1. What is the projected Compound Annual Growth Rate (CAGR) of the Refrigerant R23?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Refrigerant R23

Refrigerant R23Refrigerant R23 by Type (Disposable Steel Cylinders, Refillsble Steel Cylinders), by Application (Cryogenic Coolant, Fire Extinguishing Agent, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

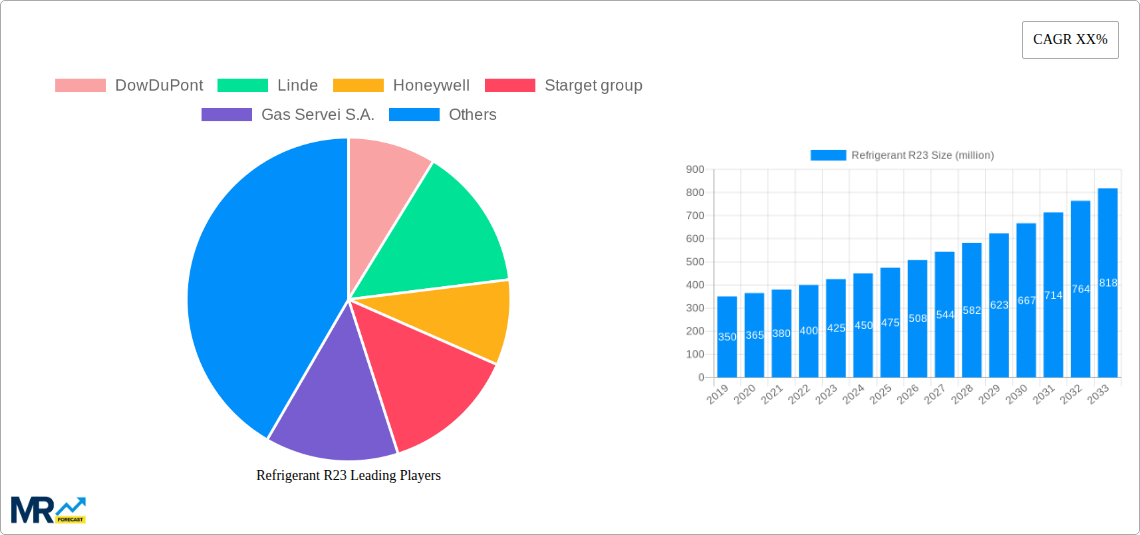

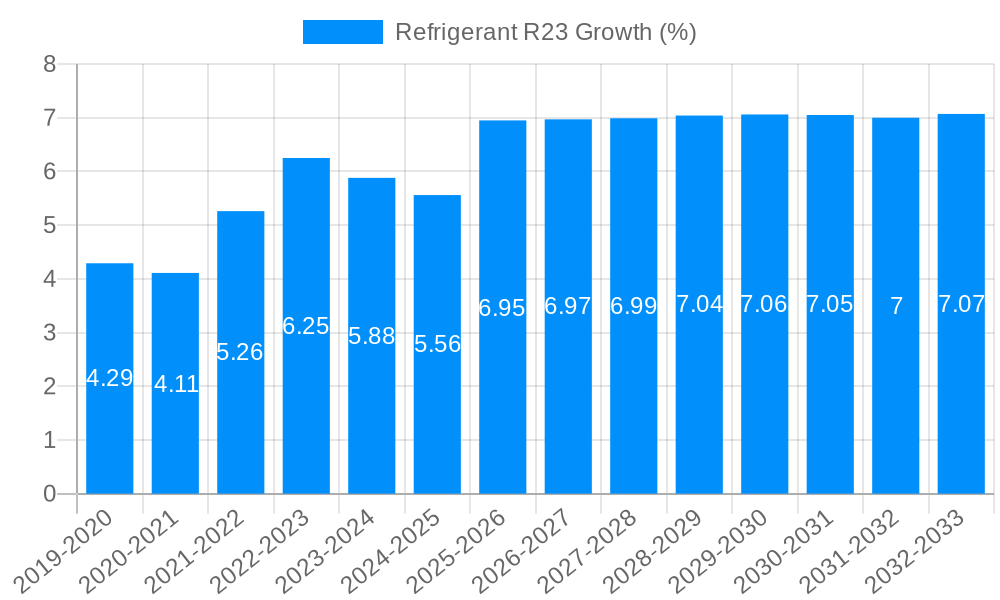

The global Refrigerant R23 market is poised for significant expansion, driven by a projected market size of approximately USD 500 million in 2025 and an estimated Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This robust growth is primarily fueled by the increasing demand for advanced cooling solutions across various industrial sectors, including refrigeration, air conditioning, and specialized cryogenic applications. The indispensable role of R23 in fire extinguishing systems, particularly in high-risk environments like data centers and industrial facilities, further bolsters its market trajectory. Moreover, advancements in manufacturing processes and the development of more efficient cylinder technologies, such as refillable steel cylinders, are contributing to market value and sustainability. Key players are focusing on expanding their production capacities and distribution networks to cater to the escalating global demand.

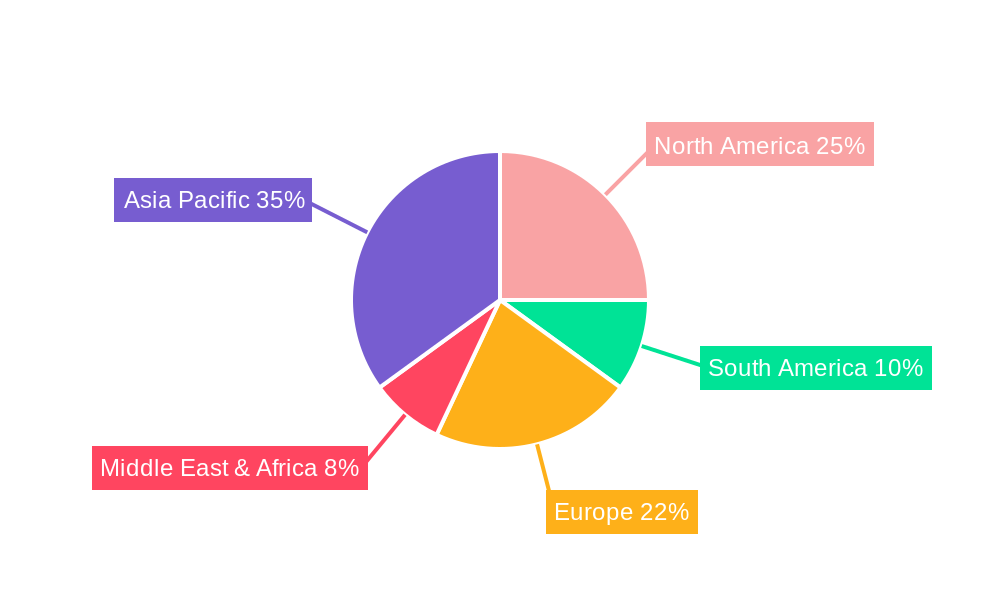

The market's growth is strategically shaped by evolving environmental regulations and a global push towards more sustainable refrigerant alternatives. While R23 offers certain performance advantages, the industry is actively exploring its long-term viability and potential phase-down in specific applications, presenting both opportunities and challenges. The dominant application segment for R23 is expected to remain cryogenic coolants due to its favorable thermodynamic properties in extremely low-temperature applications. However, the fire extinguishing agent segment is also witnessing steady growth. Geographically, Asia Pacific, led by China and India, is emerging as a pivotal growth engine due to rapid industrialization and increasing infrastructure development. North America and Europe, while mature markets, continue to be significant contributors, driven by stringent safety standards and a focus on high-performance cooling solutions. The market is characterized by a mix of established global players and emerging regional manufacturers, fostering a competitive landscape.

Here's a unique report description for Refrigerant R23, incorporating your specified elements and structure:

This report delves into the intricate landscape of Refrigerant R23, a specialized chemical with unique properties and evolving market dynamics. Covering the comprehensive study period from 2019 to 2033, with a detailed base year of 2025 and an estimated year also set for 2025, this analysis provides a forward-looking perspective on its trajectory. The historical period of 2019-2024 lays the groundwork for understanding past trends and performance. Through in-depth market intelligence, we aim to equip stakeholders with actionable insights into the opportunities and challenges within this niche but critical sector of the chemical industry. Our analysis will dissect market segmentation by product type and application, explore regional dominance, identify key growth drivers and restraints, and highlight significant industry developments. The estimated market size for Refrigerant R23 is projected to reach hundreds of million dollars by the end of the forecast period, signifying its sustained relevance and potential for growth.

The market for Refrigerant R23 is characterized by a fascinating interplay of niche applications and stringent regulatory frameworks, creating a unique trend landscape that is projected to see significant evolution over the study period of 2019-2033, with a critical base and estimated year of 2025. Historically, R23 has been primarily recognized for its exceptional performance as a cryogenic coolant, a role that necessitates its high purity and low boiling point for specific industrial refrigeration processes and scientific research. During the historical period of 2019-2024, the demand for R23 in these specialized applications remained relatively stable, driven by industries that rely on ultra-low temperature refrigeration, such as the production of semiconductors and specialized medical equipment. However, the global push towards lower Global Warming Potential (GWP) refrigerants, a key overarching trend influencing the entire refrigerant industry, has cast a long shadow over R23. Despite its relatively low consumption volumes compared to mainstream refrigerants, R23 possesses a very high GWP, making it a target for phase-downs and eventual elimination under international agreements like the Kigali Amendment to the Montreal Protocol. This has spurred a dual trend: a gradual decline in its use in new installations in some regions, coupled with an increasing focus on its recovery, recycling, and responsible disposal. Conversely, the demand for R23 as a fire extinguishing agent, while a smaller segment, has shown resilience and even potential for growth in specific, highly regulated applications where its effectiveness and rapid dispersion are paramount. This is particularly true in enclosed spaces where conventional fire suppressants might be less effective or pose greater risks to sensitive equipment. Furthermore, advancements in containment technologies for disposable and refillable steel cylinders are also shaping trends, ensuring safer handling and transportation of this potent chemical. The market is also witnessing a trend towards consolidation and strategic partnerships among key players aiming to navigate the complex regulatory environment and secure their market share in the remaining viable applications. The base year of 2025 serves as a pivotal point, where the impact of ongoing regulatory scrutiny is becoming increasingly apparent, influencing both production and consumption patterns.

The continued, albeit specialized, demand for Refrigerant R23 is primarily driven by its indispensable role in a select group of high-performance applications where alternative refrigerants fall short. Foremost among these is its critical function as a cryogenic coolant. The extremely low boiling point of R23, approximately -47.2°C, makes it exceptionally effective for achieving and maintaining ultra-low temperatures required in sophisticated industrial processes. This includes the chilling of specific chemical reactions, the production of high-purity semiconductors where precision temperature control is paramount, and in specialized laboratory equipment used for scientific research, such as lyophilization (freeze-drying) processes. In these sectors, the technical performance and reliability offered by R23 are often non-negotiable, creating a sustained demand even in the face of environmental concerns. Furthermore, the application of R23 as a fire extinguishing agent, particularly in specialized systems, is another significant driving force. Its rapid evaporation and ability to displace oxygen make it effective in suppressing fires in enclosed environments, such as server rooms, aircraft cargo holds, and certain industrial facilities where water-based or other chemical suppressants could cause significant damage to sensitive equipment or pose a risk to personnel. While the overall volume in this segment might be lower, the critical nature of these safety applications ensures a persistent demand. The established infrastructure for handling and distributing R23, coupled with the existing equipment designed to utilize it, also contributes to its continued use, especially in legacy systems.

The Refrigerant R23 market faces significant headwinds primarily due to its environmental profile. The most prominent challenge is its exceptionally high Global Warming Potential (GWP). With a GWP estimated to be in the thousands (over 14,000 over a 100-year period), R23 is a potent greenhouse gas and is therefore subject to stringent regulatory pressure and phase-down initiatives globally, including under the Kigali Amendment to the Montreal Protocol. This regulatory environment is actively driving a shift towards refrigerants with significantly lower GWPs, leading to a gradual decrease in the production and use of R23, particularly in new installations. Companies are increasingly investing in and promoting environmentally friendlier alternatives, which directly impacts the long-term market prospects for R23. Another significant restraint is the specialized nature of its applications. Unlike more common refrigerants used in widespread HVAC systems, R23's high cost and specific performance characteristics limit its applicability to niche industrial and scientific sectors. This inherent limitation restricts the overall market size and growth potential. The handling and disposal of R23 also present challenges, requiring specialized equipment and adherence to strict environmental protocols to prevent its release into the atmosphere. This adds to the operational costs for users and can be a deterrent for adopting or continuing its use where alternatives are feasible. Furthermore, the ongoing research and development of advanced, low-GWP refrigerants are creating viable substitutes that are progressively displacing R23 in its traditional application areas, further intensifying the competitive pressure and acting as a significant restraint on market expansion.

The Refrigerant R23 market is characterized by specific regional dependencies and segment dominance driven by industrial needs and regulatory landscapes.

Dominant Segments:

Application: Cryogenic Coolant

Type: Refillsble Steel Cylinders

Dominant Regions/Countries:

The market dynamics are heavily influenced by the presence of these high-demand industries and the regulatory frameworks that govern the use and disposal of high-GWP substances. Despite global phase-down efforts, the critical performance of R23 in its specialized applications ensures its continued, albeit controlled, market presence in these dominant regions and segments.

Despite the overarching trend towards low-GWP refrigerants, certain factors continue to act as catalysts for the Refrigerant R23 industry. The indispensable nature of R23 in niche but critical applications, such as semiconductor manufacturing and specialized cryogenic cooling, where no viable low-GWP alternatives can currently match its performance, provides a baseline of demand. Furthermore, its established effectiveness as a fire extinguishing agent in specific, highly regulated environments, where safety is paramount, ensures its continued use. The ongoing recovery, recycling, and repurposing of existing R23 stocks, driven by environmental regulations and economic incentives, also contributes to market activity. Innovations in cylinder technology for safer handling and transportation further support its niche market presence.

This comprehensive report offers a deep dive into the Refrigerant R23 market, providing an exhaustive analysis of its intricate dynamics from 2019 to 2033. We meticulously examine the market segmentation by product type, including disposable and refillable steel cylinders, and by application, focusing on cryogenic coolant, fire extinguishing agent, and other specialized uses. The report critically assesses the driving forces, such as its unique performance characteristics in niche industrial processes, and the significant challenges posed by its high Global Warming Potential (GWP) and stringent regulatory landscape. Extensive research identifies dominant regions and countries, underscoring the impact of industrial infrastructure and environmental policies on market trends. Furthermore, the report highlights key growth catalysts, including the persistent demand in critical applications and the focus on responsible management of existing stocks. A detailed overview of leading players and their strategic contributions, alongside a timeline of significant industry developments, ensures a holistic understanding of the Refrigerant R23 sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include DowDuPont, Linde, Honeywell, Starget group, Gas Servei S.A., Ajay Air Products, Daikin, Arkema, Chemours, Shanghai 3F New Material, Sinochem Lantian, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Refrigerant R23," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Refrigerant R23, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.