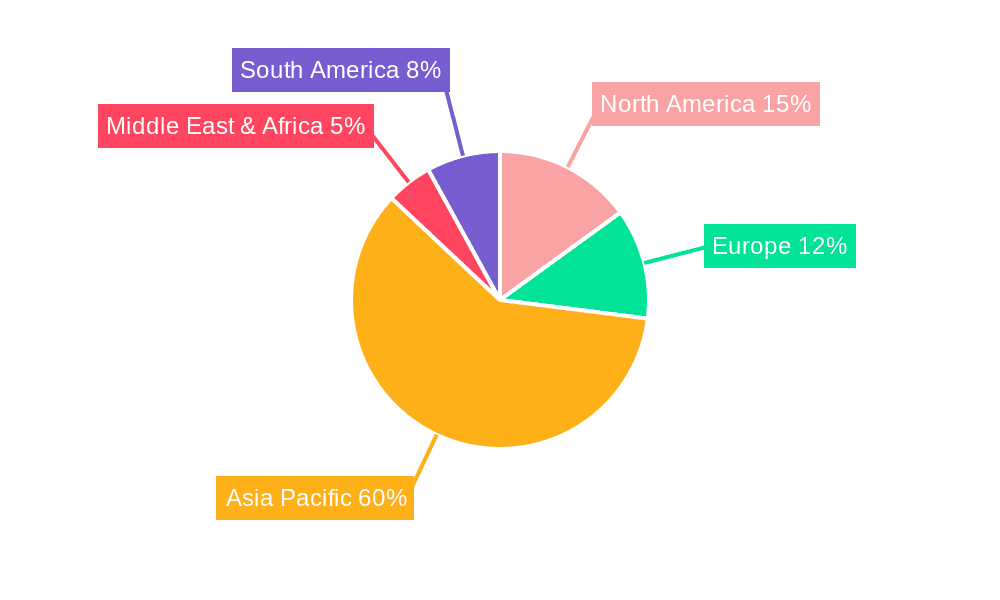

Second Hand Trading PlatformSecond Hand Trading Platform by Type (Whole Category, Specific Commodity Categories), by Application (C2C, B2C), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

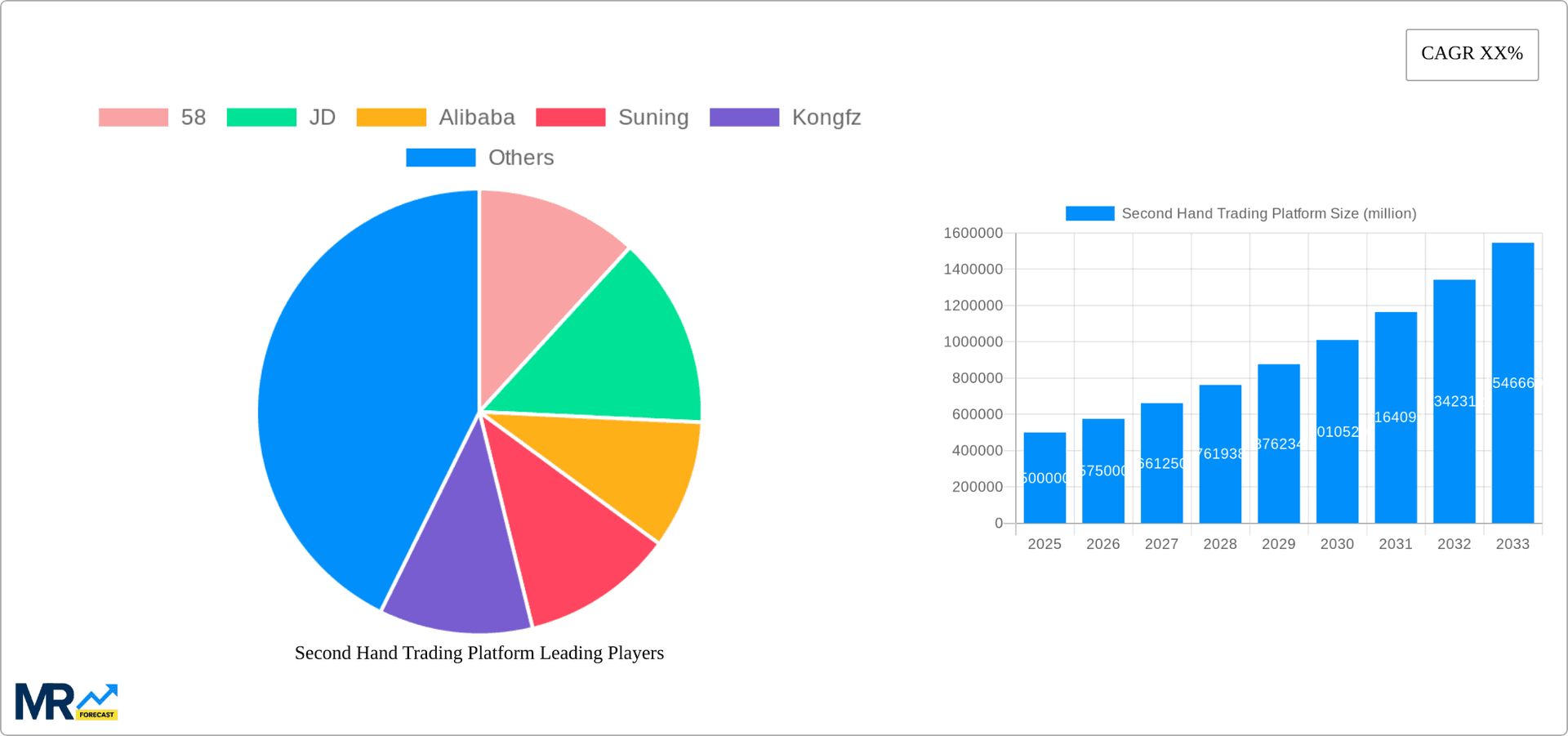

The global second-hand trading platform market is experiencing robust growth, driven by increasing consumer awareness of sustainability, the rise of the sharing economy, and the affordability offered by pre-owned goods. The market's expansion is fueled by a younger generation prioritizing value and conscious consumption, leading to a significant surge in online platforms facilitating the buying and selling of used items. E-commerce giants like JD, Alibaba, and others are actively integrating second-hand marketplaces into their existing platforms, enhancing accessibility and trust for both buyers and sellers. This integration, alongside the emergence of specialized platforms like 58.com and Guazi focusing on specific product categories (e.g., automobiles, electronics), is driving market segmentation and innovation. The market is geographically diverse, with significant contributions from North America, Europe, and particularly Asia-Pacific, driven by the massive consumer base and strong digital infrastructure in countries like China and India. However, challenges remain, including concerns about product authenticity, logistics, and the need for robust fraud prevention mechanisms. The market's future trajectory suggests continued growth, with technological advancements improving user experience and trust, ultimately leading to increased market penetration and value.

While precise figures were not provided, assuming a conservative CAGR of 15% and a 2025 market size of $50 billion (USD), a reasonable projection for the next decade can be made. This growth is based on the observed trends of increased online adoption and expansion of existing e-commerce platforms into the used goods sector. The Asian-Pacific region, particularly China and India, are expected to be key growth drivers, given their rapidly expanding e-commerce markets and large populations. North America and Europe will also contribute significantly, albeit at a potentially slower rate of growth, given their established markets. The successful navigation of challenges related to trust, logistics and counterfeiting will be crucial to sustaining this robust growth, as will adapting to evolving consumer preferences and technological innovations.

The second-hand trading platform market is experiencing explosive growth, projected to reach hundreds of billions of dollars by 2033. This surge is driven by a confluence of factors, including increased environmental consciousness, economic uncertainty prompting consumers to seek cost-effective alternatives, and the convenience offered by sophisticated online platforms. The market's evolution showcases a shift from purely C2C (consumer-to-consumer) models to a hybrid approach incorporating B2C (business-to-consumer) elements, significantly expanding the range and quality of goods available. Major players like Alibaba and JD.com are integrating second-hand marketplaces into their existing e-commerce ecosystems, leveraging their vast user bases and established logistics networks to drive market penetration. The historical period (2019-2024) saw a steady rise in transaction volume and platform diversification, with specialized platforms emerging for specific commodity categories, such as luxury goods or electronics. The estimated market size in 2025 surpasses tens of billions of dollars, indicating a robust growth trajectory in the forecast period (2025-2033). This growth is not uniform across all segments; the adoption of technology, including advanced authentication and fraud detection mechanisms, will significantly impact future market dynamics. The market is also increasingly witnessing the emergence of hybrid models that combine online and offline trading, catering to a broader consumer base. Finally, regulatory developments relating to product authenticity and consumer protection are crucial for long-term market stability and sustainable growth. These factors point towards a future where second-hand trading platforms become increasingly integrated into the broader retail landscape.

Several key factors are accelerating the growth of the second-hand trading platform market. Firstly, the rise of environmental awareness is pushing consumers towards more sustainable consumption patterns, with second-hand goods representing a significantly reduced environmental footprint compared to newly manufactured products. This is further amplified by a growing understanding of the environmental and social costs associated with fast fashion and consumerism. Secondly, economic fluctuations and periods of uncertainty influence consumer behavior, pushing many towards more affordable options, with second-hand purchases being a viable alternative to buying new. The convenience and accessibility of online platforms are also paramount; users can easily browse, compare prices, and complete transactions from the comfort of their homes, eliminating the need for physical visits to flea markets or consignment shops. This increased convenience is attracting a wider demographic, including younger generations who are digitally native and comfortable with online transactions. Furthermore, innovative business models such as those offered by Guazi, focusing on used car sales, and the emergence of specialized platforms catering to niche markets, demonstrate market dynamism and a growing consumer preference for targeted options. The overall effect of these factors leads to an upward trajectory in the market's size and influence.

Despite the impressive growth, several challenges hinder the full potential of the second-hand trading platform market. A significant hurdle is the issue of product authenticity and quality verification. Consumers often harbor concerns about the condition and legitimacy of second-hand goods, leading to hesitation in purchasing. This necessitates robust authentication mechanisms and verification systems, adding complexity and cost to platform operations. Another constraint is the potential for fraud and scams, requiring platforms to invest heavily in security measures and user protection protocols. The logistics and delivery of bulky or fragile items can also pose challenges, particularly in C2C models where individual sellers handle shipping. Building trust and ensuring a positive customer experience are critical for the success of these platforms. Furthermore, the varying regulations across different jurisdictions regarding product liability and consumer protection can create operational complexities for companies operating across multiple regions. Finally, effective competition requires platforms to continuously innovate and adapt to evolving consumer preferences and technological advancements. Addressing these challenges is critical for the long-term sustainability and growth of the second-hand trading platform sector.

The Chinese market is poised to dominate the second-hand trading platform landscape. Its massive population, rapid technological adoption, and growing environmental awareness create a fertile ground for this sector's expansion. Within China, specific commodity categories like electronics and apparel are experiencing particularly high growth. The C2C segment remains dominant due to the existing large user base and ease of access, although the B2C segment is quickly gaining traction through investments in quality control and logistics improvements.

China: The sheer size of the consumer market and the rapid expansion of e-commerce make China the primary driver of growth. Its sophisticated logistics networks and established digital infrastructure provide a strong foundation for the sector’s development.

Specific Commodity Categories: Electronics and apparel segments see a high turnover due to the frequent updates in technology and changing fashion trends. These categories are particularly suited to second-hand trading as they often retain significant value even after prior use. Luxury goods also represent a substantial and fast-growing segment within this category.

C2C Application: While B2C platforms are growing, the established trust and scale of C2C platforms in China give them a significant competitive edge, at least for the near future. The majority of consumers are comfortable transacting with fellow citizens, creating a large, established pool of sellers and buyers.

The combination of a massive population, high internet penetration, economic factors favoring affordability, and robust technological infrastructure positions the Chinese second-hand trading platform market for continued, significant growth throughout the forecast period. The rapid adoption of mobile payments and the inherent trust in well-established e-commerce platforms further strengthens the market's trajectory. This segment’s success stems from the convergence of economic factors, technological advancements, and societal shifts towards sustainability.

The second-hand trading platform industry is experiencing explosive growth fueled by several key catalysts. These include escalating environmental concerns promoting sustainable consumption, economic factors driving cost-conscious purchasing decisions, and the remarkable convenience and accessibility provided by advanced online platforms. The continuous integration of technology, like advanced authentication and fraud detection, further enhances consumer trust and platform stability, ultimately driving wider adoption.

This report offers a comprehensive analysis of the second-hand trading platform market, providing detailed insights into market trends, growth drivers, challenges, and key players. The study covers the historical period (2019-2024), the base year (2025), and provides forecasts up to 2033. It delves into various market segments, including different commodity categories and application types (C2C and B2C), offering a granular understanding of the market dynamics. The report also assesses the competitive landscape, highlighting the strategies and market positions of key players. Overall, it is a valuable resource for businesses, investors, and policymakers seeking a detailed understanding of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 13.6%.

Key companies in the market include JD, Alibaba, Suning, 58, Kongfz, 2shoujie, Guazi, Beijing Shanyi Shanmei Technology, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Second Hand Trading Platform," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Second Hand Trading Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.