1. What is the projected Compound Annual Growth Rate (CAGR) of the Road Transport Services?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Road Transport Services

Road Transport ServicesRoad Transport Services by Type (Full Loads, Part Loads), by Application (Food & Beverage, Manufacturing Industry, Apparel Industry, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

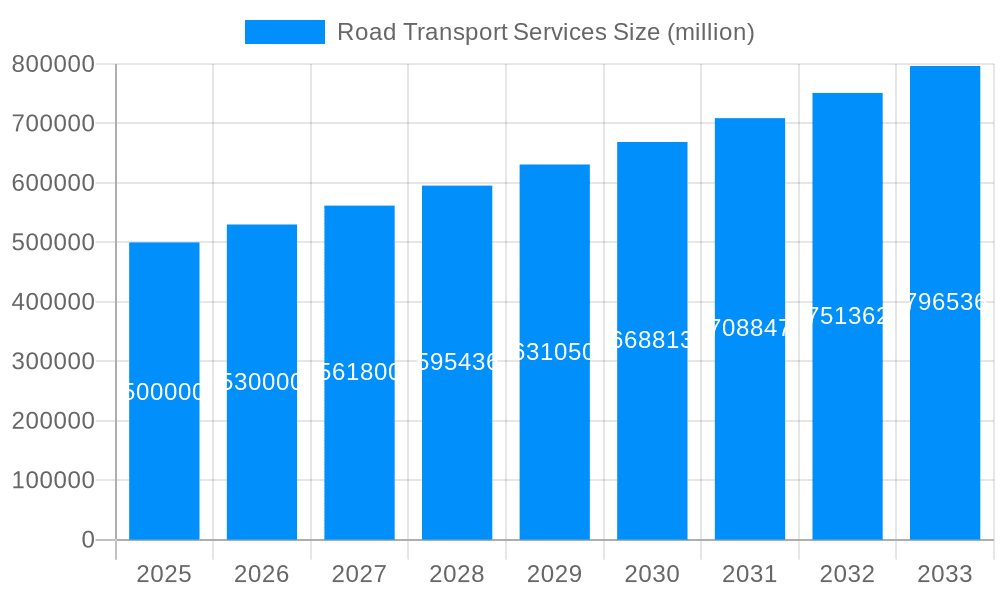

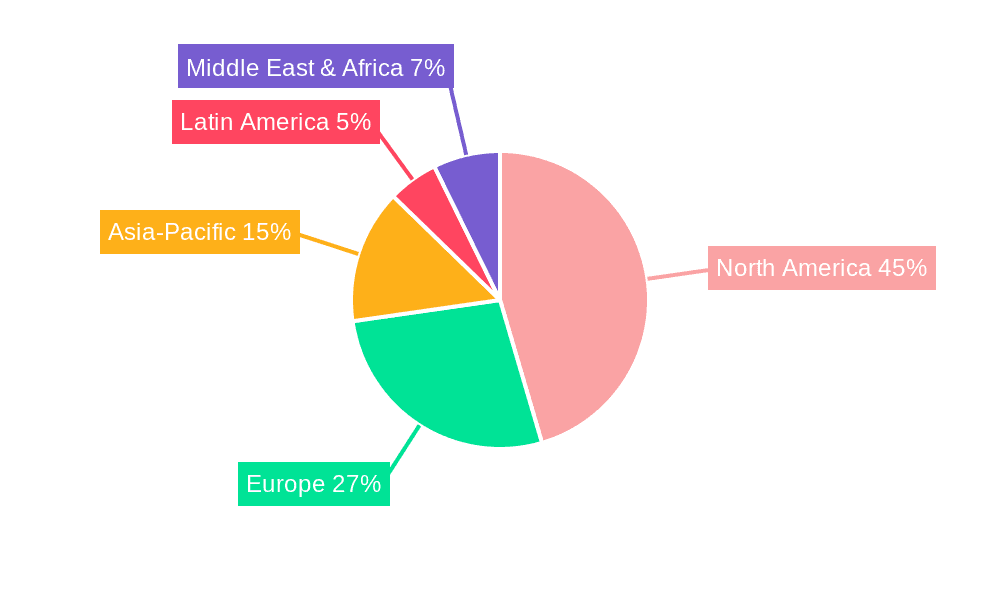

The global road transport services market is a dynamic and expansive sector, exhibiting robust growth driven by the ever-increasing demand for efficient and reliable freight movement across diverse industries. The market's substantial size, estimated at $1.5 trillion in 2025, reflects its critical role in global supply chains. A Compound Annual Growth Rate (CAGR) of 5% is projected for the period 2025-2033, indicating a steady and substantial expansion. Key growth drivers include the burgeoning e-commerce sector, requiring rapid last-mile delivery solutions, and the continuous expansion of manufacturing and food & beverage industries, both heavily reliant on road transport. Furthermore, ongoing infrastructure development in emerging economies is further fueling market growth. However, the industry faces challenges such as fluctuating fuel prices, driver shortages, and increasing regulatory complexities regarding emissions and safety standards. Segmentation reveals that full loads currently dominate the market, although part loads are experiencing faster growth due to increased demand for flexible and cost-effective solutions. Geographically, North America and Europe currently hold significant market shares, but rapidly developing economies in Asia-Pacific are expected to witness substantial growth in the coming years. This growth is primarily fueled by increasing urbanization and industrialization within those regions.

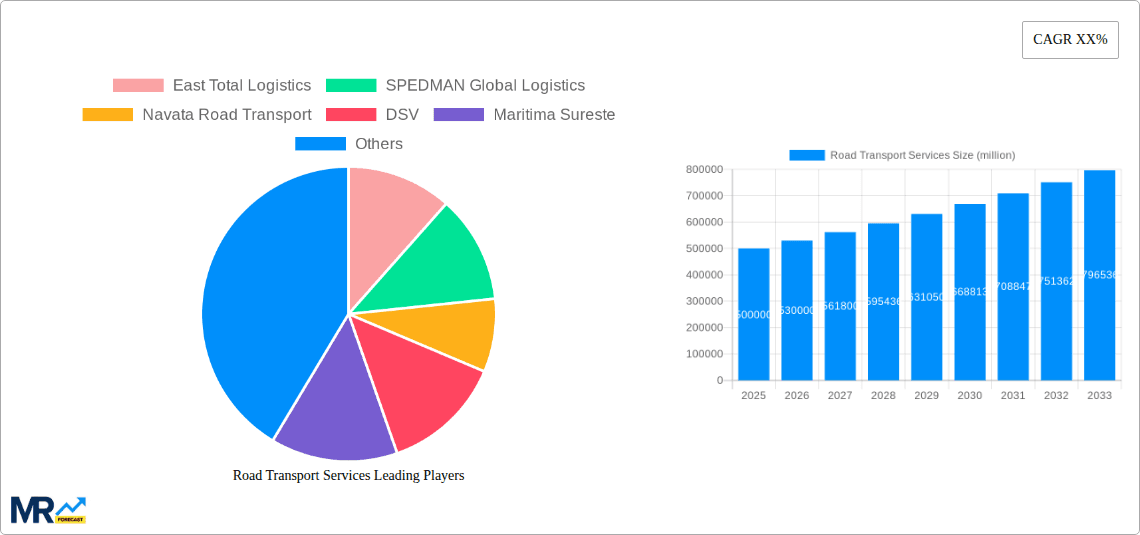

The competitive landscape is characterized by a mix of large multinational logistics providers and smaller regional players. Companies like FedEx, DSV, and DB Schenker Logistics dominate the global scene, offering comprehensive services and extensive networks. Regional players cater to specific needs and geographic areas, contributing significantly to the overall market volume. The future trajectory of the road transport services market suggests continued expansion, driven by technological advancements such as telematics, route optimization software, and autonomous driving technologies. However, successful players will need to adapt to changing regulations, address the driver shortage, and implement sustainable practices to maintain competitiveness and meet the demands of a growing and increasingly sophisticated customer base. Strategic partnerships and investments in technology are expected to play a vital role in shaping the future landscape of this vital industry.

The global road transport services market experienced robust growth during the historical period (2019-2024), exceeding $XXX million in 2024. This upward trajectory is projected to continue throughout the forecast period (2025-2033), driven by several key factors. The increasing e-commerce sector significantly fuels demand for efficient last-mile delivery solutions, a core strength of road transport. Furthermore, the expansion of manufacturing and industrial activities globally necessitates reliable and cost-effective transportation of raw materials and finished goods, further bolstering market growth. The preference for just-in-time inventory management strategies among businesses also contributes to increased reliance on road transport's flexibility and speed. However, fluctuating fuel prices, driver shortages, and stringent government regulations pose ongoing challenges. The market is witnessing a shift towards sustainable practices, with a growing adoption of electric and hybrid vehicles, as well as optimized route planning technologies aimed at reducing environmental impact and operational costs. Competition remains fierce, with established players and new entrants vying for market share through strategic acquisitions, technological advancements, and expansion into new geographical regions. The market is segmented by load type (full loads, part loads), application (food & beverage, manufacturing, apparel, others), and region, with significant variations in growth rates across these segments. The estimated market value in 2025 stands at $XXX million, showcasing its continued importance in global logistics. By 2033, the market is expected to reach a substantial $XXX million, demonstrating consistent and substantial growth throughout the forecast period. This growth is fueled by increasing cross-border trade and the continuous adaptation of the road transport industry to evolving consumer demands and technological advancements.

Several key factors contribute to the robust growth of the road transport services market. The burgeoning e-commerce industry, with its reliance on timely and efficient last-mile delivery, significantly drives demand. Simultaneously, the global expansion of manufacturing and industrial activities necessitates the reliable and cost-effective movement of goods, solidifying road transport's role. The growing adoption of just-in-time (JIT) inventory management practices by businesses necessitates faster and more flexible transportation solutions, again favoring road transport. Technological advancements, such as route optimization software, telematics, and real-time tracking systems, enhance efficiency and reduce operational costs, making road transport a more attractive option. Government infrastructure investments in road networks improve connectivity and facilitate smoother transportation, further boosting market growth. Finally, the increasing demand for faster delivery times and improved supply chain resilience fuels the market's growth, making reliable and adaptable road transport a crucial element of modern logistics.

Despite the promising growth outlook, the road transport services market faces several significant challenges. Volatile fuel prices represent a major operational cost uncertainty, impacting profitability. A persistent shortage of qualified drivers, especially in developed economies, limits operational capacity and increases labor costs. Stringent government regulations regarding emissions, safety, and driver working hours add compliance costs and operational complexities. Infrastructure limitations, such as congested roads and inadequate parking facilities, contribute to delays and increased transportation times. Increasing competition, both from established players and new entrants employing innovative business models, creates a challenging market environment. Lastly, the growing awareness of environmental concerns puts pressure on the industry to adopt more sustainable practices, requiring significant investments in green technologies and potentially impacting profitability in the short term. Overcoming these challenges requires collaborative efforts from industry stakeholders, governments, and technology providers to optimize operations and ensure sustainable growth.

The Manufacturing Industry segment is poised to dominate the road transport services market.

High Volume of Goods: The manufacturing sector generates a massive volume of goods requiring transportation from raw material sourcing to production facilities and finally to distribution centers and consumers. This high-volume demand directly translates into substantial revenue for road transport providers.

Just-in-Time (JIT) Inventory: The prevalence of JIT inventory management strategies in manufacturing increases reliance on timely and efficient delivery systems. Road transport, with its flexibility and speed, excels at meeting these requirements.

Global Supply Chains: Many manufacturing companies operate extensive global supply chains, requiring reliable and efficient cross-border transportation. Road transport forms a crucial part of these intricate networks.

Regional Variations: Growth within the manufacturing segment will vary regionally depending on factors such as industrial development, infrastructure investment, and economic growth. Developed regions with robust manufacturing sectors are likely to experience higher demand.

Specific countries and regions expected to show significant growth in the manufacturing segment include:

North America: The large and diversified manufacturing sector, coupled with significant investment in logistics infrastructure, makes North America a key market.

Asia-Pacific: Rapid industrialization and economic growth in many Asian countries drive substantial demand for road transport services within the manufacturing sector. China, India, and Southeast Asian nations are expected to be significant contributors.

Europe: Established manufacturing hubs in Western Europe continue to be important markets, while Eastern Europe's growing industrial sector also presents significant opportunities.

In summary, the combination of high-volume goods movement, JIT inventory needs, global supply chain intricacies, and regional variations in industrial development makes the manufacturing industry segment a dominant force within the road transport services market. The large-scale transport requirements of this segment are projected to contribute significantly to the overall market's growth throughout the forecast period.

Several factors are accelerating growth in the road transport services industry. The expansion of e-commerce continues to fuel demand for fast and reliable last-mile delivery solutions. Technological advancements, such as GPS tracking, route optimization software, and telematics, improve efficiency and reduce operational costs. Government initiatives to improve road infrastructure and facilitate logistics operations contribute to smoother and more efficient transportation. Finally, the growing need for resilient supply chains, particularly in the wake of recent global disruptions, drives increased investment in and reliance upon reliable road transport services.

This report provides a detailed analysis of the road transport services market, covering market size, growth trends, key drivers, challenges, and leading players. It offers a comprehensive understanding of the current market dynamics and future outlook, providing valuable insights for businesses operating in this sector. The report segments the market by load type, application, and geography, offering detailed analysis of each segment's growth potential and competitive landscape. It also includes profiles of key players, highlighting their strategies and market share. The report’s forecasts offer a clear picture of the anticipated market trajectory, empowering stakeholders to make informed business decisions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include East Total Logistics, SPEDMAN Global Logistics, Navata Road Transport, DSV, Maritima Sureste, TruckSuvidha, RHENUS Group, Yusen Logistics, Gebrüder Weiss, DB Schenker Logistics, FedEx, Werner Enterprise, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Road Transport Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Road Transport Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.