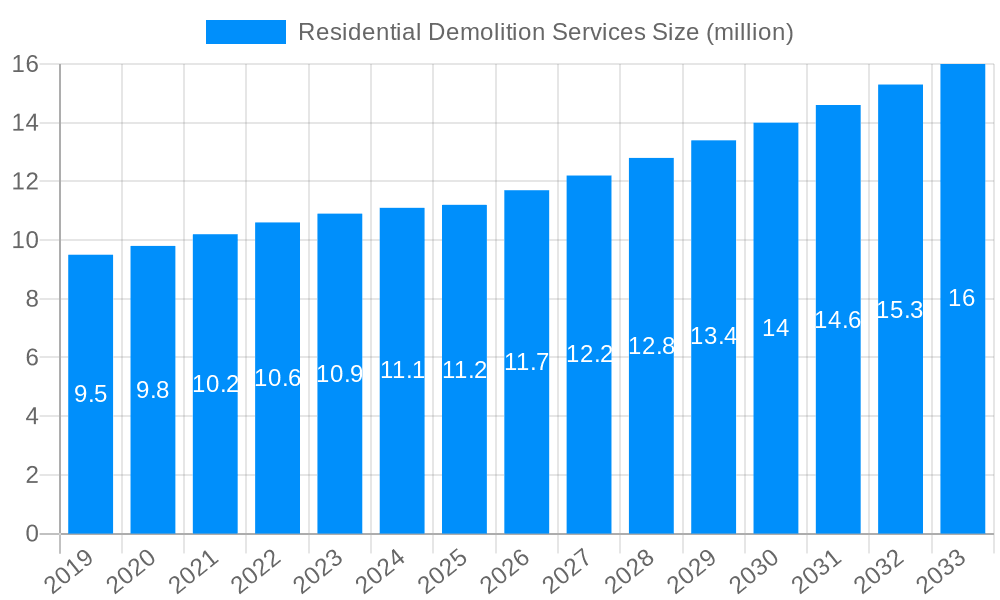

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Demolition Services?

The projected CAGR is approximately 5.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Residential Demolition Services

Residential Demolition ServicesResidential Demolition Services by Type (/> Waste Collection, House Demolition), by Application (/> Single-Family House, Multi-Family Housing, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The residential demolition services market is experiencing robust growth, driven by several key factors. Increasing urbanization and population density in many regions are leading to redevelopment projects, necessitating the demolition of existing residential structures to make way for new constructions. Furthermore, the aging housing stock in developed nations requires significant renovation or replacement, boosting demand for demolition services. Government initiatives promoting sustainable urban development and infrastructure projects also contribute to market expansion. Finally, the rising prevalence of natural disasters, such as hurricanes and wildfires, necessitates the demolition of damaged residential properties, further stimulating market growth. We estimate the market size in 2025 to be around $15 billion, based on industry reports showing similar sectors exhibiting strong growth.

Despite these drivers, the market faces certain challenges. Fluctuating material costs and labor shortages can impact profitability. Stringent environmental regulations regarding waste disposal and demolition practices add complexity and potentially increase operational expenses. Economic downturns also affect the residential construction market and, consequently, the demand for demolition services. However, the long-term outlook for the residential demolition services market remains positive due to continued urbanization, infrastructure development, and the ongoing need for property renewal and disaster recovery. Technological advancements, such as the use of more efficient and environmentally friendly demolition techniques, are likely to mitigate some of the existing challenges and shape the market's future trajectory.

The residential demolition services market experienced significant growth during the historical period (2019-2024), driven by factors such as increasing urbanization, aging housing stock, and the need for redevelopment projects. The market size, estimated at several billion USD in 2025, is projected to witness robust expansion throughout the forecast period (2025-2033), exceeding tens of billions of USD by 2033. This growth is anticipated across various segments, including demolition by type (selective, full, and interior), by method (mechanical, implosion, and explosive), and by building material. Key market insights reveal a strong preference for environmentally conscious demolition practices, leading to increased demand for services that prioritize waste reduction and recycling. The rising adoption of advanced technologies, such as robotics and AI-powered demolition planning software, is also influencing market trends, improving efficiency and safety. Furthermore, stringent regulatory frameworks concerning waste disposal and environmental protection are shaping the operational landscape, encouraging companies to invest in sustainable demolition techniques and adhere to stricter compliance standards. The competitive landscape is marked by both large multinational corporations and smaller, specialized regional contractors. Consolidation is anticipated in the coming years as larger companies seek to acquire smaller firms to expand their market share and service offerings. The overall market trajectory indicates a promising future, fueled by a combination of demographic shifts, technological advancements, and heightened environmental awareness.

Several key factors are propelling the growth of the residential demolition services market. Firstly, the increasing age of residential properties in many developed nations necessitates demolition and redevelopment to meet evolving housing demands and improve infrastructure. Secondly, urbanization continues to drive the need for new residential construction, often requiring the demolition of existing structures to make way for new developments. The rising popularity of infill development projects, where vacant or underutilized land within established urban areas is redeveloped, contributes to the demand for residential demolition services. Economic factors also play a significant role, with periods of economic expansion leading to increased investment in real estate and construction, thus boosting the demand for demolition services. Moreover, advancements in demolition technology, such as the use of robotic demolition and controlled implosion techniques, are enhancing efficiency and reducing project timelines, making demolition a more cost-effective option. Finally, changing consumer preferences towards more modern and sustainable housing are contributing to the growth of the market, as older homes are demolished to make way for newer, more energy-efficient constructions.

Despite the positive growth outlook, the residential demolition services market faces several challenges. Obtaining necessary permits and approvals for demolition projects can be a time-consuming and complex process, often subject to lengthy bureaucratic procedures and environmental impact assessments. This can lead to delays and increased project costs. Furthermore, fluctuations in the construction industry, including economic downturns and material price volatility, can significantly impact the demand for demolition services. Safety concerns are paramount, with demolition work being inherently risky. Accidents and injuries can lead to costly legal ramifications and reputational damage for demolition companies. Environmental regulations are becoming increasingly stringent, requiring demolition companies to adopt sustainable practices and manage waste effectively, which can increase operational costs. Labor shortages and the increasing cost of skilled labor also pose a significant challenge, impacting project timelines and profitability. Finally, competition in the market is intense, with a wide range of companies offering similar services. Companies must differentiate themselves through efficient operations, sustainable practices, and competitive pricing to succeed.

The North American and European markets are expected to dominate the residential demolition services market due to factors such as aging housing stock and robust construction activity. Within these regions, densely populated urban areas are expected to experience the highest growth rates. Specifically:

Segment Dominance:

The segment focused on full-scale demolition is projected to hold a substantial market share owing to the increasing number of large-scale redevelopment projects involving the complete removal of existing structures. This segment is expected to maintain its dominance throughout the forecast period.

The type of demolition method employed also impacts market share. Mechanical demolition, due to its efficiency and cost-effectiveness for many projects, is expected to dominate the method segment.

The residential demolition services industry is poised for sustained growth, fueled by several key catalysts. The confluence of increasing urbanization, the need to replace aging infrastructure, and the rising preference for energy-efficient and modern housing are creating significant demand. Government initiatives promoting sustainable demolition practices and incentivizing redevelopment projects further contribute to market expansion. Advancements in demolition technology are also playing a crucial role by enhancing efficiency, minimizing environmental impact, and reducing project completion times.

This report provides a comprehensive overview of the residential demolition services market, offering detailed analysis of market trends, driving forces, challenges, key players, and significant developments from 2019 to 2033. The report utilizes a robust methodology, including primary and secondary research, to provide accurate and reliable data. It's designed to assist stakeholders in making informed business decisions and identifying lucrative investment opportunities within this dynamic industry. The report covers key regional markets and segments providing a granular understanding of current and future market dynamics.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.1%.

Key companies in the market include Jenkins Excavating & Logging, LLC, Ontario Bollards Inc, No Dust Floor Removal, Hough Inc, Syracuse Haulers Waste Removal, Inc, Demolition Company Toronto, KEAR Civil Corporation, 1st Choice Restoration, Inc, Timco Blasting and Coatings, Ecclesia Construction Co., LLC, Floor Skinz, Colorado Hazard Control LLC, Ramsey Construction Inc, Waco, Inc, John W Gleim, Jr. Excavating Inc, Stamford Wrecking Company, EnviroVantage, CODE Environmental Services, Inc, Vic Russell Construction Inc, H&K Group, Inc, Blue Bison, Inc, Resource Recovery Solutions LLC, Bennett Paving, Inc, Cutting Technologies Inc, Oahu Concrete Paving, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Residential Demolition Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Residential Demolition Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.