1. What is the projected Compound Annual Growth Rate (CAGR) of the Satellite Antenna?

The projected CAGR is approximately 8.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Satellite Antenna

Satellite AntennaSatellite Antenna by Type (C Band, K/KU/KA Band, S And L Band, X Band, VHF And UHF Band, Other Frequency Bands, World Satellite Antenna Production ), by Application (Space, Land, Maritime, Others, World Satellite Antenna Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global satellite antenna market is projected to reach $3.83 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 8.6%. This expansion is primarily fueled by the escalating demand for high-bandwidth communication solutions across key sectors such as space exploration, terrestrial broadband expansion, and the rapidly growing maritime communications industry. Technological innovations, including advancements in materials and miniaturization, are contributing to the development of smaller, lighter, and more efficient antennas. The increasing adoption of satellite-based internet, especially in remote areas, and the integration of satellite antennas with 5G and IoT technologies are further driving market growth and creating new opportunities. Intense competition among leading providers like MDA, Viasat, and Honeywell Aerospace is fostering innovation and enhancing accessibility.

Despite the positive growth trajectory, the market encounters obstacles such as substantial initial investment requirements for satellite infrastructure and antenna deployment, which can be prohibitive for smaller entities and developing regions. Regulatory complexities and spectrum allocation challenges also present potential restraints. Nevertheless, the market's long-term prospects remain robust, underpinned by the persistent need for dependable, high-capacity communication. Emerging trends, including the adoption of phased array antennas and software-defined radios, are anticipated to enhance flexibility and performance. Market segmentation by frequency band (C, K/KU/KA, S/L, X, VHF/UHF) and application (space, land, maritime) highlights diverse growth potentials for strategic market participants.

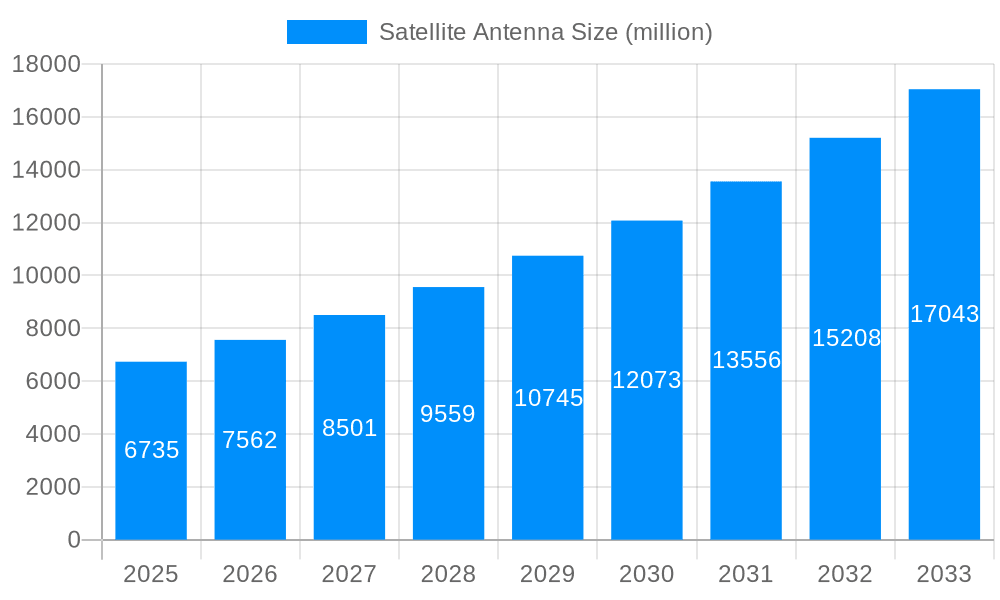

The global satellite antenna market is experiencing robust growth, driven by increasing demand across various sectors. The study period of 2019-2033 reveals a significant upward trajectory, with the estimated market value in 2025 exceeding several billion dollars. This expansion is fueled by the proliferation of satellite-based communication services, including broadband internet access, broadcasting, and government applications. Technological advancements, such as the development of high-throughput satellites (HTS) and phased array antennas, are contributing to improved efficiency and performance. The adoption of smaller, lighter, and more cost-effective antennas is also driving market penetration in previously underserved regions. The forecast period (2025-2033) anticipates continued growth, with the market exceeding tens of billions of dollars by the end of the forecast period. This growth is anticipated across various frequency bands, with a strong emphasis on higher frequency bands like K/KU/KA band and even X-band, offering higher bandwidth capabilities and improved data transmission speeds. The market's evolution reflects a shift toward more sophisticated antenna technologies, enabling more efficient use of satellite resources and delivering enhanced connectivity across land, maritime, and space applications. Millions of units are being produced annually, demonstrating the widespread adoption of this technology across numerous applications. Key market insights indicate a preference for adaptable antenna systems that cater to the needs of evolving satellite constellations and bandwidth demands. Furthermore, there is a rising preference for integration and miniaturization, making satellite antennas suitable for a larger array of applications, from personal use to large-scale infrastructure projects. This growth is not uniform; some regions and applications, as detailed later, demonstrate significantly more growth potential than others.

Several key factors are driving the rapid expansion of the satellite antenna market. The burgeoning demand for high-speed broadband internet access, particularly in remote and underserved areas, is a primary catalyst. Satellite technology provides a viable solution for bridging the digital divide, reaching populations not adequately served by terrestrial infrastructure. The increasing reliance on satellite communication for government and military operations, including surveillance, navigation, and secure communication, also fuels market growth. Moreover, the growth of the broadcasting industry, particularly in high-definition television (HDTV) and direct-to-home (DTH) broadcasting, necessitates more sophisticated and efficient satellite antennas. The continuous advancement in antenna technologies, leading to the development of smaller, lighter, more efficient, and cost-effective designs, further propels market expansion. The emergence of new satellite constellations, offering increased capacity and coverage, creates a high demand for compatible antennas. Finally, supportive government initiatives and investments in satellite infrastructure development contribute significantly to the growth momentum of the satellite antenna market. The overall trend points towards a future where satellite antenna technology plays an even more pivotal role in global communication and data transfer.

Despite its significant growth, the satellite antenna market faces several challenges. High initial investment costs associated with the development and deployment of satellite networks can be a major barrier to entry for smaller companies. The complexity of satellite technology and the need for specialized expertise can also limit market participation. Furthermore, regulatory hurdles and spectrum allocation issues can create uncertainties and hinder market expansion in certain regions. The impact of weather conditions on satellite signal transmission can affect antenna performance and reliability. Competition from alternative technologies, such as terrestrial fiber optic networks and 5G cellular networks, poses a threat to market growth, particularly in densely populated areas with readily available terrestrial infrastructure. The space environment also presents unique challenges; extreme temperatures, radiation, and micrometeoroid impacts can necessitate robust and reliable antenna designs, increasing costs and complexity. Lastly, maintaining the security and integrity of satellite communication networks in the face of cyber threats is a growing concern. These challenges necessitate ongoing innovation and collaboration among stakeholders to ensure the continued growth and success of the satellite antenna market.

The K/KU/KA band segment is projected to dominate the market due to its ability to deliver higher bandwidth capabilities compared to lower-frequency bands. This segment caters to the increasing demand for high-speed data transmission for applications such as broadband internet access, broadcasting, and government operations.

K/KU/KA Band: This segment's dominance is driven by its higher frequency range, allowing for greater bandwidth capacity and thus faster data transfer rates. The demand for high-speed internet access, particularly in remote locations, is fueling the growth in this segment.

North America and Europe: These regions are expected to remain leading consumers of satellite antenna technology due to strong government investments in satellite-based infrastructure and a high demand for high-speed broadband internet access.

Space Applications: While all application segments are growing, space applications, including satellite communication and Earth observation, show substantial growth potential. The increasing number of satellites launched annually fuels this demand for high-performance antennas capable of withstanding the harsh conditions of space.

Paragraph Elaboration: The K/KU/KA band's dominance stems from its ability to support the growing need for increased bandwidth. The projected growth for this segment is significantly higher than others due to its ability to serve the rising demand for high-throughput satellite services. This growth is further fueled by the increasing use of high-definition video and high-bandwidth applications. North America and Europe maintain their leading positions due to significant government spending on satellite projects, substantial private sector investments in satellite communications, and relatively high rates of internet adoption. In contrast, while growth is expected in other regions, including parts of Asia and South America, the developed economies in North America and Europe maintain a stronger demand and purchasing power. Finally, the space segment is driven by the ongoing and rapidly expanding space economy. Increased numbers of satellites launched globally necessitate a corresponding increase in the production and deployment of high-performance space-grade antennas. This segment is less price-sensitive, leading to faster adoption of the advanced antenna systems needed for complex space-based applications. Millions of units are forecast across the combined segments, painting a picture of robust and consistent market expansion.

The satellite antenna industry's growth is spurred by several key factors: increasing demand for high-speed internet access in underserved areas, substantial government investments in satellite technology, advancements in antenna technology leading to smaller, more efficient designs, and the launch of numerous new satellite constellations globally. These factors combine to create a positive feedback loop, driving further innovation and investment in the sector. The convergence of satellite technology with other communication systems also presents new opportunities.

This report provides a comprehensive overview of the satellite antenna market, analyzing key trends, drivers, challenges, and growth opportunities. It offers detailed insights into market segmentation by frequency band and application, as well as regional market dynamics. The report also includes profiles of leading industry players and their strategic initiatives, highlighting significant developments impacting the market landscape. The projections presented offer valuable guidance for businesses and investors seeking to understand the future trajectory of this dynamic industry. The millions of units produced annually, along with the billions of dollars in market value, underscore the importance and growth potential of this technology.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.6%.

Key companies in the market include MDA, Viasat, Honeywell Aerospace, Mitsubishi Electric Corporation, L3Harris, Communications & Power Industries (CPI), Cobham Limited, Kymeta, Gilat Satellite Networks, ThinKom, Norsat International.

The market segments include Type, Application.

The market size is estimated to be USD 3.83 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Satellite Antenna," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Satellite Antenna, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.