1. What is the projected Compound Annual Growth Rate (CAGR) of the Repackaging Service?

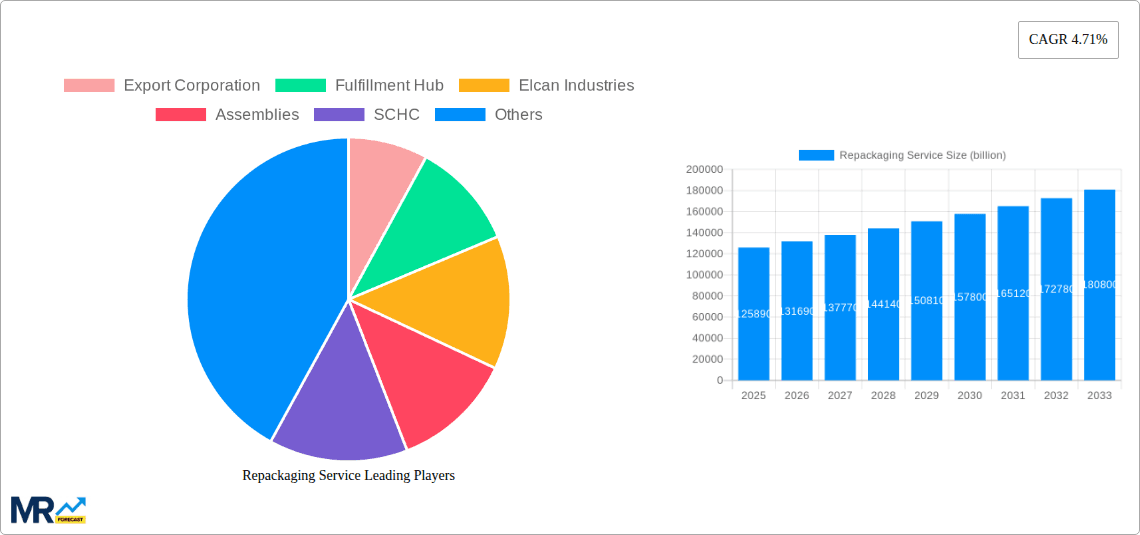

The projected CAGR is approximately 4.71%.

Repackaging Service

Repackaging ServiceRepackaging Service by Type (/> Functional Repackaging, Aesthetic Repackaging), by Application (/> Consumer Products, Food, Pharmaceutical, Electronics, Chemical, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

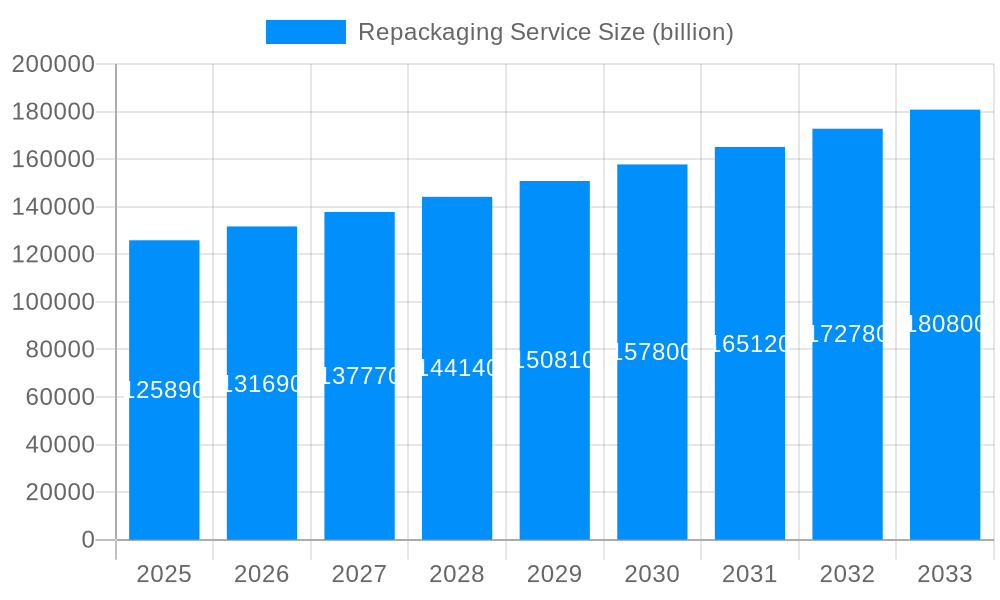

The global repackaging service market is poised for robust expansion, projected to reach $125.89 billion by 2025, with a steady Compound Annual Growth Rate (CAGR) of 4.71% anticipated through 2033. This growth is fueled by a confluence of factors, primarily driven by the escalating demand for streamlined supply chains and enhanced product presentation across diverse industries. The rise of e-commerce has significantly amplified the need for specialized repackaging solutions, enabling businesses to efficiently consolidate, customize, and prepare products for direct-to-consumer shipping. Furthermore, regulatory compliance in sectors like pharmaceuticals and chemicals necessitates precise and secure repackaging, further underpinning market demand. The market segments are broadly categorized into functional and aesthetic repackaging. Functional repackaging addresses the practical needs of product protection, preservation, and efficient logistics, while aesthetic repackaging focuses on enhancing visual appeal, brand consistency, and consumer experience, particularly crucial for consumer goods and luxury items.

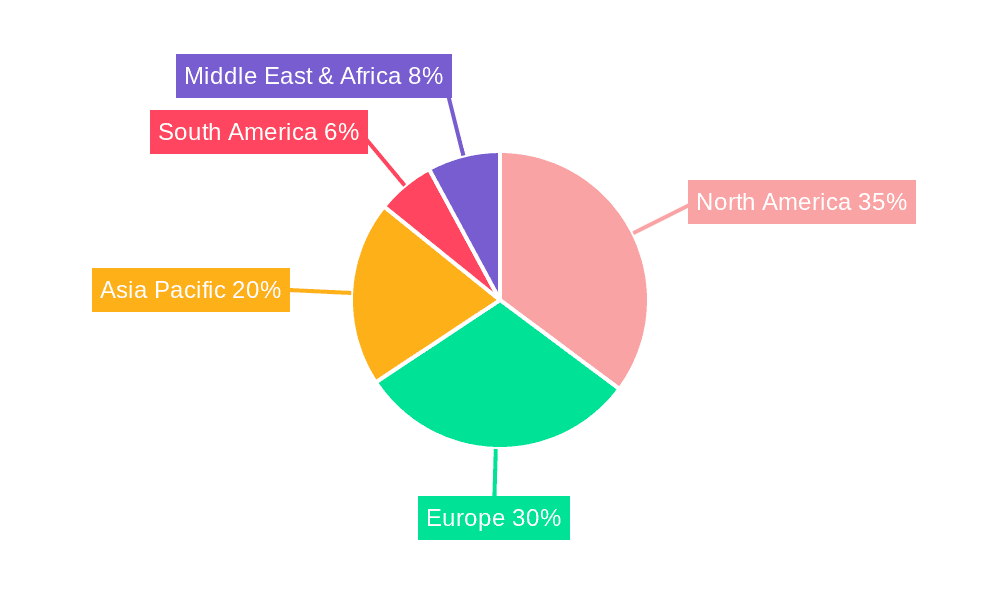

Key industry trends indicate a growing emphasis on sustainable packaging solutions, with businesses increasingly seeking eco-friendly materials and optimized packaging designs to minimize waste and appeal to environmentally conscious consumers. Technological advancements in automation and specialized equipment are also revolutionizing repackaging processes, leading to improved efficiency, accuracy, and cost-effectiveness. The market is characterized by a fragmented landscape with numerous small and medium-sized enterprises alongside larger, established players offering a comprehensive suite of services. Geographically, North America and Europe currently lead the market due to well-established retail and e-commerce infrastructures and stringent quality control standards. However, the Asia Pacific region, driven by its burgeoning consumer base and rapid industrialization, is expected to witness the highest growth trajectory in the coming years. Emerging economies are increasingly adopting efficient repackaging strategies to compete effectively in the global marketplace.

Study Period: 2019-2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025-2033 | Historical Period: 2019-2024

The global repackaging service market is poised for substantial growth, projected to reach $75.75 billion by 2025, and is anticipated to expand further to $132.87 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 7.31% during the forecast period. This robust expansion is fueled by a confluence of factors, including evolving consumer demands, the burgeoning e-commerce landscape, and increasing regulatory pressures across various industries. The historical period from 2019 to 2024 has witnessed a steady rise in the adoption of repackaging services, driven by companies seeking to optimize their supply chains, enhance product appeal, and comply with stringent labeling and safety standards. Functional repackaging, aimed at improving product protection, convenience, and transportability, is a key driver. This includes services like re-bagging, re-kitting, and specialized containment for sensitive materials. Furthermore, aesthetic repackaging is gaining significant traction as brands strive to create differentiated shelf appeal and cater to specific market segments, especially in the consumer products and food industries. The shift towards sustainable packaging solutions also presents a noteworthy trend, with a growing emphasis on recyclable, biodegradable, and reusable materials for repackaging operations. The increasing complexity of global supply chains and the need for localized product adaptation further bolster the demand for flexible and efficient repackaging solutions. For instance, companies like Export Corporation and Fulfillment Hub are actively investing in advanced technologies and infrastructure to meet these dynamic market requirements, anticipating a significant market share within the projected growth trajectory. The strategic importance of repackaging is underscored by its role in product customization, promotional bundling, and the management of end-of-life packaging, all of which contribute to increased market value. The market's trajectory indicates a sustained and dynamic evolution, reflecting its critical role in modern commerce.

The global repackaging service market is experiencing a significant upswing, primarily driven by the unprecedented expansion of the e-commerce sector. As online retail continues its meteoric rise, businesses across various industries are increasingly relying on repackaging services to adapt products for individual shipment, ensure safe transit, and present a compelling unboxing experience. This surge is further amplified by the growing demand for product customization and personalization. Consumers today expect products tailored to their specific needs, and repackaging services provide the agility to offer variations in size, quantity, and packaging formats. Moreover, the pharmaceutical and chemical industries, with their stringent regulatory requirements and specialized handling needs, are major contributors to market growth. Companies such as Pharmaclean and OctoChem are heavily invested in sophisticated repackaging solutions that ensure product integrity, safety, and compliance with evolving global standards. The push for sustainability is another powerful catalyst. As environmental consciousness rises, businesses are seeking repackaging partners like Lean Supply Solutions and United Packaging who can offer eco-friendly materials and processes, reducing waste and enhancing brand image. The need to adapt products for diverse international markets, including compliance with local labeling laws and consumer preferences, also necessitates specialized repackaging expertise, benefiting providers like myGermany and Paraguaybox. This multifaceted demand creates a robust and expanding market for repackaging services.

Despite the promising growth trajectory, the repackaging service sector faces several significant challenges that could potentially restrain its expansion. One of the primary concerns is the escalating cost of raw materials, particularly for packaging supplies. Fluctuations in the price of plastics, paper, and other essential materials can directly impact the profitability of repackaging operations and subsequently affect service pricing for clients. Furthermore, the increasing complexity of global supply chains, while a driver of demand, also introduces logistical hurdles. Managing diverse product SKUs, ensuring timely delivery, and maintaining inventory accuracy across multiple locations can be a considerable operational challenge for repackaging providers like Warehousing Companies Inc and SK Logistics. The stringent and ever-evolving regulatory landscape across industries, especially in pharmaceuticals and chemicals, presents another hurdle. Companies must invest heavily in ensuring compliance with a myriad of standards related to safety, labeling, and traceability, which can be resource-intensive. The need for specialized equipment and skilled labor for handling sensitive or hazardous materials can also be a barrier to entry and scalability for smaller players. Moreover, the potential for cross-contamination, particularly in food and pharmaceutical repackaging, demands rigorous quality control measures and investments in sterile environments, adding to operational costs. Finally, intense competition within the market, with numerous players vying for contracts, can lead to price wars and reduced profit margins, impacting overall industry profitability.

The global repackaging service market is characterized by its dynamic regional and segment dominance, with North America currently leading the charge. This dominance is attributed to a robust industrial base, a highly developed e-commerce infrastructure, and a strong consumer demand for customized and efficiently packaged products. Companies like Affiliated Warehouse Companies Inc and Repackaging Services are central to this North American leadership. The United States, in particular, represents a significant market share owing to the presence of major manufacturers and a vast retail network that increasingly relies on repackaging for product distribution and market adaptation.

Within this dominant region, the Consumer Products segment is projected to command a substantial market share, driven by the constant demand for new product launches, promotional bundling, and the need for attractive packaging that appeals to a broad consumer base. Companies like Impak Corp and JONCO are heavily involved in providing specialized repackaging solutions for this sector. The increasing prevalence of private label brands and the desire for unique in-store and online presentation further fuel this segment's growth.

However, the Pharmaceutical segment, while perhaps smaller in volume, is anticipated to exhibit the highest growth rate. This is propelled by the stringent regulatory requirements for drug packaging, the need for specialized handling of sensitive medications, and the growing demand for unit-dose packaging and clinical trial material repackaging. Companies like Pharmaclean and Delfarma are at the forefront of this segment, offering advanced sterile repackaging services and adherence to Good Manufacturing Practices (GMP). The increasing global healthcare expenditure and the demand for personalized medicine also contribute to the pharmaceutical segment's accelerated growth.

Looking ahead, Asia-Pacific is emerging as a significant growth region, driven by rapid industrialization, a burgeoning middle class, and the aggressive expansion of e-commerce platforms across countries like China, India, and Southeast Asian nations. Countries like China are becoming manufacturing hubs that require extensive repackaging services for both domestic consumption and international export. Companies like Sofeast are playing a crucial role in facilitating this growth by offering comprehensive repackaging and quality control solutions.

In terms of segments, Functional Repackaging is expected to maintain its dominance throughout the forecast period. This is due to the fundamental need across all industries to ensure product integrity, safety, and efficient transportation. Services such as re-kitting, shrink-wrapping, and specialized palletizing are essential for optimizing supply chains and reducing damage. While Aesthetic Repackaging is crucial for brand differentiation, the core requirement for functionality remains paramount for the majority of packaged goods.

The synergy between these regions and segments underscores the multifaceted nature of the repackaging market, where diverse demands converge to create a landscape ripe for innovation and expansion. The strategic positioning of companies in key regions and their specialization in high-growth segments will be critical for market success.

The repackaging service industry is experiencing robust growth, significantly catalyzed by the explosive expansion of the e-commerce sector. This channel necessitates the adaptation of products for individual shipment, requiring efficient and protective repackaging. Furthermore, the increasing consumer demand for personalized and customized products presents a major growth opportunity, as repackaging services allow for the creation of unique product bundles and variations. The growing emphasis on sustainability and eco-friendly packaging solutions is also a key catalyst, driving innovation in materials and processes.

This report offers an in-depth analysis of the global repackaging service market, providing a comprehensive overview from 2019 to 2033. It details market trends, driving forces such as e-commerce growth and consumer demand for personalization, and significant challenges including rising material costs and regulatory complexities. The report identifies key regions and segments, such as Consumer Products and Pharmaceutical, poised for dominance and high growth, respectively. It also highlights the critical role of leading players and tracks significant industry developments, offering valuable insights for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.71% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.71%.

Key companies in the market include Export Corporation, Fulfillment Hub, Elcan Industries, Assemblies, SCHC, Repack, Pharmaclean, Transene, Lean Supply Solutions, Impak Corp, OctoChem, Sam-Son, Fulfillrite, Baker, Jetkrate, UICL, Borderlinx, Repackaging Services, Goodwill, Sofeast, myGermany, Affiliated Warehouse Companies Inc, SK Logistics, Waverley Industries, Techtron, AVEKA, Techni-Pak, Hazclear, Grotech Production, New Life Chemical & Equipment, MORRE-TEC, United Packaging, True line repackaging, JONCO, Paraguaybox, Canadian Material Repack, Delfarma, .

The market segments include Type, Application.

The market size is estimated to be USD 125.89 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Repackaging Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Repackaging Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.