1. What is the projected Compound Annual Growth Rate (CAGR) of the Recordable Optical Disc?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Recordable Optical Disc

Recordable Optical DiscRecordable Optical Disc by Type (CD, DVD, Blu-ray Disc, World Recordable Optical Disc Production ), by Application (Online Sales, Offline Retail, World Recordable Optical Disc Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

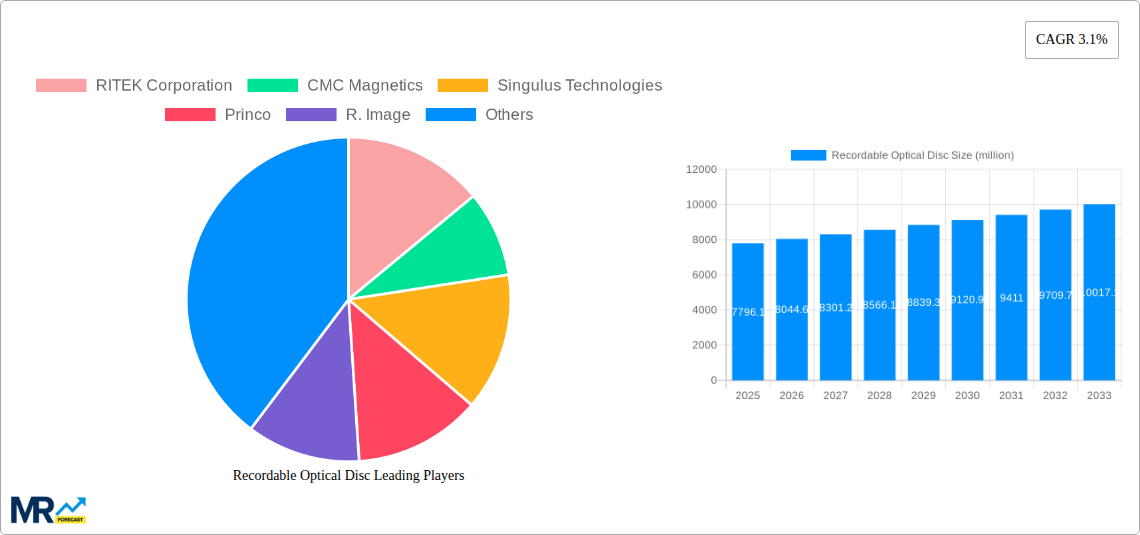

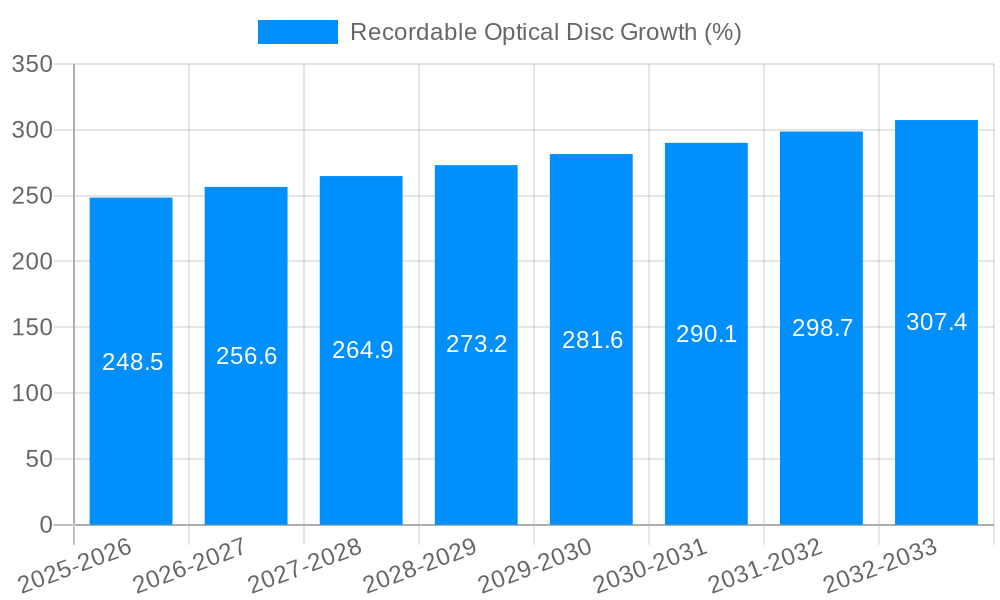

The global recordable optical disc market, valued at approximately $9.63 billion in 2025, is projected to experience moderate growth over the forecast period (2025-2033). While the overall market size might not show explosive growth, several factors contribute to its sustained relevance. The continued demand for archival storage, particularly in sectors like government and healthcare where data integrity and long-term accessibility are paramount, remains a significant driver. The relatively low cost per gigabyte compared to some newer storage solutions makes recordable optical discs a cost-effective option for certain applications. Furthermore, the robust and physical nature of these discs offers resilience against cyber threats and data loss scenarios, a significant advantage in an increasingly digital world. However, the market faces challenges from the rapid growth of cloud storage and other digital archiving technologies. The shrinking manufacturing base and increased production costs also pose a threat to market expansion. The market segmentation, with CD, DVD, and Blu-ray Disc types catering to different storage needs, is likely to remain a key characteristic. Online sales channels are expected to gain traction, although offline retail will maintain a significant presence, especially for smaller-scale consumers.

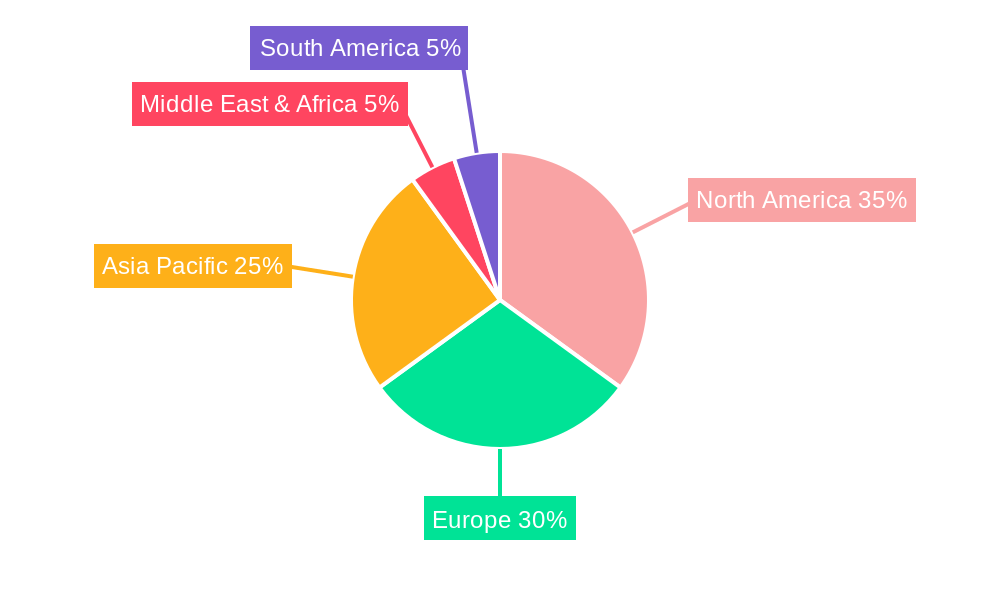

Growth will likely be fueled by niche applications requiring high data security and longevity, as well as regions with less developed digital infrastructure. The geographic distribution will see continued dominance from North America and Europe, but Asia-Pacific, particularly China and India, is anticipated to experience a modest increase in market share due to growing data storage needs and potential for manufacturing expansion. Specific growth rates will hinge on technological advancements, pricing strategies, and successful marketing campaigns that highlight the unique advantages of optical disc storage in specific contexts. The market players, including established manufacturers like RITEK Corporation and CMC Magnetics, will need to adapt by innovating in areas such as disc longevity and exploring new applications to maintain their market position.

The global recordable optical disc market, while facing the persistent challenge of digital media dominance, demonstrates surprising resilience. The study period of 2019-2033 reveals a complex interplay of factors influencing its trajectory. While overall production volume in millions of units has experienced a decline in recent years, driven primarily by the shift towards cloud storage and streaming services, certain segments show unexpected growth. The historical period (2019-2024) highlights a significant decrease in the demand for CDs and DVDs, particularly in online sales. However, the offline retail sector surprisingly maintained a more stable market share, catering to niche applications such as archiving personal data and distributing software or multimedia content requiring physical media. Blu-ray discs, while also experiencing a decline, have shown a steadier rate of contraction compared to CDs and DVDs, likely due to their higher storage capacity and continued use in the gaming and high-definition movie markets. The estimated year 2025 reflects a consolidation of these trends, with the market showing a reduced overall size but still a significant production volume, albeit concentrated in specific segments. The forecast period (2025-2033) suggests a continued albeit slow decline, however, certain niche applications are likely to sustain the market for years to come. The base year of 2025 provides a crucial benchmark to evaluate the ongoing transformation within this sector. The industry is adapting by focusing on specialized applications, higher-capacity discs, and cost-effective manufacturing processes to remain competitive.

Despite the digital revolution, several factors continue to fuel demand for recordable optical discs, albeit at a slower pace than in previous decades. The relatively low cost of production and distribution of optical media remains a crucial factor, making them a cost-effective solution, especially for archiving large amounts of data where the cost per GB is still competitive. Furthermore, the inherent portability and lack of dependency on internet connectivity make recordable optical discs a reliable storage solution in regions with limited or unreliable internet infrastructure. Another surprisingly resilient factor is the ongoing demand for physical media in specific niche markets, such as archival applications for sensitive data, where the offline storage and lack of digital vulnerabilities are paramount. The persistence of some professional applications, such as data backup in industries with strict data security protocols, supports the continued need for this physical storage. Finally, the continued presence of legacy systems and devices that rely on optical media for operation ensures a residual demand in certain sectors, even as the broader shift to digital formats continues. The resistance to obsolescence, therefore, drives market persistence, albeit in a significantly smaller capacity compared to previous decades.

The recordable optical disc market faces significant headwinds. The most dominant challenge is the overwhelming shift towards cloud storage and digital media distribution. The convenience, accessibility, and virtually unlimited storage capacity offered by cloud services are hard to compete with. This trend has significantly reduced the demand for CDs, DVDs, and even Blu-ray discs across various applications. The increasing affordability and widespread availability of high-capacity flash memory devices (USB drives, SSDs) also present a direct competition, offering greater portability and durability in some cases. Another challenge is the inherent limitations of optical media, such as the risk of physical damage, limited lifespan, and susceptibility to data loss due to scratching or environmental factors. Technological advancements in data storage are continuously pushing the boundaries of storage capacity, making optical media less attractive for large-scale data storage needs. Finally, environmental concerns associated with the production and disposal of plastic media are increasingly impacting consumer choices and governmental regulations, further hindering market growth.

Analyzing the global recordable optical disc market reveals a complex picture of regional and segmental dominance. While the overall market size is declining, certain regions and segments exhibit greater resilience than others.

Offline Retail Dominance: While online sales of recordable optical discs are experiencing a steep decline, offline retail channels maintain a surprisingly robust share. This is largely attributable to the continued presence of niche applications, such as the aforementioned personal data archiving and the distribution of software and multimedia where physical media is still preferred by consumers. The direct customer interaction and physical accessibility in offline stores maintain a steady market segment for recordable discs. This segment is notably strong in developing countries with lower internet penetration rates.

Blu-ray Disc Resilience: Compared to CDs and DVDs, Blu-ray discs show greater resilience. Their higher storage capacity makes them a viable option for specific applications, such as high-definition movie distribution and gaming. This allows for a longer lifecycle and continued production, though on a much smaller scale compared to previous years.

Geographic Focus: Regions with lower internet penetration and developing economies still show a significant demand for optical discs. This is due to lower costs, greater accessibility, and the absence of reliable cloud storage alternatives. These markets often prioritize affordability and tangible media over digital solutions.

The continued existence of this sector within the offline retail channels, particularly focusing on Blu-ray discs and regional markets with less developed digital infrastructure, sustains the overall production, even if on a reduced scale. The overall market size is shrinking but these segments show sustained and relatively more stable market shares compared to other segments.

The recordable optical disc market's future hinges on adapting to changing demands. Focus on niche applications, such as archival storage for security-sensitive data and high-definition content distribution, is crucial for growth. Cost optimization and innovative manufacturing processes are also necessary to remain competitive. Finally, highlighting the environmental benefits of reusability compared to constantly discarded flash drives, can help reposition the discs as a sustainable option for certain niche markets.

This report provides a detailed analysis of the recordable optical disc market, encompassing historical data, current trends, and future projections. It offers invaluable insights into market segments, regional variations, leading players, and key drivers and challenges. The comprehensive nature of this report helps businesses and stakeholders navigate the evolving landscape of optical media and make informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include RITEK Corporation, CMC Magnetics, Singulus Technologies, Princo, R. Image, Falcon Technologies International.

The market segments include Type, Application.

The market size is estimated to be USD 9629 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Recordable Optical Disc," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Recordable Optical Disc, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.