1. What is the projected Compound Annual Growth Rate (CAGR) of the Rear Load Garbage Trucks?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Rear Load Garbage Trucks

Rear Load Garbage TrucksRear Load Garbage Trucks by Type (Below 5 Cubic Meter, 5-7 Cubic Meter, 7-10 Cubic Meter, Above 10 Cubic Meter), by Application (Urban Garbage Treatment, Building and Mining Industry, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

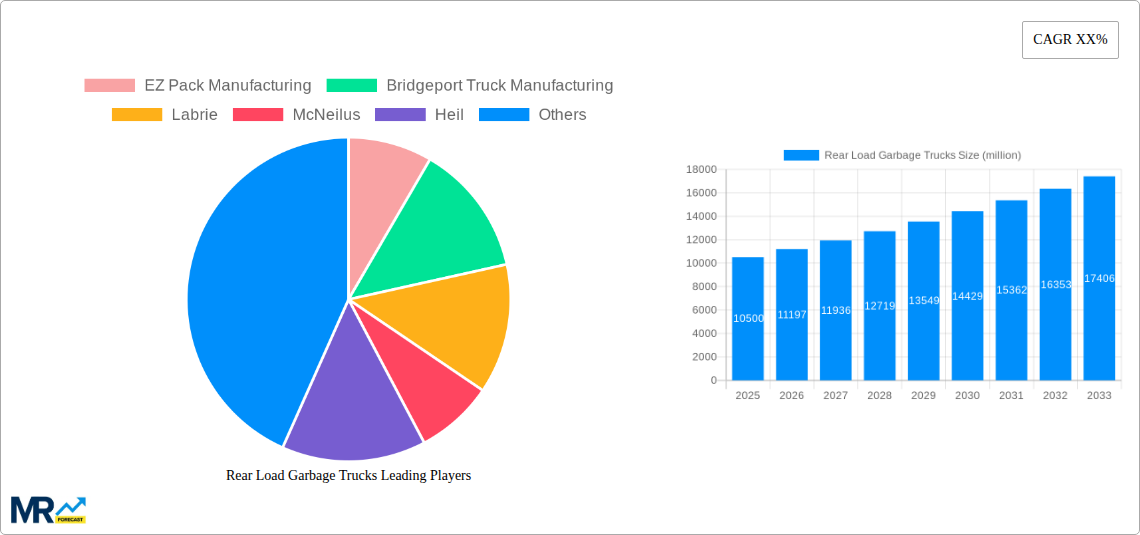

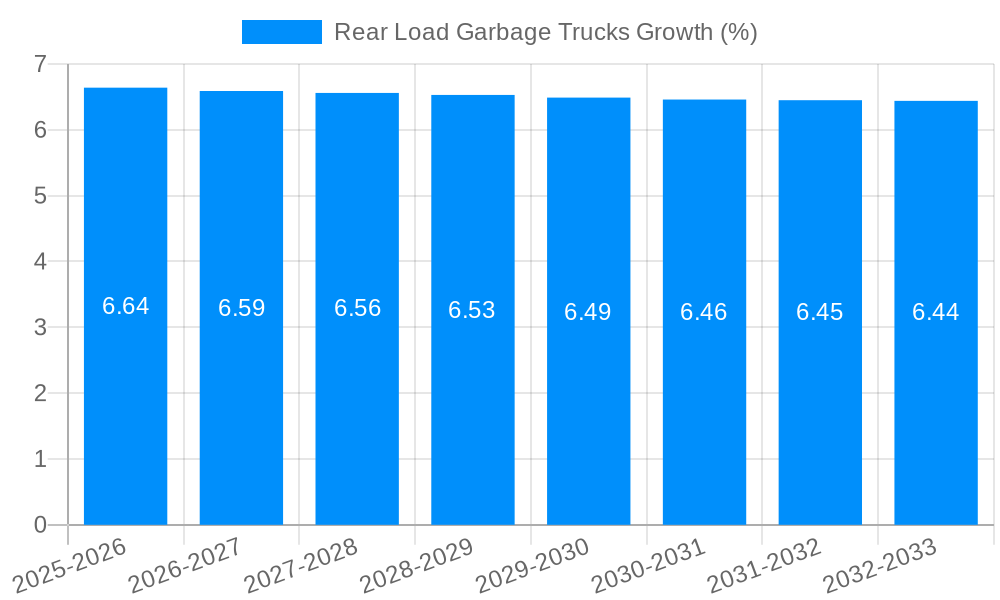

The global Rear Load Garbage Trucks market is poised for significant expansion, projected to reach an estimated market size of approximately USD 10,500 million by 2025, and is anticipated to grow at a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This robust growth is primarily fueled by escalating global waste generation, increasing urbanization, and a heightened focus on efficient waste management solutions by municipal bodies and private enterprises alike. The demand for Rear Load Garbage Trucks is particularly strong in urban areas grappling with the challenges of collecting and transporting residential and commercial waste. Advancements in truck technology, such as enhanced compaction ratios, improved fuel efficiency, and the integration of smart features for route optimization and operational monitoring, are also acting as key growth stimulants. Furthermore, government initiatives and stringent environmental regulations promoting cleaner waste disposal practices are compelling organizations to invest in modern and efficient garbage collection vehicles, further bolstering market momentum.

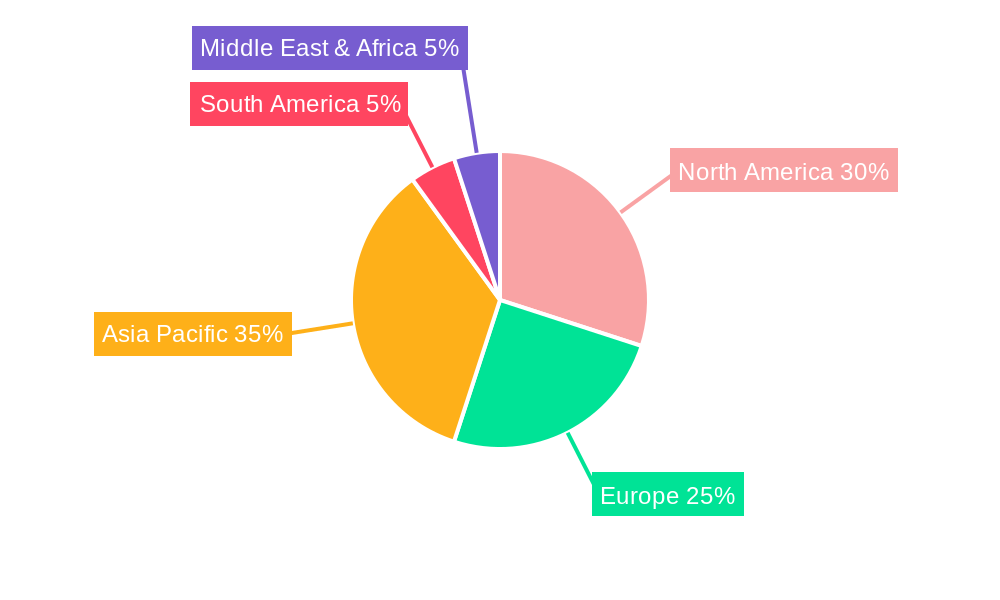

The market is segmented based on truck capacity, with the "Above 10 Cubic Meter" category likely holding a substantial market share due to the requirements of large-scale municipal waste collection. Similarly, the "Urban Garbage Treatment" application segment is expected to dominate, reflecting the concentrated need for these vehicles in densely populated areas. Geographically, the Asia Pacific region, driven by rapid industrialization and urbanization in countries like China and India, is expected to emerge as a significant growth engine, alongside well-established markets in North America and Europe. While the market benefits from strong demand drivers, it faces certain restraints, including high initial procurement costs for advanced models and the operational expenses associated with maintenance and fuel. However, the long-term benefits of improved efficiency, reduced environmental impact, and compliance with evolving waste management regulations are expected to outweigh these challenges, ensuring sustained market growth.

The global market for rear load garbage trucks is undergoing a significant transformation, driven by an escalating need for efficient waste management solutions and evolving regulatory landscapes. XXX, the market is projected to witness robust growth from USD 1.2 million in the base year 2025 to an estimated USD 1.8 million by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 4.5% during the forecast period 2025-2033. This expansion is underpinned by several key trends that are reshaping the industry. A prominent trend is the increasing adoption of technologically advanced features. Manufacturers are integrating sophisticated automation, GPS tracking, and data analytics into their vehicles to optimize collection routes, monitor fuel efficiency, and enhance operational safety. This push towards smart waste management not only improves efficiency but also contributes to a more sustainable approach to urban sanitation.

Furthermore, there is a discernible shift towards vehicles with higher compaction ratios, enabling them to carry larger volumes of waste per trip. This directly translates to reduced operational costs and fewer collection cycles, particularly beneficial for densely populated urban areas. The growing emphasis on environmental sustainability is also influencing product development, with a rising demand for rear load garbage trucks that are more fuel-efficient and emit lower levels of pollutants. This includes the exploration and integration of alternative fuel technologies, such as compressed natural gas (CNG) and electric powertrains, although these are still in nascent stages for widespread adoption in this segment. The historical period 2019-2024 saw steady growth, with market penetration accelerating in the latter years due to increased urbanization and a greater focus on public health and sanitation. The base year 2025 represents a pivotal point, with established players and emerging innovators poised to capitalize on the burgeoning opportunities.

The market is also witnessing consolidation and strategic partnerships as companies aim to expand their geographical reach and product portfolios. This competitive landscape is driving innovation and pushing the boundaries of what is possible in waste collection vehicle design. The study period, spanning 2019-2033, highlights a dynamic market trajectory, moving from incremental improvements to more transformative changes driven by technology and environmental consciousness. The integration of advanced safety features, such as proximity sensors and enhanced lighting systems, is also becoming a standard, reflecting the industry's commitment to worker safety and accident prevention. Overall, the rear load garbage truck market is on an upward trajectory, characterized by technological advancements, a growing demand for efficiency, and a commitment to environmental responsibility.

The growth of the rear load garbage truck market is fundamentally propelled by a confluence of powerful driving forces, with urban population growth and increasing waste generation standing at the forefront. As cities worldwide continue to expand, so does the volume of municipal solid waste, necessitating more efficient and robust waste collection infrastructure. Rear load garbage trucks, with their versatile designs and effective compaction capabilities, are essential components of this infrastructure, making them indispensable for maintaining urban hygiene and public health.

Furthermore, government initiatives and stringent environmental regulations are playing a crucial role. Many municipalities are implementing policies aimed at improving waste management practices, reducing landfill dependency, and promoting recycling. This often translates into increased investment in modern waste collection vehicles, including rear loaders, that can handle diverse waste streams and operate more sustainably. The growing awareness among citizens about the importance of clean environments and effective waste disposal also contributes to sustained demand. As public expectations rise, so does the pressure on local authorities to upgrade their services, leading to a continuous need for reliable and advanced garbage trucks.

The economic benefits associated with optimized waste collection routes and reduced operational costs are also significant drivers. Rear load trucks, when equipped with smart technologies, can significantly improve fuel efficiency and reduce the number of trips required, thereby lowering overall expenditure for waste management companies and municipalities. This cost-effectiveness makes them an attractive investment, especially in competitive markets. The ongoing development of more durable and fuel-efficient models by manufacturers further enhances their appeal, ensuring a consistent demand for these critical pieces of equipment in the waste management ecosystem.

Despite the promising growth trajectory, the rear load garbage truck market faces several significant challenges and restraints that could impede its full potential. One of the primary hurdles is the substantial capital investment required for acquiring these specialized vehicles. The advanced technology and robust construction necessitate a high upfront cost, which can be a deterrent for smaller waste management companies or municipalities with limited budgets. This financial barrier can slow down the adoption rate of newer, more efficient models.

Moreover, the maintenance and repair costs associated with complex rear load garbage trucks can be considerable. The intricate hydraulic systems, compaction mechanisms, and electronic components require specialized expertise and parts, leading to ongoing operational expenses. This can create a preference for older, simpler models, even if they are less efficient or environmentally friendly, especially in regions where skilled technicians are scarce or parts are difficult to source.

The evolving regulatory landscape, while a driver of growth, can also present challenges. As new environmental standards and safety regulations are introduced, manufacturers and operators must adapt their vehicles and practices accordingly. This often involves costly retrofits or the need for entirely new fleets, creating uncertainty and potential compliance issues. Furthermore, the availability of skilled labor to operate and maintain these technologically advanced vehicles can be a constraint in certain regions, limiting their widespread and efficient deployment. The operational disruptions caused by frequent upgrades or the unavailability of replacement parts can also impact service reliability.

The Urban Garbage Treatment application segment is poised to dominate the rear load garbage truck market, driven by the relentless pace of urbanization across the globe and the resultant exponential increase in domestic waste generation. As cities expand and population densities rise, the need for efficient, reliable, and high-capacity waste collection systems becomes paramount. Rear load garbage trucks are inherently suited for this purpose due to their compact footprint in relation to their carrying capacity, making them ideal for navigating congested urban streets and alleyways. The ability to effectively compact waste on-site also means fewer collection trips are required, a critical factor in optimizing logistics and minimizing operational costs in densely populated areas.

Within this application segment, the 7-10 Cubic Meter type segment is expected to witness substantial dominance. This particular size range offers a compelling balance between capacity and maneuverability, catering effectively to the diverse needs of urban waste collection. Trucks in this category are large enough to handle significant volumes of refuse from residential areas and smaller commercial establishments without being excessively cumbersome for urban driving. They represent a sweet spot for municipal sanitation departments and private waste haulers operating in varied urban environments, from dense downtown cores to sprawling suburban neighborhoods.

Key Regions or Countries Driving Dominance:

The interplay between the Urban Garbage Treatment application and the 7-10 Cubic Meter type segment, supported by the market dynamics in key regions, will undeniably solidify their dominant position in the global rear load garbage truck market throughout the study period 2019-2033.

Several key factors are acting as significant growth catalysts for the rear load garbage trucks industry. The relentless growth of global urbanization and the subsequent increase in waste generation are primary drivers. As more people congregate in cities, the volume of municipal solid waste escalates, necessitating the deployment of efficient collection vehicles. Furthermore, increasingly stringent environmental regulations worldwide are compelling municipalities and waste management companies to invest in modern, compliant, and sustainable waste disposal solutions, which often include advanced rear load trucks. The growing public awareness and demand for cleaner urban environments also contribute to sustained demand for efficient waste collection services.

The comprehensive coverage of the rear load garbage trucks report delves into the intricate details of market dynamics, offering a holistic view of its trajectory. It meticulously analyzes the market size and growth projections from 2019-2033, with a specific focus on the base year 2025 and the forecast period 2025-2033. The report provides in-depth insights into key market trends, such as the increasing adoption of technological advancements and the demand for higher compaction ratios, which are shaping product development. It also thoroughly examines the driving forces, including urbanization and regulatory mandates, alongside the challenges and restraints, such as high capital costs and maintenance expenses. Furthermore, the report identifies dominant segments and regions, offering a granular understanding of where the market is most robust. This comprehensive approach ensures stakeholders have the necessary information to make informed strategic decisions within this evolving industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include EZ Pack Manufacturing, Bridgeport Truck Manufacturing, Labrie, McNeilus, Heil, Fujian Longma Sanitation, Cnhtc, Curbtender, Pak-Mor, Haul-All Equipment, New Way, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Rear Load Garbage Trucks," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Rear Load Garbage Trucks, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.