1. What is the projected Compound Annual Growth Rate (CAGR) of the Resealable Packaging Labels?

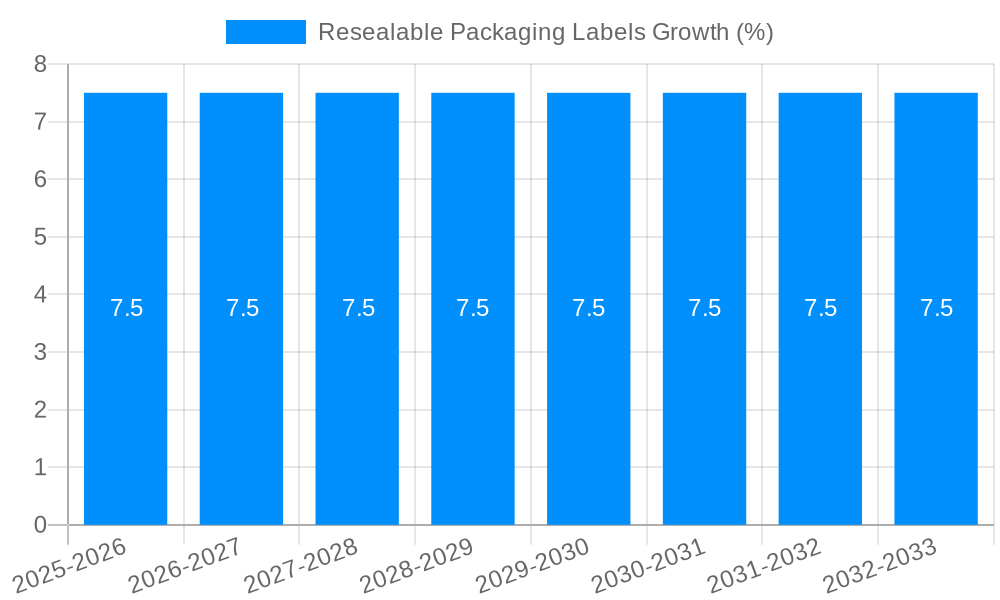

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Resealable Packaging Labels

Resealable Packaging LabelsResealable Packaging Labels by Application (Food & Beverage, Retail, Consumer Durables, Pharmaceuticals, Others, World Resealable Packaging Labels Production ), by Type (Heat Sealable Polyesters, Polypropylenes, Metalized Films, Foils, World Resealable Packaging Labels Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

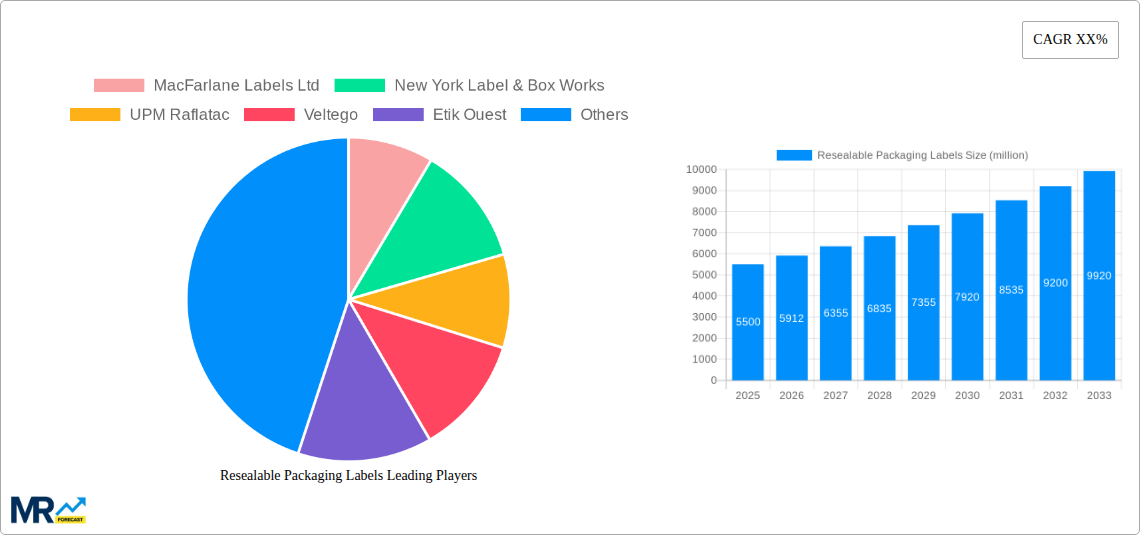

The global resealable packaging labels market is poised for significant expansion, driven by increasing consumer demand for convenience and the growing emphasis on product freshness and safety. With an estimated market size of approximately USD 5,500 million in 2025, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This robust growth is fueled by the expanding applications across diverse sectors, most notably the food and beverage industry, where resealable features significantly enhance product appeal and reduce waste. The retail sector also contributes substantially, with e-commerce growth necessitating packaging solutions that can withstand multiple handling and opening cycles. Furthermore, the pharmaceuticals and consumer durables segments are increasingly adopting resealable labels to ensure product integrity and offer user-friendly experiences.

Key drivers for this market include the ongoing innovation in material science, leading to the development of more advanced and sustainable resealable label technologies such as heat sealable polyesters and polypropylenes, which offer superior performance and environmental benefits. The shift towards premiumization in packaging is also playing a crucial role, with brands investing in high-quality labels that communicate value and functionality. However, certain restraints, such as the fluctuating costs of raw materials like metalized films and foils, and the stringent regulatory landscape in some regions concerning packaging materials, could pose challenges. Despite these hurdles, the market's inherent appeal to manufacturers seeking to extend shelf life, prevent spoilage, and improve consumer engagement with their products ensures a dynamic and promising future. Key players like UPM Raflatac, MacFarlane Labels Ltd., and Veltego are actively innovating and expanding their offerings to capture this growing market.

This comprehensive report delves deep into the global Resealable Packaging Labels market, providing an in-depth analysis of its dynamics from the historical period of 2019-2024 to a projected forecast period extending to 2033, with a robust base year of 2025. The study meticulously examines production volumes, market trends, driving forces, challenges, and future growth catalysts, offering invaluable insights for industry stakeholders.

The global Resealable Packaging Labels market is experiencing a significant surge, projected to reach several hundred million units by the end of the study period. This growth is underpinned by a confluence of evolving consumer preferences and advancements in packaging technology. Consumers are increasingly prioritizing convenience, extended product freshness, and a reduced environmental footprint, all of which are directly addressed by resealable packaging solutions. The ability to open and reclose a package multiple times not only enhances user experience but also plays a crucial role in minimizing food waste, a growing concern for environmentally conscious consumers. From a market perspective, this translates to a robust demand for labels that can withstand repeated opening and closing cycles, maintain their adhesion, and offer effective barrier properties to preserve product integrity. The market is witnessing a distinct shift towards innovative materials and designs that offer superior sealing performance and ease of use. For instance, the integration of advanced adhesive technologies that allow for secure resealing without compromising the packaging material itself is becoming a key differentiator. Furthermore, the aesthetics of resealable labels are also gaining prominence, with manufacturers focusing on high-quality printing and innovative designs to enhance brand appeal and shelf presence. The proliferation of flexible packaging formats across various industries, particularly in the food and beverage sector, is acting as a significant tailwind for the resealable packaging labels market. These flexible formats, inherently suited for resealing mechanisms, are becoming the preferred choice for single-serve portions, snacks, and ready-to-eat meals, further amplifying the demand for specialized resealable labels. The report forecasts continued upward momentum in this sector, driven by an ongoing commitment to product preservation, user convenience, and the broader push towards sustainable packaging solutions that extend the life of packaged goods.

Several potent forces are collectively propelling the growth of the Resealable Packaging Labels market. Foremost among these is the escalating demand for convenience and portability across all consumer segments. In today's fast-paced world, consumers seek products that can be easily opened, consumed in multiple sittings, and conveniently stored, all of which are core benefits offered by resealable packaging. This convenience factor is particularly pronounced in the Food & Beverage sector, where snack foods, ready-to-eat meals, and beverages are increasingly designed for on-the-go consumption and extended freshness. Secondly, the growing consumer awareness and concern regarding food waste is a significant driver. Resealable packaging directly addresses this by allowing consumers to preserve the quality and freshness of products after initial opening, thereby reducing the likelihood of spoilage and waste. This resonates strongly with sustainability initiatives and ethical consumerism. Furthermore, advancements in labeling technology and material science are enabling the development of more effective and cost-efficient resealable solutions. Innovations in adhesive formulations, film substrates, and integrated sealing mechanisms are enhancing the performance and applicability of these labels across a wider range of packaging types and products. The expanding e-commerce landscape also indirectly fuels demand, as it necessitates robust packaging that can withstand multiple handling stages while maintaining product integrity, with resealable features offering an added layer of protection and appeal.

Despite its robust growth trajectory, the Resealable Packaging Labels market faces certain challenges and restraints that warrant careful consideration. A primary hurdle is the inherent cost factor associated with specialized resealable labels compared to conventional labels. The materials, adhesive technologies, and manufacturing processes involved often translate to higher production costs, which can be a deterrent for price-sensitive manufacturers, particularly in highly competitive markets. Secondly, the technical complexity of achieving consistent and reliable resealing performance across diverse packaging materials and environmental conditions can be a challenge. Ensuring that the resealing mechanism maintains its integrity over the product's shelf life, while also being user-friendly, requires significant research and development. Furthermore, regulatory compliance and evolving sustainability mandates can pose complex challenges. While resealable packaging aims to reduce waste, the materials used in the labels themselves must meet stringent environmental standards, including recyclability and biodegradability requirements, which can be a moving target for manufacturers. The need for specialized converting equipment for applying certain types of resealable labels can also be a capital investment barrier for smaller manufacturers. Finally, consumer education and perception play a role; while many appreciate the convenience, some may perceive resealable packaging as an unnecessary added feature, impacting adoption rates.

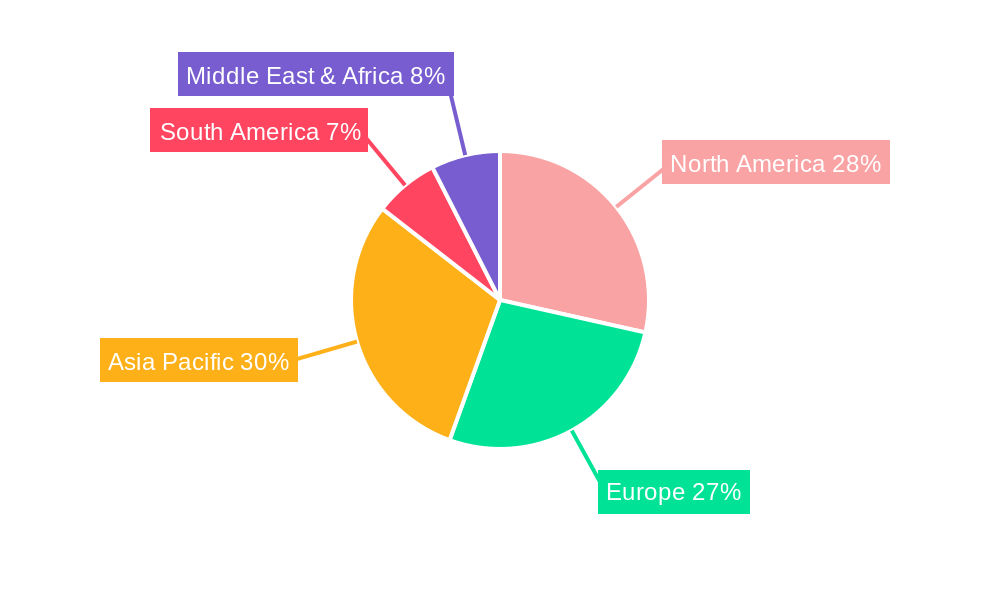

The global Resealable Packaging Labels market is poised for significant dominance by the Asia Pacific region, driven by a confluence of rapid economic growth, a burgeoning middle class, and a substantial manufacturing base. This region is anticipated to account for a considerable share of the World Resealable Packaging Labels Production. Within this region, countries like China, India, and Southeast Asian nations are expected to be key contributors, fueled by their massive populations and increasing disposable incomes. The Food & Beverage segment is also set to be a dominant force, both globally and within the Asia Pacific, representing a significant portion of the market.

Asia Pacific Region:

Food & Beverage Segment:

Type: Polypropylenes:

Several key catalysts are poised to significantly accelerate the growth of the Resealable Packaging Labels industry. The increasing consumer demand for sustainable packaging solutions that minimize waste is a paramount driver. Resealable packaging directly contributes to this by extending product freshness and reducing spoilage, thereby diminishing the overall environmental impact. Furthermore, continuous innovation in adhesive technologies and material science is enabling the creation of more effective, user-friendly, and cost-efficient resealable labels. The expansion of the e-commerce sector also plays a crucial role, as resealable packaging offers enhanced product protection and consumer appeal during transit and delivery.

This report offers unparalleled and comprehensive coverage of the Resealable Packaging Labels market. It meticulously analyzes market size and forecasts in million units for the Study Period: 2019-2033, using 2025 as the Base Year and Estimated Year, with a detailed Forecast Period: 2025-2033 and insights from the Historical Period: 2019-2024. The analysis dissects the market by critical Segments, including Application (Food & Beverage, Retail, Consumer Durables, Pharmaceuticals, Others) and Type (Heat Sealable Polyesters, Polypropylenes, Metalized Films, Foils). Furthermore, it provides a thorough examination of Industry Developments, regional dynamics, leading players, and the key factors shaping this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include MacFarlane Labels Ltd, New York Label & Box Works, UPM Raflatac, Veltego, Etik Ouest, Presto Products Company, Desmedt Labels, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Resealable Packaging Labels," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Resealable Packaging Labels, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.