1. What is the projected Compound Annual Growth Rate (CAGR) of the Rugged Electronic Devices?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Rugged Electronic Devices

Rugged Electronic DevicesRugged Electronic Devices by Type (Rugged Communication Equipment, Rugged Computers, Rugged Displays, World Rugged Electronic Devices Production ), by Application (Defense and Military, Industrial, Others, World Rugged Electronic Devices Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

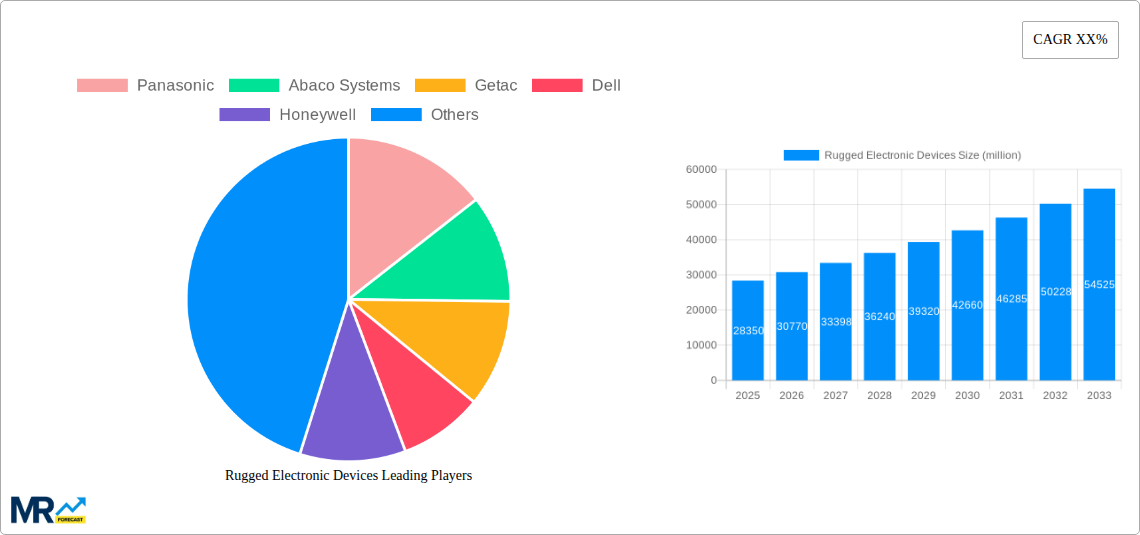

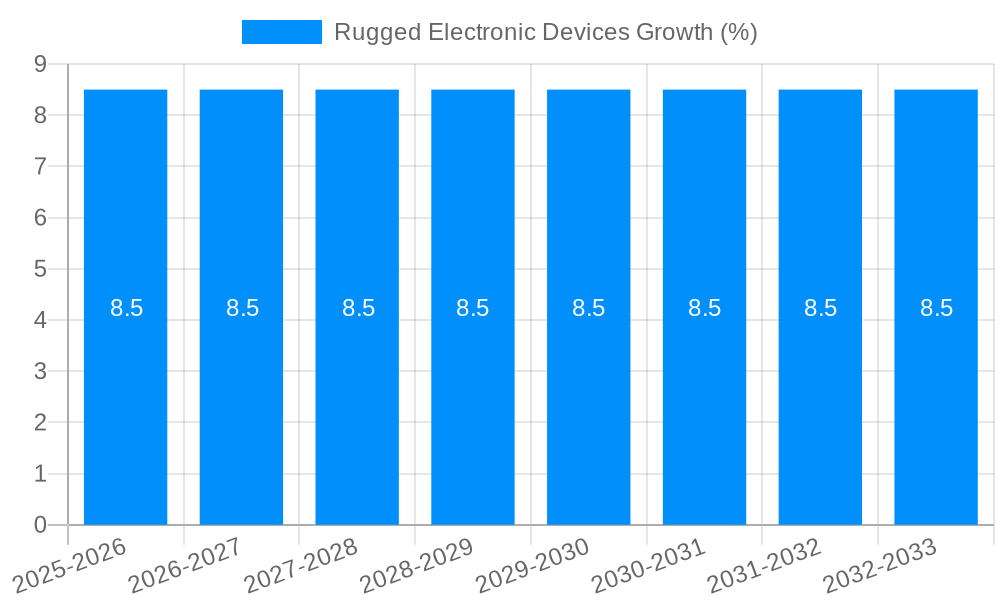

The global Rugged Electronic Devices market is projected to experience robust growth, reaching an estimated market size of approximately $28,350 million by 2025, with a compound annual growth rate (CAGR) of around 8.5% expected throughout the forecast period of 2025-2033. This significant expansion is primarily fueled by the increasing adoption of robust and durable electronic solutions across defense and military sectors, where operational reliability in harsh environments is paramount. The industrial sector also presents a substantial growth avenue, driven by the need for resilient devices in manufacturing, logistics, field service, and public safety applications that demand resistance to extreme temperatures, shock, vibration, and water ingress. Innovations in miniaturization, enhanced processing power, and improved connectivity for these devices are further propelling market demand.

The market landscape is characterized by a diverse range of products, including rugged communication equipment, rugged computers, and rugged displays, each catering to specific operational needs. Key market restraints include the higher initial cost of rugged devices compared to their commercial counterparts, which can be a deterrent for some budget-conscious organizations. However, the total cost of ownership, considering reduced failure rates and extended lifespan, often justifies the upfront investment. Emerging trends such as the integration of advanced IoT capabilities, enhanced cybersecurity features, and the development of lighter, more ergonomic designs are set to shape the future of the rugged electronic devices market. Key players like Panasonic, Getac, Dell, and Honeywell are actively investing in research and development to introduce sophisticated solutions that meet the evolving demands of these critical industries.

Here's a report description on Rugged Electronic Devices, incorporating your specified requirements:

The global market for Rugged Electronic Devices is poised for significant expansion, projected to witness a notable surge from approximately 5.5 million units in the historical period of 2019-2024 to an estimated 12.8 million units in the base year of 2025. This robust growth trajectory is expected to continue through the forecast period of 2025-2033, with projections indicating a substantial increase in production volumes as the demand for durable and reliable electronic solutions intensifies across various sectors. Several key trends are shaping this dynamic market. Firstly, the increasing adoption of sophisticated IoT technologies within industrial and enterprise environments is a major driver. As businesses push for greater connectivity and real-time data acquisition in harsh conditions, the need for devices that can withstand extreme temperatures, shocks, vibrations, dust, and water ingress becomes paramount. This trend is particularly evident in sectors like manufacturing, logistics, and field services, where operational continuity is critical. Secondly, the ongoing digital transformation initiatives within the defense and military sectors are fueling demand for highly resilient communication equipment and computing platforms. Modern warfare and defense operations require robust devices capable of operating in contested electromagnetic environments and under extreme physical stress. This includes advanced communication devices, battlefield management systems, and rugged tablets for soldiers. Thirdly, there is a discernible trend towards miniaturization and increased processing power within rugged devices. Manufacturers are investing heavily in R&D to develop smaller, lighter, yet more powerful devices that offer enhanced functionality without compromising on their ruggedness. This allows for greater portability and integration into more compact systems. Furthermore, the evolving regulatory landscape, with an increasing emphasis on safety and operational efficiency in hazardous environments, is also indirectly contributing to the market's growth as industries seek to comply with these mandates by deploying ruggedized solutions. The increasing integration of advanced features such as AI capabilities, enhanced GPS accuracy, and extended battery life are also becoming standard expectations, pushing the boundaries of what rugged devices can offer. The shift towards cloud-connected rugged devices, enabling seamless data synchronization and remote management, represents another significant trend that will likely define the market's future.

The burgeoning demand for Rugged Electronic Devices is underpinned by a confluence of powerful driving forces. Foremost among these is the relentless pursuit of operational efficiency and resilience in challenging environments. Industries such as oil and gas, mining, construction, and transportation are increasingly reliant on electronic devices for critical operations in the field. The inherent fragility of standard commercial-grade electronics makes them unsuitable for these demanding conditions, necessitating the adoption of ruggedized alternatives that can ensure uninterrupted functionality, thereby minimizing downtime and associated costs. Coupled with this is the accelerated digital transformation across various sectors. The integration of IoT, AI, and advanced analytics is pushing the boundaries of data collection and processing in real-time, even in remote or hazardous locations. Rugged devices serve as the essential conduits for this data, bridging the gap between the physical and digital worlds. The defense and military sectors represent a significant and persistent driver, with continuous investment in advanced technologies to maintain a strategic advantage. The evolving nature of modern conflicts, characterized by complex environments and the need for immediate, reliable communication and situational awareness, directly translates into a robust demand for rugged communication equipment, computers, and displays that can withstand battlefield conditions. Furthermore, advancements in material science and manufacturing technologies are enabling the development of more sophisticated and cost-effective rugged devices. Innovations in shock absorption, sealing techniques, and screen technologies are continuously improving device durability and user experience. The increasing emphasis on worker safety in high-risk industries is also a substantial catalyst. Rugged devices are designed to be intrinsically safe, reducing the risk of ignition in potentially explosive atmospheres and safeguarding personnel from physical harm, thereby contributing to a safer working environment.

Despite the promising growth outlook, the Rugged Electronic Devices market faces several inherent challenges and restraints that can temper its expansion. A primary hurdle is the higher initial cost associated with rugged devices compared to their consumer-grade counterparts. The specialized engineering, robust materials, and rigorous testing required to achieve industry-standard rugged certifications (such as MIL-STD-810G/H and IP ratings) contribute to a significantly higher manufacturing cost. This premium price point can be a barrier for smaller businesses or those with limited budgets, especially when standard devices might suffice for less demanding use cases. Another significant challenge is the rapid pace of technological evolution in consumer electronics. While rugged devices are built for durability, the technological advancements in areas like processing power, battery life, and display resolution in mainstream devices can sometimes outpace the development cycles for ruggedized versions. This can lead to a perceived gap in cutting-edge features for certain users who require both ruggedness and the latest consumer technology. Supply chain complexities and lead times can also pose a restraint. The specialized components and manufacturing processes involved in producing rugged devices can sometimes lead to longer lead times and more complex supply chain management, especially during periods of high global demand or material shortages. Furthermore, market fragmentation and standardization efforts are ongoing. While there are established standards for ruggedness, the diverse range of specific environmental requirements across different industries can lead to a complex product landscape. This can make it challenging for end-users to identify the optimal device for their unique needs and for manufacturers to offer a one-size-fits-all solution. Finally, perceived overkill for some applications can also be a restraint. In environments where extreme conditions are not consistently present, businesses might opt for less rugged or even standard devices to save costs, even if occasional exposure to harsh elements is a possibility.

The global Rugged Electronic Devices market is characterized by a dynamic interplay between regions and specific product segments, with both contributing significantly to overall market dominance.

Key Dominant Segments:

Rugged Computers (Tablets, Laptops, and Handhelds): This segment is expected to remain a cornerstone of the market's dominance. The versatility and increasing processing power of rugged tablets and laptops, coupled with the portability and ease-of-use of rugged handheld devices, make them indispensable across a wide array of applications. For instance, in the Industrial sector, rugged tablets are crucial for inventory management, quality control, predictive maintenance, and worker communication on factory floors, in warehouses, and at remote sites. Similarly, handheld rugged devices are vital for logistics, retail (e.g., inventory scanning, point-of-sale in challenging environments), and public safety for rapid data entry and communication. The Defense and Military application heavily relies on rugged laptops and tablets for battlefield operations, intelligence gathering, command and control systems, and soldier-worn computing. The ability to withstand extreme temperatures, shock, vibration, and electromagnetic interference is non-negotiable. The World Rugged Electronic Devices Production as a segment itself, considering the overall manufacturing output, will naturally show high volume, but the application and type segments are more indicative of market drivers and dominance.

Rugged Communication Equipment: This segment plays a critical role, especially within the Defense and Military application. Advanced rugged radios, satellite communication devices, and secure data modems are essential for maintaining connectivity in contested environments. The increasing sophistication of military operations, requiring real-time information dissemination and secure voice and data transmission, directly fuels the demand for these devices. In the Industrial sector, rugged communication equipment is also gaining traction for applications like remote asset monitoring, fleet management, and critical infrastructure communication where reliable connectivity is paramount.

Key Dominant Regions/Countries:

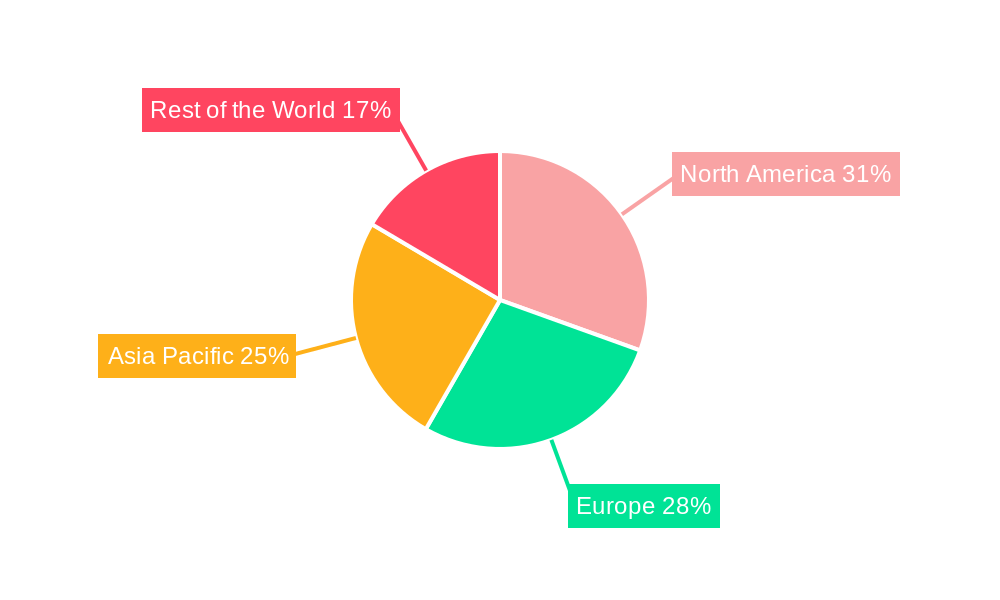

North America: This region, encompassing the United States and Canada, is a significant market for rugged electronic devices. The strong presence of the Defense and Military sector, with its continuous need for advanced and resilient technologies, is a primary driver. Furthermore, the extensive industrial landscape, including sectors like oil and gas, manufacturing, and logistics, coupled with a high rate of technological adoption and significant investment in digital transformation, propels the demand for rugged computing and communication solutions. The stringent safety regulations and the emphasis on operational efficiency in industrial settings also contribute to market growth.

Europe: Similar to North America, Europe exhibits strong demand across both Industrial and Defense and Military applications. Countries like Germany, the UK, and France have robust manufacturing bases and a growing focus on Industry 4.0 initiatives, requiring rugged devices for smart factories and automated processes. The significant defense spending by several European nations, coupled with ongoing geopolitical considerations, further bolsters the market for rugged communication equipment and computers. Stringent environmental and safety regulations across the EU also mandate the use of durable equipment in various industrial settings.

The combination of the essential role of Rugged Computers and Rugged Communication Equipment, particularly within the expansive Defense and Military and the rapidly digitizing Industrial sectors, forms the backbone of market dominance. These segments, driven by the technological advancements and stringent operational requirements, are further amplified by the significant market presence and investment in North America and Europe, creating a powerful synergy that defines the leading edge of the global Rugged Electronic Devices landscape.

Several key growth catalysts are propelling the Rugged Electronic Devices industry forward. The relentless digital transformation across industries, pushing for increased connectivity and data utilization in challenging environments, is a primary driver. The evolving nature of defense and security operations, demanding highly resilient and reliable communication and computing solutions, provides sustained demand. Furthermore, advancements in material science and miniaturization are enabling the development of more versatile, powerful, and user-friendly rugged devices at potentially more accessible price points. The increasing focus on worker safety and regulatory compliance in hazardous industries also acts as a significant catalyst, mandating the adoption of durable electronic solutions.

This report offers a comprehensive analysis of the Rugged Electronic Devices market, delving deep into its current landscape and future projections. It meticulously examines market trends, identifying key insights and drivers shaping the industry's trajectory from the historical period of 2019-2024 through the forecast period of 2025-2033, with a base year of 2025. The report provides an in-depth understanding of the forces propelling growth, including technological advancements and the increasing demand for operational resilience. Conversely, it also addresses the significant challenges and restraints that market players must navigate. Furthermore, the report highlights the dominant market segments and key regions that are spearheading the market's expansion, offering valuable intelligence for strategic decision-making. It also outlines the critical growth catalysts that will continue to fuel the industry's ascent and provides an exhaustive list of leading players. The "Significant Developments" section offers a chronological overview of recent and anticipated advancements, providing a forward-looking perspective. This detailed coverage ensures stakeholders are equipped with the necessary information to capitalize on opportunities and mitigate risks within this dynamic and expanding market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Panasonic, Abaco Systems, Getac, Dell, Honeywell, Curtiss-Wright Defense Solutions, Zebra(Xplore), Datalogic, Trenton Systems, Leonardo DRS, Extreme Engineering Solutions, Handheld Group, CIPHERLAB, TouchStar, Juniper Systems, Ecrin Systems, Aqeri(Borderlight), MilDef(AMREL), Winmate, ACME, Advantech, Sparton Rugged Electronics, Kontron, HP, Twinhead(Durabook), Lenovo, JLT Mobile Computers, MobileDemand, Xenarc, AAEON, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Rugged Electronic Devices," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Rugged Electronic Devices, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.