1. What is the projected Compound Annual Growth Rate (CAGR) of the Radiation Hardened Analog ICs?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Radiation Hardened Analog ICs

Radiation Hardened Analog ICsRadiation Hardened Analog ICs by Type (Power Management, Signal Chain, World Radiation Hardened Analog ICs Production ), by Application (Aerospace, Defense and Military, Nuclear, Others, World Radiation Hardened Analog ICs Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

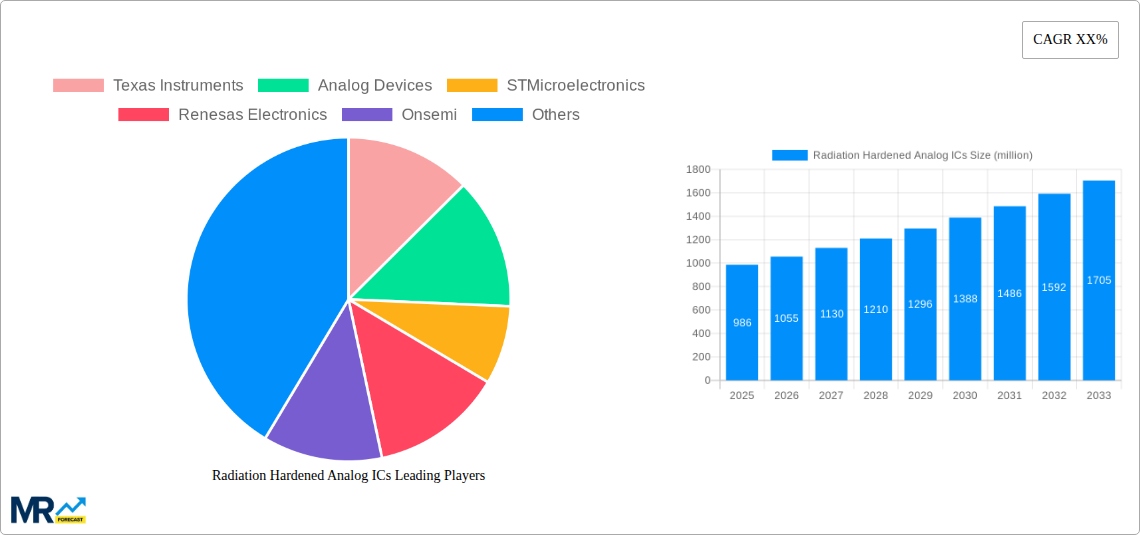

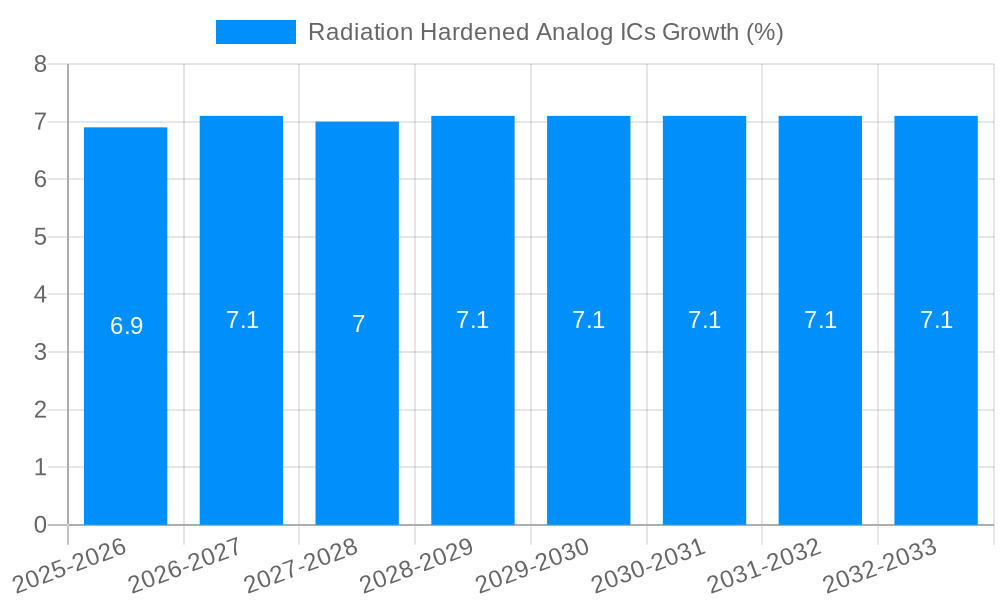

The global market for Radiation Hardened Analog ICs is poised for significant expansion, projected to reach approximately \$986 million in 2025. Driven by escalating demand from the defense and aerospace sectors, coupled with the growing complexities in space exploration and nuclear applications, the market is expected to witness a robust Compound Annual Growth Rate (CAGR) of around 7-9% over the forecast period. This upward trajectory is fueled by the increasing need for reliable electronic components that can withstand harsh radiation environments. Key applications like satellite communication, missile systems, and next-generation aircraft rely heavily on these specialized ICs to ensure operational integrity and mission success. The continuous advancements in semiconductor technology, coupled with stringent reliability requirements in critical applications, are further bolstering market growth.

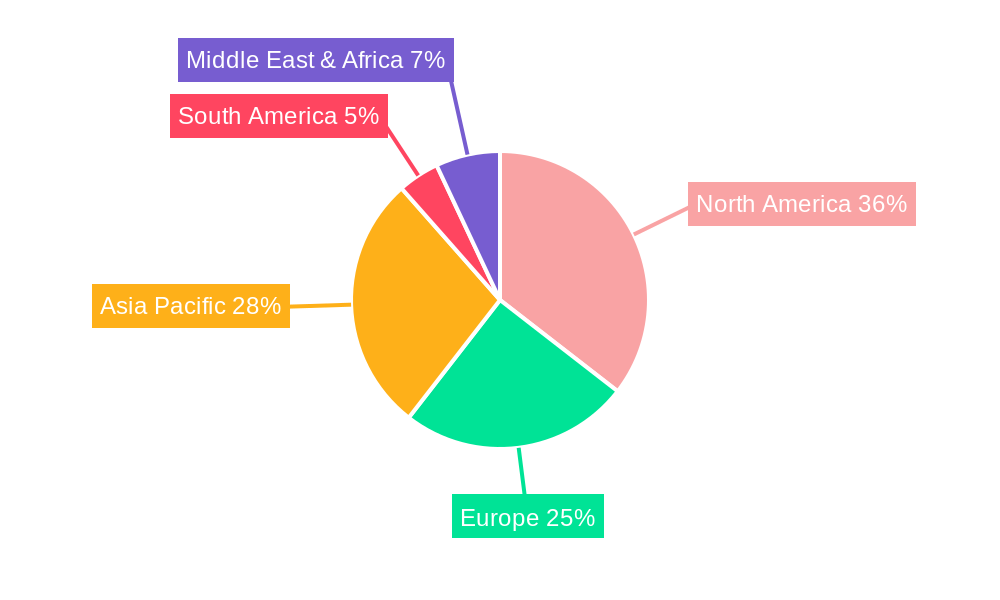

The market is segmented into Power Management and Signal Chain ICs, with both categories experiencing substantial demand. The Power Management segment is crucial for maintaining stable power supply in radiation-intensive environments, while Signal Chain ICs are vital for accurate data acquisition and processing. Geographically, North America and Asia Pacific are anticipated to lead the market due to significant investments in space exploration and defense programs in regions like the United States and China. Europe also represents a substantial market, driven by its established aerospace and defense industries. While the market presents immense opportunities, potential restraints include the high cost of development and manufacturing of these specialized components, as well as the relatively niche market size compared to mainstream analog ICs. However, the increasing sophistication of modern weaponry and the expanding satellite constellations are expected to outweigh these challenges, ensuring sustained market growth.

The global market for Radiation-Hardened (Rad-Hard) Analog Integrated Circuits (ICs) is experiencing robust and sustained growth, driven by an escalating demand for high-reliability electronic components in environments characterized by extreme radiation levels. The study period, spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, highlights a significant upward trajectory. The estimated market size for radiation-hardened analog ICs is projected to reach several hundred million units by the end of the forecast period, reflecting the critical nature of these specialized components. The historical period of 2019-2024 has laid a strong foundation, witnessing consistent adoption in key sectors, and the trend is expected to accelerate. Innovation in semiconductor manufacturing processes, coupled with advancements in material science, is enabling the production of more sophisticated and cost-effective Rad-Hard analog ICs. These components are no longer confined to niche applications but are increasingly integral to mainstream technological advancements in aerospace, defense, and nuclear energy. The development of next-generation space exploration missions, involving deeper space penetration and longer durations, necessitates ICs that can withstand the harsh cosmic radiation environment. Similarly, the modernization of defense systems, including satellite constellations for communication and surveillance, and strategic missile defense, relies heavily on the unwavering performance of Rad-Hard electronics. The nuclear industry, with its stringent safety requirements for power plants and research facilities, also continues to be a major consumer. Moreover, the evolving landscape of commercial space, with a surge in satellite launches for broadband internet and Earth observation, is opening up new avenues for market expansion. The increasing complexity and sensitivity of electronic systems in these demanding applications are driving the need for analog ICs that can maintain their functional integrity and performance parameters even when subjected to ionizing radiation. This intricate interplay of technological evolution, critical application needs, and market dynamics is shaping a highly promising future for the Radiation-Hardened Analog ICs market, with significant opportunities for growth and development in the coming years.

Several potent forces are propelling the growth of the Radiation-Hardened Analog ICs market. Foremost among these is the burgeoning demand from the Aerospace and Defense (A&D) sector. With an increasing number of satellites being deployed for communication, navigation, reconnaissance, and scientific research, the need for robust electronics that can withstand the intense radiation of space – including solar flares and cosmic rays – is paramount. Similarly, modern military applications, from advanced radar systems and electronic warfare platforms to strategic missile guidance, require unparalleled reliability in challenging electromagnetic and radiation environments. The Nuclear industry, a long-standing consumer, continues to drive demand for Rad-Hard components in power generation, research reactors, and waste management facilities, where safety and uninterrupted operation are non-negotiable. Furthermore, the growing private sector interest in space, often referred to as "New Space," with its ambitious projects like satellite mega-constellations and space tourism, is creating a substantial new market for these specialized ICs. These ventures, by their very nature, require electronic systems that can survive the rigors of space. Beyond these primary drivers, advancements in semiconductor technology are also playing a crucial role. The continuous drive for miniaturization, increased processing power, and enhanced functionality in electronic devices, even in radiation-prone environments, necessitates the development of more sophisticated Rad-Hard analog ICs. This includes the creation of analog ICs that can handle higher frequencies, greater precision, and more complex signal processing while maintaining their radiation tolerance. The inherent reliability and extended lifespan offered by Rad-Hard analog ICs, compared to their commercial counterparts when exposed to radiation, make them the indispensable choice for mission-critical applications where failure is not an option, thus underpinning their sustained market growth.

Despite the robust growth trajectory, the Radiation-Hardened Analog ICs market faces certain inherent challenges and restraints that temper its expansion. A primary impediment is the high cost of development and manufacturing. Designing and fabricating Rad-Hard ICs requires specialized processes, materials, and rigorous testing protocols to ensure radiation tolerance. These specialized requirements translate into significantly higher unit costs compared to standard commercial-grade ICs. This cost factor can make it prohibitive for some applications, especially in cost-sensitive commercial sectors or for less critical defense systems, to adopt Rad-Hard solutions. The limited vendor ecosystem and longer lead times also present a hurdle. The number of companies capable of producing high-quality Rad-Hard analog ICs is relatively small, leading to a concentrated supply chain. This can result in longer lead times for production and potential supply chain vulnerabilities, especially during periods of heightened demand. Technological obsolescence is another consideration; while Rad-Hard ICs are designed for longevity, the rapid pace of technological advancement in non-hardened electronics means that system designers must carefully balance the need for radiation tolerance with the desire for cutting-edge functionality. Stringent qualification and testing requirements add to the complexity and expense. Each Rad-Hard IC must undergo extensive and often costly testing to verify its performance under various radiation conditions. This rigorous validation process, while essential for reliability, can prolong product development cycles and increase overall project costs. Finally, the niche nature of the market itself, while driving specialization, also limits the economies of scale achievable in high-volume commercial semiconductor manufacturing. This inherent cost structure and supply chain dynamic will continue to influence the market's growth potential.

The global Radiation-Hardened Analog ICs market is characterized by a strong dominance of specific regions and segments, primarily driven by defense spending, space exploration initiatives, and the presence of established semiconductor manufacturers.

Dominant Regions/Countries:

North America (United States): This region unequivocally holds a leading position in the Rad-Hard Analog ICs market. This dominance is propelled by several key factors:

Europe: Europe, particularly countries like France, the United Kingdom, and Germany, also represents a significant market.

Asia Pacific (China, Japan, India): This region is experiencing rapid growth, particularly driven by its increasing investments in space and defense.

Dominant Segments:

Application: Aerospace and Defense: This segment is the undisputed leader and is expected to maintain its dominance throughout the forecast period.

Type: Signal Chain: While Power Management ICs are crucial, the Signal Chain segment is poised for significant growth and is a key area of focus.

The interplay of these dominant regions and segments creates a concentrated yet rapidly expanding market for Radiation-Hardened Analog ICs, with substantial opportunities for growth and innovation.

The Radiation-Hardened Analog ICs industry is fueled by several key growth catalysts. The escalating global geopolitical tensions and the subsequent surge in defense modernization programs worldwide are a significant driver, increasing the demand for reliable electronic components in military hardware. Furthermore, the burgeoning commercial space sector, with its ambitious plans for satellite constellations for global internet access, Earth observation, and space tourism, is creating a substantial new market for Rad-Hard solutions. Advancements in semiconductor fabrication technologies are also enabling the development of more sophisticated and cost-effective Rad-Hard analog ICs, expanding their applicability into a wider range of mission-critical systems. The increasing complexity and sensitivity of modern electronic systems across aerospace, defense, and nuclear applications necessitate components that can maintain their performance under extreme radiation conditions, thus acting as a continuous catalyst for innovation and adoption.

This comprehensive report provides an in-depth analysis of the global Radiation-Hardened Analog ICs market, offering critical insights for stakeholders. It meticulously examines market trends, size, and growth projections from 2019 to 2033, with a specific focus on the base year of 2025. The report delves into the key driving forces, such as the burgeoning aerospace and defense sector and the expanding commercial space industry, while also addressing the significant challenges posed by high costs and limited vendor ecosystems. Detailed regional analysis highlights the dominance of North America and the growing influence of Asia Pacific, alongside an examination of key segments like Signal Chain and Aerospace & Defense. Furthermore, the report identifies leading players and significant industry developments, offering a complete understanding of the current landscape and future opportunities within this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Texas Instruments, Analog Devices, STMicroelectronics, Renesas Electronics, Onsemi, Microchip Technology, Honeywell Aerospace, Infineon Technologies, Triad Semiconductor.

The market segments include Type, Application.

The market size is estimated to be USD 986 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Radiation Hardened Analog ICs," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Radiation Hardened Analog ICs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.