1. What is the projected Compound Annual Growth Rate (CAGR) of the Robotics Simulation Software?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Robotics Simulation Software

Robotics Simulation SoftwareRobotics Simulation Software by Type (Cloud Based, On-Premise), by Application (Aerospace & Defense, Automotive & Transportation, Machine Manufacturing, Energy & Utilities, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

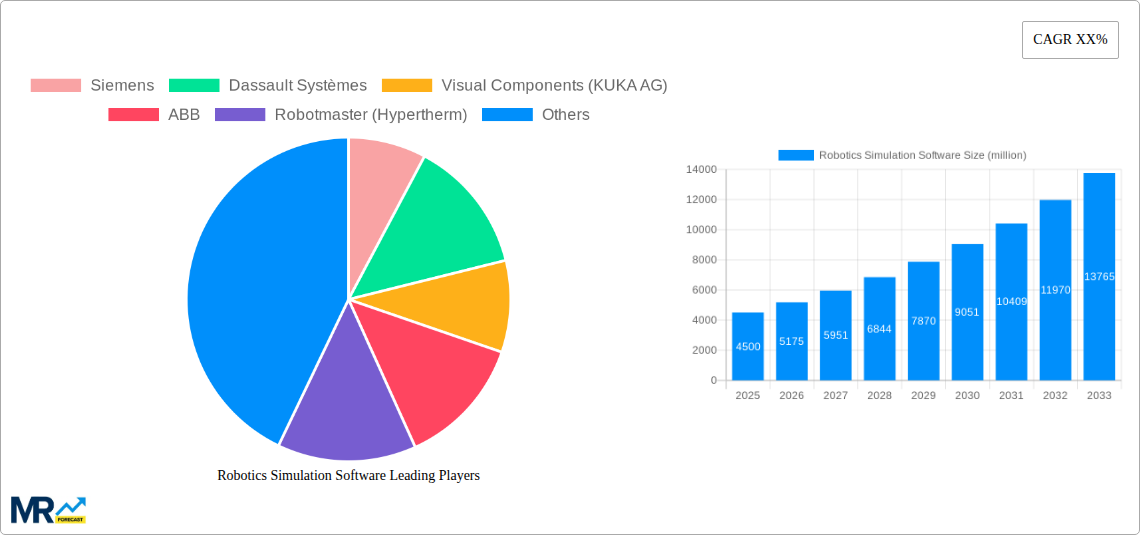

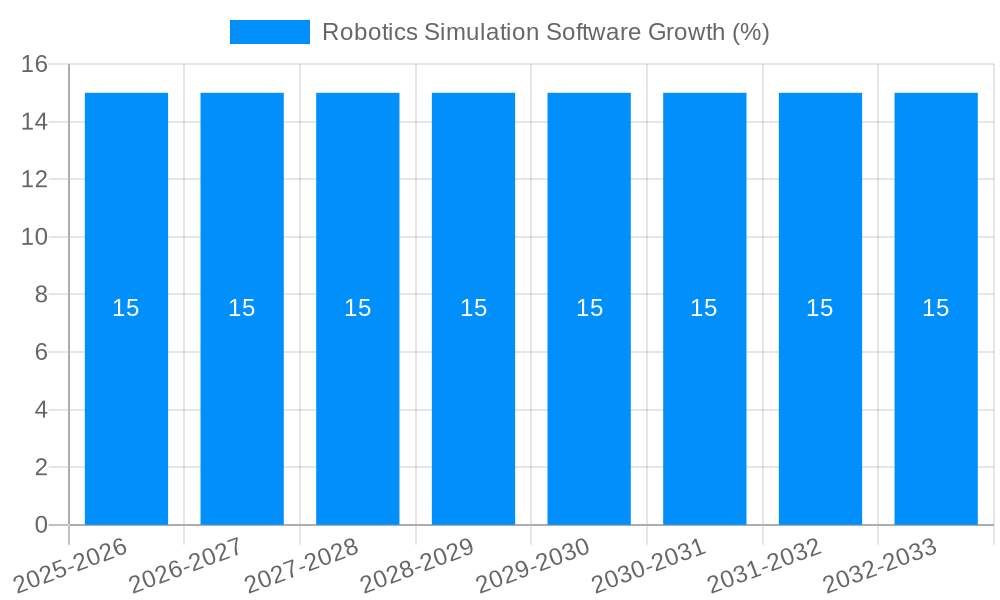

The global Robotics Simulation Software market is experiencing robust expansion, projected to reach approximately $4,500 million in 2025 and poised for substantial growth with a Compound Annual Growth Rate (CAGR) of around 15% through 2033. This surge is primarily driven by the increasing adoption of industrial automation across various sectors, the escalating complexity of robotic systems demanding sophisticated testing and validation, and the critical need for enhanced worker safety by simulating hazardous environments. The demand for accurate virtual prototyping and reduced development cycles further fuels this market. Key applications span Aerospace & Defense, Automotive & Transportation, and Machine Manufacturing, where precision and efficiency are paramount. The shift towards cloud-based solutions is a significant trend, offering scalability, accessibility, and cost-effectiveness, complementing the continued relevance of on-premise deployments for highly sensitive or specialized applications.

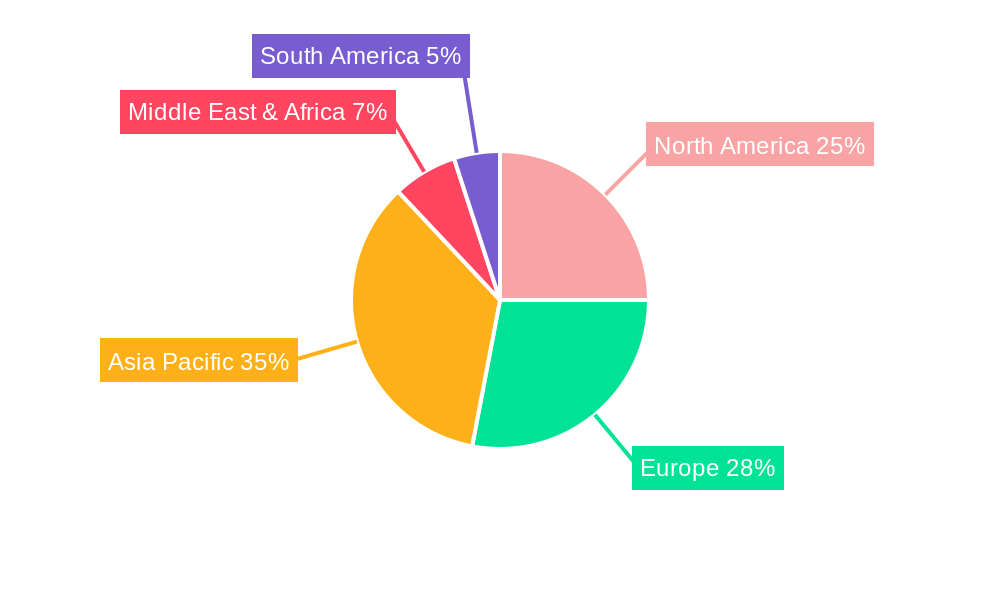

The market is characterized by strong innovation, with companies like Siemens, Dassault Systèmes, and ABB leading the charge in developing advanced simulation capabilities. While the market benefits from strong growth drivers, certain restraints, such as the initial investment costs for high-fidelity simulation tools and the need for skilled personnel to operate them, need to be addressed. However, the long-term outlook remains exceptionally positive, with continuous advancements in AI and machine learning set to further enhance simulation accuracy and efficiency. Asia Pacific, led by China and India, is expected to emerge as a dominant region due to rapid industrialization and a growing manufacturing base, closely followed by North America and Europe, which have mature automation ecosystems. The continuous evolution of robotic technologies ensures that simulation software will remain an indispensable tool for designing, testing, and optimizing robotic systems for years to come.

This report offers an in-depth analysis of the global Robotics Simulation Software market, encompassing a historical overview from 2019-2024, a base year analysis in 2025, and projections through 2033. The market is experiencing dynamic shifts driven by technological advancements, increasing automation adoption across industries, and the growing demand for enhanced robotic system efficiency and safety.

The global Robotics Simulation Software market is poised for substantial growth, with market insights indicating a trajectory from approximately \$1.2 million in the historical period to an estimated \$4.5 million by 2025, and further projected to reach an impressive \$18.9 million by 2033. This exponential growth is fueled by a confluence of factors, including the burgeoning complexity of robotic systems, the imperative for cost reduction in industrial automation, and the ever-present need to mitigate risks associated with real-world robotic deployments. The study period, 2019-2033, reveals a consistent upward trend, with the base year of 2025 serving as a critical inflection point where cloud-based solutions begin to significantly outpace their on-premise counterparts. This shift is driven by the inherent scalability, accessibility, and collaborative capabilities offered by cloud platforms. Furthermore, the forecast period of 2025-2033 is expected to witness a surge in demand from emerging applications, particularly in the Machine Manufacturing and Automotive & Transportation sectors, where the adoption of advanced robotics is at its zenith. The increasing sophistication of AI and machine learning algorithms integrated within simulation software is also a major trend, enabling more realistic and predictive models of robot behavior. This allows for the virtual testing of complex scenarios, optimization of motion paths, and identification of potential collisions before any physical hardware is involved. The demand for user-friendly interfaces and intuitive programming environments is also escalating, democratizing the use of robotics simulation beyond specialized engineering teams. This trend is further amplified by the growing need for digital twins, where simulated environments accurately mirror physical assets, facilitating real-time monitoring and predictive maintenance. The environmental and energy sectors are also showing nascent but significant interest, recognizing the potential of robotics simulation to optimize operations and improve safety in hazardous environments. The integration of VR/AR technologies into simulation platforms is another emerging trend, offering immersive experiences for robot training and operational planning. Overall, the market is characterized by a strong emphasis on enhancing efficiency, reducing development cycles, and ensuring the safe and reliable deployment of robotic solutions across a wide spectrum of industrial applications.

The robust expansion of the robotics simulation software market is primarily propelled by the escalating need for enhanced efficiency and cost optimization within industrial automation. As businesses across various sectors strive to streamline operations and reduce manufacturing cycle times, sophisticated simulation tools become indispensable for virtually testing and refining robotic workflows. The increasing complexity of modern robotic systems, featuring advanced kinematics, sensors, and collaborative functionalities, necessitates comprehensive virtual environments for design, programming, and validation. This allows engineers to identify and resolve potential issues, such as collisions, path interferences, and reach limitations, without the expense and downtime associated with physical prototyping. Furthermore, the growing emphasis on worker safety is a significant driver. By simulating robotic interactions in a controlled virtual environment, potential hazards can be identified and mitigated, ensuring that human operators can work alongside robots without risk. This is particularly crucial in industries like automotive and aerospace, where heavy machinery and intricate assembly processes are prevalent. The rapid advancements in computational power and graphics processing have also made it feasible to create highly realistic and accurate simulations, further enhancing their value proposition. The digital twin concept, where simulated models closely mirror physical assets, is gaining traction, enabling continuous performance monitoring and predictive maintenance, thereby driving the demand for advanced simulation software.

Despite the promising growth trajectory, the robotics simulation software market encounters several challenges that can temper its expansion. A significant restraint is the substantial initial investment required for high-end simulation software and the necessary hardware infrastructure, particularly for on-premise solutions. This cost barrier can be prohibitive for small and medium-sized enterprises (SMEs) with limited budgets, hindering their adoption of these advanced tools. The steep learning curve associated with complex simulation software can also be a deterrent. While vendors are increasingly focusing on user-friendly interfaces, mastering advanced functionalities often requires specialized training and expertise, leading to a shortage of skilled personnel. Interoperability issues between different simulation platforms and CAD/CAM software can also pose challenges. The lack of standardized data formats can lead to data loss or require extensive data conversion processes, adding to the development time and cost. Maintaining the accuracy and fidelity of simulations, especially when dealing with highly dynamic or unpredictable environments, remains a technical challenge. Real-world factors like variations in material properties, environmental conditions, and sensor noise can be difficult to perfectly replicate in a virtual setting, potentially leading to discrepancies between simulation results and actual performance. The security concerns associated with cloud-based simulation platforms, particularly regarding data privacy and intellectual property protection, are also a significant consideration for some organizations. Finally, the ongoing need for frequent software updates and the associated costs for maintenance and support can also present a restraint, especially for companies with long product lifecycles or limited IT resources.

The global Robotics Simulation Software market is characterized by dominant regions and segments that are shaping its overall growth and adoption. From a regional perspective, North America, particularly the United States, is a significant powerhouse in the robotics simulation software market. This dominance is attributed to a strong presence of leading automotive manufacturers, advanced aerospace and defense industries, and a robust ecosystem of technology developers and adopters. The region benefits from substantial investment in research and development, a skilled workforce, and government initiatives promoting industrial automation and advanced manufacturing. Companies in North America are early adopters of cutting-edge technologies, readily integrating robotics simulation into their product development cycles.

Furthermore, Europe, with countries like Germany, France, and the United Kingdom, represents another major market. Germany, in particular, is a global leader in industrial robotics and automation, with a highly developed machine manufacturing sector that heavily relies on simulation for optimizing production lines and robot programming. The automotive industry in Europe also plays a pivotal role, driving demand for sophisticated simulation solutions to design and test complex assembly processes. The region's focus on Industry 4.0 initiatives further fuels the adoption of digital tools like robotics simulation.

The Asia-Pacific region, especially China, is emerging as a rapidly growing market. Fueled by its massive manufacturing base, increasing investments in automation, and a burgeoning domestic robotics industry, China is becoming a key consumer and developer of robotics simulation software. The "Made in China 2025" initiative has significantly accelerated the adoption of advanced technologies, including robotics and simulation, across various sectors.

When considering segments, the Automotive & Transportation sector is a dominant application segment. The automotive industry's relentless pursuit of efficiency, safety, and customization in vehicle manufacturing makes it a prime candidate for robotics simulation. From designing complex assembly lines to simulating the interaction of autonomous vehicles, simulation software plays a crucial role. The demand for virtual prototyping, collision detection, and motion planning for intricate robotic arms used in welding, painting, and assembly processes drives significant market share.

The Machine Manufacturing segment is also a critical driver. This sector encompasses a broad range of industries that rely on automated machinery and robotics for precision manufacturing. Simulation software is essential for designing, programming, and optimizing the performance of industrial robots used in tasks such as material handling, packaging, and quality inspection. The need for flexibility and adaptability in manufacturing processes further amplifies the importance of simulation.

Moreover, the Cloud Based type segment is experiencing a substantial surge in adoption and is projected to dominate in the coming years. The inherent advantages of cloud-based solutions, including scalability, accessibility from anywhere, reduced IT infrastructure costs, and facilitated collaboration among geographically dispersed teams, are making them increasingly attractive. Companies are leveraging cloud platforms to run complex simulations without significant upfront hardware investments and to enable faster iteration and development cycles. This trend is particularly evident in the forecast period (2025-2033) as more organizations embrace digital transformation and cloud-native technologies. The ability to access powerful simulation tools on a subscription basis democratizes their use and accelerates innovation.

The robotics simulation software industry is experiencing robust growth catalyzed by several key factors. The increasing complexity and sophistication of robotic systems demand advanced virtual testing environments for efficient design and programming. Furthermore, the escalating need for cost reduction in industrial automation, coupled with the drive to minimize risks and downtime associated with physical deployments, propels the adoption of simulation solutions. The continuous advancements in computational power and AI/ML integration are enabling more realistic and predictive simulations, thereby enhancing their value proposition.

This comprehensive report delves into the multifaceted landscape of the robotics simulation software market. It offers a granular analysis of market dynamics, encompassing historical trends, present-day scenarios, and future projections. The report meticulously examines the driving forces behind market growth, such as the imperative for operational efficiency and cost-effectiveness, and the critical challenges, including high initial investment and the need for specialized expertise. It also identifies key regions and industry segments poised for significant growth, with a particular focus on the dominance of cloud-based solutions and the automotive and machine manufacturing sectors. Furthermore, the report details growth catalysts and provides an exhaustive list of leading players and significant developments, offering a complete understanding of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Siemens, Dassault Systèmes, Visual Components (KUKA AG), ABB, Robotmaster (Hypertherm), ArtiMinds, OCTOPUZ, machineering GmbH Co. KG, RoboDK, drag and bot (KEBA), Coppelia Robotics, Webots.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Robotics Simulation Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Robotics Simulation Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.