1. What is the projected Compound Annual Growth Rate (CAGR) of the RFID Inlays?

The projected CAGR is approximately 9.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

RFID Inlays

RFID InlaysRFID Inlays by Application (Retail, Asset Management/Inventory/Documents, Logistics, Ticketing/Cards/Books, Others), by Type (UHF RFID Inlays, LF RFID Inlays, HF RFID Inlays), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

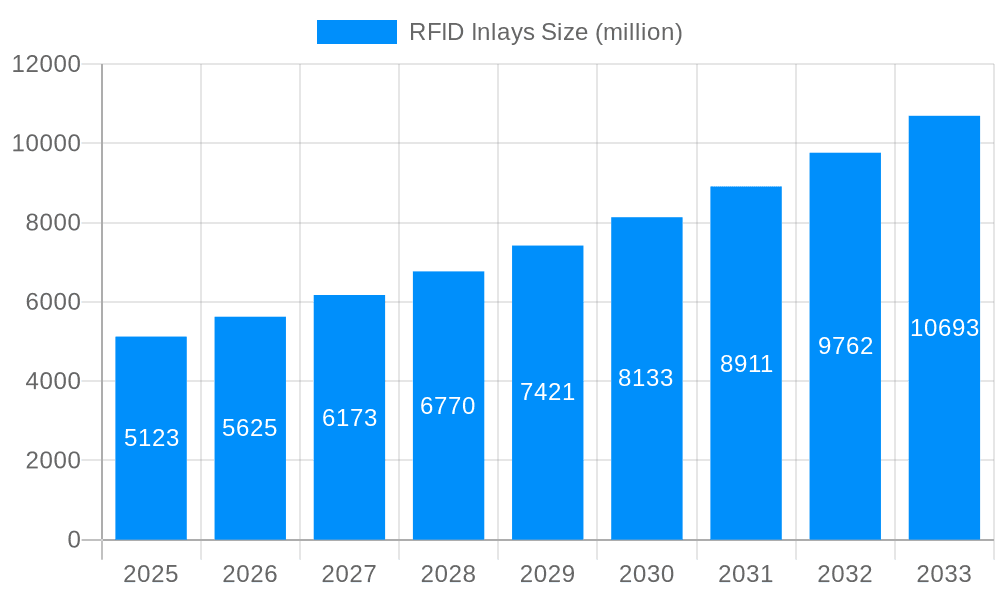

The global RFID Inlays market is poised for significant expansion, projected to reach an estimated value of approximately $5,123 million by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 9.8% over the forecast period from 2025 to 2033. This impressive growth trajectory is primarily fueled by the escalating demand across various key applications, including retail for inventory management and loss prevention, asset management for enhanced tracking and control, and the logistics sector for streamlined supply chain operations. The continuous innovation in RFID technology, leading to smaller, more cost-effective, and more versatile inlays, further stimulates market adoption. Additionally, the increasing digitalization of industries and the growing need for real-time data visibility are powerful drivers pushing businesses to invest in RFID solutions. The market is segmented by type, with UHF (Ultra High Frequency) RFID Inlays dominating due to their superior read range and speed, followed by HF (High Frequency) and LF (Low Frequency) inlays, each catering to specific application requirements.

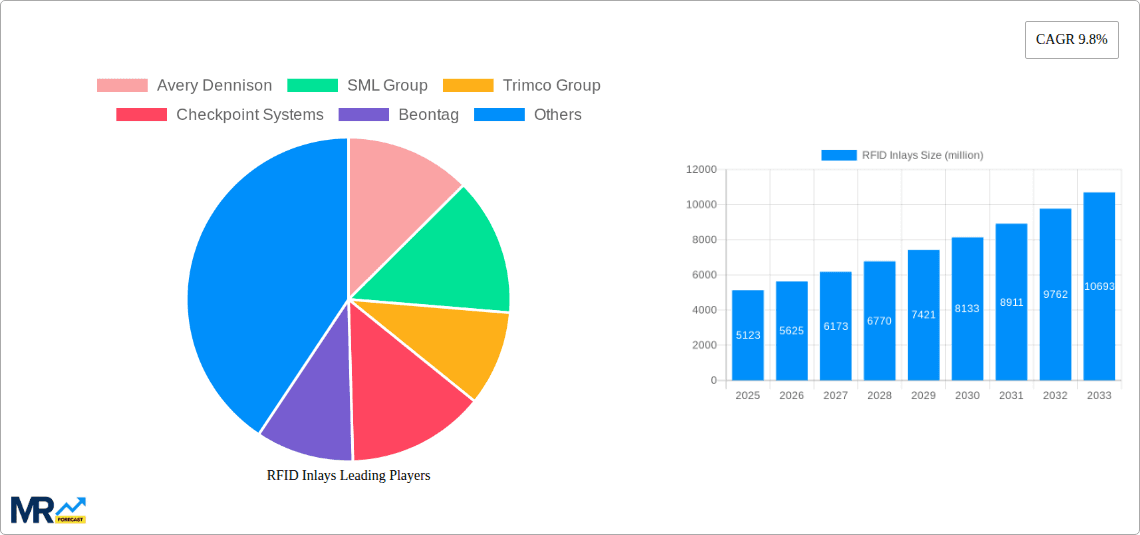

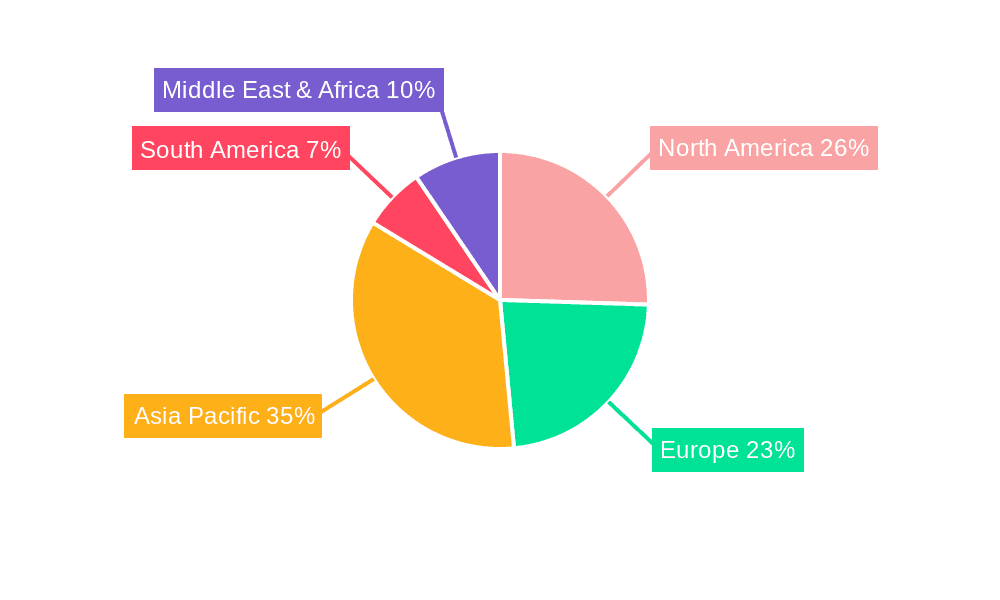

The competitive landscape is characterized by a mix of established global players and emerging regional manufacturers, all striving to capture market share through product differentiation, technological advancements, and strategic partnerships. Key companies like Avery Dennison, SML Group, and Checkpoint Systems are at the forefront, offering a comprehensive range of inlay solutions. Emerging trends such as the integration of RFID with IoT devices, the development of secure and tamper-evident inlays, and the increasing adoption of RFID in specialized sectors like healthcare and pharmaceuticals are expected to shape the market's future. While opportunities abound, potential restraints include the initial implementation costs for some businesses and the ongoing need for standardization and interoperability across different RFID systems. Geographically, Asia Pacific is anticipated to be a significant growth engine, driven by rapid industrialization and a burgeoning e-commerce market, closely followed by North America and Europe, which are mature markets with established RFID infrastructures.

Here's a unique report description on RFID Inlays, incorporating your specified elements:

This report delves into the dynamic and rapidly evolving RFID Inlays market, offering a comprehensive analysis of trends, drivers, challenges, and future trajectories from 2019 to 2033, with a detailed focus on the base year of 2025 and the forecast period of 2025-2033. The market, projected to witness substantial growth, will see unit shipments cross the 500 million mark by 2025 and are expected to exceed 1.2 billion by 2033, underscoring its increasing integration across diverse industries. We provide granular insights into the competitive landscape, technological advancements, and the strategic imperatives shaping the future of this critical component of the Internet of Things (IoT).

The RFID Inlays market is experiencing a significant paradigm shift, driven by the relentless pursuit of enhanced supply chain visibility, improved operational efficiency, and richer consumer experiences. By 2025, the estimated market size for RFID Inlays is projected to reach 550 million units, a testament to the increasing adoption of RFID technology as a foundational element for smart operations. A pivotal trend is the escalating demand for UHF RFID Inlays, which are expected to constitute over 70% of the total inlay shipments by 2025, owing to their superior read range and data transfer capabilities, making them ideal for large-scale inventory management and logistics applications. The historical period from 2019-2024 laid the groundwork for this surge, witnessing a steady increase in adoption driven by pilot programs and early integrations. Looking ahead, the forecast period of 2025-2033 will be characterized by further technological maturation, including miniaturization of inlays, enhanced security features, and the integration of sensing capabilities, pushing unit shipments beyond the 1.2 billion mark. The growth is not confined to a single application; while Retail remains a dominant sector, contributing an estimated 35% of unit sales in 2025, we foresee substantial expansion in Asset Management/Inventory/Documents and Logistics, with each segment projected to account for over 20% of the market. Furthermore, the increasing use of RFID in Ticketing/Cards/Books, particularly for secure document authentication and access control, is also a noteworthy trend, estimated to grow at a CAGR of 18% during the forecast period. The evolution of HF and LF RFID Inlays, while perhaps not matching the sheer volume of UHF, will continue to serve niche applications where their specific characteristics, such as close-proximity reading or suitability for harsh environments, remain indispensable. The market will also witness the emergence of novel applications in the "Others" segment, driven by innovation in areas like smart packaging and wearable technology.

The exponential growth of the RFID Inlays market is propelled by a confluence of powerful factors that are fundamentally reshaping how businesses operate and interact with their assets and products. The overarching need for enhanced visibility and traceability across complex global supply chains stands as a primary driver. Companies are increasingly recognizing that real-time tracking of goods, from raw materials to finished products, is no longer a luxury but a necessity for optimizing inventory management, reducing stockouts, and minimizing losses due to theft or obsolescence. This demand is further amplified by the retail sector's ongoing efforts to combat counterfeit goods and improve the customer experience through accurate inventory data and personalized interactions. Furthermore, the burgeoning digital transformation initiatives across various industries are creating fertile ground for RFID adoption. As businesses invest in smart factories, intelligent logistics networks, and connected retail environments, RFID inlays serve as the crucial link, enabling seamless data capture and communication between physical objects and digital systems. The decreasing cost of RFID tags and readers, coupled with advancements in inlay technology that offer improved performance and smaller form factors, are also making RFID a more accessible and economically viable solution for a wider range of applications. The regulatory landscape, in some sectors, also plays a role, with mandates for item-level tagging in specific industries indirectly fostering RFID adoption.

Despite the robust growth trajectory, the RFID Inlays market is not without its hurdles. One of the significant challenges remains the initial implementation cost, particularly for large-scale deployments across extensive supply chains. While tag costs have decreased, the investment in readers, middleware, software, and integration services can still be a barrier for smaller enterprises or those with tight budgets. Interoperability and standardization also present ongoing concerns. Ensuring that RFID systems from different vendors can seamlessly communicate and exchange data can be complex, leading to fragmented solutions and hindering widespread adoption. The security and privacy implications associated with RFID technology also require careful consideration. The potential for unauthorized data access or tracking of individuals necessitates the development and implementation of robust security protocols and ethical guidelines. Furthermore, environmental factors can impact RFID performance. Metal surfaces, liquids, and extreme temperatures can interfere with radio frequency signals, requiring specialized inlay designs and careful placement strategies. The lack of widespread technical expertise among potential adopters, coupled with the need for skilled personnel to manage and maintain RFID systems, can also act as a restraint. Lastly, while the market is growing, competition from alternative identification technologies such as barcodes and QR codes, which are often less expensive for basic identification, continues to pose a competitive pressure, especially in applications where advanced functionality is not a primary requirement.

The global RFID Inlays market is poised for significant expansion, with certain regions and application segments demonstrating exceptional growth potential and a propensity to dominate market share.

Dominant Segments:

Emerging Dominant Regions/Countries:

While other regions like Europe are also significant markets, the growth trajectory and sheer volume of adoption in Asia-Pacific, coupled with the sustained strength of North America, position these as the key dominating forces shaping the global RFID Inlays landscape in the coming years.

The RFID Inlays industry is experiencing robust growth, propelled by key catalysts that are expanding its reach and utility. The fundamental driver is the escalating demand for enhanced supply chain visibility and real-time inventory management across diverse sectors, from retail to manufacturing. The increasing digitalization of businesses and the broader adoption of IoT technologies create a fertile ground for RFID's role as a foundational identification and tracking solution. Furthermore, the continuous innovation leading to smaller, more cost-effective, and higher-performance inlays, particularly in the UHF spectrum, is making RFID an increasingly accessible and attractive option for a wider range of applications and organizations.

This report provides an exhaustive analysis of the RFID Inlays market, meticulously detailing trends, growth drivers, and critical challenges. It offers in-depth insights into the competitive landscape, highlighting the strategic moves and market positions of leading players. The study meticulously forecasts market evolution across various segments, including UHF, HF, and LF RFID Inlays, and their application in Retail, Asset Management, Logistics, and Ticketing. With a dedicated focus on the period from 2019 to 2033, including a detailed base year analysis of 2025, this report equips stakeholders with the essential knowledge to navigate the complexities and capitalize on the burgeoning opportunities within the RFID Inlays ecosystem.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.8%.

Key companies in the market include Avery Dennison, SML Group, Trimco Group, Checkpoint Systems, Beontag, Arizon, XINDECO IOT, Tageos, SATO, INLAYLINK, Zebra, NAXIS, Hangzhou Century, Talkin' Things, Hana Technologies, Invengo.

The market segments include Application, Type.

The market size is estimated to be USD 5123 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "RFID Inlays," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the RFID Inlays, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.