1. What is the projected Compound Annual Growth Rate (CAGR) of the Rear Projection Projectors?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Rear Projection Projectors

Rear Projection ProjectorsRear Projection Projectors by Type (LCD, LCOS, DLP, World Rear Projection Projectors Production ), by Application (Online Sales, Offline Sales, World Rear Projection Projectors Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

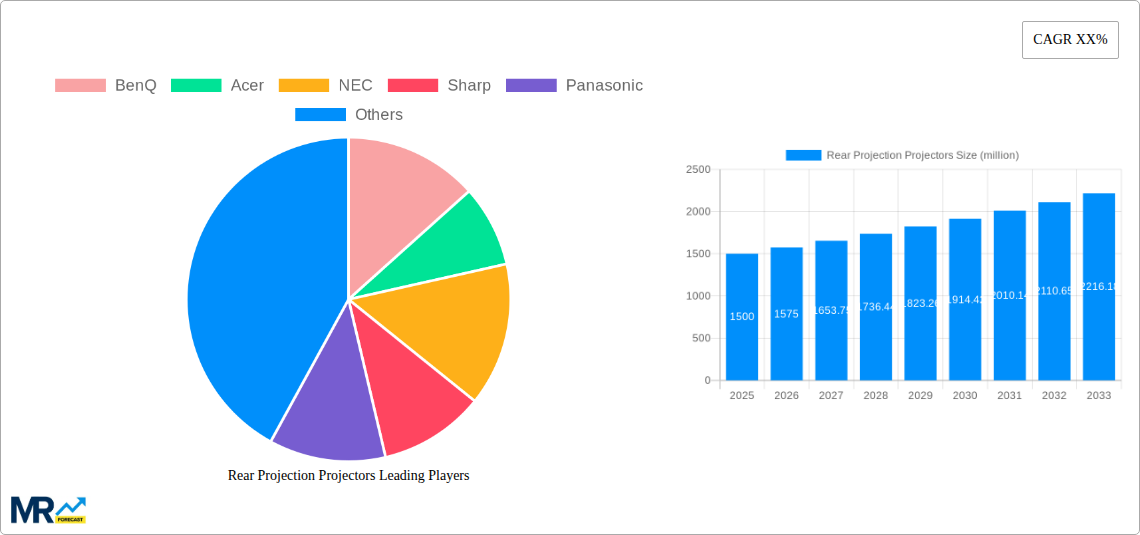

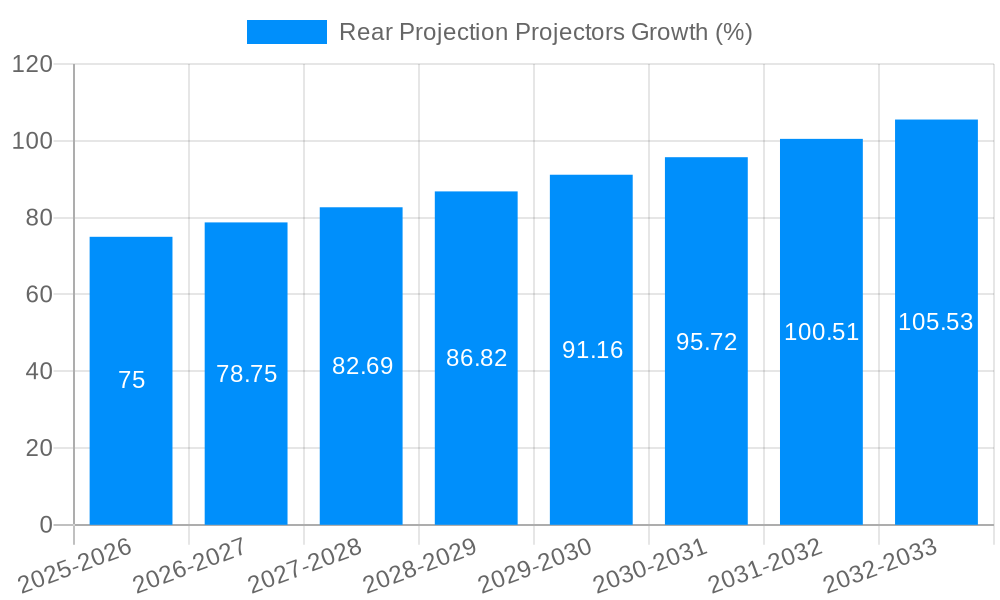

The rear projection projector market, while facing competition from newer display technologies, continues to hold a niche position, particularly in specific applications requiring large screen sizes and high brightness. The market, estimated at $1.5 billion in 2025, is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 5% from 2025 to 2033. This growth is driven by sustained demand from sectors like education, corporate presentations, and specialized entertainment venues where high-impact visuals are crucial. Trends such as the integration of advanced features like 4K resolution and improved lamp technology are enhancing the appeal of rear projection projectors, offsetting some of the pressure from flat-panel alternatives. However, restraints include the higher cost compared to flat-panel displays and the relatively bulky nature of the projectors themselves. Major players like BenQ, Epson, and Optoma are focusing on product innovation and targeted marketing to maintain their market share within this specialized segment. The market is segmented by resolution (ranging from standard definition to 4K), brightness levels, and screen size. Geographic distribution reflects a continued strength in developed markets such as North America and Europe, alongside emerging opportunities in regions experiencing economic growth and infrastructure development.

The forecast period (2025-2033) anticipates a gradual but steady increase in market value, driven by the aforementioned technological advancements and targeted applications. Despite the challenges, rear projection projectors maintain relevance in situations demanding high lumen output for large, bright images, especially where ambient light is a significant factor. The competitive landscape is characterized by intense innovation and strategic positioning by established players seeking to capture market share within this relatively smaller but persistent sector. Understanding the specific needs of target customer segments and continuous technological improvement will be pivotal for manufacturers seeking success in this market.

The rear projection projector market, while facing competition from newer display technologies, continues to hold a niche position, particularly in specific applications where its unique advantages shine. The global market, valued at approximately 2.5 million units in 2024, is projected to experience moderate growth during the forecast period (2025-2033), reaching an estimated 3.2 million units by 2033. This growth, however, is not uniform across all segments. The historical period (2019-2024) witnessed a decline in overall unit sales, primarily due to the increasing popularity of flat-panel displays and LED projectors for home and small office applications. However, the market has shown resilience, driven by continued demand in specific sectors such as large-venue installations, simulation centers, and high-end home theaters. These sectors value the unique benefits of rear projection, including the ability to create exceptionally large screens at a relatively lower cost per square inch compared to comparable flat-panel solutions. Furthermore, advancements in lamp technology and image processing have improved picture quality and reduced maintenance costs, making rear projection a more attractive option for certain applications. The continued refinement of technologies like DLP and LCD for rear projection, along with the exploration of laser-based illumination, suggests a more stable, albeit niche, future for this technology. The shift is noticeable from the predominance of lower-resolution models to a growing demand for higher-resolution units, catering to the requirements of professional and high-end applications. This trend is reflected in the pricing strategies of major players, who are increasingly focusing on providing high-quality, high-resolution options that justify the cost premium.

Several factors are contributing to the continued, albeit moderate, growth of the rear projection projector market. The most significant driver is the demand for large-screen displays in specialized applications. Large-venue installations like auditoriums, cinemas, and lecture halls often favor rear projection due to its cost-effectiveness in delivering images of impressive size. Similarly, simulation and training centers, where high-resolution images are critical, continue to rely on rear projection systems. In addition, advancements in projection technology itself are playing a role. Improvements in lamp life, brightness, and resolution are making rear projection systems more compelling, addressing some of the historical limitations of the technology. The ongoing development of laser-based light sources promises to further enhance brightness, color accuracy, and longevity, potentially expanding the appeal of rear projection to new applications. Finally, the emergence of innovative solutions incorporating rear projection technology within interactive displays for educational and corporate settings further contributes to its ongoing relevance in select market segments. These factors suggest a sustained, albeit limited, demand for rear projection systems in the foreseeable future.

Despite the niche advantages, rear projection projectors face several significant challenges that limit their overall market growth. The most prominent obstacle is the stiff competition from flat-panel displays, which have become increasingly affordable and offer superior image quality, especially in smaller screen sizes. The higher installation costs associated with large rear projection systems, including the necessary space and specialized installation expertise, often make it less attractive compared to the ease of deployment offered by flat panel alternatives. Furthermore, the bulkiness and relatively high power consumption of rear projection units remain drawbacks, especially in space-constrained environments. Technological advancements, although improving picture quality and longevity, have not fully addressed these core challenges. The maintenance requirements of lamp replacement and potential issues with the optical system add to the overall operational cost, creating a cost disadvantage against flat-panel displays. Finally, the perceived image quality issues associated with certain rear-projection technologies, including issues like screen door effect, also continue to hinder broader market penetration. These factors significantly impact the market’s growth potential.

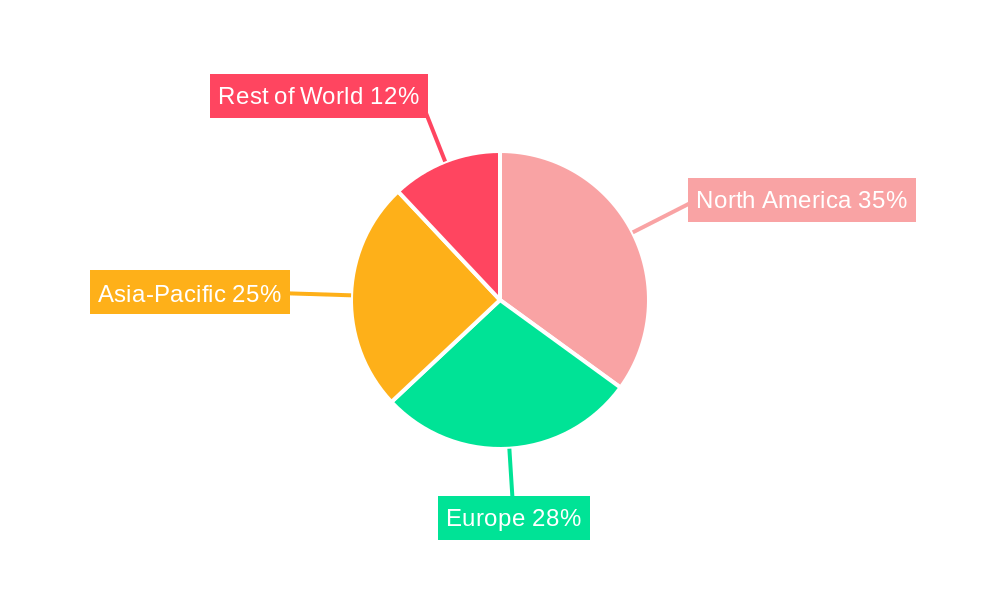

North America and Europe: These regions are expected to remain significant markets for rear projection projectors due to the presence of large-scale entertainment venues, educational institutions, and corporate training facilities requiring large-screen display solutions. High disposable incomes and a greater willingness to invest in high-end AV technologies further contribute to market growth within these geographies. However, the growth rate is expected to be relatively modest compared to other display technologies.

Asia-Pacific: While facing increased competition from flat-panel alternatives, the Asia-Pacific region presents a substantial growth opportunity, particularly in emerging economies with expanding entertainment and education sectors. The rising demand for large-scale public displays in commercial and public spaces provides a potential impetus for growth in the region.

High-Resolution Segment: The demand for high-resolution rear projection systems for professional applications like simulation, command centers, and high-end home theaters is a key driver. This segment is expected to experience faster growth compared to the overall market due to a willingness to pay a premium for superior image quality and performance in these specialized applications.

Large-Venue Installation Segment: This segment continues to be a cornerstone of the rear projection market. Large-format displays for auditoriums, conference halls, and similar venues remain a significant revenue stream for manufacturers. The cost-effectiveness of rear projection for very large displays remains its key selling point within this segment.

In summary, while the overall rear projection market faces challenges, segments focused on high-resolution and large-venue installations in developed and emerging economies offer the greatest potential for sustained growth in the coming years. However, this growth is predicted to be gradual rather than explosive, primarily constrained by the strong competition from alternative display technologies.

The continued improvement in light source technology, particularly the adoption of laser-based illumination, significantly boosts brightness, color accuracy, and lamp life, thus enhancing the overall value proposition of rear projection projectors. Additionally, innovative software solutions focused on enhancing image processing and improving overall user experience play a crucial role in attracting new customers and sustaining the market.

This report offers a comprehensive analysis of the rear projection projector market, encompassing historical data, current market conditions, and future projections. It provides a detailed examination of market trends, driving forces, challenges, and key players, allowing for informed strategic decision-making regarding this specialized sector of the display technology industry. The report also offers a granular segment breakdown to help identify the most promising opportunities for growth within the rear projection market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BenQ, Acer, NEC, Sharp, Panasonic, Epson, Lenovo, Sony, Digital Projection, Canon, Hitachi, InFocus, JVC, Optoma, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Rear Projection Projectors," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Rear Projection Projectors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.