1. What is the projected Compound Annual Growth Rate (CAGR) of the Rigid PU Foam Additives?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Rigid PU Foam Additives

Rigid PU Foam AdditivesRigid PU Foam Additives by Type (Surfactant, Catalyst, Modifier, World Rigid PU Foam Additives Production ), by Application (Refrigerated and Insulated Industry, Building Industry, Solar Water Heater, Others, World Rigid PU Foam Additives Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

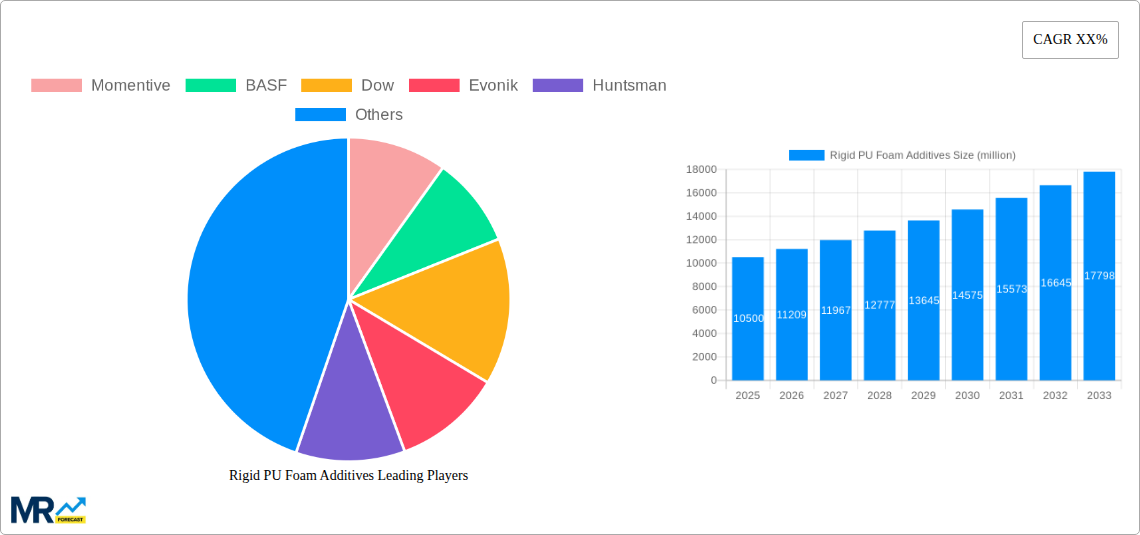

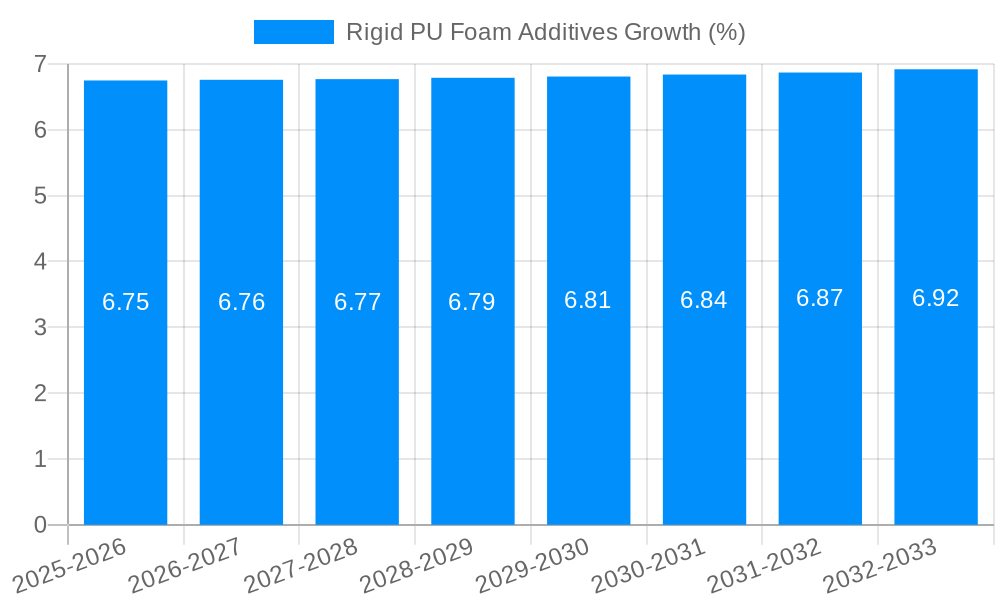

The global Rigid PU Foam Additives market is poised for significant expansion, projected to reach an estimated USD 10,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.5% extending through 2033. This growth is primarily propelled by the escalating demand for energy-efficient solutions across various industries, particularly in insulation for refrigeration, construction, and solar water heating applications. The inherent properties of rigid PU foam, such as its excellent thermal insulation and structural integrity, make it an indispensable material, driving the consumption of a diverse range of additives. These additives, including surfactants, catalysts, and modifiers, play a crucial role in optimizing foam performance, ensuring desired cell structure, cure rates, and overall physical properties. The increasing stringency of building codes and energy efficiency regulations globally further fuels the adoption of rigid PU foam and, consequently, its associated additives.

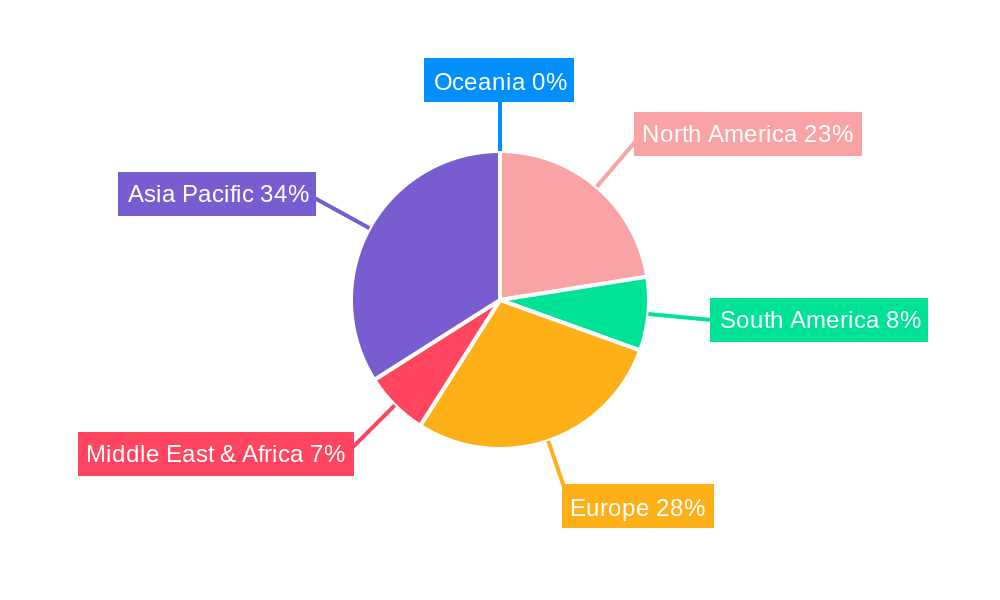

The market landscape is characterized by a dynamic interplay of established global players and emerging regional manufacturers, fostering innovation and competitive pricing. Key drivers include advancements in additive formulations to enhance fire retardancy, reduce environmental impact (e.g., low-GWP blowing agents), and improve processing efficiency. However, the market faces certain restraints, such as the fluctuating raw material costs and the development of alternative insulation materials that could pose a competitive threat. Geographically, the Asia Pacific region is expected to lead in terms of market share and growth, driven by rapid industrialization, urbanization, and significant investments in infrastructure and manufacturing. North America and Europe remain substantial markets due to mature industries and strong regulatory frameworks promoting energy efficiency. The "Others" application segment, encompassing diverse niche uses, also presents opportunities for growth as new applications for rigid PU foam continue to emerge.

This report provides an in-depth analysis of the global Rigid Polyurethane (PU) Foam Additives market, spanning a study period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, encompassing historical data from 2019 to 2024. The market is characterized by dynamic innovation and evolving demand drivers, offering significant opportunities for stakeholders.

The global Rigid PU Foam Additives market is experiencing robust growth, projected to reach XXX million units by the forecast period. A significant trend is the increasing demand for enhanced thermal insulation properties in various applications, driven by stringent energy efficiency regulations worldwide and a growing consumer consciousness regarding sustainability. XXX, a key market insight, highlights the escalating adoption of advanced surfactant technologies that improve cell structure and reduce thermal conductivity, thereby enhancing the overall performance of rigid PU foam. Catalysts are also witnessing significant innovation, with a focus on developing lower VOC (Volatile Organic Compound) formulations to meet environmental compliance and user safety standards. Modifiers are gaining prominence as manufacturers seek to tailor foam properties for specific end-uses, such as improved fire retardancy, mechanical strength, and water resistance. The World Rigid PU Foam Additives Production is witnessing a steady upward trajectory, fueled by advancements in manufacturing processes and a broader application base. The historical period (2019-2024) laid a strong foundation for this growth, with consistent investment in R&D and capacity expansion by major players. The base year of 2025 marks a pivotal point, with the market poised for accelerated expansion in the coming years. The estimated year of 2025 is expected to reflect significant market maturation, with further technological refinements and strategic partnerships shaping the competitive landscape. The forecast period (2025-2033) anticipates sustained demand, driven by emerging economies and the continuous need for efficient insulation solutions across diverse industries. The emphasis on environmentally friendly additives, such as bio-based surfactants and halogen-free flame retardants, is another crucial trend that will shape market dynamics. Furthermore, the integration of digital technologies in production and supply chain management is expected to optimize efficiency and responsiveness to market demands.

The expansion of the rigid PU foam additives market is propelled by a confluence of potent driving forces. Foremost among these is the escalating global emphasis on energy efficiency and sustainability. Governments worldwide are enacting and strengthening building codes and energy performance standards, mandating better insulation in residential, commercial, and industrial structures. Rigid PU foam, known for its exceptional thermal insulation capabilities, is a primary beneficiary of these regulations, and consequently, the demand for specialized additives that enhance its performance, such as improved blowing agents and fire retardants, is surging. Another significant driver is the robust growth in the construction sector, particularly in emerging economies. Rapid urbanization, infrastructure development, and increasing disposable incomes are fueling new construction projects, which in turn, require substantial quantities of rigid PU foam for insulation. The refrigerated and insulated industry also plays a crucial role, with increasing demand for efficient cold chain logistics and energy-efficient appliances like refrigerators and freezers directly translating into higher consumption of rigid PU foam and its associated additives. Furthermore, technological advancements in additive formulations are creating new market opportunities. Innovations in catalysts, surfactants, and modifiers are enabling the development of foams with superior properties, such as enhanced dimensional stability, reduced flammability, and improved processability, making them more attractive for a wider range of applications.

Despite the promising growth trajectory, the Rigid PU Foam Additives market faces several challenges and restraints that could impede its full potential. One of the primary concerns revolves around the environmental impact and regulatory landscape surrounding certain additive components. Historically, some blowing agents used in rigid PU foam production, such as hydrofluorocarbons (HFCs), have been identified as having high global warming potential (GWP). International agreements like the Kigali Amendment to the Montreal Protocol are phasing down the production and consumption of HFCs, forcing manufacturers to seek and adopt lower GWP alternatives, such as hydrofluoroolefins (HFOs) and hydrocarbons. This transition can incur significant R&D costs and capital investments for reformulation and new production processes, presenting a substantial challenge for smaller players. The volatility of raw material prices is another significant restraint. The production of PU foam additives relies on a range of petrochemical-derived feedstocks, and their prices are susceptible to fluctuations in global oil markets. Such volatility can impact the profitability of additive manufacturers and potentially lead to price increases for end-users, affecting demand. Stringent health and safety regulations related to the handling and use of certain chemical additives also pose a challenge. While efforts are being made to develop safer formulations, continuous compliance and rigorous testing add to the operational complexities and costs. Furthermore, the development of alternative insulation materials with comparable performance and potentially lower environmental impact could also pose a competitive threat to rigid PU foam and its additives. The long lead times and high initial investment required for developing and commercializing new additive technologies can also act as a restraint, particularly for innovative yet unproven solutions.

The Building Industry segment, encompassing applications in residential, commercial, and industrial construction, is poised to dominate the global Rigid PU Foam Additives market. This dominance is underpinned by a multitude of factors, including an increasing global focus on energy efficiency, stringent building codes, and rapid urbanization, particularly in emerging economies. The demand for enhanced thermal insulation to reduce energy consumption for heating and cooling in buildings is paramount. Rigid PU foam, due to its excellent insulation properties and versatility in application (e.g., spray foam, boards), is a preferred material. Additives play a critical role in optimizing these properties, such as improving the blowing agent performance for lower thermal conductivity, enhancing fire retardancy for safety compliance, and ensuring dimensional stability under varying environmental conditions.

Geographically, Asia Pacific is expected to emerge as a dominant region, driven by the massive scale of its construction activities. Countries like China, India, and Southeast Asian nations are experiencing unprecedented infrastructure development, driven by population growth, economic expansion, and government initiatives to improve living standards and industrial capacity. This surge in construction directly translates into a substantial demand for rigid PU foam and its accompanying additives. The region's growing middle class also fuels demand for energy-efficient homes and appliances, further bolstering the market.

Within the Type segment, Surfactants are projected to hold a significant share and exhibit strong growth. Surfactants are indispensable for controlling cell structure during foam formation, ensuring uniform cell distribution, and preventing cell collapse. These attributes are crucial for achieving optimal thermal insulation, mechanical strength, and processing efficiency. The development of new generation surfactants with improved performance, lower environmental impact, and better compatibility with evolving blowing agents will be a key driver for this segment.

The Application segment of the Refrigerated and Insulated Industry is also a major contributor and a key driver of market growth. The expanding global cold chain logistics network, essential for preserving perishable goods, pharmaceuticals, and other sensitive products, relies heavily on insulated containers and warehouses. Similarly, the increasing adoption of energy-efficient refrigerators, freezers, and commercial refrigeration units by consumers and businesses alike necessitates the use of high-performance rigid PU foam insulation. Additives that enhance the long-term insulating performance, moisture resistance, and structural integrity of the foam in these demanding environments are in high demand.

The World Rigid PU Foam Additives Production itself is a segment to watch, as technological advancements and economies of scale in manufacturing will influence market dynamics. Increased production capacities and process optimizations by leading players will contribute to meeting the growing global demand efficiently. The report will delve into the specific production volumes and trends within this segment, offering insights into supply chain dynamics and regional manufacturing hubs.

The rigid PU foam additives industry is experiencing significant growth catalysts that are shaping its future. A primary catalyst is the increasing global imperative for energy conservation and sustainability. Stricter building codes and environmental regulations worldwide are mandating enhanced insulation performance, directly boosting the demand for rigid PU foam and its specialized additives. Furthermore, technological advancements in additive formulations, particularly in developing lower GWP blowing agents, more efficient catalysts, and high-performance surfactants, are creating new market opportunities and driving innovation. The expanding end-use industries, such as construction, refrigeration, and automotive, particularly in emerging economies, provide a broad and growing application base. Finally, government incentives and subsidies for green building and energy-efficient technologies further accelerate the adoption of rigid PU foam and its advanced additive solutions.

The global Rigid PU Foam Additives market features a competitive landscape with several key players driving innovation and market expansion. These companies are instrumental in shaping the industry through their diverse product portfolios and strategic initiatives.

The Rigid PU Foam Additives sector has witnessed several significant developments in recent years, reflecting the industry's dynamism and response to market demands. These developments highlight the ongoing innovation and strategic moves by key stakeholders.

This comprehensive report offers an exhaustive examination of the global Rigid PU Foam Additives market, providing deep insights into its multifaceted dynamics. The analysis delves into key market segments, including Type (Surfactant, Catalyst, Modifier), Application (Refrigerated and Insulated Industry, Building Industry, Solar Water Heater, Others), and encompasses detailed projections for World Rigid PU Foam Additives Production. The report meticulously covers the Study Period (2019-2033), with specific emphasis on the Base Year (2025) and Forecast Period (2025-2033), drawing upon historical data from 2019-2024. Through detailed market segmentation, regional analysis, and an exploration of growth catalysts, this report equips stakeholders with the knowledge necessary to navigate the evolving landscape and capitalize on emerging opportunities within this vital industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Momentive, BASF, Dow, Evonik, Huntsman, Albemarle, Lanxess, TOSOH, Majorel, Schill+Seilacher, Concentrol, Umicore, Zhejiang Xinan Chemical, OSiC, Jiangsu Maysta Chemical, Suzhou Siltech, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Rigid PU Foam Additives," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Rigid PU Foam Additives, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.