1. What is the projected Compound Annual Growth Rate (CAGR) of the Recombinant Carbonyl Reductase?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Recombinant Carbonyl Reductase

Recombinant Carbonyl ReductaseRecombinant Carbonyl Reductase by Type (Liquid, Powder, World Recombinant Carbonyl Reductase Production ), by Application (Pharmaceutical Synthesis, Chemical Manufacturing, Others, World Recombinant Carbonyl Reductase Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

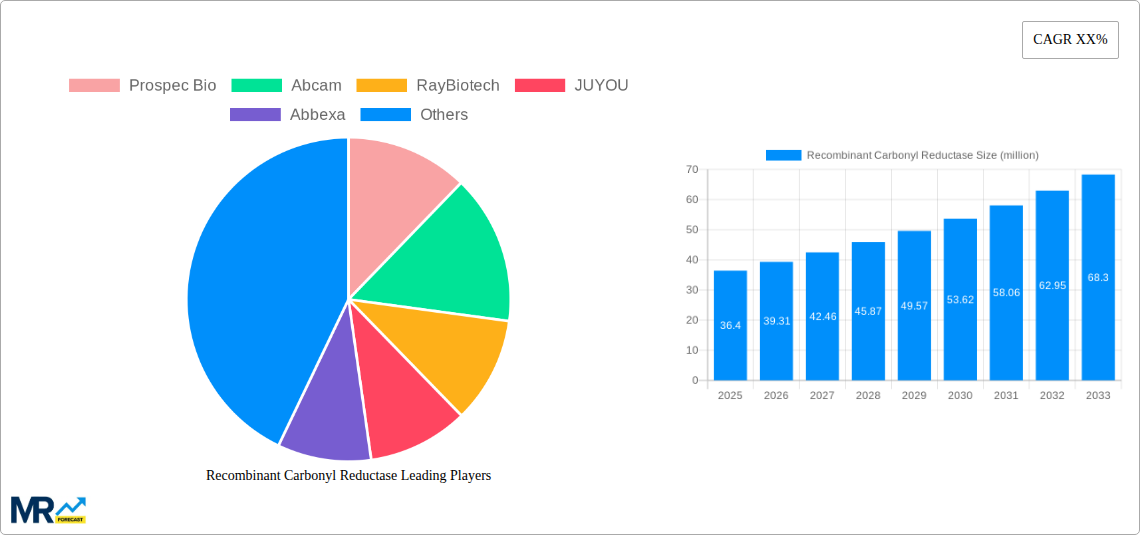

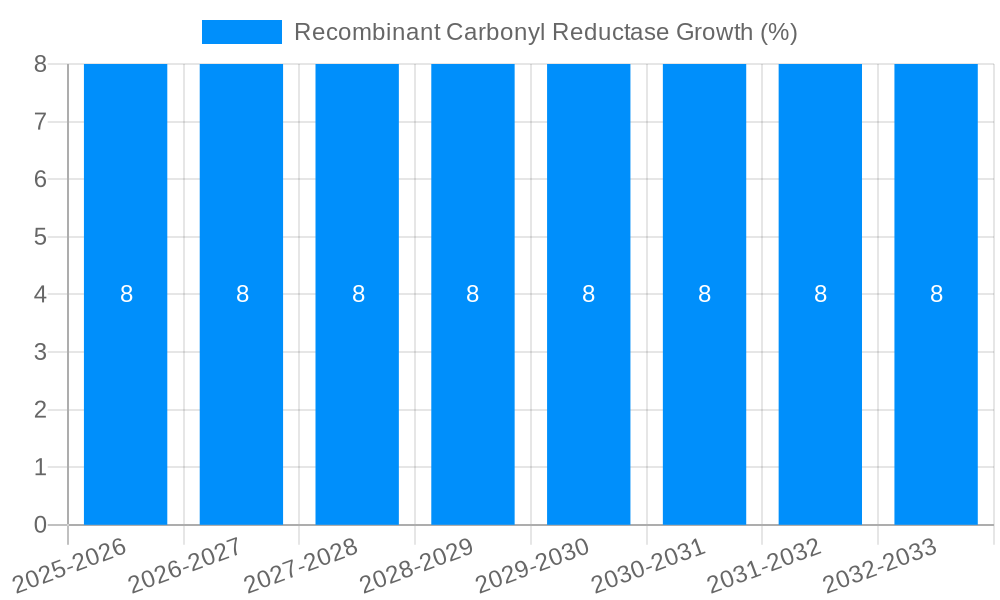

The global Recombinant Carbonyl Reductase market is poised for significant expansion, projected to reach a market size of $36.4 million. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of approximately 8-10%, driven by increasing demand from the pharmaceutical synthesis sector for efficient and stereoselective production of chiral compounds. The rising prevalence of chronic diseases and the continuous development of new drug molecules requiring complex synthesis pathways are primary catalysts. Furthermore, advancements in biotechnology and enzyme engineering are enhancing the efficacy and specificity of recombinant carbonyl reductases, making them more attractive alternatives to traditional chemical catalysts. The market is segmented into liquid and powder forms, with liquid formulations gaining traction due to ease of use and better solubility in reaction media.

Key drivers for market expansion include the growing emphasis on green chemistry principles, where biocatalysis offers a more environmentally friendly approach compared to conventional chemical synthesis, reducing waste and energy consumption. The pharmaceutical industry's need for high-purity intermediates and active pharmaceutical ingredients (APIs) further fuels the adoption of these enzymes. However, the market faces restraints such as the high cost of enzyme production and the need for specialized expertise in enzyme immobilization and process optimization. Despite these challenges, the forecast period from 2025 to 2033 is expected to witness sustained growth, propelled by ongoing research and development efforts, strategic collaborations between enzyme manufacturers and pharmaceutical companies, and the expanding applications of recombinant carbonyl reductases in chemical manufacturing beyond pharmaceuticals, including fine chemicals and specialty ingredients.

This comprehensive report provides an in-depth analysis of the global Recombinant Carbonyl Reductase market, spanning the historical period of 2019-2024, a base year of 2025, and an estimated year of 2025, with projections extending through the forecast period of 2025-2033. The study leverages extensive data to offer critical market insights, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant industry developments, offering a complete understanding of this dynamic sector.

The Recombinant Carbonyl Reductase market is poised for significant expansion, driven by its burgeoning applications in critical industrial sectors. The global market is projected to witness a compound annual growth rate (CAGR) of [Insert CAGR]% from 2025 to 2033, reaching an estimated market valuation of [Insert Market Value] million USD by 2033. This growth trajectory is underpinned by the increasing demand for biocatalysis in various chemical transformations, where recombinant carbonyl reductases offer unparalleled selectivity, efficiency, and environmental benefits compared to traditional chemical catalysts. Pharmaceutical synthesis stands as a primary growth engine, with these enzymes playing a crucial role in the stereoselective reduction of carbonyl compounds to produce chiral alcohols, which are vital intermediates in the synthesis of numerous drugs. The development of novel therapeutics, particularly those with complex chiral structures, is directly fueling the need for highly efficient and specific biocatalysts like recombinant carbonyl reductases.

Beyond pharmaceuticals, the chemical manufacturing sector is also a significant contributor to market growth. The drive towards greener chemistry and sustainable manufacturing practices is leading industries to explore enzymatic routes for product synthesis. Recombinant carbonyl reductases enable cleaner production processes, reducing waste generation, energy consumption, and the use of hazardous chemicals. This aligns with global regulatory pressures and corporate sustainability initiatives, further accelerating their adoption. The "Others" segment, encompassing applications in food and beverage processing, fine chemical synthesis for flavors and fragrances, and even diagnostic assays, is also exhibiting steady growth, reflecting the versatility and expanding utility of these biocatalysts. The continuous innovation in enzyme engineering and optimization is leading to the development of reductases with enhanced stability, broader substrate specificity, and improved catalytic activity, thereby expanding their applicability and market penetration. Furthermore, advancements in recombinant DNA technology and large-scale fermentation processes are making these enzymes more accessible and cost-effective, paving the way for wider industrial adoption. The market is witnessing a trend towards the development of immobilized enzymes, which offer reusability and easier separation from reaction mixtures, further enhancing their industrial feasibility. The increasing focus on personalized medicine and the need for complex chiral molecules will continue to be a dominant factor in the market's evolution.

The Recombinant Carbonyl Reductase market's ascent is propelled by a confluence of powerful drivers. Foremost among these is the ever-increasing demand for enantiomerically pure chiral compounds, particularly within the pharmaceutical industry. The synthesis of many life-saving drugs necessitates precise stereochemical control, and recombinant carbonyl reductases excel in delivering this precision, offering highly selective reduction of carbonyl groups to produce desired chiral alcohols. This inherent specificity translates into higher yields, reduced by-product formation, and ultimately, more cost-effective drug manufacturing processes. The global push towards greener and more sustainable chemical processes is another significant catalyst. As industries worldwide strive to minimize their environmental footprint, enzymatic catalysis, with its mild reaction conditions, reduced energy consumption, and lower waste generation, emerges as a highly attractive alternative to traditional chemical synthesis. Recombinant carbonyl reductases are at the forefront of this green chemistry revolution, enabling cleaner production routes that align with stringent environmental regulations and growing consumer demand for eco-friendly products.

Furthermore, advancements in biotechnology and enzyme engineering are continuously expanding the capabilities and accessibility of recombinant carbonyl reductases. Innovations in genetic engineering, directed evolution, and high-throughput screening allow for the development of enzymes with enhanced activity, improved stability under harsh industrial conditions, broader substrate specificity, and tailored cofactor requirements. These improvements make recombinant carbonyl reductases applicable to a wider array of substrates and reaction conditions, thus broadening their market appeal. The growing R&D investments in novel drug discovery and development also indirectly fuels the demand for these biocatalysts. As researchers explore new therapeutic avenues requiring complex chiral molecules, the need for efficient and reliable synthetic tools, such as recombinant carbonyl reductases, intensifies. This symbiotic relationship between drug innovation and biocatalysis development ensures sustained market growth.

Despite the promising growth trajectory, the Recombinant Carbonyl Reductase market faces certain hurdles that can temper its expansion. A primary challenge lies in the cost of production and scalability for certain specialized enzymes. While advancements in recombinant technology have reduced costs, the production of highly tailored or rare carbonyl reductases can still be expensive, particularly for small-scale applications or initial research phases. This can limit their widespread adoption in price-sensitive industries or for niche chemical transformations. Furthermore, enzyme stability and activity under industrial process conditions remain a critical consideration. While many recombinant carbonyl reductases exhibit excellent performance in laboratory settings, their stability can be compromised by factors such as high temperatures, extreme pH values, or the presence of specific inhibitors in industrial reaction mixtures. Ensuring consistent and prolonged enzyme activity under these demanding conditions often requires significant process optimization, which can be time-consuming and resource-intensive.

Another restraint stems from the need for cofactor regeneration systems. Many carbonyl reductases require cofactors, such as NADPH or NADH, to function. The cost and efficiency of regenerating these cofactors on an industrial scale can be a significant factor influencing the overall economic viability of enzymatic processes. Developing robust and cost-effective cofactor regeneration systems is crucial for widespread adoption. Moreover, regulatory hurdles and the 'newness' factor can pose challenges in certain established industries. While biocatalysis is gaining acceptance, some sectors may be hesitant to adopt novel enzymatic processes due to the perceived risks associated with new technologies, the need for validation, and compliance with existing regulatory frameworks. This can slow down the integration of recombinant carbonyl reductases into established manufacturing pipelines. Finally, competition from established chemical synthesis methods remains a factor, particularly for well-understood and cost-effective chemical routes that do not require the high specificity offered by enzymes.

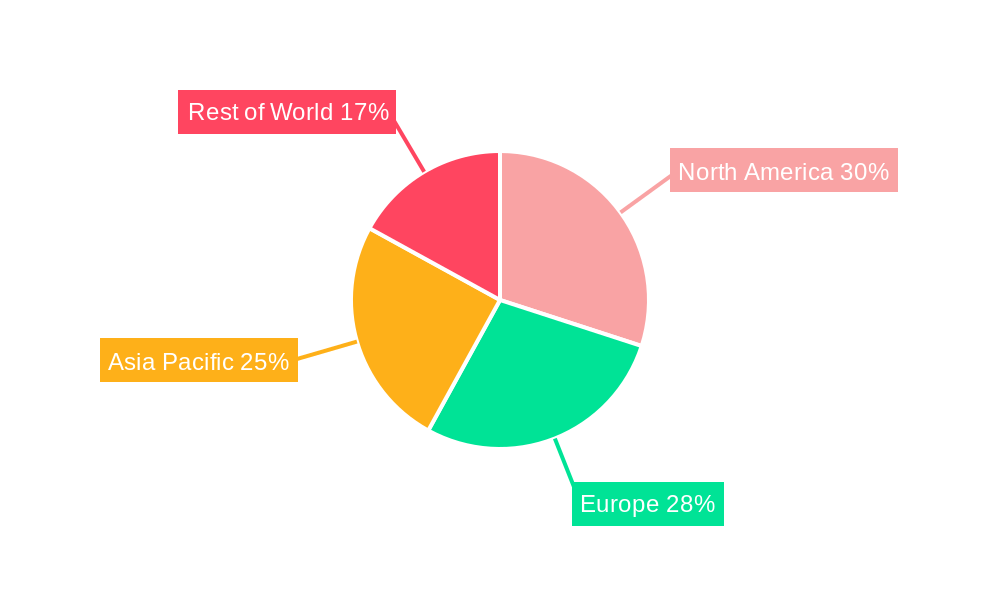

The global Recombinant Carbonyl Reductase market is characterized by distinct regional strengths and segment dominance, with significant contributions expected from North America, Europe, and Asia-Pacific.

Key Regions/Countries:

North America: This region, particularly the United States, is a powerhouse in Recombinant Carbonyl Reductase market dominance. Several factors contribute to this:

Europe: Europe, led by countries like Germany, Switzerland, and the United Kingdom, is another dominant force in the Recombinant Carbonyl Reductase market.

Asia-Pacific: This region, particularly China and Japan, is emerging as a rapidly growing market for Recombinant Carbonyl Reductases.

Dominant Segment:

Among the various segments, Pharmaceutical Synthesis is projected to dominate the Recombinant Carbonyl Reductase market. This dominance is driven by the following factors:

While Chemical Manufacturing and "Others" are important segments with significant growth potential, the sheer scale of pharmaceutical production, coupled with the absolute necessity for stereochemical control in drug synthesis, positions Pharmaceutical Synthesis as the leading segment in the Recombinant Carbonyl Reductase market. The demand from this sector is expected to represent a substantial portion of the global market revenue throughout the forecast period (2025-2033).

Several factors are acting as potent catalysts for the Recombinant Carbonyl Reductase industry's growth. The relentless pursuit of sustainable and environmentally friendly manufacturing processes is a primary driver, pushing industries away from hazardous chemical routes towards greener biocatalytic alternatives. Furthermore, significant investments in R&D for novel drug discovery and development continuously creates a demand for precise chiral intermediates, which recombinant carbonyl reductases are uniquely positioned to provide. Advancements in enzyme engineering and directed evolution are leading to the creation of more efficient, stable, and versatile reductases, expanding their applicability across diverse industrial processes. Finally, the increasing focus on personalized medicine and the synthesis of complex therapeutic molecules further amplifies the need for highly specific biocatalysts.

This report offers a thorough examination of the Recombinant Carbonyl Reductase market, delving into historical trends from 2019-2024 and providing expert projections for the period 2025-2033, with a focus on the estimated year of 2025. It meticulously analyzes the key drivers propelling market growth, including the escalating demand for chiral compounds in pharmaceuticals and the increasing adoption of green chemistry principles. Conversely, it also sheds light on the existing challenges and restraints that might impact market expansion, such as production costs and enzyme stability. The report provides an insightful overview of the dominant regions and segments, with a particular emphasis on the pivotal role of Pharmaceutical Synthesis. Furthermore, it highlights crucial growth catalysts and provides a comprehensive list of leading industry players and significant recent developments, ensuring readers have a complete understanding of this evolving market landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Prospec Bio, Abcam, RayBiotech, JUYOU, Abbexa, Cosmo Bio USA, American Research Products, Inc., Biomatik, Cloud-Clone Corp, Tebubio, Biocompare, Sino Biological, Fisher Scientific, Novatein Biosciences, Nordic Diagnostica AB.

The market segments include Type, Application.

The market size is estimated to be USD 36.4 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Recombinant Carbonyl Reductase," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Recombinant Carbonyl Reductase, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.