1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Food Waste Disposer?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Residential Food Waste Disposer

Residential Food Waste DisposerResidential Food Waste Disposer by Type (Wet Grinding, Dry Grinding, Fermentation, World Residential Food Waste Disposer Production ), by Application (Online Sale, Offline Sale, World Residential Food Waste Disposer Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

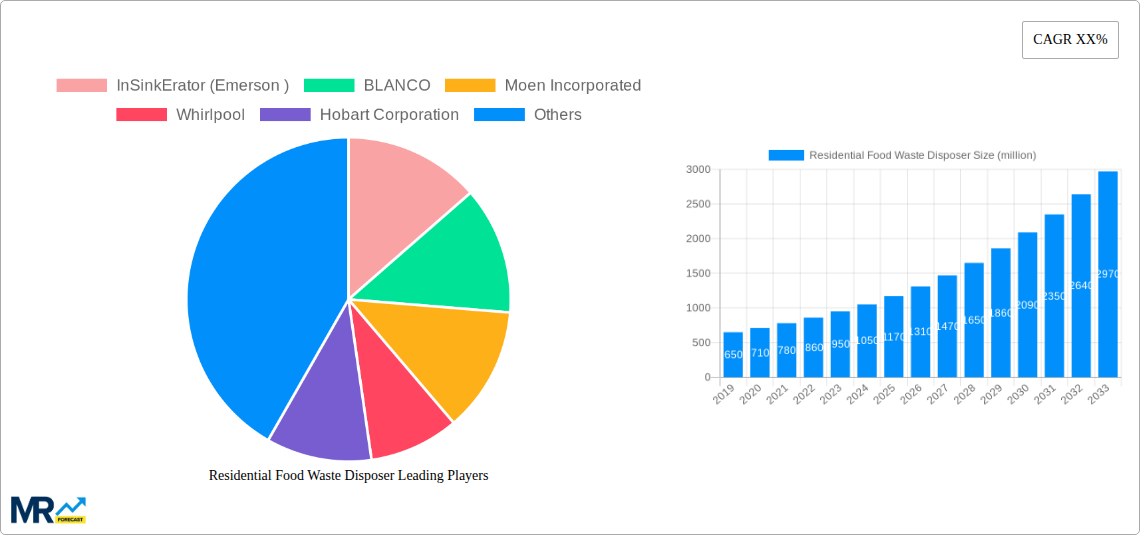

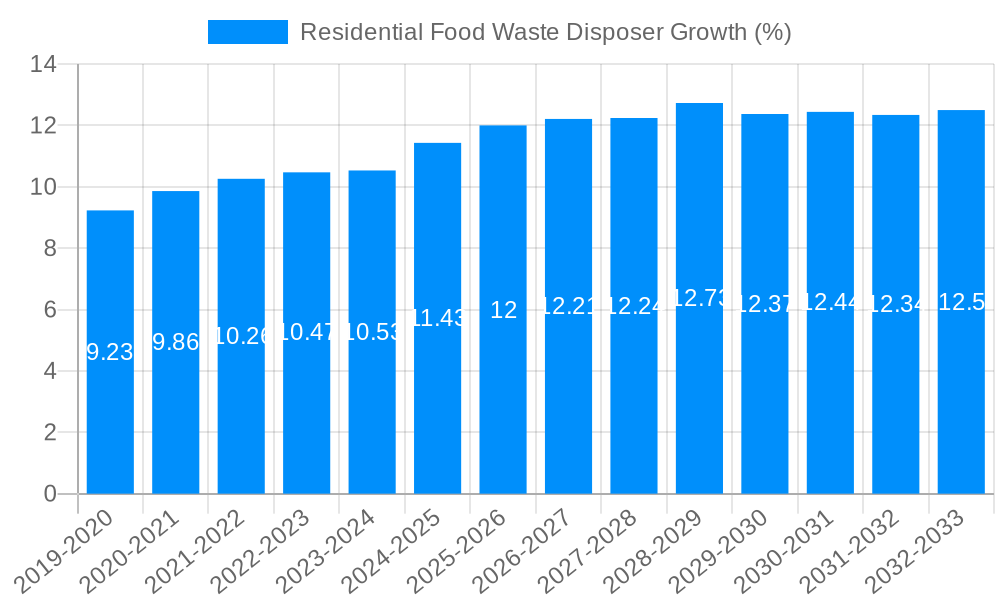

The global Residential Food Waste Disposer market is experiencing significant growth, projected to reach an estimated USD 1.2 billion by 2025, expanding at a robust Compound Annual Growth Rate (CAGR) of 12% through 2033. This upward trajectory is primarily fueled by increasing consumer awareness regarding food waste management, coupled with growing adoption of eco-friendly practices in households. Government initiatives promoting sustainable living and stricter regulations on landfill waste are also playing a crucial role in driving market expansion. The "Wet Grinding" segment is anticipated to dominate, owing to its efficiency and widespread consumer preference for immediate waste disposal. Furthermore, the rising trend of online sales channels is significantly impacting the market, offering consumers greater accessibility and convenience in purchasing these appliances. The growing urbanization and a surge in apartment living, particularly in developed and developing economies, further bolster the demand for compact and efficient food waste disposal solutions.

The market, while showing strong growth, faces certain restraints. High initial purchase cost and the need for professional installation for some advanced models can deter a segment of consumers. Additionally, concerns about water usage and potential plumbing issues, though often mitigated by modern designs, can still pose adoption challenges in certain regions. However, these restraints are progressively being overcome by technological advancements that enhance energy efficiency, reduce water consumption, and simplify installation processes. Leading companies such as InSinkErator (Emerson), Moen Incorporated, and Whirlpool are actively investing in research and development to introduce innovative, user-friendly, and cost-effective solutions. The Asia Pacific region, especially China and India, is emerging as a key growth engine due to rapid urbanization, rising disposable incomes, and an increasing emphasis on environmental consciousness.

This comprehensive report offers an in-depth analysis of the global Residential Food Waste Disposer market, encompassing the historical period of 2019-2024, the base and estimated year of 2025, and a robust forecast period extending from 2025 to 2033. The study meticulously examines key market insights, driving forces, challenges, dominant segments, growth catalysts, leading industry players, and significant recent developments. With a projected global residential food waste disposer production valued in the millions, this report provides essential intelligence for stakeholders seeking to understand market dynamics, identify opportunities, and navigate the evolving landscape of kitchen waste management solutions.

XXX The global Residential Food Waste Disposer market is poised for significant expansion, driven by an increasing awareness of environmental sustainability and the burgeoning need for efficient waste management solutions within households. The historical period from 2019 to 2024 witnessed a steady rise in adoption, fueled by growing urbanization and a shift towards more conscious consumption patterns. As we move into the estimated year of 2025 and the forecast period of 2025-2033, several key trends are expected to shape the market's trajectory. The dominant trend is the increasing consumer preference for Wet Grinding disposers due to their effectiveness in handling a wider range of food scraps and their relative ease of maintenance compared to dry grinding alternatives. This segment is anticipated to continue its upward climb, capturing a substantial share of the World Residential Food Waste Disposer Production. Furthermore, the market is experiencing a pronounced shift in sales channels, with Online Sale platforms emerging as a significant force. The convenience of e-commerce, coupled with competitive pricing and wider product availability, is attracting a growing number of consumers. While Offline Sale channels, such as traditional retail stores and appliance showrooms, will remain relevant, their dominance is expected to gradually diminish.

Another crucial trend is the growing interest in Fermentation-based disposers, although this segment is currently nascent and represents a smaller portion of the World Residential Food Waste Disposer Production. However, advancements in bio-digestion technology and increasing consumer desire for eco-friendly solutions that convert waste into usable byproducts could see this segment gain traction in the latter half of the forecast period. The market is also seeing innovation in product design, with manufacturers focusing on quieter operation, energy efficiency, and enhanced safety features. Smart home integration, allowing for remote monitoring and control of disposers, is also emerging as a premium feature. The overall World Residential Food Waste Disposer Production is projected to experience a compound annual growth rate (CAGR) that reflects this multifaceted evolution. As more regions adopt stricter waste disposal regulations and as disposable incomes rise in developing economies, the demand for these appliances is expected to accelerate. The sustainability narrative is no longer a niche concern; it is becoming a mainstream driver for consumer purchasing decisions in the residential food waste disposer sector. The integration of disposers into modern kitchen designs, emphasizing both functionality and aesthetic appeal, further bolsters their market presence.

The residential food waste disposer market is propelled by a confluence of powerful driving forces, primarily centered around growing environmental consciousness and an increasing demand for convenient and hygienic household solutions. As global populations expand and urbanization intensifies, the challenge of managing household waste, particularly food scraps, becomes more pronounced. Governments worldwide are implementing stricter waste management regulations, encouraging or mandating the separation and proper disposal of organic waste. This regulatory push, coupled with heightened public awareness about the environmental impact of landfill-bound food waste – including methane gas emissions – is creating a significant demand for in-sink disposers as an effective and immediate solution.

Furthermore, the evolving lifestyle of consumers, characterized by busier schedules and a greater emphasis on home hygiene, plays a crucial role. Food waste can attract pests and generate unpleasant odors if left to accumulate in bins. Residential food waste disposers offer a convenient and sanitary way to manage this waste directly at the source, eliminating the need for frequent trips to outdoor bins and reducing the risk of household contamination. The increasing adoption of modern kitchen designs, which often prioritize integrated appliances and streamlined functionality, also contributes to the market's growth. As consumers invest in upgrading their homes, the inclusion of a food waste disposer is increasingly seen as a standard, albeit optional, appliance that enhances convenience and promotes a cleaner living environment. The technological advancements in disposer efficiency, noise reduction, and overall performance are making these units more attractive and accessible to a wider consumer base, further fueling their adoption.

Despite the robust growth prospects, the residential food waste disposer market faces several significant challenges and restraints that could temper its expansion. One of the primary obstacles is the lack of widespread awareness and understanding of how food waste disposers work and their environmental benefits. In many regions, consumers are still accustomed to traditional waste disposal methods, and the initial cost of purchasing and installing a disposer can be perceived as an unnecessary expense. Furthermore, misconceptions about the potential for plumbing issues or environmental harm can hinder adoption.

Another considerable restraint is the varying regulatory landscape across different countries and even within specific municipalities. While some regions actively promote or even mandate the use of food waste disposers as part of their waste management strategies, others may have limitations or outright bans due to concerns about sewer system capacity or wastewater treatment plant efficiency. These inconsistencies create market fragmentation and can be a barrier to global growth. The initial cost of purchase and installation remains a significant deterrent for budget-conscious consumers, especially in developing economies. While prices have become more competitive over the years, the upfront investment can still be a hurdle. Additionally, the availability and cost of professional installation services can also pose a challenge, particularly in remote areas. Finally, concerns regarding the energy consumption and water usage of some disposer models, though often overstated and offset by reduced landfill contributions, can still be a point of hesitation for environmentally conscious consumers who are not fully informed about the latest energy-efficient technologies.

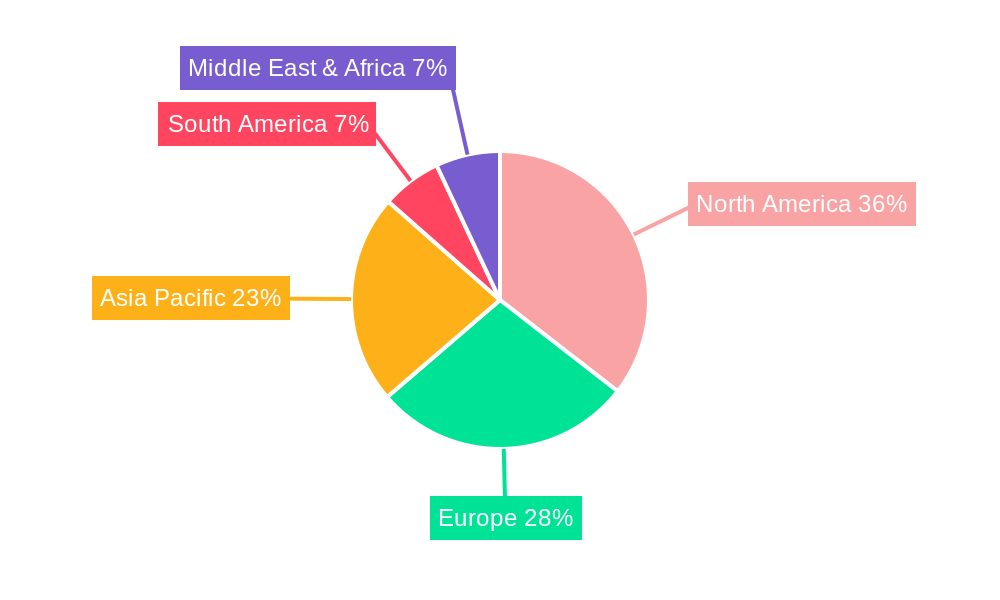

The global Residential Food Waste Disposer market is characterized by a dynamic interplay between regions and segments, with certain areas and product types exhibiting greater dominance. The North America region, particularly the United States, is a long-standing leader in this market. This dominance is attributed to a combination of factors including a relatively higher disposable income, a well-established infrastructure for plumbing and waste management, and a strong existing consumer base that has embraced kitchen disposers for decades. The U.S. market is further characterized by its advanced building codes that often accommodate the integration of such appliances.

Within North America, the Wet Grinding segment is overwhelmingly the most dominant. These disposers are favored for their ability to process a wider array of food waste, from soft scraps to tougher materials, and are perceived as more robust and effective by a larger segment of consumers. The World Residential Food Waste Disposer Production from this segment significantly outweighs other types due to established consumer preference and manufacturer focus. Consequently, the Online Sale application segment is also experiencing substantial growth and is projected to increase its market share significantly within North America and globally. The convenience of purchasing these appliances online, coupled with competitive pricing and a wider selection, resonates well with the tech-savvy consumer base in the region.

Europe is emerging as a rapidly growing market, driven by increasing environmental regulations and a strong focus on sustainability. Countries like Germany, the UK, and the Scandinavian nations are seeing a rise in adoption, although the market penetration is still lower compared to North America. This growth is fueled by government initiatives aimed at reducing landfill waste and promoting organic waste recycling. In Europe, there is a growing interest in Fermentation-based disposers as consumers become more aware of circular economy principles, although Wet Grinding disposers still hold the larger market share. The Offline Sale segment remains prominent in Europe, with consumers often preferring to see and touch appliances before purchase, especially in light of varying installation requirements.

Asia Pacific represents a market with immense untapped potential. Countries like China and India, with their large populations and rapidly urbanizing landscapes, are witnessing an increasing demand for modern kitchen appliances. While adoption rates are currently lower, the long-term growth trajectory is highly promising. The initial entry into this market might see a preference for more affordable Dry Grinding disposers, but as awareness and disposable incomes rise, Wet Grinding will likely gain prominence. Both Online Sale and Offline Sale channels are expected to play crucial roles in penetrating this diverse market.

Globally, the World Residential Food Waste Disposer Production is heavily influenced by the strong output from North America, followed by Europe. The Type: Wet Grinding segment consistently contributes the largest volume to this global production. The Application: Online Sale is projected to witness the highest growth rate in the coming years, reflecting the global shift in retail trends. The dominance of specific regions and segments is thus a complex interplay of economic development, consumer behavior, regulatory frameworks, and technological advancements in waste management solutions.

The residential food waste disposer industry is poised for accelerated growth, driven by several key catalysts. Foremost among these is the escalating global focus on sustainability and environmental protection, leading to stricter waste management policies and a greater public demand for eco-friendly solutions. Technological advancements in product efficiency, energy conservation, and noise reduction are making disposers more attractive and accessible to a wider consumer base. Furthermore, the increasing urbanization and a rising middle class in emerging economies are creating new markets with a growing appetite for modern kitchen appliances that enhance convenience and hygiene. The continuous expansion of e-commerce platforms also acts as a significant catalyst, facilitating wider product reach and competitive pricing.

This comprehensive report delves into the intricate dynamics of the Residential Food Waste Disposer market, offering a panoramic view of its present state and future trajectory. It meticulously analyzes the market size, share, and growth patterns across various segments, including Type (Wet Grinding, Dry Grinding, Fermentation) and Application (Online Sale, Offline Sale). The report provides detailed forecasts for the World Residential Food Waste Disposer Production from 2025 to 2033, underpinned by rigorous research methodologies. Stakeholders will gain critical insights into the prevailing trends, the driving forces that propel market expansion, and the challenges that necessitate strategic navigation. Furthermore, the report identifies dominant regions and countries, highlighting their unique market characteristics, and provides an exhaustive list of leading players alongside their recent significant developments, offering a holistic understanding of this vital industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include InSinkErator (Emerson ), BLANCO, Moen Incorporated, Whirlpool, Hobart Corporation, Haier, Franke, Salvajor, Waste King, Breville, Becbas, Joneca Corporation, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Residential Food Waste Disposer," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Residential Food Waste Disposer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.