1. What is the projected Compound Annual Growth Rate (CAGR) of the Rare Gases?

The projected CAGR is approximately 6.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Rare Gases

Rare GasesRare Gases by Type (Helium, Neon, Argon, Krypton, Xenon), by Application (Large Industries, Electronics, Healthcare, Aerospace, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

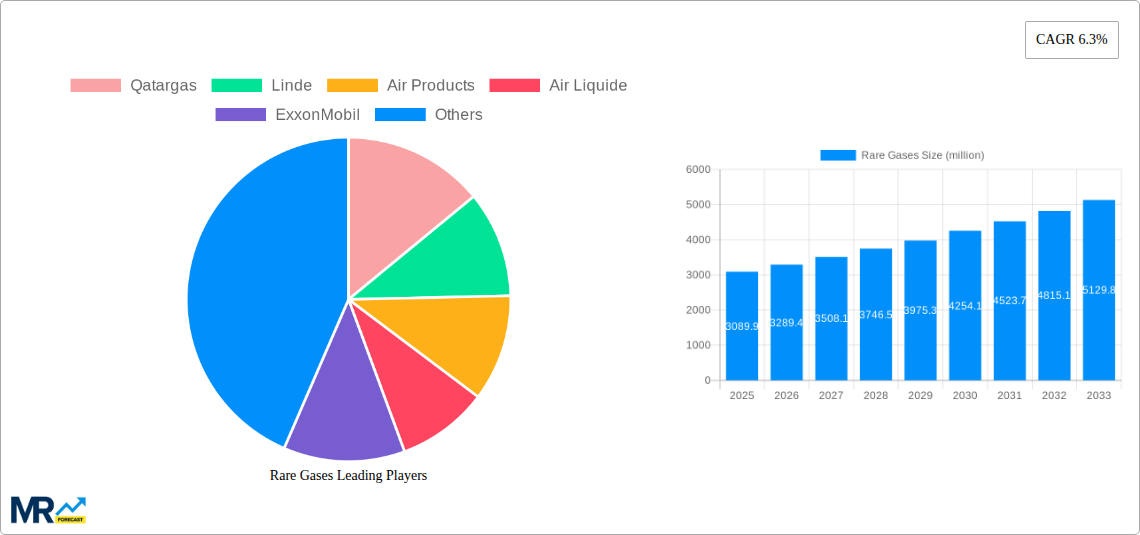

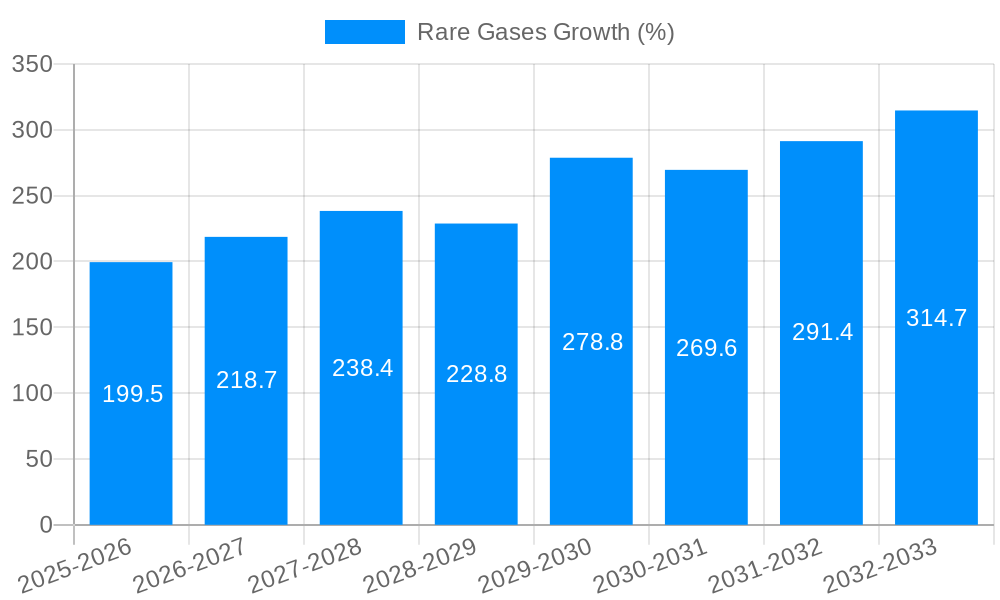

The global rare gases market is poised for significant expansion, projected to reach a substantial size with a robust Compound Annual Growth Rate (CAGR) of 6.3%. This upward trajectory, estimated to culminate in a market value of $3089.9 million by 2025, is fueled by a confluence of dynamic drivers and evolving industrial demands. The increasing adoption of rare gases across diverse applications, from sophisticated electronics manufacturing and advanced healthcare technologies to critical aerospace components and burgeoning large-scale industries, underscores their indispensable nature. Furthermore, ongoing technological innovations and the development of novel applications for these inert gases are continually broadening their market reach. The inherent properties of rare gases, such as their high purity, inertness, and unique luminescence, make them vital in processes requiring precise control and exceptional performance. This sustained demand, coupled with strategic investments in production capacities and research and development by leading global players like Linde, Air Products, and Air Liquide, will collectively propel the market forward through the forecast period.

While the market exhibits strong growth potential, certain factors may influence its pace. The capital-intensive nature of rare gas extraction and purification processes, along with the need for stringent safety protocols, can present initial investment hurdles. Additionally, fluctuations in energy prices, which impact production costs, and the geographical concentration of certain rare gas sources could pose localized challenges. However, the overarching trend points towards increasing demand driven by sectors at the forefront of technological advancement. For instance, the burgeoning semiconductor industry's reliance on specific rare gases for etching and deposition processes, alongside their critical role in advanced medical imaging and laser technologies, will continue to be significant growth engines. The market's segmentation by type, including Helium, Neon, Argon, Krypton, and Xenon, further highlights the specialized and high-value applications of each gas, contributing to the overall market’s resilience and growth prospects.

This comprehensive report delves into the dynamic global Rare Gases market, offering an in-depth analysis of trends, driving forces, challenges, and future growth trajectories. Spanning a Study Period of 2019-2033, the report leverages data from the Historical Period (2019-2024), utilizes the Base Year (2025) for crucial benchmarks, and provides robust projections through the Forecast Period (2025-2033), with the Estimated Year also set at 2025. Our analysis encompasses all major rare gases, including Helium, Neon, Argon, Krypton, and Xenon, and explores their critical applications across Large Industries, Electronics, Healthcare, Aerospace, and Others. The report also highlights key industry developments and identifies the leading market players and their strategic initiatives.

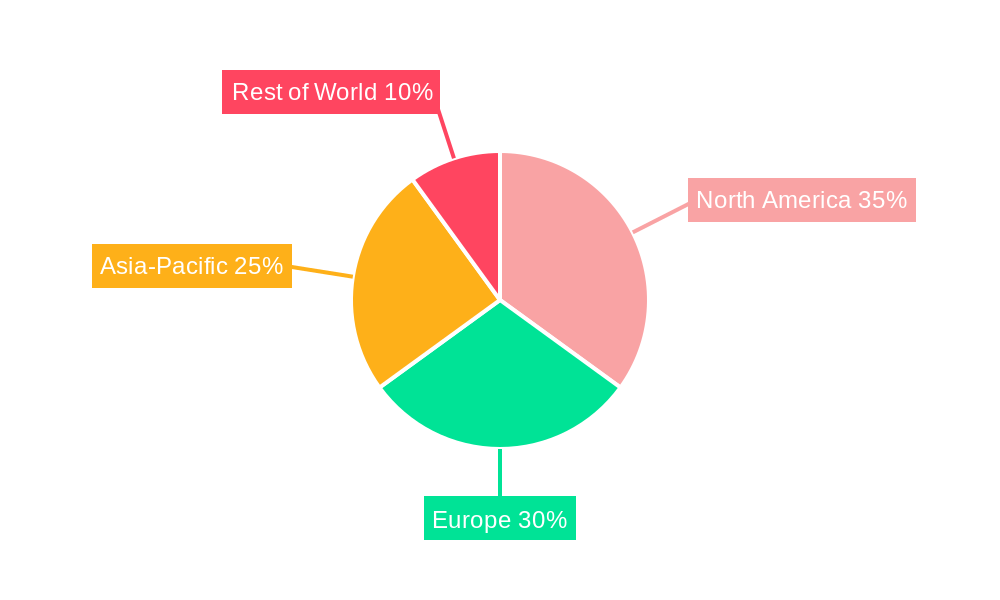

The global Rare Gases market is poised for significant expansion, driven by an intricate interplay of technological advancements and evolving industrial demands. XXX The market is projected to witness a Compound Annual Growth Rate (CAGR) of over 7% during the forecast period, with the market size expected to reach an impressive value exceeding $15,000 million by 2033. This robust growth is underpinned by several key trends. Firstly, the increasing demand for high-purity gases in the semiconductor industry, particularly for advanced lithography and specialized etching processes, is a primary growth engine. Neon, for instance, is indispensable for Excimer lasers used in deep ultraviolet (DUV) lithography, a critical step in manufacturing sophisticated microchips. Argon continues to be a workhorse gas, widely adopted in welding, metal inert gas (MIG) welding, and gas tungsten arc welding (GTAW) processes, essential for large industries like automotive and construction, where its use is projected to increase by approximately 5 million units annually. Helium’s unique properties, including its extremely low boiling point and inertness, continue to fuel its demand in MRI machines (Healthcare segment), superconducting magnets, and even as a lifting gas in balloons and airships (Aerospace and Others segments), with projections indicating a steady rise in its application volume. Krypton and Xenon, though more niche, are experiencing growing demand in specialized lighting applications, such as energy-efficient lighting and high-intensity discharge (HID) lamps, as well as in ion propulsion systems for spacecraft (Aerospace segment), hinting at a potential market value increase of $500 million for these two gases alone by 2033. Furthermore, the expanding applications of rare gases in advanced materials research, medical imaging, and even in the food and beverage industry (e.g., for modified atmosphere packaging) are contributing to market diversification and growth. The increasing emphasis on sustainable practices and energy efficiency across various industries is also indirectly boosting the demand for rare gases in energy-saving lighting technologies and in processes that reduce environmental impact. The geographical distribution of production and consumption is also a key trend, with Asia-Pacific emerging as a dominant region due to its burgeoning electronics manufacturing sector and significant industrial output.

Several potent driving forces are propelling the global Rare Gases market towards sustained growth. The most significant of these is the relentless innovation and expansion within the semiconductor industry. The ever-increasing complexity and miniaturization of microchips necessitate the use of ultra-high purity gases, including Neon, Krypton, and Xenon, for critical manufacturing steps like photolithography and plasma etching. As demand for advanced electronics, 5G technology, and artificial intelligence hardware escalates, so too does the reliance on these specialized gases. For instance, the demand for Neon in semiconductor manufacturing alone is expected to grow by over 10 million units annually by 2033. Secondly, the burgeoning healthcare sector, driven by an aging global population and advancements in medical imaging and treatment, is a consistent demand generator for Helium. Its critical role in MRI machines, powering superconducting magnets, ensures a stable and growing market for this gas. The number of MRI procedures globally is estimated to increase by over 8% year-on-year, directly impacting Helium consumption. Thirdly, the aerospace industry's pursuit of lighter, more efficient propulsion systems and advanced materials is creating new avenues for Krypton and Xenon, particularly in ion thrusters. The development of next-generation satellites and space exploration initiatives will further amplify this demand. Moreover, the increasing adoption of energy-efficient lighting solutions, such as LED and HID lamps, which often incorporate Krypton and Xenon, is contributing to market expansion, especially in regions with stringent energy efficiency regulations. The global focus on industrial modernization and automation, particularly in emerging economies, is also boosting the demand for Argon in welding and other industrial processes, projected to see an uptick of nearly 7 million units in large industrial applications by 2033.

Despite the promising growth prospects, the Rare Gases market faces several significant challenges and restraints that could temper its expansion. A primary concern is the concentration of production. Helium, in particular, is primarily sourced from a few natural gas fields globally, making its supply inherently vulnerable to geopolitical factors, extraction costs, and the operational status of these limited reserves. Any disruption in these key production areas can lead to price volatility and supply shortages, impacting downstream industries. For example, a temporary shutdown of a major Helium production facility in the US could lead to a price surge of over 20% for the commodity. The high cost of extraction and purification for all rare gases is another considerable restraint. Separating these gases from atmospheric air or natural gas requires complex and energy-intensive processes, contributing to their premium pricing and limiting their use in cost-sensitive applications. The energy expenditure for extracting a single cubic meter of Xenon can be substantial, influencing its application in mass-market products. Furthermore, regulatory hurdles and environmental concerns associated with the extraction and handling of certain rare gases, particularly their potential impact on groundwater and air quality, can lead to stricter regulations and increased compliance costs for producers. The fluctuating demand from key end-use industries also poses a challenge. For instance, a slowdown in the semiconductor manufacturing cycle or a decline in large-scale industrial projects can directly impact the demand for Argon, Neon, and Krypton. The reliance of the Helium market on the LNG (Liquefied Natural Gas) industry also presents a unique challenge; a downturn in LNG production can inadvertently affect Helium supply. Lastly, the development of alternative technologies in certain sectors, though currently limited, could gradually erode the market share of specific rare gases, necessitating continuous innovation and diversification by market players.

The global Rare Gases market is characterized by the significant dominance of specific regions and segments, driven by technological advancement, industrial output, and resource availability.

Dominant Region/Country:

Dominant Segment (Application):

Dominant Segment (Type):

Emerging Trends in Dominant Segments:

The dominance of these segments is not static. We are observing a trend towards increased demand for higher purity grades of all rare gases, driven by the need for greater precision and reliability in advanced manufacturing and scientific research. Furthermore, the development of novel applications in areas like specialized medical treatments (e.g., Argon in laser surgery) and scientific instrumentation will continue to diversify the demand landscape. The convergence of industries, where advancements in one sector (e.g., medical imaging) influence the demand in another (e.g., Helium production), is also a significant evolving trend.

The Rare Gases industry is primed for growth, spurred by several key catalysts. The relentless pursuit of smaller, faster, and more efficient microchips by the semiconductor industry is a primary driver, demanding high-purity Neon and Krypton for advanced lithography. The healthcare sector's expanding reliance on MRI technology for diagnostics ensures consistent demand for Helium. Furthermore, advancements in aerospace, particularly in satellite propulsion systems utilizing Xenon and Krypton, are opening new markets. The global push towards energy-efficient lighting solutions also contributes to the demand for Krypton and Xenon.

This report offers a holistic perspective on the Rare Gases market, providing granular insights into market size, growth rates, and key drivers across various segments. It meticulously analyzes the influence of technological advancements in electronics and healthcare, alongside the impact of industrial expansion in large industries. The report also scrutinizes the supply chain dynamics, geopolitical factors, and extraction costs that shape the market, offering a balanced view of both opportunities and challenges. Furthermore, it identifies emerging trends and potential growth catalysts, empowering stakeholders with actionable intelligence to navigate this complex and vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.3% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.3%.

Key companies in the market include Qatargas, Linde, Air Products, Air Liquide, ExxonMobil, Ingas, Cryoin Engineering, Huate Gas, Messer Group, Yingde Gases Group, BASF, Nippon Shokubai, Chromium, Air Water, PGnig, Coregas (Wesfarmers), .

The market segments include Type, Application.

The market size is estimated to be USD 3089.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Rare Gases," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Rare Gases, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.