1. What is the projected Compound Annual Growth Rate (CAGR) of the Resin Filter Element?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Resin Filter Element

Resin Filter ElementResin Filter Element by Type (Activated Carbon Resin Filter Element, Ion Exchange Resin Filter Element), by Application (Home, Chemical Industry, Pharmaceutical, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

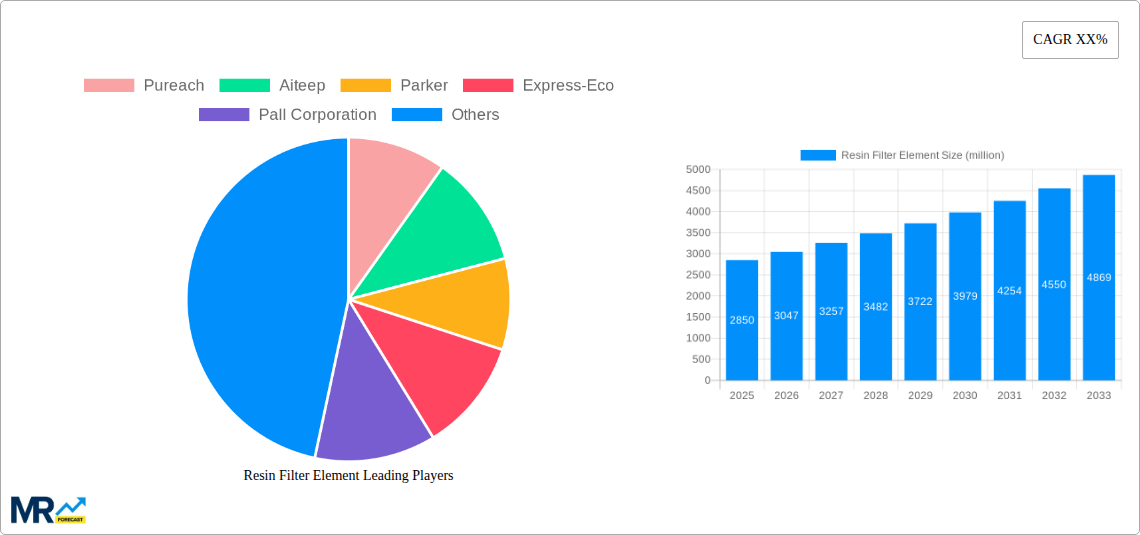

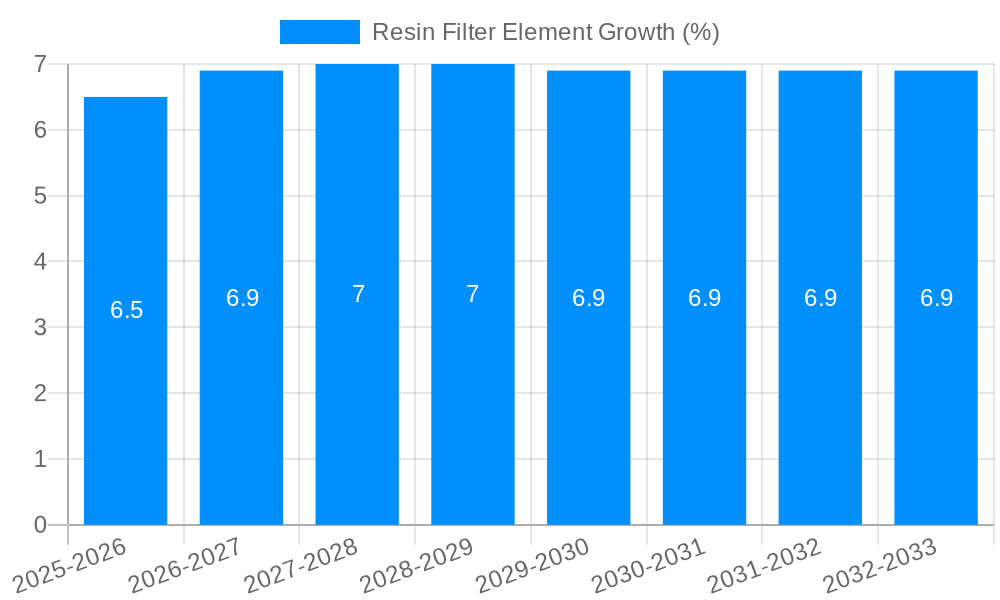

The global Resin Filter Element market is poised for significant expansion, projected to reach an estimated $2,850 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.5% expected to drive it to approximately $3,750 million by 2033. This growth is primarily fueled by the escalating demand for pure water across residential, industrial, and commercial sectors, coupled with stringent environmental regulations mandating effective wastewater treatment. The increasing adoption of advanced filtration technologies, particularly in the chemical and pharmaceutical industries for product purification and contaminant removal, is a significant driver. Furthermore, the growing awareness of water scarcity and the need for efficient water recycling are stimulating investment in sophisticated resin-based filtration solutions. The market is segmented into Activated Carbon Resin Filter Elements and Ion Exchange Resin Filter Elements, with both categories witnessing steady demand, though Ion Exchange Resin Filter Elements are anticipated to see a slightly higher growth trajectory due to their specialized applications in water softening and demineralization.

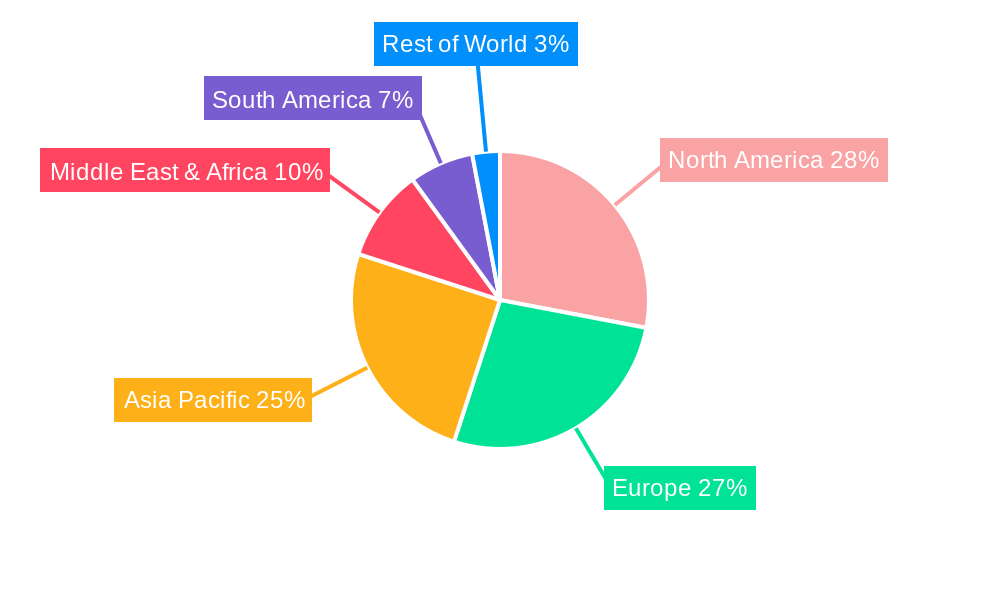

The market's expansion is also influenced by emerging trends such as the development of more sustainable and regenerative resin materials, designed for extended lifespan and reduced environmental impact. Innovations in smart filter systems, incorporating real-time monitoring and predictive maintenance capabilities, are gaining traction, particularly within large-scale industrial applications. However, the market faces certain restraints, including the initial high cost of advanced resin filter systems and the fluctuating prices of raw materials, which can impact manufacturing costs and, consequently, end-user pricing. Despite these challenges, the pervasive need for high-purity water, driven by stringent quality control in sectors like pharmaceuticals and food & beverage, alongside the ongoing need for industrial process water treatment, underpins a positive outlook. Key players like Parker, Pall Corporation, and Resin Tech are actively investing in research and development to introduce next-generation filtration solutions, further solidifying the market's growth trajectory. Regional analysis indicates strong market penetration in North America and Europe, with Asia Pacific expected to emerge as a high-growth region due to rapid industrialization and increasing environmental consciousness.

The global Resin Filter Element market is poised for substantial growth and transformation over the study period of 2019-2033, with the base year of 2025 indicating a robust market valuation projected to reach $5,000 million by 2033. This impressive trajectory is fueled by a confluence of escalating demand for purified water across diverse applications, stringent environmental regulations, and continuous technological advancements in resin filtration technology. The estimated year of 2025 itself will witness a market size of approximately $3,200 million, underscoring the dynamic nature and inherent potential of this sector. During the historical period of 2019-2024, the market has already demonstrated consistent upward momentum, laying a strong foundation for future expansion. Key market insights reveal a discernible shift towards specialized resin filter elements, such as those incorporating activated carbon for superior impurity removal and ion exchange resins for targeted contaminant capture. The proliferation of advanced manufacturing techniques, coupled with an increased focus on material science, is leading to the development of filter elements with enhanced efficiency, longer lifespans, and improved chemical resistance. This innovation directly translates into higher performance and cost-effectiveness for end-users. Furthermore, the growing awareness of water quality's impact on health and industrial processes is driving the adoption of resin filter elements in both residential and commercial settings. The pharmaceutical and chemical industries, in particular, are significant contributors to this trend, requiring high-purity water for their operations and product manufacturing. The "Others" segment, encompassing a broad spectrum of applications including food and beverage processing, power generation, and industrial wastewater treatment, is also expected to exhibit considerable growth. The forecast period of 2025-2033 is anticipated to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5%, a testament to the sustained and vigorous demand for these critical filtration solutions. Market players are actively investing in research and development to introduce novel resin materials and filter designs that can address emerging contaminants and cater to evolving industry needs, further solidifying the positive outlook for the resin filter element market.

The remarkable growth trajectory of the resin filter element market is primarily propelled by an unwavering and escalating global demand for high-purity water. This demand stems from a multitude of sectors, including the rapidly expanding pharmaceutical industry, where stringent quality standards necessitate exceptionally pure water for drug manufacturing and research. Similarly, the chemical industry relies on precise water quality for its complex processes, impacting product yield and purity. The "Home" application segment is also witnessing substantial growth, driven by increasing consumer awareness of waterborne contaminants and a desire for healthier living environments, leading to a surge in the adoption of residential water purification systems. Furthermore, evolving environmental regulations worldwide are playing a pivotal role. Governments and international bodies are imposing stricter standards on wastewater discharge and the quality of potable water, compelling industries to implement advanced filtration solutions. Resin filter elements, with their efficacy in removing a wide array of impurities, dissolved solids, and specific chemical compounds, are becoming indispensable tools for compliance. The continuous innovation within the resin filtration technology itself acts as another significant driver. Manufacturers are investing heavily in R&D to develop more efficient, durable, and cost-effective filter media and element designs. This includes advancements in resin synthesis, encapsulation techniques, and the development of specialized resins tailored to specific contaminant removal needs, thereby expanding the application scope and enhancing the overall performance of these filtration systems.

Despite the robust growth prospects, the resin filter element market is not without its hurdles. One of the primary challenges lies in the initial cost of advanced resin filter elements, particularly those employing specialized resins for niche applications. While these elements offer superior performance, their higher upfront investment can be a deterrent for some smaller-scale industries or price-sensitive consumers. The lifespan and regeneration of resin media also present a logistical and economic consideration. While many resin filter elements are designed for longevity, their eventual replacement or regeneration requires careful planning and can incur ongoing operational costs. Proper disposal of spent resin, especially in industrial settings, can also pose environmental challenges and necessitate adherence to specific waste management protocols. Furthermore, the complexity of selecting the right resin for a specific application can be a barrier. With a wide variety of resin types available, each with unique properties and affinities for different contaminants, end-users often require expert guidance to choose the most effective and efficient solution, adding a layer of technical expertise requirement. Fluctuations in raw material prices, particularly for the polymers and chemicals used in resin synthesis, can impact manufacturing costs and, consequently, the final product pricing, introducing an element of market volatility. Lastly, growing competition from alternative filtration technologies, such as membrane filtration and advanced oxidation processes, which may offer certain advantages in specific scenarios, presents a continuous need for resin filter element manufacturers to innovate and demonstrate their unique value proposition to maintain market share.

The Chemical Industry segment, alongside the Pharmaceutical sector, is poised to dominate the global resin filter element market throughout the study period of 2019-2033. These industries are characterized by an insatiable demand for ultra-pure water and the stringent removal of specific contaminants, making resin filter elements an indispensable component of their operational infrastructure.

Explanation:

The Chemical Industry requires highly purified water for a myriad of processes, including synthesis reactions, catalyst regeneration, and wastewater treatment. The use of Ion Exchange Resin Filter Elements is paramount in this sector for precisely removing dissolved salts, heavy metals, and other ionic impurities that can interfere with chemical reactions or contaminate final products. The sheer volume of water processed in the chemical industry, coupled with the high stakes associated with product purity and process efficiency, ensures a sustained and significant demand for robust and reliable resin filtration solutions. The market valuation within this segment is projected to be in the hundreds of millions of dollars annually.

Similarly, the Pharmaceutical Industry is a critical driver for resin filter element growth. The production of active pharmaceutical ingredients (APIs), sterile injectables, and biological therapeutics demands water of the highest purity, often meeting USP (United States Pharmacopeia) or EP (European Pharmacopoeia) standards. Ion Exchange Resin Filter Elements are extensively used here to demineralize water, remove organic contaminants, and achieve specific ionic balances required for drug formulation. The rigorous regulatory landscape governing pharmaceutical manufacturing necessitates the use of advanced filtration technologies that guarantee consistent performance and prevent microbial contamination. The market for resin filter elements in pharmaceuticals is also projected to be in the high hundreds of millions, driven by ongoing research and development, new drug discoveries, and the expansion of biopharmaceutical production.

Geographically, North America, with its well-established chemical and pharmaceutical manufacturing base, particularly in the United States, is a leading consumer of resin filter elements. The region's strong emphasis on quality control, environmental compliance, and technological adoption fuels demand. Europe follows closely, with countries like Germany, France, and the UK boasting advanced chemical and life sciences sectors that require sophisticated water purification solutions.

The Asia Pacific region is emerging as a powerhouse for resin filter element consumption. China, with its rapidly expanding chemical and pharmaceutical manufacturing capabilities, and India, a global hub for generic drug production, are experiencing substantial growth in demand. The increasing industrialization, growing middle class, and rising disposable incomes are also contributing to a surge in the adoption of Activated Carbon Resin Filter Elements for residential water purification in this region, further bolstering the overall market. The sheer scale of manufacturing in these countries, coupled with a growing awareness of water quality, points towards Asia Pacific becoming a dominant force in the resin filter element market in the coming years, with its market share projected to surpass 30% by the end of the forecast period. The "Others" application segment, encompassing food and beverage, power generation, and industrial processes, will also contribute significantly, but the precision and critical nature of the Chemical and Pharmaceutical industries will ensure their leading position.

The resin filter element industry is propelled by several key growth catalysts. The increasing global emphasis on water conservation and the need for efficient water recycling in industrial processes significantly boost the demand for effective filtration solutions. Furthermore, advancements in resin technology, leading to higher selectivity, improved capacity, and extended lifespan, enable broader applications and reduce operational costs. The growing awareness of health issues linked to contaminated water, particularly in residential settings, is driving the adoption of point-of-use filtration systems, fueled by convenience and perceived health benefits. The stringent regulatory frameworks governing water quality in various industries, especially pharmaceuticals and food & beverage, necessitate the use of high-performance filtration, acting as a constant demand driver.

This comprehensive report provides an in-depth analysis of the global Resin Filter Element market, meticulously examining its trends, drivers, challenges, and future prospects. Spanning the historical period of 2019-2024 and extending through the forecast period of 2025-2033, with a base year set in 2025, the report offers valuable insights into market dynamics. It details the estimated market size of $3,200 million in the base year, projecting a substantial growth to approximately $5,000 million by 2033. The report delves into the segmentation of the market by type, application, and region, highlighting the dominance of the Chemical Industry and Pharmaceutical sectors, particularly within North America and Europe, with Asia Pacific exhibiting significant growth potential. It also identifies key growth catalysts, leading players, and significant industry developments, providing a holistic understanding for stakeholders seeking to navigate this evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Pureach, Aiteep, Parker, Express-Eco, Pall Corporation, Precision Filtration Products, Filtra International, Resin Tech, Filter Concept, M.L. Ball Company, Allied Filter Systems, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Resin Filter Element," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Resin Filter Element, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.