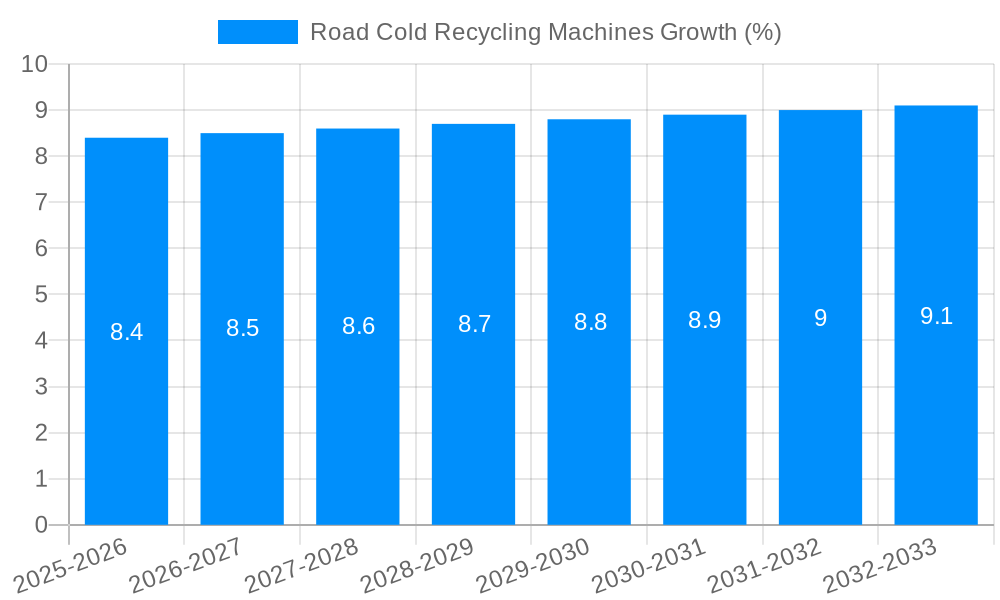

1. What is the projected Compound Annual Growth Rate (CAGR) of the Road Cold Recycling Machines?

The projected CAGR is approximately XX%.

Road Cold Recycling Machines

Road Cold Recycling MachinesRoad Cold Recycling Machines by Type (Below 400 KW, 400-500 KW, Above 500 KW, World Road Cold Recycling Machines Production ), by Application (Road Construction, Public Engineering, Others, World Road Cold Recycling Machines Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

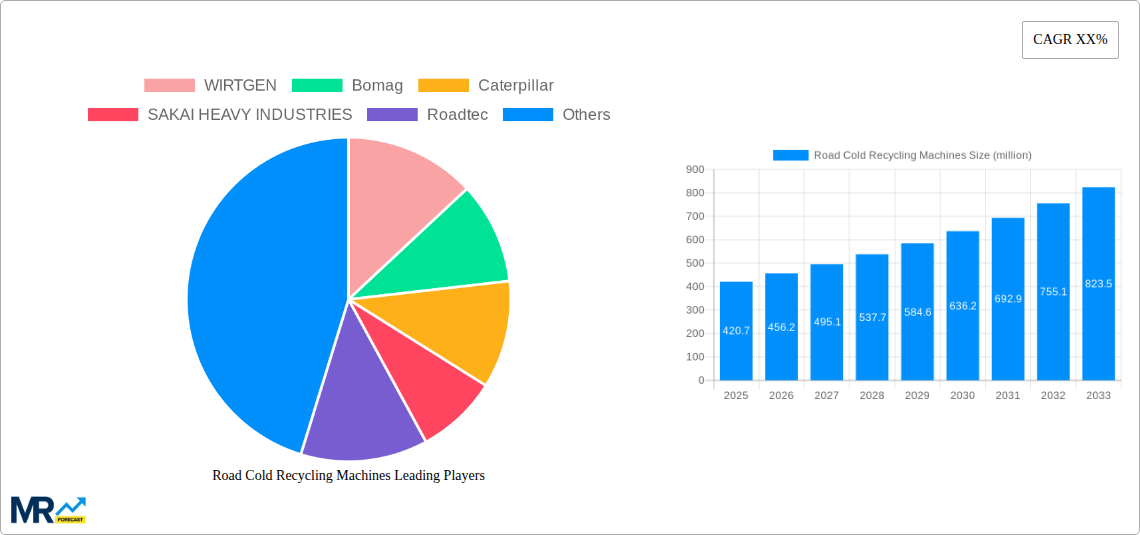

The global Road Cold Recycling Machines market is poised for significant expansion, with a current market size of approximately $420.7 million. This growth is propelled by a robust Compound Annual Growth Rate (CAGR) of roughly 8.5%, indicating a dynamic and upward trajectory for the industry. The primary drivers for this expansion are the increasing demand for sustainable and cost-effective road construction and maintenance solutions. Cold recycling offers a more environmentally friendly approach by reusing existing asphalt materials, reducing the need for virgin aggregate and significantly lowering energy consumption and carbon emissions compared to traditional hot mix recycling. Furthermore, the growing emphasis on infrastructure development and upgrades across both developed and developing economies, particularly in public engineering projects and extensive road construction initiatives, is a major catalyst. Technological advancements leading to more efficient and versatile cold recycling machines are also contributing to market penetration.

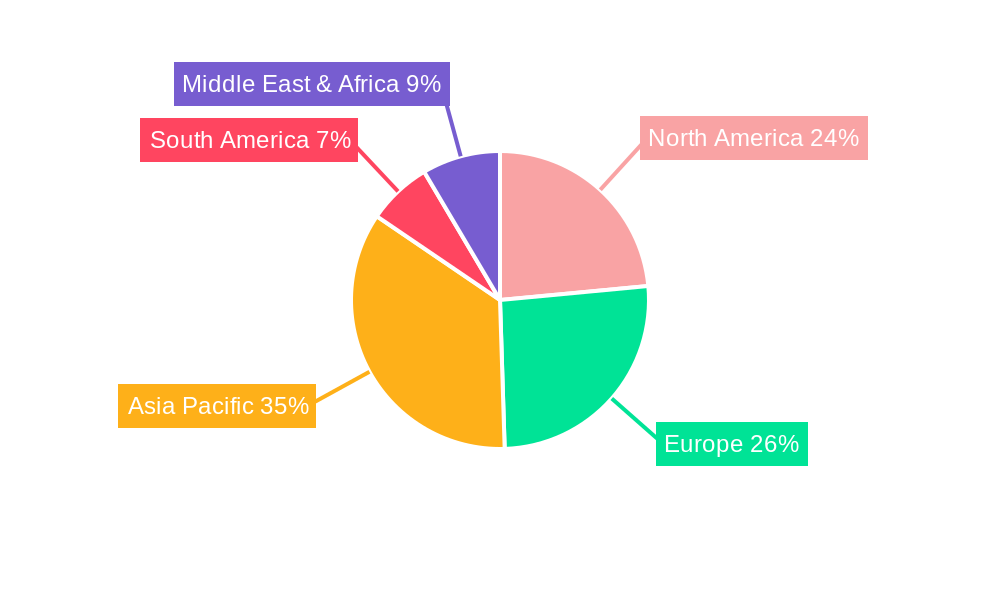

The market is segmented by machine type, with machines above 500 KW likely holding the largest share due to their capacity for large-scale projects, followed by the 400-500 KW and below 400 KW segments, catering to varied project scopes. Geographically, Asia Pacific, driven by rapid urbanization and infrastructure investment in countries like China and India, is expected to be a dominant region. North America and Europe, with their established infrastructure and strong focus on sustainable practices, will also represent substantial markets. Despite the positive outlook, potential restraints include high initial investment costs for advanced machinery and a lack of skilled labor in certain regions. However, the long-term economic and environmental benefits associated with cold recycling are expected to outweigh these challenges, ensuring sustained market growth through 2033.

Here is a comprehensive report description for Road Cold Recycling Machines, incorporating your specified elements:

This in-depth report provides a holistic examination of the global Road Cold Recycling Machines market, encompassing a detailed analysis of historical trends, current market dynamics, and future projections. The Study Period spans from 2019 to 2033, with a Base Year and Estimated Year of 2025, and a Forecast Period from 2025 to 2033. The Historical Period covered is 2019-2024. The report delves into production volumes, market segmentation by machine type and application, and explores crucial industry developments and driving forces that are shaping the road construction machinery landscape. This analysis is critical for stakeholders seeking to understand market opportunities and navigate the evolving challenges within the cold recycling sector, with projected global production volumes potentially reaching into the low millions of units over the forecast period.

The global Road Cold Recycling Machines market is experiencing a significant upswing driven by a confluence of factors, positioning it for robust growth throughout the Study Period (2019-2033). A key trend is the increasing adoption of sustainable construction practices, with cold recycling emerging as a cost-effective and environmentally friendly alternative to traditional methods. This shift is not merely a preference but a necessity, as governments worldwide implement stricter regulations on waste reduction and carbon emissions in infrastructure projects. Manufacturers are responding by innovating their product lines, introducing machines with enhanced fuel efficiency, reduced operational noise, and improved material processing capabilities. The integration of advanced technologies, such as GPS guidance systems and real-time data analytics, is also becoming standard, allowing for greater precision and efficiency in road repair and rehabilitation. The market is witnessing a steady increase in the demand for versatile machines capable of handling a wider range of applications, from minor pothole repairs to large-scale pavement reconstruction. Consequently, the World Road Cold Recycling Machines Production is projected to climb steadily, with the market size expected to grow substantially, potentially reaching several hundred thousand units annually by the end of the forecast period. The increasing focus on extending the lifespan of existing road infrastructure, rather than solely relying on new construction, further amplifies the demand for these machines.

Several powerful forces are propelling the growth of the Road Cold Recycling Machines market. Foremost among these is the increasing global emphasis on sustainable infrastructure development and circular economy principles. Cold recycling significantly reduces the need for virgin materials, conserves energy by eliminating the need for asphalt heating, and minimizes landfill waste, aligning perfectly with environmental mandates and corporate social responsibility initiatives. Governments worldwide are actively promoting and incentivizing the use of recycled materials in road construction through favorable policies and tender requirements. Furthermore, the economic advantages of cold recycling are undeniable. It offers substantial cost savings compared to hot mix asphalt recycling and new material production, due to lower energy consumption and reduced transportation costs associated with acquiring and disposing of materials. This cost-effectiveness makes it an attractive option for both public and private sector infrastructure projects, especially in an era of fluctuating material prices and constrained budgets. The growing need for efficient and rapid road maintenance and rehabilitation also fuels demand. Cold recycling processes are generally quicker and less disruptive than traditional methods, leading to reduced traffic congestion and faster project completion times, a crucial factor in urban areas.

Despite the promising growth trajectory, the Road Cold Recycling Machines market faces certain challenges and restraints that could temper its expansion. A primary hurdle is the initial capital investment required for advanced cold recycling equipment. While the long-term operational cost savings are significant, the upfront purchase price of sophisticated machines, particularly those with higher power ratings (e.g., Above 500 KW category), can be a barrier for smaller contractors or entities in developing economies with limited access to financing. Secondly, the performance and durability of recycled pavements can, in some instances, be perceived as a concern. While modern cold recycling techniques have vastly improved, there may still be regional variations in technical expertise and material quality control, leading to inconsistent outcomes. This can foster a degree of hesitancy among some clients and engineers who prioritize proven, traditional methods. Furthermore, the availability of suitable recycled materials, such as reclaimed asphalt pavement (RAP) and other suitable aggregates, can be a limiting factor in certain geographic locations, requiring efficient logistics and material processing infrastructure. Regulatory landscapes, while generally supportive of recycling, can also be complex and vary from region to region, sometimes creating a fragmented market and hindering widespread adoption.

Several regions and segments are poised to dominate the global Road Cold Recycling Machines market.

Dominant Regions:

Dominant Segments:

The Road Cold Recycling Machines industry is being propelled by several key growth catalysts. The increasing global imperative for sustainable construction practices and the circular economy model is a primary driver. Governments and regulatory bodies are mandating the use of recycled materials, thereby boosting demand for specialized equipment. Furthermore, the economic benefits of cold recycling, including reduced material and energy costs, are making it an attractive alternative for infrastructure projects, especially in regions facing budget constraints. The continuous technological advancements in machine design, offering enhanced efficiency, precision, and versatility, are also spurring adoption. Finally, the growing awareness of the environmental advantages, such as reduced carbon emissions and landfill waste, is influencing procurement decisions and creating a favorable market environment for cold recycling solutions.

This comprehensive report on Road Cold Recycling Machines offers an unparalleled deep dive into the market's intricacies. It meticulously analyzes market size and forecast, breaking down projections by Type (Below 400 KW, 400-500 KW, Above 500 KW) and Application (Road Construction, Public Engineering, Others). The report extensively covers World Road Cold Recycling Machines Production trends and delves into the Industry Developments shaping the future of this sector. With a robust methodology spanning the Study Period (2019-2033), Base Year (2025), and Forecast Period (2025-2033), it provides actionable insights for stakeholders. The report details key market drivers, challenges, and opportunities, alongside a thorough review of leading manufacturers and their product portfolios, empowering businesses to make informed strategic decisions in this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include WIRTGEN, Bomag, Caterpillar, SAKAI HEAVY INDUSTRIES, Roadtec, XCMG, Shantui, Shandong Road Construction Machinery Factory Co.,Ltd, Xuzhou Rema heavy Machinery, .

The market segments include Type, Application.

The market size is estimated to be USD 420.7 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Road Cold Recycling Machines," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Road Cold Recycling Machines, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.