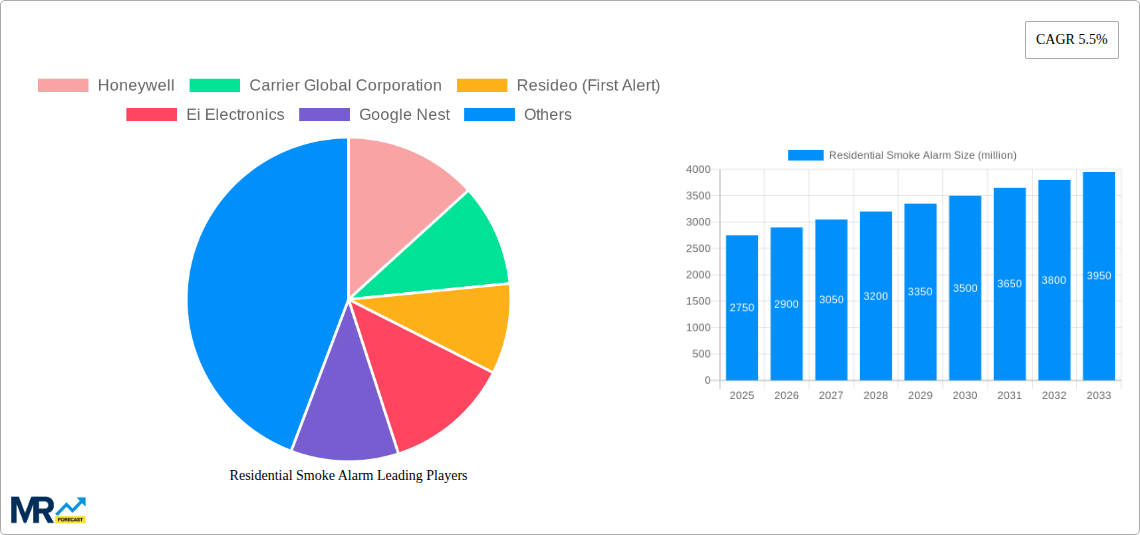

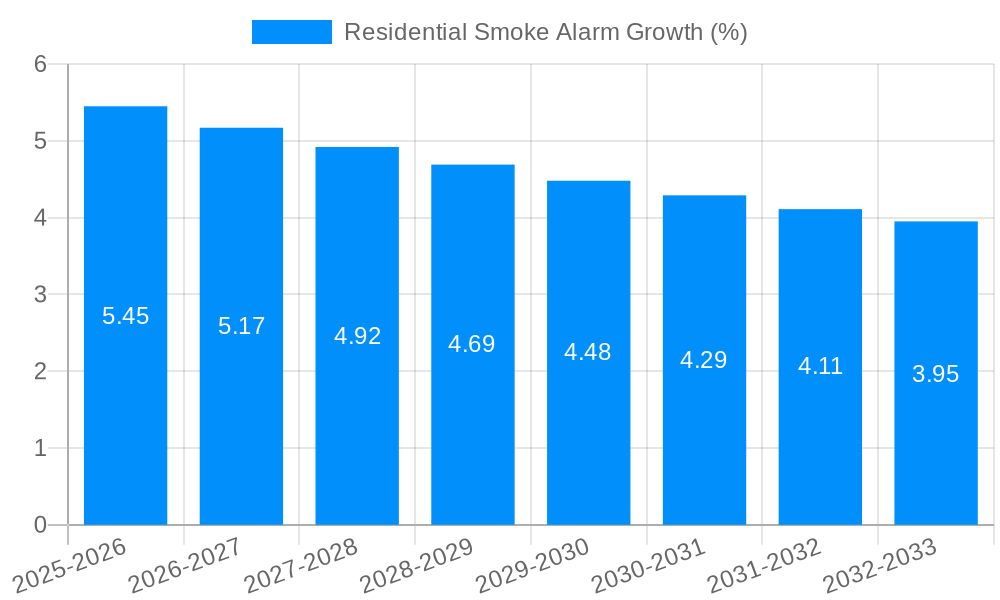

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Smoke Alarm?

The projected CAGR is approximately 5.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Residential Smoke Alarm

Residential Smoke AlarmResidential Smoke Alarm by Application (Online, Offline), by Type (Photoelectric Smoke Alarms, Ionization Smoke Alarms, Combination Smoke Alarms), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global residential smoke alarm market is poised for robust expansion, with a current market size estimated at USD 2408 million and projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% from 2019 to 2033. This significant growth trajectory is propelled by an increasing emphasis on home safety and a growing awareness of fire prevention among homeowners worldwide. Stringent building codes and regulations mandating the installation of smoke detectors in new constructions and renovations are a primary driver. Furthermore, the rising adoption of smart home technologies, which integrate smoke alarms with other connected devices for enhanced monitoring and alert systems, is further stimulating market demand. The proliferation of photoelectric smoke alarms, known for their effectiveness against smoldering fires, alongside the continued relevance of ionization smoke alarms, are shaping the product landscape. The market is also benefiting from product innovation, with combination smoke alarms offering dual detection capabilities becoming increasingly popular.

The market's expansion is further fueled by increasing disposable incomes in emerging economies, enabling greater investment in home safety solutions. The ongoing urbanization and a shift towards smaller living spaces also contribute to a higher density of residential units requiring robust fire detection systems. While the market benefits from these strong growth drivers, potential restraints include the initial cost of advanced smart smoke alarm systems for some consumer segments and the need for ongoing maintenance and battery replacements. However, the long-term benefits of early fire detection and the potential to save lives and property are consistently outweighing these considerations. The competitive landscape features a diverse array of established global players and emerging regional manufacturers, all vying to capture market share through product innovation, strategic partnerships, and expanding distribution networks across various applications, including online and offline sales channels.

The residential smoke alarm market is undergoing a significant transformation, driven by an increasing awareness of fire safety and the relentless march of technological innovation. Over the study period of 2019-2033, the market has witnessed a consistent upward trajectory, punctuated by crucial developments and shifts in consumer preferences. The base year of 2025 serves as a pivotal point for understanding the current landscape, with the estimated year of 2025 mirroring this, projecting robust growth into the forecast period of 2025-2033. The historical period of 2019-2024 laid the groundwork for this expansion, characterized by the slow but steady adoption of interconnected and smart smoke alarm systems.

Key market insights reveal a growing demand for combination smoke alarms, which detect both smoke and carbon monoxide, offering a more comprehensive safety solution for households. This trend is directly linked to an elevated understanding of the dual threats posed by fire and invisible, odorless gases. Furthermore, the distinction between online and offline applications is blurring, with smart home integration becoming increasingly paramount. Consumers are no longer content with standalone devices; they expect seamless connectivity, remote monitoring capabilities, and integration with their existing smart home ecosystems. This has led to a surge in the popularity of Wi-Fi enabled alarms, which can send real-time alerts to smartphones, regardless of the user's location. The photoelectric smoke alarm segment continues to hold a dominant position due to its effectiveness in detecting smoldering fires, which are more common in residential settings. However, advancements in ionization technology are also contributing to its appeal, particularly in its speed of response to flaming fires. The market is also experiencing a growing emphasis on user-friendly installation and maintenance, with manufacturers investing in intuitive designs and comprehensive mobile applications to enhance the user experience. Regulatory mandates and insurance incentives are also playing a crucial role in driving the adoption of advanced smoke detection technologies, pushing the market towards higher standards of safety and reliability. The overall trend points towards a future where smoke alarms are not just passive safety devices but active, intelligent components of a connected and secure home. The market size, which is currently in the millions of units, is projected to experience significant expansion in the coming years.

Several powerful forces are collectively propelling the residential smoke alarm market forward, ensuring its continued growth and evolution. A primary driver is the ever-increasing global emphasis on fire safety and public health. Governments worldwide are enacting and strengthening regulations that mandate the installation of smoke alarms in homes, coupled with stricter performance standards. This regulatory push, driven by the tragic consequences of house fires, directly translates into a larger addressable market and a consistent demand for compliant devices. Beyond regulations, a growing consumer awareness of the devastating impact of house fires, fueled by extensive media coverage and educational campaigns, is another significant impetus. Homeowners are increasingly prioritizing the safety of their families and property, actively seeking out reliable and advanced smoke detection solutions.

Furthermore, the rapid proliferation of smart home technology acts as a powerful catalyst. As more households embrace connected devices for convenience and security, the demand for smart smoke alarms that integrate seamlessly into these ecosystems has exploded. These connected alarms offer features like remote monitoring, instant alerts on smartphones, and even integration with other smart safety devices, providing a level of peace-of-mind previously unattainable. The continuous innovation in sensor technology, leading to more accurate and faster detection capabilities, also plays a crucial role. Manufacturers are constantly developing improved sensors that can differentiate between nuisance alarms (like cooking smoke) and genuine fire threats, enhancing user confidence and reducing alarm fatigue. The affordability and accessibility of these devices, coupled with various distribution channels including online retail, have also made them more attainable for a wider segment of the population.

Despite the robust growth trajectory, the residential smoke alarm market faces several challenges and restraints that could temper its expansion. A significant hurdle remains consumer awareness and education, particularly in certain developing regions. While awareness is increasing, there are still segments of the population that may not fully grasp the importance of functional smoke alarms or understand the differences between various types and their effectiveness. This can lead to complacency, incorrect installation, or a reluctance to upgrade outdated devices. The issue of nuisance alarms also continues to be a persistent problem. False alarms triggered by cooking, steam, or insects can lead to user frustration, potentially resulting in devices being disconnected or disabled, thereby negating their safety benefits. While advancements are being made to mitigate this, it remains a concern that can dampen consumer enthusiasm.

The cost factor can also act as a restraint, especially for lower-income households or in regions where disposable incomes are limited. While basic smoke alarms are relatively inexpensive, the more advanced smart and interconnected models come with a higher price tag. This can create a disparity in safety, with those who can afford them gaining enhanced protection while others remain more vulnerable. Furthermore, the complexity of installation and maintenance for some smart systems can be a deterrent for less tech-savvy consumers. While manufacturers strive for user-friendliness, setting up Wi-Fi connectivity, app integration, and managing device settings can still pose a barrier for some individuals. Finally, the fragmented nature of the market with numerous players, while fostering competition, can also lead to a lack of standardization in certain aspects, potentially causing confusion for consumers regarding compatibility and interoperability between different brands and systems.

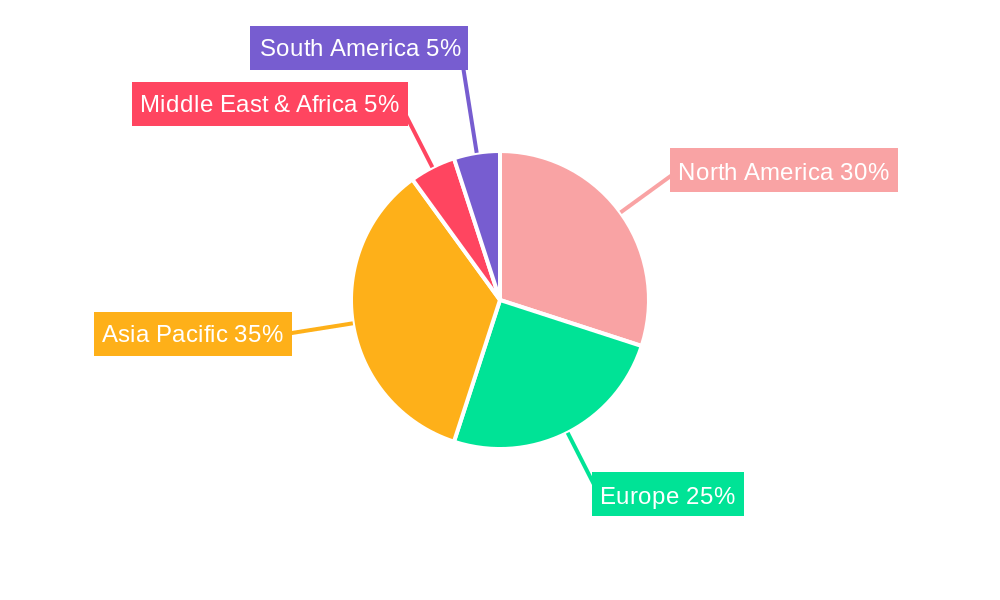

The residential smoke alarm market is characterized by significant regional variations and segment dominance. North America, particularly the United States and Canada, is poised to remain a dominant region. This dominance is underpinned by several factors: stringent building codes and fire safety regulations that mandate the installation and maintenance of smoke alarms in residential properties; a high level of consumer awareness regarding fire safety; and a mature smart home ecosystem that readily integrates advanced connected devices. The online application segment is expected to witness substantial growth and exert significant influence in this region, as consumers increasingly opt for the convenience of purchasing and managing their smoke alarms through digital platforms. The widespread adoption of high-speed internet and the prevalence of e-commerce channels further bolster this trend.

Another key region with immense growth potential is Europe, driven by similar regulatory frameworks and an escalating commitment to enhancing residential safety. Countries like Germany, the UK, and France are leading the charge, with increasing awareness and the adoption of smart home technologies. Within Europe, the offline application segment, encompassing traditional retail channels and professional installations, will continue to hold considerable sway, catering to a demographic that prefers in-person purchasing and expert guidance.

However, the most dynamic growth is anticipated in the Asia-Pacific region, particularly in countries like China and India. While historically lagging in adoption, these regions are witnessing a rapid acceleration due to:

In terms of dominant segments globally, the Photoelectric Smoke Alarms type is expected to continue its reign. This is primarily due to their superior performance in detecting smoldering fires, which are often the cause of fatalities in residential settings. Their ability to generate fewer false alarms compared to ionization alarms further solidifies their position. The increasing demand for enhanced safety solutions also propels the Combination Smoke Alarms segment. These devices, which detect both smoke and carbon monoxide, offer a dual-layer of protection and are gaining significant traction as consumers seek comprehensive home safety solutions. The market for these combination alarms is expected to grow at a healthy pace, driven by the desire for convenience and a more holistic approach to home security.

The residential smoke alarm industry is fueled by several key growth catalysts. The continuous innovation in sensor technology, leading to more accurate and faster detection capabilities, is a major driver. This includes advancements in photoelectric and ionization technologies, as well as the development of multi-sensor alarms. The increasing integration of smart home ecosystems, with smoke alarms becoming an integral part of connected living, significantly boosts demand. Furthermore, stricter government regulations and building codes mandating smoke alarm installations worldwide are creating a consistent and expanding market. Growing consumer awareness of fire safety and the desire for enhanced personal security are also critical growth catalysts, prompting homeowners to invest in reliable and advanced detection solutions.

This comprehensive report delves into the intricacies of the residential smoke alarm market, providing an in-depth analysis from 2019 to 2033. It meticulously examines the market's evolution, driven by technological advancements and rising safety consciousness. The report highlights the crucial role of both online and offline applications, acknowledging the distinct consumer preferences and purchasing behaviors associated with each. The detailed breakdown of photoelectric, ionization, and combination smoke alarms offers a clear understanding of the technological landscape and the segments poised for substantial growth. With a robust base year of 2025 and an extended forecast period through 2033, this report offers invaluable insights for stakeholders seeking to navigate and capitalize on the dynamic opportunities within this critical safety sector. The market size, currently in the millions of units, is meticulously projected, offering a clear roadmap for future investments and strategic planning.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.5%.

Key companies in the market include Honeywell, Carrier Global Corporation, Resideo (First Alert), Ei Electronics, Google Nest, Johnson Controls, Swiss Securitas Group, Bosch, FireAngel Safety Technology, ABB (Busch-jaeger), Schneider Electric, Halma, Siemens, Legrand, Smartwares, ABUS, Panasonic Fire & Security, Hochiki, Nittan Group, Zeta Alarms, Nohmi Bosai Limited, Eaton, Fireguard, Fireblitz (FireHawk), Inim Electronics, Hugo Brennenstuhl GmbH, SOMFY, eQ-3 (Homematic IP), FARE, Olympia Electronics SA, USI (Universal Security Instruments, Inc.), MTS (UNITEC), Siterwell Electronics, Jade Bird Fire, X-Sense Technology, LEADER Group, Shenzhen Heiman Technology, Zhongxiaoyun Technology, Shenzhen HTI Sanjiang Electronics, Ningbo Kingdun Electronic Industry, Shanghai Songjiang Feifan Electronic, Shenzhen Yanjen Technology, HIKVISION, Dahua Technology, Xiaomi.

The market segments include Application, Type.

The market size is estimated to be USD 2408 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Residential Smoke Alarm," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Residential Smoke Alarm, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.