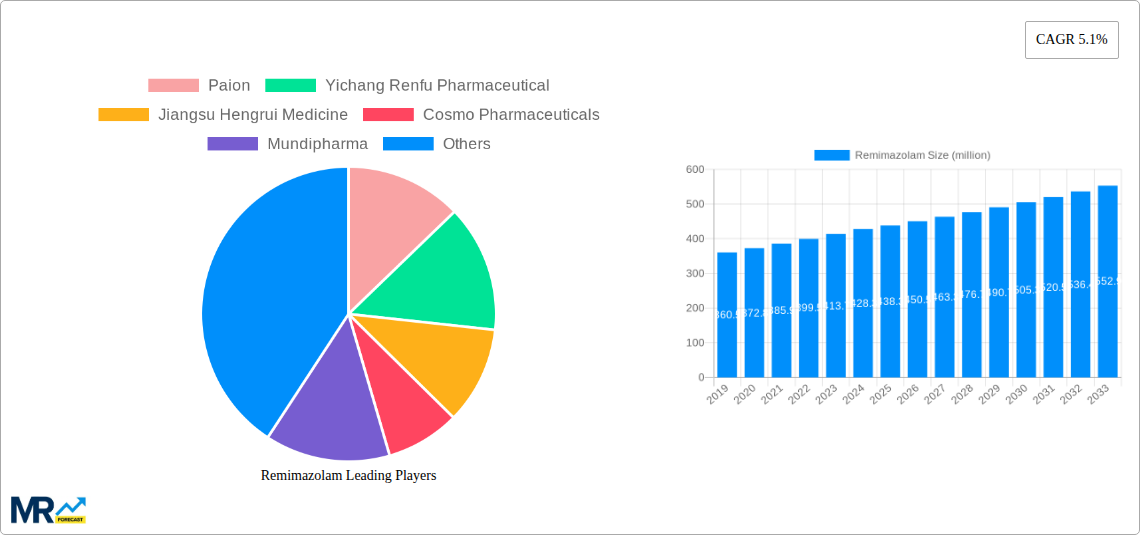

1. What is the projected Compound Annual Growth Rate (CAGR) of the Remimazolam?

The projected CAGR is approximately 5.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Remimazolam

RemimazolamRemimazolam by Application (Surgical Anesthesia, ICU Sedation, Other), by Type (2.5mg, 20mg), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

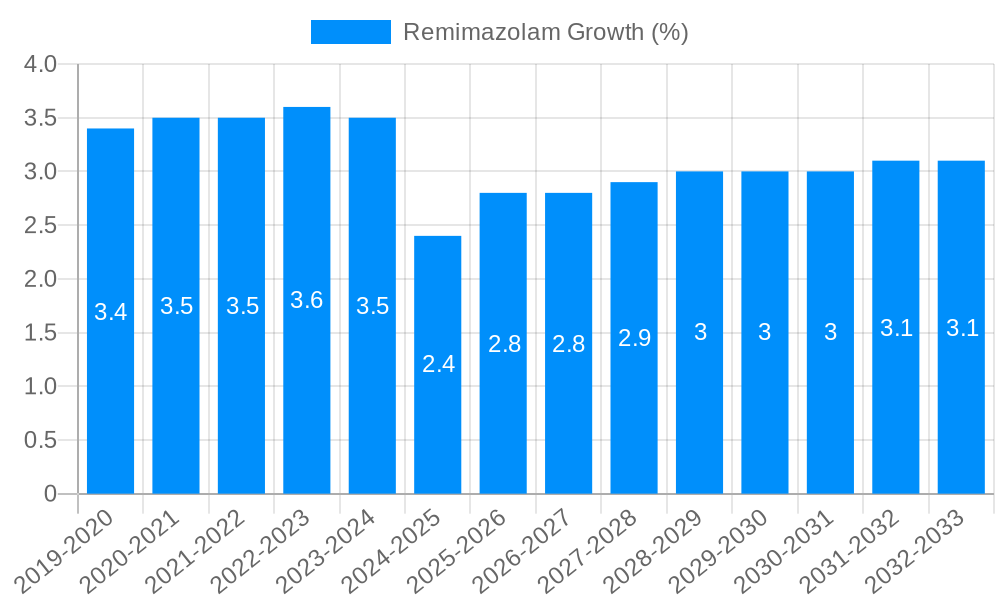

The global Remimazolam market is poised for significant expansion, projected to reach an estimated value of $438.3 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.1% anticipated through 2033. This growth trajectory is primarily fueled by the increasing demand for advanced anesthetic agents that offer rapid onset, predictable offset, and improved safety profiles for surgical procedures and intensive care settings. Remimazolam's unique pharmacokinetic and pharmacodynamic properties, including its ultra-short-acting nature and organ-independent metabolism, position it as a compelling alternative to traditional sedatives and anesthetics. The market is segmented by application into Surgical Anesthesia, ICU Sedation, and Other, with Surgical Anesthesia expected to dominate due to the high volume of procedures requiring precise anesthetic control. The Type segment, encompassing 2.5mg and 20mg dosages, caters to diverse patient needs and procedural requirements, further driving market adoption.

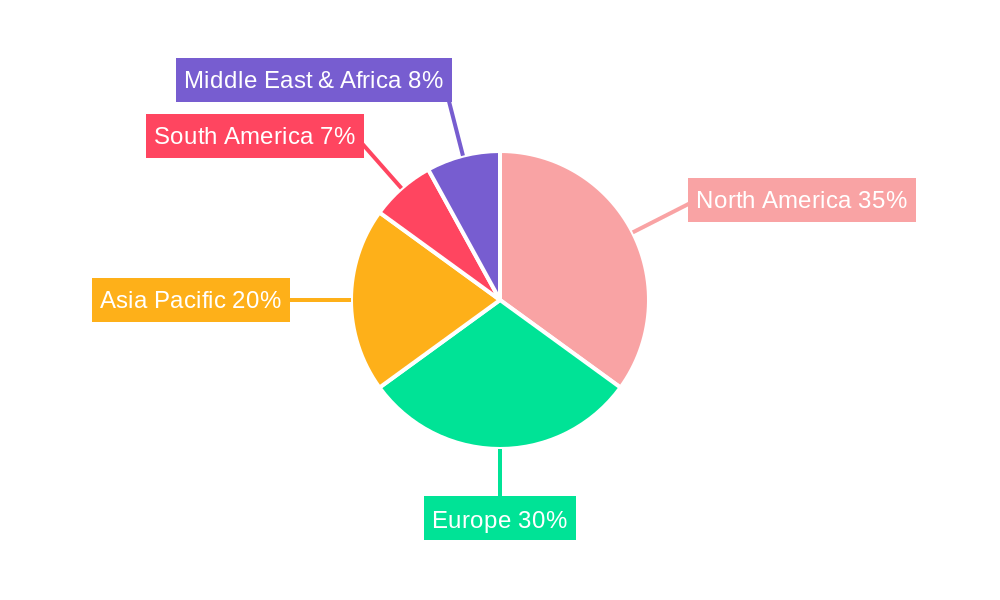

Geographically, North America, led by the United States, is expected to maintain a leading position in the Remimazolam market, driven by advanced healthcare infrastructure, a high prevalence of complex surgical procedures, and early adoption of innovative pharmaceutical products. Europe follows closely, with key markets like Germany, the United Kingdom, and France contributing significantly due to their well-established healthcare systems and supportive regulatory environments. The Asia Pacific region, particularly China and India, presents a substantial growth opportunity, owing to increasing healthcare expenditure, a growing patient population, and rising awareness and accessibility of advanced medical treatments. Key industry players, including Paion, Yichang Renfu Pharmaceutical, Jiangsu Hengrui Medicine, Cosmo Pharmaceuticals, Mundipharma, Pharmascience, and Hana Pharm, are actively engaged in research, development, and market penetration strategies to capitalize on the burgeoning demand for Remimazolam and solidify their market share. The market's momentum is further sustained by ongoing clinical research and the potential for expanded indications.

Here's a unique report description on Remimazolam, incorporating the requested elements:

The global Remimazolam market is poised for substantial growth, projected to surge from an estimated US$ 150 million in the base year of 2025 to a remarkable US$ 850 million by the end of the forecast period in 2033. This significant expansion is largely underpinned by the drug's favorable pharmacokinetic and pharmacodynamic profile, offering a rapid onset and offset of action coupled with a predictable recovery. During the historical period of 2019-2024, early-stage clinical trials and initial market entries laid the groundwork for this anticipated surge. The study period of 2019-2033 encompasses this foundational phase and extends through the projected widespread adoption and market maturity. A key market insight is the increasing preference for ultra-short-acting sedatives and anesthetics in both procedural settings and intensive care units. Remimazolam, with its distinct advantage of reduced cardiorespiratory depression compared to traditional agents, is exceptionally well-positioned to capture this evolving demand. The estimated market size for 2025 of US$ 150 million reflects initial market penetration and the growing awareness among healthcare professionals. As more clinical data emerges and regulatory approvals broaden, the market is expected to accelerate, driven by its versatility across various patient populations and medical scenarios. The potential for Remimazolam to streamline patient management, reduce recovery times, and potentially lower healthcare costs is a significant trend that will continue to shape its market trajectory. Furthermore, advancements in drug delivery systems and the development of new formulations are also contributing to the evolving landscape of Remimazolam utilization. The industry is witnessing a strategic focus on expanding its therapeutic applications beyond established indications, further bolstering the long-term growth prospects.

The escalating demand for safer and more efficient anesthetic and sedative agents is the primary impetus behind the robust growth of the Remimazolam market. Healthcare providers are increasingly seeking medications that minimize post-operative complications, expedite patient recovery, and offer greater control during procedures. Remimazolam's rapid metabolism by tissue esterases, independent of organ function, provides a crucial advantage, ensuring predictable and quick patient awakening. This inherent characteristic directly addresses the need for reduced hospital stays and improved patient throughput, particularly in ambulatory surgery centers and busy ICUs. The growing prevalence of minimally invasive surgical techniques, which often require precise and rapidly reversible sedation, further amplifies the need for drugs like Remimazolam. Moreover, the increasing global healthcare expenditure, coupled with advancements in medical technology and a rising aging population with comorbidities, necessitates the adoption of innovative pharmacotherapies that enhance patient safety and optimize resource utilization. The pharmaceutical industry's ongoing investment in research and development to broaden the therapeutic indications and optimize the administration of Remimazolam is also a significant driving force, promising to unlock new market segments and sustain its upward trajectory.

Despite its promising outlook, the Remimazolam market faces certain challenges that could temper its growth. The initial high cost of the drug compared to established, generic alternatives presents a significant barrier, particularly in resource-limited healthcare systems. Widespread adoption will necessitate cost-effectiveness studies and favorable reimbursement policies to bridge this economic gap. Furthermore, the relatively nascent stage of Remimazolam's market presence means that comprehensive long-term safety data across diverse patient populations is still accumulating. Building this robust evidence base will be crucial for gaining physician confidence and securing broader clinical acceptance. Regulatory hurdles, while already navigated for initial approvals, can still pose challenges for new indications or formulations in different geographical regions, requiring significant investment in time and resources. Physician education and training are also paramount, as unfamiliarity with the drug's unique pharmacokinetic profile and administration protocols can lead to hesitancy in its utilization. Lastly, potential competition from emerging ultra-short-acting agents, should they prove equally or more advantageous, could also present a restraint to market dominance.

The Surgical Anesthesia segment, particularly within the North America and Europe regions, is anticipated to dominate the Remimazolam market throughout the forecast period. The North America region, with its advanced healthcare infrastructure, high adoption rate of new technologies, and a substantial volume of surgical procedures, is expected to be the largest market. The demand for shorter recovery times and improved patient outcomes in surgical settings, from routine procedures to complex surgeries, directly translates to a significant need for Remimazolam. The prevalence of ambulatory surgery centers, where efficiency and rapid patient turnover are critical, further bolsters this dominance.

North America:

Europe:

The Surgical Anesthesia application is predicted to hold the largest market share due to the inherent need for precise, rapidly reversible, and safe sedation and anesthesia during a wide array of surgical interventions. The development and widespread availability of the 20mg formulation are crucial for meeting the dosage requirements in many surgical scenarios, offering flexibility and efficacy for practitioners. The advanced healthcare systems in North America and Europe, coupled with their higher healthcare spending and proactive adoption of innovative medical treatments, position these regions as the leading markets for Remimazolam, particularly within the surgical anesthesia context.

The Remimazolam industry is experiencing several key growth catalysts. The increasing preference for ultra-short-acting anesthetic and sedative agents that offer rapid onset and offset, minimizing patient recovery time, is a primary driver. This trend is particularly evident in outpatient surgical settings and for procedures requiring quick patient turnarounds. Furthermore, the growing body of clinical evidence demonstrating Remimazolam's favorable safety profile, including reduced cardiorespiratory depression compared to traditional agents, is enhancing physician confidence and encouraging its wider adoption. The expansion of regulatory approvals into new geographical markets and for additional indications will also significantly fuel growth.

This comprehensive report offers an in-depth analysis of the Remimazolam market, meticulously examining trends, drivers, and challenges shaping its trajectory from 2019 to 2033. The report provides detailed market sizing and forecasts, with the base year of 2025 estimated at US$ 150 million and projected to reach US$ 850 million by 2033. It delves into the competitive landscape, highlighting key players and their strategic initiatives, alongside an exploration of significant industry developments from 2019 onwards. The report also scrutinizes the dominance of key regions and segments, particularly focusing on Surgical Anesthesia and the 20mg dosage type. This comprehensive coverage equips stakeholders with the insights necessary to navigate the evolving Remimazolam market effectively.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.1%.

Key companies in the market include Paion, Yichang Renfu Pharmaceutical, Jiangsu Hengrui Medicine, Cosmo Pharmaceuticals, Mundipharma, Pharmascience, Hana Pharm, .

The market segments include Application, Type.

The market size is estimated to be USD 438.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Remimazolam," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Remimazolam, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.