1. What is the projected Compound Annual Growth Rate (CAGR) of the Reversing Viewing Systems?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Reversing Viewing Systems

Reversing Viewing SystemsReversing Viewing Systems by Type (CCD Cameras, CMOS Cameras, World Reversing Viewing Systems Production ), by Application (Passenger Cars, Commercial Vehicles, World Reversing Viewing Systems Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

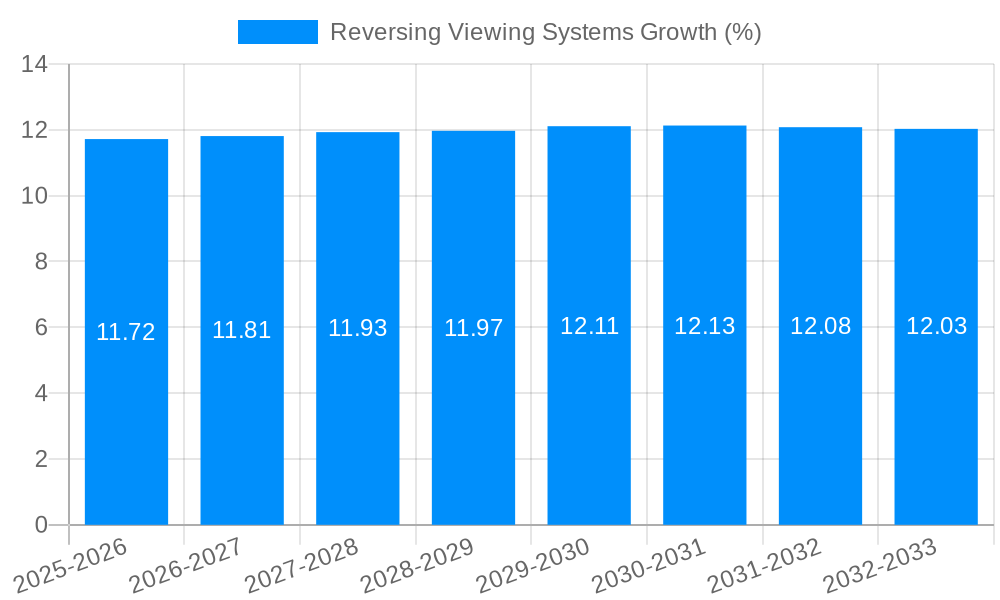

The global Reversing Viewing Systems market is poised for significant expansion, projected to reach an estimated USD 5.8 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 11.5% from 2019 to 2033. This upward trajectory is primarily fueled by the increasing adoption of advanced driver-assistance systems (ADAS) in both passenger and commercial vehicles, driven by stringent safety regulations and a growing consumer demand for enhanced vehicle safety and convenience features. The widespread integration of these systems is crucial for reducing blind spots and preventing accidents, making them an indispensable component in modern automotive design. Key technologies like CMOS cameras are dominating the market due to their superior image quality, lower power consumption, and cost-effectiveness compared to older CCD camera technology, further propelling market growth.

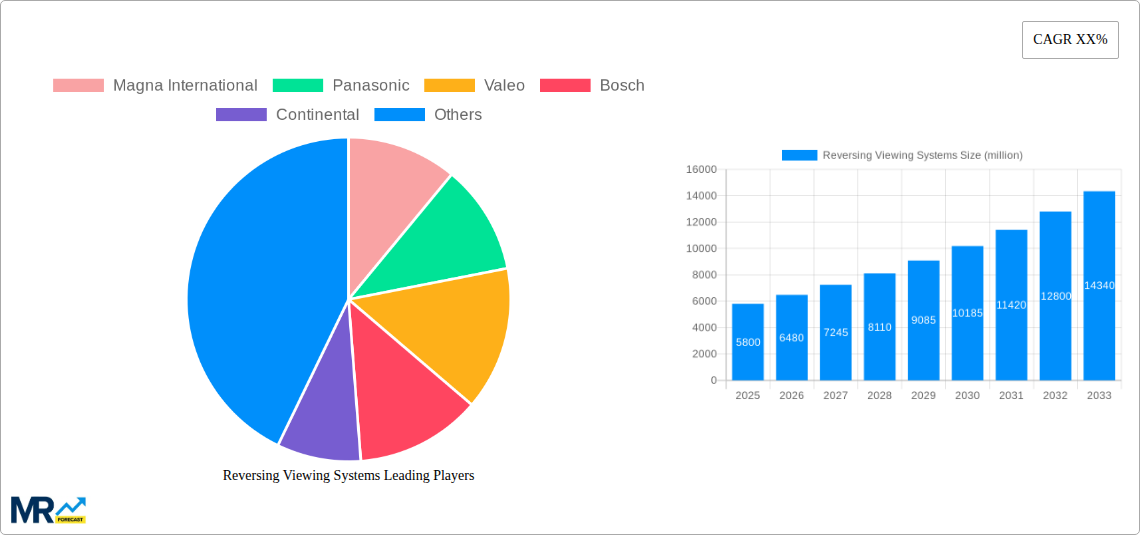

The market is characterized by a competitive landscape featuring major automotive suppliers and technology giants. Companies such as Magna International, Panasonic, Valeo, Bosch, and Continental are at the forefront, investing heavily in research and development to innovate and expand their product portfolios. The trend towards sophisticated, high-resolution cameras and integrated systems offering features like 360-degree views and object detection is expected to shape the market dynamics. However, challenges such as the high initial cost of advanced systems and the need for robust infrastructure for seamless integration could present some restraints. Nevertheless, the unwavering focus on automotive safety, coupled with technological advancements and strategic collaborations among key players, will continue to drive the demand for reversing viewing systems across all major automotive markets globally, with Asia Pacific expected to be a key growth engine.

This comprehensive report delves into the dynamic global Reversing Viewing Systems market, projecting a significant expansion from USD 3,500 million in the base year of 2025 to an estimated USD 7,800 million by the end of the forecast period in 2033. The study meticulously analyzes the historical performance from 2019-2024, establishing a robust foundation for understanding market trajectory. Our projections, built upon sophisticated modeling techniques, are meticulously validated for the Estimated Year of 2025 and extend through the extensive Forecast Period of 2025-2033.

The report offers an in-depth examination of the market landscape, covering critical segments such as CCD Cameras and CMOS Cameras, alongside the overarching World Reversing Viewing Systems Production. Furthermore, it dissects the market by key applications, including Passenger Cars and Commercial Vehicles, providing granular insights into the demand drivers within each sector. We also explore the broader World Reversing Viewing Systems Production context, identifying overarching trends that influence the entire industry. This report is an indispensable resource for stakeholders seeking to navigate the evolving opportunities and challenges within this burgeoning automotive technology sector.

The global Reversing Viewing Systems market is experiencing a transformative surge, driven by an unwavering commitment to enhanced automotive safety and a growing consumer appetite for advanced driver-assistance systems (ADAS). As vehicle complexity increases and urban environments become more congested, the demand for intuitive and reliable visibility solutions is paramount. The study period, spanning from 2019 to 2033, underscores a consistent upward trajectory, with the base year of 2025 marking a pivotal point where market value is estimated at USD 3,500 million. This growth is projected to accelerate significantly, reaching an impressive USD 7,800 million by 2033. This expansion is not merely quantitative; it reflects a qualitative shift towards more sophisticated camera technologies and integrated intelligent systems. The historical period from 2019-2024 laid the groundwork for this boom, witnessing the initial widespread adoption of basic reversing cameras as standard equipment in many new vehicle models. Now, the focus is rapidly shifting towards higher resolution, wider field-of-view cameras, and the integration of artificial intelligence for object recognition and predictive warnings. The evolution from simple rearview displays to comprehensive 360-degree surround-view systems, along with the incorporation of augmented reality overlays, signifies a maturation of the market. Manufacturers are increasingly differentiating their offerings by integrating these advanced viewing systems, recognizing them as key selling points that directly contribute to occupant safety and driver confidence. The trend towards digitalization within the automotive industry further fuels this demand, as vehicles become more connected and data-driven, necessitating advanced visual input systems. This continuous innovation cycle, coupled with evolving regulatory mandates and consumer expectations, positions the Reversing Viewing Systems market for sustained and robust growth throughout the forecast period.

The escalating adoption of Reversing Viewing Systems is propelled by a confluence of powerful market forces that prioritize safety, convenience, and technological advancement in the automotive sector. Foremost among these is the unwavering global focus on reducing road accidents, particularly those involving rearward collisions which often have severe consequences. Regulatory bodies worldwide are increasingly mandating the inclusion of these systems in new vehicles, transforming them from optional add-ons to essential safety features. This legislative push creates a baseline demand that underpins market growth. Beyond regulatory impetus, consumer awareness and demand play a crucial role. As drivers become more educated about the benefits of enhanced visibility, particularly in complex parking situations and blind spots, they actively seek out vehicles equipped with these technologies. The increasing prevalence of these systems in mid-range and even entry-level vehicles has normalized their presence, further stimulating consumer expectations. Furthermore, the relentless pace of technological innovation within the automotive industry is a significant catalyst. Advances in CMOS sensor technology have led to more cost-effective, higher-resolution, and better low-light performance cameras, making them more accessible and superior to older CCD counterparts. The integration of these cameras with sophisticated image processing algorithms and AI capabilities is creating intelligent systems that not only display the rear view but also actively identify potential hazards, offering predictive warnings and aiding drivers in making safer maneuvers. The continuous drive by automotive OEMs to differentiate their products and enhance the overall user experience also contributes significantly, positioning advanced reversing viewing systems as a key feature that elevates the perceived value and technological sophistication of a vehicle.

Despite the promising growth trajectory, the Reversing Viewing Systems market is not without its hurdles. One of the primary challenges lies in the cost sensitivity associated with advanced camera systems and the associated integration. While the cost of individual components like CMOS cameras has decreased, the overall system, including the display, processing units, and intricate wiring harnesses, can still represent a significant investment for automakers, particularly for entry-level vehicle segments. This can lead to slower adoption rates in price-sensitive markets or necessitate a tiered approach to feature availability. Another significant restraint is the reliability and durability of these systems in harsh automotive environments. Cameras and their associated electronics are exposed to extreme temperatures, moisture, dust, and vibration, which can impact their performance and lifespan. Ensuring long-term reliability and minimizing potential failure points is a critical engineering challenge that requires continuous innovation in component design and manufacturing processes. Furthermore, consumer education and understanding of the limitations of these systems can sometimes be a restraint. While generally effective, these systems are not infallible. Blind spots can still exist, and environmental factors like heavy rain, snow, or fog can impair image clarity, potentially leading to over-reliance and subsequent incidents if users are not fully aware of these limitations. The increasing complexity of integration with other vehicle systems also presents a challenge. As Reversing Viewing Systems become more sophisticated, incorporating features like object detection, trajectory prediction, and even merging with other ADAS functionalities, the integration process becomes more intricate, requiring seamless interoperability between different electronic control units (ECUs) and software platforms. Finally, cybersecurity concerns related to connected vehicles, including the potential for camera systems to be compromised, represent an emerging, albeit currently less prominent, restraint that requires ongoing attention and robust security measures.

The global Reversing Viewing Systems market is poised for significant growth, with certain regions and segments exhibiting a dominant influence on its expansion. Among the application segments, Passenger Cars are expected to continue their reign as the primary market driver, projected to account for over 70% of the global market share by 2033. This dominance stems from several factors: the sheer volume of passenger car production worldwide, the increasing integration of reversing cameras as standard safety equipment in this segment, and the growing consumer demand for advanced driver-assistance systems (ADAS) in personal vehicles. As manufacturers strive to differentiate their passenger car offerings, sophisticated viewing systems become a crucial competitive advantage.

Within the types of cameras, CMOS Cameras are unequivocally set to dominate the market. Historical data from 2019-2024 clearly indicates a strong shift away from CCD technology due to the superior performance, lower power consumption, and cost-effectiveness of CMOS sensors. By the base year of 2025, CMOS cameras are estimated to hold well over 80% of the market share for reversing viewing systems, a figure projected to grow to over 90% by 2033. Their ability to deliver higher resolution images, better low-light performance, and faster frame rates, coupled with their inherent integration capabilities for digital signal processing, makes them the preferred choice for modern vehicle designs.

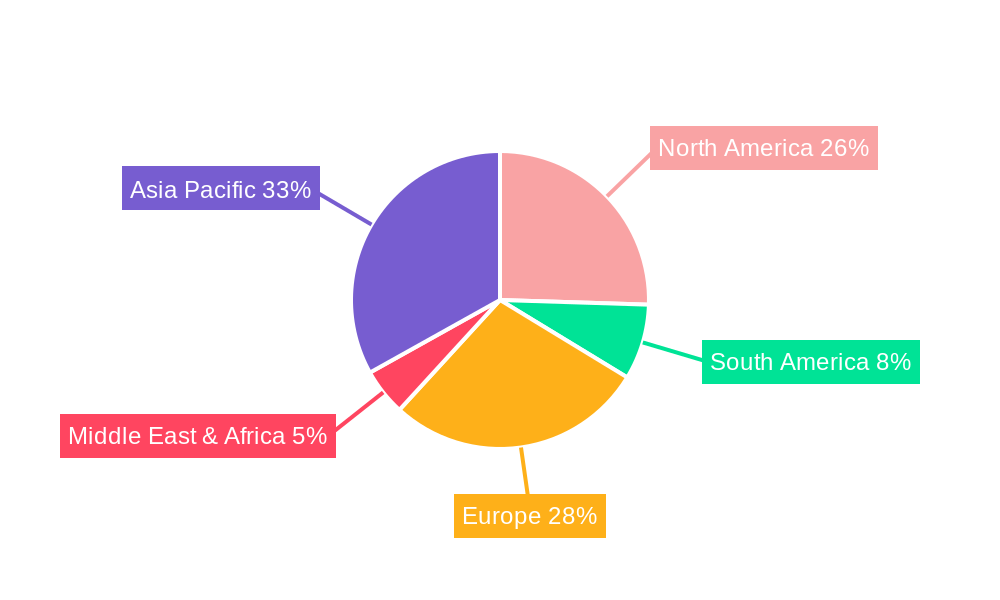

Geographically, Asia-Pacific is emerging as the undisputed leader and the most dynamic region for Reversing Viewing Systems. The region's robust automotive manufacturing base, particularly in countries like China, Japan, and South Korea, coupled with the rapidly expanding middle class and increasing disposable incomes, fuels substantial demand for vehicles equipped with advanced safety features. By 2025, Asia-Pacific is estimated to command a market share of approximately 35%, a figure expected to escalate to over 45% by 2033. China, in particular, is a powerhouse, not only as a massive consumer market but also as a significant producer of automotive electronics and components, including reversing cameras. The government's proactive approach to promoting automotive safety technologies further bolsters this regional dominance.

Following closely, North America and Europe are also critical markets, driven by stringent safety regulations, a mature automotive industry, and a high consumer awareness of vehicle safety. North America, benefiting from a large passenger car market and a strong focus on technological adoption, is projected to hold around 25-30% of the global market share throughout the forecast period. Europe, with its emphasis on advanced automotive engineering and sustainability, is expected to maintain a significant presence, accounting for approximately 20-25% of the market. The continuous push for autonomous driving technologies in these developed regions also necessitates highly sophisticated visual perception systems, further solidifying the importance of advanced Reversing Viewing Systems.

The burgeoning Reversing Viewing Systems industry is experiencing significant growth catalysts that are shaping its future trajectory. The escalating emphasis on automotive safety regulations globally, mandating the inclusion of these systems in new vehicles, acts as a primary driver. Furthermore, advancements in camera sensor technology, particularly the widespread adoption of higher-resolution and more cost-effective CMOS sensors, are making these systems more accessible and performant. The increasing integration of these cameras with artificial intelligence (AI) and machine learning algorithms for enhanced object detection and hazard prediction is also a key catalyst, transforming them from passive display tools to active safety aids.

This report offers an exhaustive analysis of the global Reversing Viewing Systems market, projecting a robust expansion from USD 3,500 million in 2025 to an impressive USD 7,800 million by 2033. The study meticulously covers the Historical Period (2019-2024), establishing a strong foundation for understanding market dynamics. Key segments analyzed include CCD Cameras and CMOS Cameras, with CMOS technology poised for significant market dominance. The report also deeply explores the World Reversing Viewing Systems Production and its applications within Passenger Cars and Commercial Vehicles. Geographically, Asia-Pacific is identified as the leading region, driven by its vast automotive manufacturing capabilities and burgeoning consumer market. This report is an essential tool for stakeholders seeking to navigate the intricate landscape of this critical automotive safety technology.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Magna International, Panasonic, Valeo, Bosch, Continental, ZF Friedrichshafen, Denso, Sony, MCNEX, LG Innotek, Aptiv, Veoneer, Samsung Electro Mechanics (SEMCO), HELLA GmbH, TungThih Electronic, OFILM, Suzhou Invo Automotive Electronics, Desay SV.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Reversing Viewing Systems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Reversing Viewing Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.