1. What is the projected Compound Annual Growth Rate (CAGR) of the Remanufactured Compressor?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Remanufactured Compressor

Remanufactured CompressorRemanufactured Compressor by Type (Screw Compressor, Reciprocating Compressor, Centrifugal Compressor, Others, World Remanufactured Compressor Production ), by Application (Oil and Gas, Food and Beverage, Pharmaceutical and Chemical, Commercial, Others, World Remanufactured Compressor Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

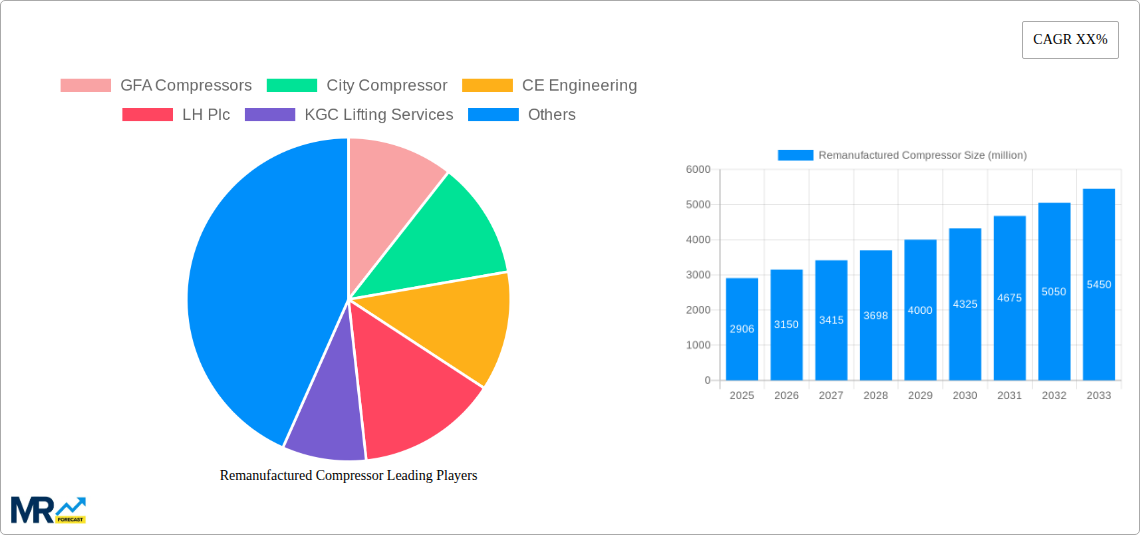

The global remanufactured compressor market is poised for robust growth, projected to reach a substantial size of $2906 million by 2025. This expansion is fueled by a confluence of critical drivers, prominently including the increasing demand for cost-effective and sustainable industrial solutions across various sectors. The oil and gas industry, in particular, is a significant contributor, driven by the need for reliable and economically viable compressor units for exploration, production, and refining operations. Similarly, the food and beverage sector is witnessing heightened adoption of remanufactured compressors due to stringent regulatory requirements and the pursuit of operational efficiency. The pharmaceutical and chemical industries also play a pivotal role, benefiting from the reduced capital expenditure and faster delivery times associated with remanufactured equipment, while ensuring adherence to quality and performance standards.

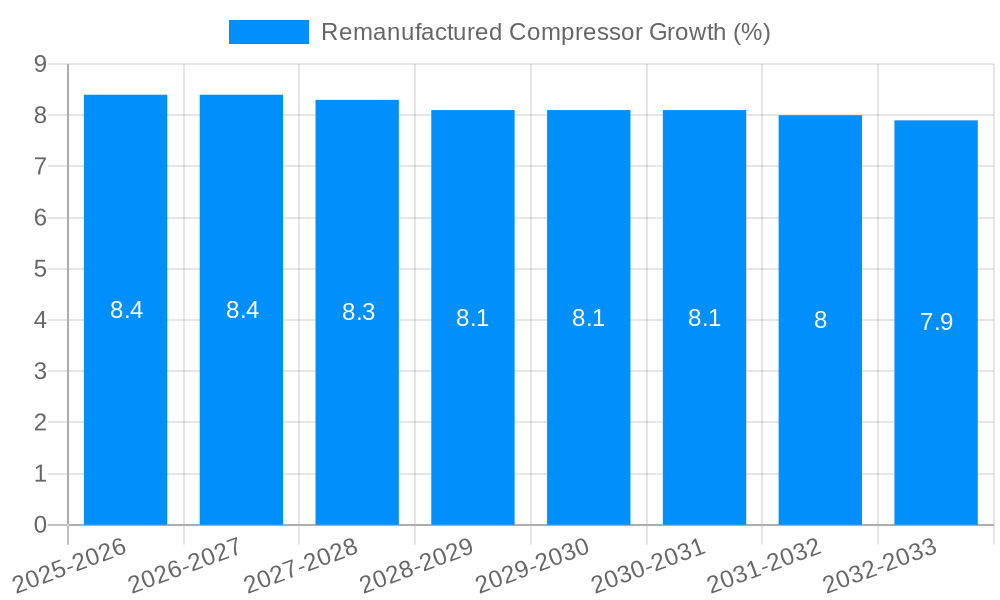

The market's growth trajectory is further bolstered by evolving industry trends such as the growing emphasis on circular economy principles and extended product lifecycles. Manufacturers and end-users are increasingly recognizing the environmental benefits of remanufacturing, which reduces waste and conserves resources. Technological advancements in remanufacturing processes, leading to improved quality and performance of refurbished units, are also contributing to market expansion. While the market demonstrates a promising outlook, certain restraints exist. Fluctuations in the availability of used compressors for remanufacturing and the perception of remanufactured products as inferior to new ones, though diminishing, can pose challenges. However, the overarching trend towards sustainability and cost optimization, coupled with the continuous innovation in remanufacturing techniques, is expected to propel the World Remanufactured Compressor Production significantly in the coming years. The CAGR of XX% over the study period 2019-2033 indicates a sustained and healthy expansion, underlining the market's resilience and future potential.

This in-depth report provides an exhaustive analysis of the global remanufactured compressor market, projecting its trajectory from the historical period of 2019-2024 through to a comprehensive forecast extending to 2033, with a strong focus on the base year of 2025. We delve into the intricate landscape of remanufactured compressors, dissecting key market insights, driving forces, and critical challenges that shape its evolution. The report meticulously examines the market across various compressor types including Screw Compressors, Reciprocating Compressors, and Centrifugal Compressors, and scrutinizes its penetration into diverse application segments such as Oil and Gas, Food and Beverage, Pharmaceutical and Chemical, and Commercial industries.

The projected World Remanufactured Compressor Production is anticipated to witness substantial growth, moving from an estimated XX million units in 2025 to over YY million units by 2033. This surge is fueled by a confluence of economic, environmental, and industrial factors, all meticulously detailed within this report. Our analysis also spotlights the dominant regions and countries poised to lead this market expansion, alongside specific segments that are expected to exhibit the most significant demand and innovation. Furthermore, we identify the key industry players, their strategic initiatives, and recent significant developments that are collectively redefining the future of the remanufactured compressor sector. This report serves as an indispensable guide for stakeholders seeking to understand and capitalize on the burgeoning opportunities within this dynamic market.

The global remanufactured compressor market is experiencing a robust uptrend, driven by a strategic shift towards cost-efficiency and sustainability across various industrial sectors. Over the study period of 2019-2033, with a pivotal base year in 2025, this market is not merely a niche segment but is rapidly evolving into a mainstream alternative to new compressor units. Key market insights reveal a growing adoption rate, particularly in regions with established industrial infrastructures and a strong emphasis on environmental regulations. The estimated World Remanufactured Compressor Production for 2025 is projected to be in the millions of units, a figure expected to see significant year-on-year growth as industries increasingly recognize the tangible benefits.

A major trend is the increasing sophistication of the remanufacturing process itself. Companies are investing heavily in advanced diagnostic tools, precision engineering, and quality control measures to ensure remanufactured compressors meet or even exceed the performance standards of new units. This enhanced reliability has been instrumental in overcoming initial hesitations and building trust among end-users. Furthermore, the economic downturns and supply chain disruptions experienced historically, especially in the period 2019-2024, have highlighted the inherent resilience and availability advantages of remanufactured options. Industries are actively seeking ways to mitigate risks associated with new equipment lead times and price volatility, making remanufactured compressors a more attractive proposition. The environmental imperative is also a substantial tailwind, with the circular economy gaining traction. Remanufacturing significantly reduces waste, energy consumption, and the carbon footprint associated with manufacturing new components. This aligns perfectly with corporate sustainability goals and increasing regulatory pressures. Consequently, the market is witnessing a diversification of applications, with segments like Food and Beverage, Pharmaceutical and Chemical, and even certain Oil and Gas operations, becoming increasingly receptive to high-quality remanufactured solutions. The forecast period of 2025-2033 is thus poised to see sustained expansion and innovation within this vital market segment.

The remanufactured compressor market's ascent is propelled by a powerful combination of economic imperatives, environmental consciousness, and technological advancements. A primary driver is the significant cost advantage offered by remanufactured units. These compressors, after undergoing a rigorous refurbishment process, provide a substantial saving compared to purchasing brand-new equipment, making them an attractive option for businesses looking to optimize operational expenditures, especially in capital-intensive industries. The estimated World Remanufactured Compressor Production, projected to be in the millions of units by 2025, underscores the scale of this economic appeal.

Beyond cost savings, the growing global emphasis on sustainability and the principles of the circular economy acts as a potent catalyst. Remanufacturing drastically reduces waste and energy consumption compared to the manufacturing of new compressors, contributing to a lower carbon footprint. This aligns with the increasing corporate social responsibility mandates and stricter environmental regulations being implemented worldwide. Furthermore, historical supply chain vulnerabilities, particularly evident during the 2019-2024 period, have underscored the benefits of readily available remanufactured alternatives. Lead times for new equipment can be lengthy and subject to disruption, whereas remanufactured options offer a more predictable and often quicker turnaround time. Technological advancements in diagnostic equipment and refurbishment techniques have also played a crucial role, ensuring that remanufactured compressors deliver reliable performance and meet stringent industry standards, thereby building greater confidence among end-users.

Despite its promising growth, the remanufactured compressor market faces several challenges and restraints that influence its overall trajectory. A persistent concern revolves around the perception of quality and reliability. While many remanufacturing processes are highly sophisticated, some end-users still harbor doubts about the long-term performance and durability of refurbished equipment compared to brand-new units. This can lead to a hesitancy in adopting remanufactured solutions, particularly in critical applications where downtime is extremely costly. This perception gap, although diminishing, remains a notable restraint for the projected World Remanufactured Compressor Production, estimated to be in the millions of units by 2025.

Another significant challenge is the availability of genuine spare parts and the standardization of remanufacturing processes. The industry relies on a consistent supply of high-quality components for refurbishment, and any disruption in this supply chain can impede production. Furthermore, the lack of universal industry standards for remanufacturing can create inconsistencies in quality across different providers, making it difficult for buyers to assess the true value and reliability of a remanufactured product. Regulatory hurdles and varying warranty policies across different regions and manufacturers can also present complexities. Ensuring compliance with diverse safety and performance regulations requires diligent effort and can add to the cost and complexity of the remanufacturing process. Lastly, the initial capital investment required by remanufacturing companies for advanced equipment and skilled labor, while crucial for quality, can be a barrier to entry for smaller players, potentially limiting the competitive landscape and the overall availability of high-quality remanufactured options.

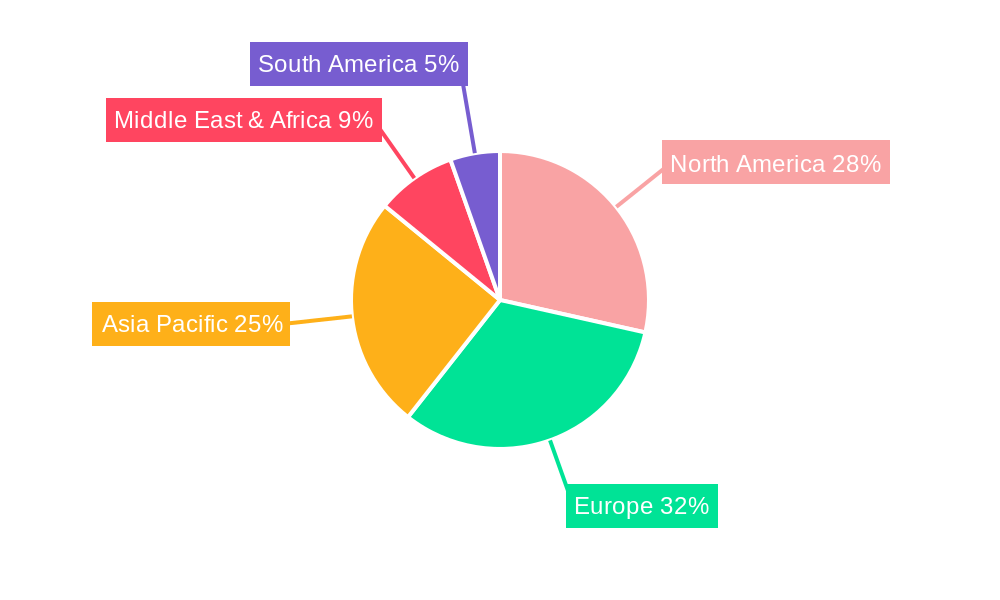

The global remanufactured compressor market is poised for significant regional and segmental dominance, driven by a confluence of industrial activity, regulatory frameworks, and economic considerations.

Dominant Regions/Countries:

Dominant Segments:

The remanufactured compressor industry is experiencing significant growth catalysts that are shaping its future. A primary driver is the escalating focus on sustainability and the circular economy. As global environmental concerns mount, industries are actively seeking ways to reduce their carbon footprint and minimize waste, making remanufactured components a more environmentally responsible choice compared to manufacturing new ones. This aligns with government initiatives and corporate social responsibility goals.

This comprehensive report aims to provide an unparalleled understanding of the global remanufactured compressor market. It meticulously analyzes the market dynamics from the historical period of 2019-2024, establishing a strong foundation with the base year of 2025, and projecting future trends through to 2033. The report delves into the intricate details of World Remanufactured Compressor Production, quantifying its growth in millions of units and identifying key growth catalysts.

The report offers deep insights into the dominant segments such as Screw, Reciprocating, and Centrifugal Compressors, alongside their applications in vital sectors like Oil and Gas, Food and Beverage, Pharmaceutical and Chemical, and Commercial industries. Furthermore, it highlights the leading regions and countries poised to spearhead market expansion. This exhaustive coverage ensures that stakeholders gain a holistic view of the opportunities, challenges, and strategic imperatives within this dynamic and evolving industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include GFA Compressors, City Compressor, CE Engineering, LH Plc, KGC Lifting Services, Advanced Compressor Engineering, Carlyle Compressor, J & E Hall, Aces, National Compressor Exchange, ARRCO, Haldex, Four Seasons.

The market segments include Type, Application.

The market size is estimated to be USD 2906 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Remanufactured Compressor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Remanufactured Compressor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.