1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Digital Price Tags?

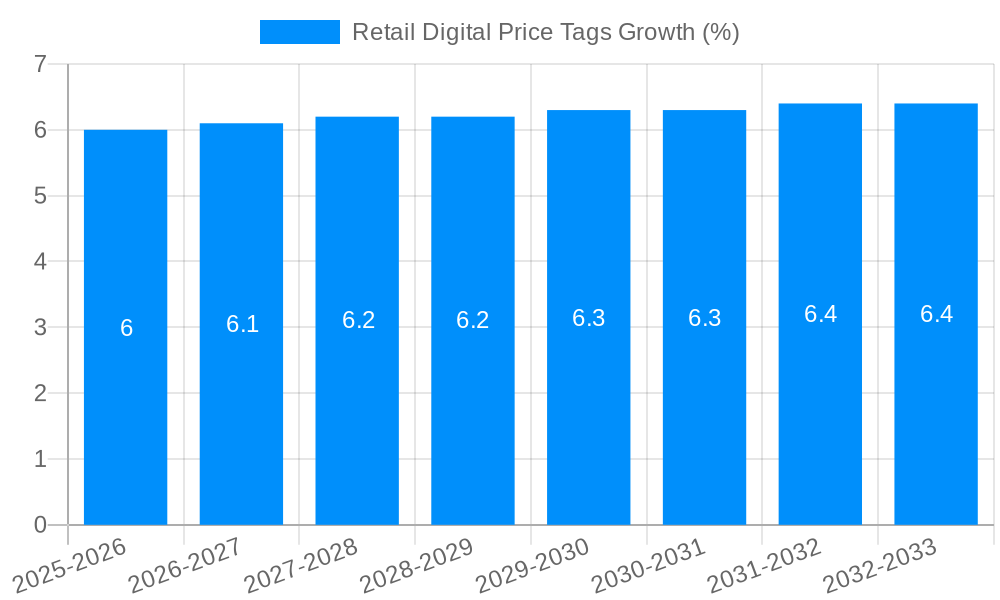

The projected CAGR is approximately 6.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Retail Digital Price Tags

Retail Digital Price TagsRetail Digital Price Tags by Type (Standard (1-3 inch), Mid-Large (3.1-7 inch), Large (7.1-10 inch)), by Application (Supermarket, Drug Stores, Specialty Stores, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

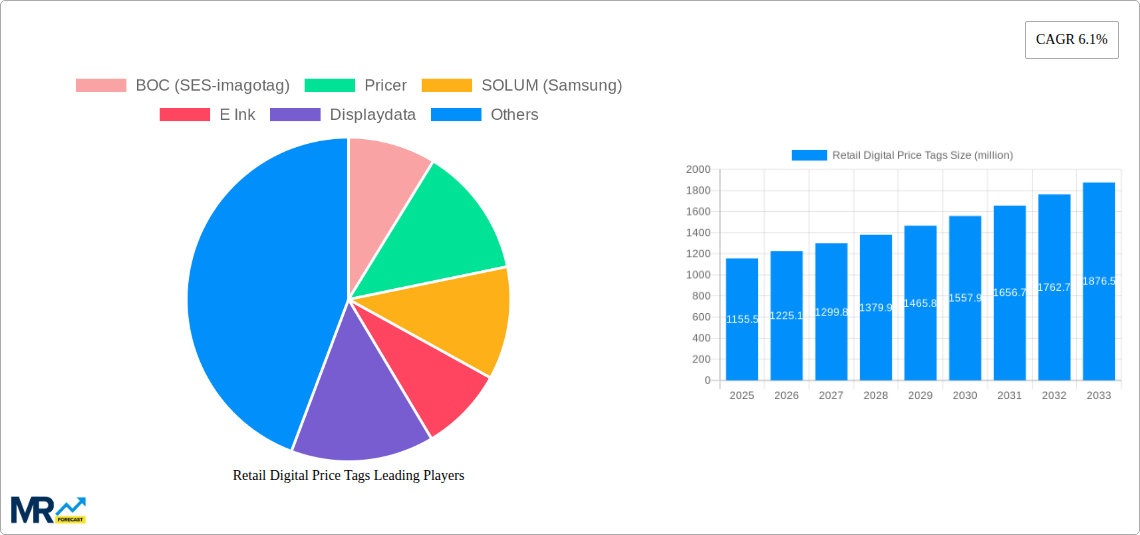

The global market for Retail Digital Price Tags is poised for substantial growth, projected to reach a market size of $1155.5 million in 2025 with a Compound Annual Growth Rate (CAGR) of 6.1% from 2019 to 2033. This robust expansion is primarily driven by the increasing adoption of Electronic Shelf Labels (ESLs) across various retail formats seeking enhanced operational efficiency and dynamic pricing capabilities. Key market drivers include the demand for real-time price updates, reduced labor costs associated with manual tag changes, and improved inventory management. The surge in e-commerce has also indirectly fueled the adoption of ESLs as retailers strive to bridge the gap between online and offline pricing strategies, offering a seamless omnichannel experience. Furthermore, the growing emphasis on sustainability and waste reduction, as ESLs eliminate the need for paper tags, is another significant catalyst.

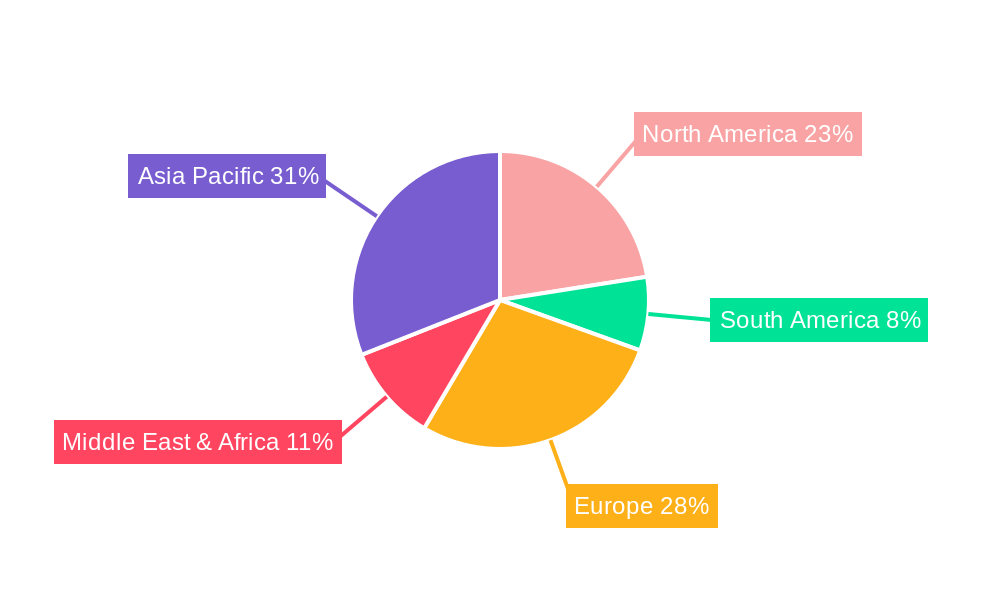

The market is segmented by Type and Application, with the "Mid-Large (3.1-7 inch)" segment expected to dominate due to its versatility across various product displays. In terms of Applications, "Supermarkets" are leading the charge, followed closely by "Drug Stores" and "Specialty Stores," as these sectors increasingly recognize the tangible benefits of digital price tags in optimizing sales and customer engagement. Emerging trends point towards the integration of ESLs with advanced analytics platforms, enabling personalized promotions and data-driven merchandising decisions. While the market exhibits strong growth, potential restraints could include the initial capital investment required for widespread deployment and the need for robust IT infrastructure. However, with continuous technological advancements and increasing awareness of ESL benefits, these challenges are expected to be overcome, paving the way for sustained market expansion across key regions like Asia Pacific and Europe, which are anticipated to be major growth centers.

Here's a comprehensive report description for Retail Digital Price Tags, incorporating your specified details:

This report delves into the dynamic and rapidly evolving market for Retail Digital Price Tags (RDPTs), offering a granular analysis of its present state and future trajectory. The study encompasses a comprehensive historical review from 2019-2024, a detailed base year analysis for 2025, and a robust forecast extending from 2025-2033. The market's growth is analyzed across various segments including Type (Standard (1-3 inch), Mid-Large (3.1-7 inch), Large (7.1-10 inch)) and Application (Supermarket, Drug Stores, Specialty Stores, Others). Key industry developments and the strategies of leading players such as BOC (SES-imagotag), Pricer, SOLUM (Samsung), E Ink, Displaydata, Opticon Sensors Europe B.V, DIGI, Hanshow, LG Innotek, Panasonic, Altierre, Huawei, Ooredoo, and LabelNest are meticulously examined. The report aims to provide actionable insights for stakeholders seeking to understand and capitalize on the opportunities within the RDPT market, projecting a significant market expansion driven by technological advancements and the increasing demand for efficient retail operations.

The retail landscape is undergoing a profound transformation, with Digital Price Tags (DPTs) emerging as a pivotal technology reshaping in-store operations and customer experience. These smart labels, replacing traditional paper tags, offer dynamic pricing, real-time inventory updates, and enhanced promotional capabilities. The market for RDPTs is projected to witness substantial growth, with unit shipments expected to surge from an estimated 15 million units in 2025 to over 100 million units by 2033, reflecting a compound annual growth rate (CAGR) of approximately 20% during the forecast period. Several key trends are shaping this expansion. Firstly, the increasing adoption of electronic shelf labels (ESLs) is a dominant force. Retailers are recognizing the inefficiencies and costs associated with manual price changes, including labor, errors, and the inability to react swiftly to market fluctuations. DPTs provide an automated and centralized solution, enabling price updates across thousands of shelves in mere seconds. This agility is particularly crucial in volatile markets or for retailers implementing dynamic pricing strategies to optimize margins and sales volume. Secondly, the integration of DPTs with broader retail technologies is a significant trend. DPTs are no longer standalone devices; they are increasingly connected to inventory management systems, customer relationship management (CRM) platforms, and even in-store analytics solutions. This interconnectedness allows for a seamless flow of information, enabling retailers to personalize promotions displayed on DPTs based on customer loyalty data or stock levels, thereby driving targeted engagement and sales. The development of more sophisticated DPT functionalities, such as color displays, interactive capabilities, and even embedded sensors for environmental monitoring, is also pushing the market forward. These advanced features cater to a wider range of retail needs, moving beyond simple price display to enhanced merchandising and operational intelligence. The growing focus on sustainability is another underlying trend. By reducing the need for frequent paper printouts, DPTs contribute to a more eco-friendly retail environment. This aligns with growing consumer consciousness and corporate social responsibility initiatives, making DPTs an attractive option for forward-thinking retailers.

The accelerating adoption of Retail Digital Price Tags (RDPTs) is driven by a confluence of powerful forces fundamentally altering the retail operational paradigm. At its core, the pursuit of operational efficiency and cost reduction stands as a primary catalyst. Retailers grapple with the mounting expenses and inherent inefficiencies of manual price management, including the labor required for frequent tag changes, the potential for human error leading to pricing discrepancies, and the logistical challenges of distributing updated price information across a vast store network. RDPTs offer an elegant solution by automating this entire process. Through centralized control systems, prices can be updated instantaneously across hundreds or even thousands of shelves, slashing labor costs and minimizing pricing errors. This immediate price adjustment capability is invaluable for retailers operating in dynamic markets or those seeking to implement sophisticated pricing strategies like dynamic pricing, where prices are adjusted in real-time based on demand, competitor pricing, or inventory levels, thereby maximizing revenue and profitability. Furthermore, the enhancement of the in-store customer experience is a significant driver. DPTs enable retailers to present accurate and up-to-date pricing information, thereby reducing customer frustration caused by incorrect or outdated prices. Beyond basic price display, the integration of DPTs with promotional campaigns allows for eye-catching digital signage, enabling retailers to highlight special offers, new products, and loyalty program benefits directly at the point of purchase. This capability to dynamically showcase promotions can significantly influence impulse buys and improve overall sales performance. The increasing trend towards hyper-personalization in retail also fuels RDPT adoption. With advancements in data analytics and IoT integration, DPTs can be leveraged to display personalized offers and recommendations to shoppers, based on their purchase history or loyalty program status, creating a more engaging and tailored shopping journey. This not only boosts sales but also fosters stronger customer loyalty and advocacy.

Despite the compelling advantages, the widespread adoption of Retail Digital Price Tags (RDPTs) is not without its hurdles and restraining factors. A significant challenge lies in the initial capital investment required for deployment. While the long-term ROI is often substantial, the upfront cost of purchasing and installing thousands of DPTs, along with the necessary network infrastructure and management software, can be a considerable barrier, particularly for smaller retailers or those operating on tighter margins. This financial commitment necessitates careful budgeting and a clear demonstration of the technology's benefits. Another critical restraint is the complexity of integration with existing retail IT systems. For many established retailers, their current infrastructure may not be seamlessly compatible with DPT solutions. Integrating new DPT platforms with legacy inventory management, point-of-sale (POS), and enterprise resource planning (ERP) systems can be a technically challenging and time-consuming process, often requiring custom development or significant system upgrades. This can lead to project delays and increased implementation costs. Reliability and maintenance also present ongoing concerns. While modern DPTs are designed for durability, issues such as battery life, connectivity disruptions, or screen malfunctions can occur, necessitating regular maintenance and technical support. Ensuring consistent operation across a large number of devices requires robust IT support and efficient troubleshooting protocols. Consumer perception and adoption can also be a factor, though less of a restraint and more of an evolving aspect. While generally positive, some consumers might initially be wary of technology replacing the tactile experience of paper tags, or they might simply be accustomed to the familiar. Educating customers about the benefits of DPTs, such as accurate pricing and engaging promotions, is crucial for a smooth transition. Finally, data security and privacy are paramount considerations. As DPTs become more connected and integrated with customer data, ensuring the secure transmission and storage of this information is critical to prevent breaches and maintain customer trust. Robust cybersecurity measures are essential to mitigate these risks.

The Retail Digital Price Tags (RDPT) market exhibits significant regional and segment-driven dominance, with specific areas poised to lead the charge in adoption and revenue generation.

Dominant Segment: Supermarkets

Dominant Segment: Mid-Large (3.1-7 inch) Tags

Key Dominant Region: North America

Emerging Dominant Region: Europe

Several factors are poised to accelerate the growth of the Retail Digital Price Tags (RDPT) industry. The increasing sophistication of IoT technology and its seamless integration with retail systems is a primary catalyst. This allows for enhanced data exchange, enabling dynamic pricing adjustments and real-time inventory management. Furthermore, the growing demand for personalized customer experiences is pushing retailers to leverage DPTs for targeted promotions and loyalty program integration. As retailers increasingly recognize the potential for significant operational cost savings through reduced labor for price changes and minimized pricing errors, the economic imperative for adopting DPTs will continue to strengthen. Finally, the global push towards sustainability and the reduction of paper waste is creating a favorable market environment for eco-friendly digital solutions like DPTs.

This report provides an exhaustive examination of the Retail Digital Price Tags (RDPT) market, offering a deep dive into its multifaceted dynamics. The analysis meticulously covers market segmentation by Type (Standard, Mid-Large, Large) and Application (Supermarket, Drug Stores, Specialty Stores, Others), alongside a thorough assessment of key regional markets. It scrutinizes the historical performance from 2019-2024, establishes a detailed base year understanding for 2025, and presents a robust five-year forecast (2025-2033) with CAGR estimations. The report highlights critical trends, driving forces, and challenges, while also identifying growth catalysts and profiling leading industry players. Furthermore, it documents significant industry developments with precise timelines, providing stakeholders with a complete understanding of the RDPT ecosystem and its future potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.1%.

Key companies in the market include BOC (SES-imagotag), Pricer, SOLUM (Samsung), E Ink, Displaydata, Opticon Sensors Europe B.V, DIGI, Hanshow, LG innotek, Panasonic, Altierre, Huawei, Ooredoo, LabelNest, .

The market segments include Type, Application.

The market size is estimated to be USD 1155.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Retail Digital Price Tags," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Retail Digital Price Tags, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.