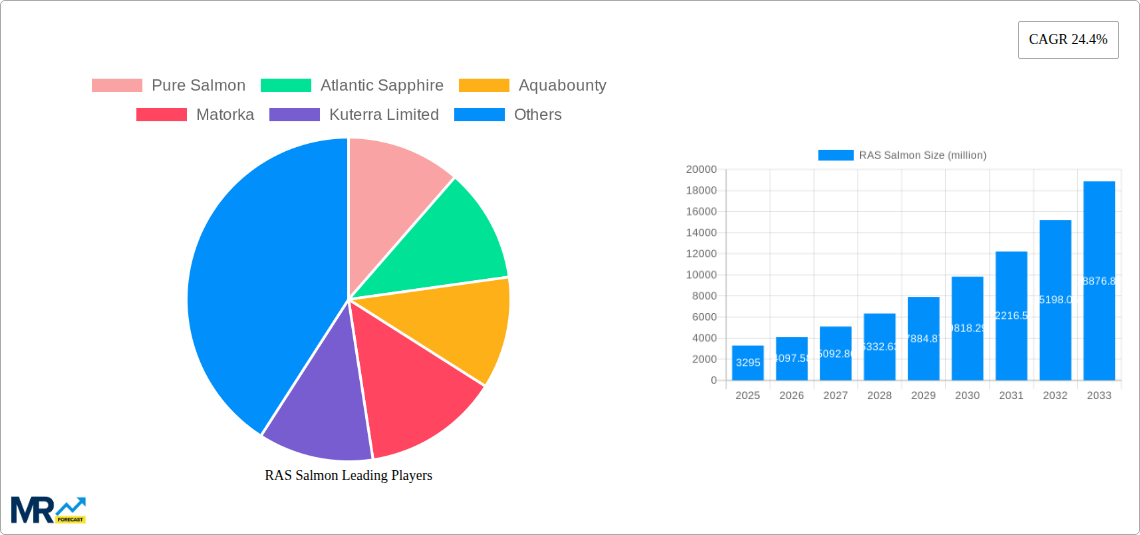

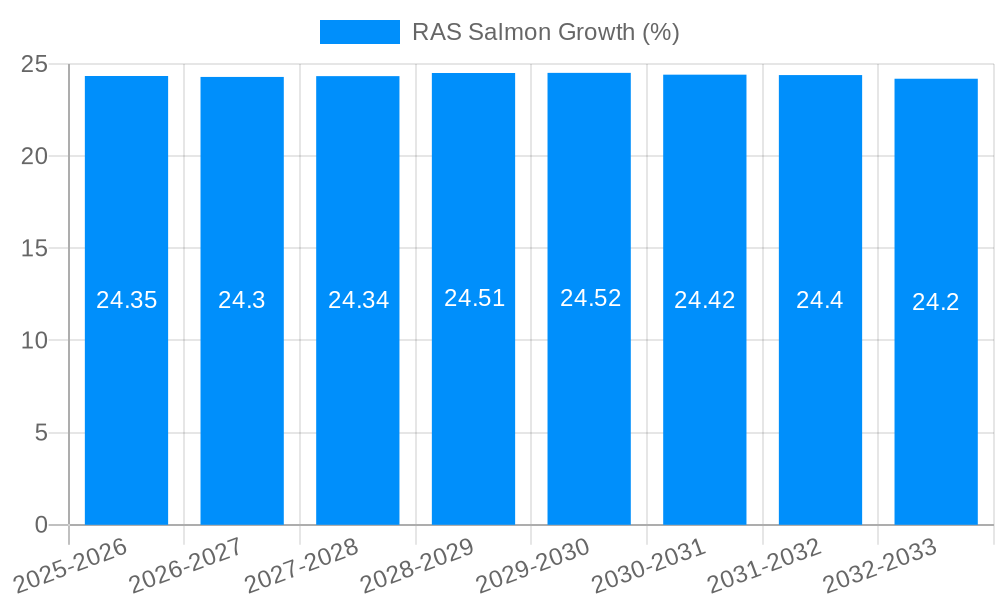

1. What is the projected Compound Annual Growth Rate (CAGR) of the RAS Salmon?

The projected CAGR is approximately 24.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

RAS Salmon

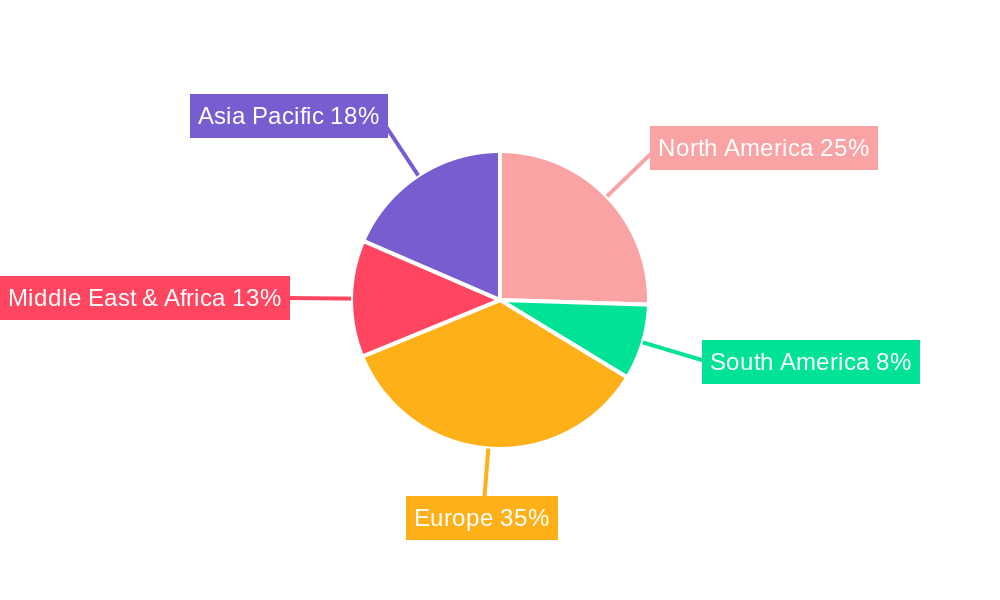

RAS SalmonRAS Salmon by Type (Atlantic Salmon, Others), by Application (Food Service Sector, Retail Sector), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Recirculating Aquaculture Systems (RAS) Salmon market is poised for explosive growth, projected to reach approximately \$3,295 million in value by 2025. This significant expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 24.4%, indicating a rapidly maturing industry. Key drivers fueling this upward trajectory include increasing global demand for sustainable and high-quality protein sources, coupled with the inherent advantages of RAS technology. These advantages encompass enhanced environmental control, reduced reliance on natural water bodies, minimized disease outbreaks, and a more predictable and consistent supply of salmon, irrespective of external climatic conditions. Furthermore, growing consumer awareness regarding the health benefits of omega-3 fatty acids found in salmon, alongside a rising middle class in emerging economies with greater disposable income for premium food products, are powerful market catalysts. The sector's ability to offer fresher, locally sourced salmon with a reduced carbon footprint compared to traditional ocean farming further strengthens its appeal.

The market is segmented primarily by type, with Atlantic Salmon leading the charge due to its established consumer preference and high market penetration. The "Others" segment, encompassing other salmonid species cultivated in RAS, is also expected to witness considerable growth as technological advancements allow for the efficient farming of a wider variety of fish. On the application front, both the Food Service Sector and the Retail Sector are crucial demand centers. Restaurants and hotels are increasingly incorporating RAS-farmed salmon into their menus to meet consumer expectations for premium, sustainable seafood, while retailers are capitalizing on the growing consumer desire for fresh, traceable, and responsibly produced fish. Despite the immense growth potential, potential restraints such as high initial capital investment for RAS infrastructure, the need for skilled labor, and evolving regulatory landscapes could pose challenges. However, ongoing technological innovations, economies of scale, and supportive government initiatives are expected to mitigate these restraints, paving the way for sustained market dominance.

Here's a unique report description for RAS Salmon, incorporating your specified elements:

The recirculating aquaculture system (RAS) salmon market is experiencing a profound and transformative shift, moving from a nascent concept to a significant force in global seafood production. XXX [mention key market insights here – e.g., projected market value in millions, expected CAGR]. The study period, spanning from 2019 to 2033, with a base year of 2025, underscores the rapid evolution of this sector. During the historical period (2019-2024), we witnessed the foundational investments and initial scaling efforts, often characterized by ambitious pilot projects and early-stage commercial ventures. The estimated year of 2025 marks a pivotal point where the industry is poised for accelerated growth, moving beyond experimental phases and demonstrating increasing economic viability. The forecast period (2025-2033) anticipates a substantial surge in production capacity and market penetration, driven by technological advancements, increasing consumer demand for sustainable seafood, and a growing recognition of the benefits of land-based aquaculture.

Current trends indicate a strong preference for Atlantic Salmon within the RAS segment, accounting for a significant portion of production due to its established market presence and consumer familiarity. However, diversification into other species is gradually emerging, albeit at a slower pace. The application sector is bifurcating, with the Retail Sector showing robust growth as consumers increasingly seek traceable and locally sourced protein options. Simultaneously, the Food Service Sector is also demonstrating considerable uptake, driven by restaurants and catering services looking to secure a consistent and high-quality supply of salmon, irrespective of traditional oceanic constraints. The industry is also characterized by a move towards larger-scale, more efficient facilities, with significant capital being injected into optimizing water treatment, feed management, and disease control. Furthermore, there's a growing emphasis on minimizing the environmental footprint of aquaculture, with RAS technology offering a compelling solution to issues like effluent discharge and seabed impact associated with traditional net-pen farming. The increasing integration of AI and automation in RAS operations is also a notable trend, promising enhanced efficiency and predictive maintenance. Market participants are actively exploring novel feed ingredients and genetics to improve growth rates and fish health, further solidifying the long-term prospects of RAS salmon. The global adoption of stringent environmental regulations is also a silent but powerful trend, pushing the industry towards more controlled and sustainable production methods, of which RAS is a prime example.

The escalating global demand for seafood, coupled with increasing concerns over the sustainability and environmental impact of traditional ocean-based salmon farming, is a primary catalyst for the growth of the Recirculating Aquaculture System (RAS) salmon market. As wild fish stocks face depletion and conventional aquaculture grapples with issues like sea lice infestations, disease outbreaks, and pollution, RAS presents a compelling alternative. This land-based, controlled environment offers significant advantages, including reduced environmental footprint, minimal disease transmission risks, and enhanced biosecurity. Furthermore, the ability of RAS to operate in diverse geographical locations, irrespective of access to pristine marine environments, opens up new production frontiers and reduces logistical complexities. Technological advancements in water treatment, oxygenation, filtration, and feed optimization have made RAS systems more efficient and cost-effective, attracting substantial investment. The growing consumer awareness regarding the origin, quality, and sustainability of their food is also a significant driver, with RAS salmon often marketed as a premium, eco-friendly, and traceable product. Government support and initiatives promoting sustainable aquaculture practices further bolster the market's expansion. The increasing maturity of the technology, evidenced by larger-scale operational farms and improved yields, is building confidence among investors and consumers alike, solidifying the role of RAS in meeting future seafood needs.

Despite its promising trajectory, the RAS salmon market faces several significant challenges that temper its growth. The substantial initial capital investment required to establish state-of-the-art RAS facilities remains a considerable barrier for many potential investors. The complex operational requirements, demanding expertise in areas like water quality management, disease prevention, and energy consumption, can also be a deterrent. Energy consumption, particularly for pumping and maintaining water quality, represents a significant ongoing operational cost, making it crucial for facilities to integrate renewable energy sources or optimize their energy efficiency. Disease outbreaks, though less prevalent and easier to contain in RAS compared to open-net pens, can still be devastating if biosecurity protocols are not rigorously maintained, leading to significant financial losses. The market also grapples with a perception gap, with some consumers still associating salmon primarily with ocean farming, requiring concerted marketing efforts to educate and build trust in RAS-produced fish. Regulatory hurdles and permitting processes can also be lengthy and complex, delaying project timelines. Furthermore, the availability of skilled labor proficient in RAS operations is a growing concern as the industry scales up. Finally, fluctuations in feed costs and the development of sustainable and cost-effective feed alternatives remain critical factors influencing the overall profitability and competitiveness of RAS salmon production.

The RAS salmon market is poised for significant dominance by a combination of key regions and specific market segments, driven by unique economic, environmental, and consumer-driven factors.

Key Dominating Regions:

North America (specifically Canada and the United States): These regions are emerging as significant players due to a strong existing seafood culture, high consumer demand for premium protein, and a growing emphasis on sustainable food production. The extensive coastlines and inland water bodies offer ample opportunities for land-based aquaculture. The presence of advanced technological infrastructure and a conducive regulatory environment in certain states and provinces is also a major advantage. For instance, the proximity to large consumer markets in the US and the established fishing heritage in Canada create a fertile ground for RAS salmon to thrive. The increasing awareness of the environmental impact of traditional aquaculture methods is pushing consumers and regulators towards more controlled and sustainable alternatives, which RAS perfectly embodies. Investments from both domestic and international entities are further accelerating the development of RAS facilities in these countries, aiming to reduce reliance on imported seafood and enhance domestic supply chain resilience.

Europe (particularly Norway, Denmark, and Scotland): While Norway is a traditional powerhouse in salmon farming, its adoption of RAS is becoming increasingly important for mitigating the environmental challenges associated with its vast open-pen operations. Denmark and Scotland are also witnessing significant growth in RAS development, driven by stringent environmental regulations and a proactive approach to sustainable aquaculture. These countries possess a deep understanding of salmon farming best practices and are leveraging this expertise to implement advanced RAS technologies. The European Union's commitment to the "Farm to Fork" strategy, which emphasizes sustainable food systems, further supports the growth of RAS in the region. The focus on reducing carbon footprints and minimizing waste aligns perfectly with the inherent benefits of RAS technology.

Asia-Pacific (especially China and Japan): With their massive populations and burgeoning middle class, the demand for high-quality protein, including salmon, is immense. While these regions have historically relied on imports, the development of domestic RAS capabilities is becoming a strategic imperative for food security and self-sufficiency. China, in particular, is making significant investments in land-based aquaculture technologies, including RAS, to meet its growing demand and address environmental concerns associated with its extensive aquaculture sector. Japan, with its strong culinary tradition and appreciation for high-quality seafood, is also exploring RAS for consistent and traceable salmon supply.

Key Dominating Segments:

Type: Atlantic Salmon: Unquestionably, Atlantic Salmon is the dominant type within the RAS sector. This is due to several intertwined factors that make it the species of choice for early-stage and large-scale RAS adoption.

Application: Retail Sector: The Retail Sector is emerging as a dominant application for RAS salmon.

The RAS salmon industry is propelled by several key growth catalysts. Technological advancements in water filtration, oxygenation, and waste management are significantly improving system efficiency and reducing operational costs. Growing consumer demand for sustainable and traceable seafood, coupled with increasing environmental concerns surrounding traditional aquaculture, creates a strong market pull for RAS salmon. Furthermore, the development of advanced genetic strains and optimized feed formulations contribute to faster growth rates and improved fish health, enhancing profitability. Strategic investments and government support for sustainable aquaculture also play a crucial role in accelerating market expansion.

This comprehensive report delves into the intricacies of the RAS salmon market, offering detailed analysis and projections. It meticulously examines market trends, growth drivers, and the challenges hindering widespread adoption. The report highlights key regions and countries poised for market dominance, alongside the specific segments—such as Atlantic Salmon and the Retail Sector—that will lead the charge. We explore the critical growth catalysts, including technological advancements and increasing consumer demand for sustainability, that are shaping the future of this industry. Furthermore, the report provides an in-depth overview of the leading players and their strategic initiatives, alongside a timeline of significant developments that have impacted the RAS salmon sector. This report serves as an indispensable resource for stakeholders seeking to understand and capitalize on the evolving RAS salmon landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.4% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 24.4%.

Key companies in the market include Pure Salmon, Atlantic Sapphire, Aquabounty, Matorka, Kuterra Limited, Danish Salmon, Superior Fresh, Samherji fiskeldi ltd, Nordic Aquafarms, Swiss Lachs, Sustainable Blue, Cape d'Or, Andfjord Salmon, Shandong Ocean Oriental Sci-Tech, Jurassic Salmon, Cape Nordic Corporation, Fish Farm UAE, West Creek Aquaculture.

The market segments include Type, Application.

The market size is estimated to be USD 3295 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "RAS Salmon," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the RAS Salmon, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.