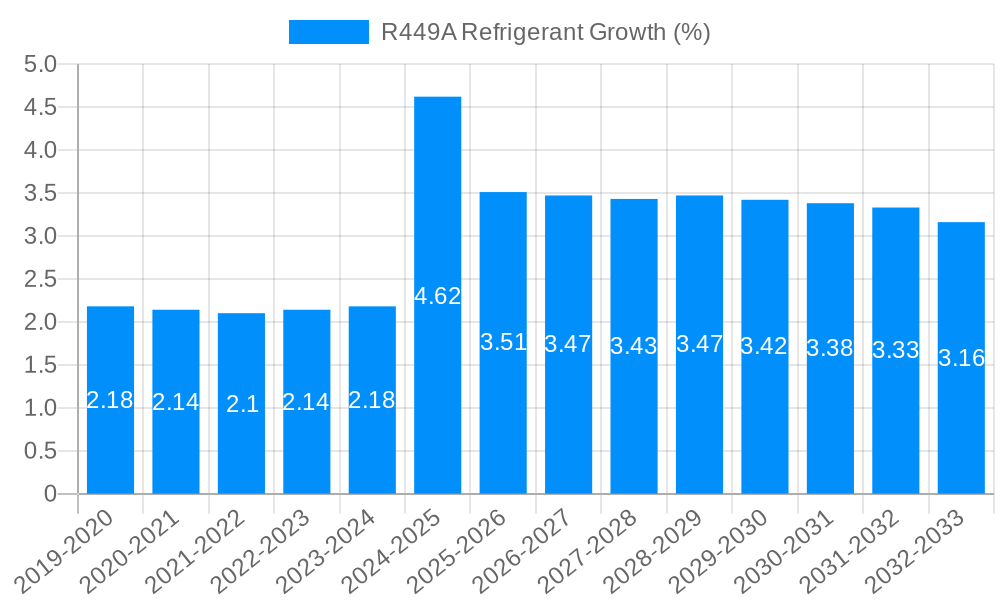

1. What is the projected Compound Annual Growth Rate (CAGR) of the R449A Refrigerant?

The projected CAGR is approximately 3.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

R449A Refrigerant

R449A RefrigerantR449A Refrigerant by Application (Commercial Refrigeration, Industrial Refrigeration), by Type (Purity ≥99.5%, Purity ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global R449A refrigerant market is poised for steady expansion, projected to reach an estimated market size of approximately USD 122.4 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.4% anticipated through 2033. This growth trajectory is primarily fueled by the increasing demand for more energy-efficient and environmentally friendly refrigeration solutions. Regulatory pressures pushing for the phase-out of high Global Warming Potential (GWP) refrigerants, such as R404A and R507, are significantly driving the adoption of R449A as a viable retrofit and new equipment option. The refrigerant's favorable environmental profile, coupled with its excellent thermodynamic performance, makes it a preferred choice across various applications. The commercial refrigeration sector, encompassing supermarkets, convenience stores, and food service operations, represents a substantial segment, benefiting from the need to comply with evolving environmental standards and enhance operational efficiency. Industrial refrigeration, crucial for food processing, cold storage, and chemical industries, also contributes significantly to the market's upward trend, driven by the imperative for reliable and sustainable cooling systems.

The market's growth is further bolstered by ongoing technological advancements and a growing awareness among end-users regarding the long-term economic and environmental benefits of transitioning to lower-GWP refrigerants. Key drivers include stringent environmental regulations like the Kigali Amendment to the Montreal Protocol, which mandates a global phase-down of hydrofluorocarbons (HFCs), and the increasing focus on energy efficiency in commercial and industrial operations. While the market is on a positive growth path, potential restraints could include the initial cost of retrofitting existing systems and the availability of alternative refrigerants. However, the long-term cost savings associated with R449A's energy efficiency and compliance with future regulations are expected to outweigh these initial considerations. Innovations in refrigerant management and the development of more efficient installation and maintenance practices will continue to support the market's expansion, ensuring its relevance in the evolving landscape of refrigeration technology.

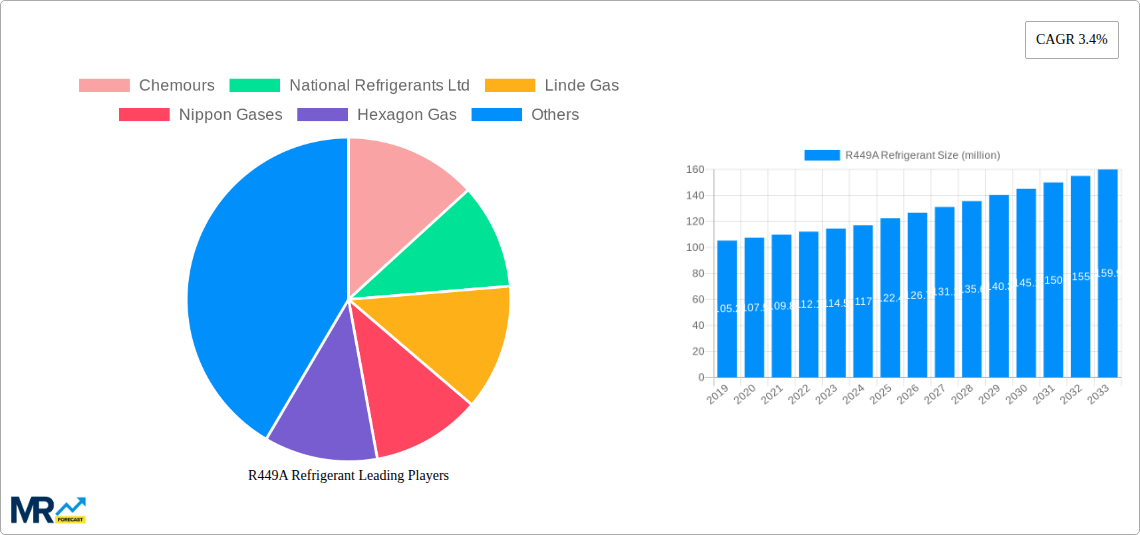

This comprehensive report delves into the dynamic R449A refrigerant market, offering an in-depth analysis of trends, drivers, challenges, and future prospects. Utilizing data spanning the Study Period: 2019-2033, with a Base Year: 2025 and an Estimated Year: 2025, and a Forecast Period: 2025-2033, this report provides actionable insights for stakeholders. The analysis builds upon the Historical Period: 2019-2024, capturing past market evolutions. Key market players, including Chemours, National Refrigerants Ltd, Linde Gas, Nippon Gases, Hexagon Gas, A-Gas, Tazzetti, and Zhejiang Cfreon Chemical, are meticulously profiled, alongside an examination of critical segments such as Commercial Refrigeration and Industrial Refrigeration, with a focus on Purity ≥99.5%.

The global R449A refrigerant market is on a discernible upward trajectory, driven by a complex interplay of regulatory mandates and evolving industry demands. The transition away from high Global Warming Potential (GWP) refrigerants, spurred by international agreements like the Kigali Amendment to the Montreal Protocol, has placed R449A, a hydrofluoroolefin (HFO) blend with a significantly lower GWP compared to its predecessors, in a position of substantial market relevance. Projections indicate a compound annual growth rate (CAGR) that will translate into a market valuation reaching several hundred million units by the end of the Forecast Period: 2025-2033. This growth is not uniform across all regions, with developed economies in North America and Europe leading the adoption curve due to stringent environmental regulations and advanced infrastructure for refrigerant management. The Estimated Year: 2025 signifies a crucial inflection point where the market solidifies its growth trajectory, with continued expansion anticipated. The demand for R449A is intrinsically linked to the lifecycle of refrigeration and air conditioning systems, with replacements and new installations contributing significantly. The report highlights that by 2025, a substantial portion of existing equipment will have either transitioned to R449A or will be slated for retrofitting, underscoring its growing importance. Furthermore, advancements in manufacturing processes and economies of scale are expected to contribute to price stabilization, making R449A a more economically viable option for a wider range of applications. The market's evolution is also influenced by the development of more efficient system designs that leverage the thermodynamic properties of R449A. This synergy between refrigerant choice and equipment optimization is a key trend that will shape market dynamics in the coming years. The report will detail the specific volume projections in million units for both the Base Year: 2025 and the Estimated Year: 2025, offering a quantitative basis for understanding this market expansion. The increasing focus on sustainability across various industries is a foundational trend that underpins the continued growth and adoption of lower-GWP refrigerants like R449A.

The ascendancy of R449A refrigerant in the global market is predominantly fueled by stringent environmental regulations aimed at mitigating climate change. The phasing out of refrigerants with high Global Warming Potential (GWP), such as R404A and R410A, mandated by international agreements and national legislations, has created a significant demand for alternatives like R449A. Its favorable GWP profile, considerably lower than traditional hydrofluorocarbons (HFCs), positions it as a leading transitional and long-term solution for many refrigeration applications. Furthermore, the energy efficiency offered by R449A in many systems is another key driver. As energy costs rise and sustainability targets become more ambitious, end-users are actively seeking refrigerants that can reduce operational expenses and minimize their carbon footprint. The cost-effectiveness of R449A, especially considering its performance and longevity, also plays a crucial role. While initial investment in retrofitting or new equipment might be a factor, the overall lifecycle cost, including reduced refrigerant top-ups and energy savings, makes it an attractive proposition. The continuous innovation within the chemical industry, leading to improved purity and supply chain reliability for R449A, further supports its market penetration. Companies are investing in research and development to optimize production processes, ensuring consistent quality and availability, which is paramount for industrial and commercial applications. The increasing awareness among consumers and businesses about environmental responsibility is also indirectly driving the demand for sustainable refrigerants, pushing the market towards solutions like R449A. The projected market size by 2025 in million units will reflect the cumulative impact of these driving forces.

Despite its promising growth, the R449A refrigerant market faces several hurdles. The primary challenge lies in the cost of transition. Retrofitting existing refrigeration systems to accommodate R449A can involve significant upfront investment in new components and specialized labor. This cost can be a deterrent for small and medium-sized enterprises or for systems nearing the end of their operational life, where the economic feasibility of retrofitting is questionable. Another restraint is the availability of skilled technicians. Proper handling, installation, and servicing of R449A require specific training and expertise, as it has different thermodynamic properties and safety considerations compared to older refrigerants. A shortage of qualified personnel can slow down the adoption rate and increase operational risks. Furthermore, while R449A has a lower GWP than many legacy refrigerants, it is still an HFO blend with some flammability characteristics. Although classified as A1 (non-flammable under normal conditions), specific safety measures and equipment compatibility checks are necessary, which can add complexity to its deployment. Competition from other low-GWP refrigerants, such as HFC/HFO blends with even lower GWPs or natural refrigerants like CO2 and ammonia, also presents a challenge. The selection of the optimal refrigerant often depends on specific application requirements, operating temperatures, and local regulations, creating a complex decision-making process for end-users. The report will quantify the potential market impact of these restraints, especially in terms of projected million unit sales by 2025. The evolving regulatory landscape, while a driver, can also be a source of uncertainty. Changes in policy or the introduction of new refrigerant mandates could impact the long-term market outlook for R449A.

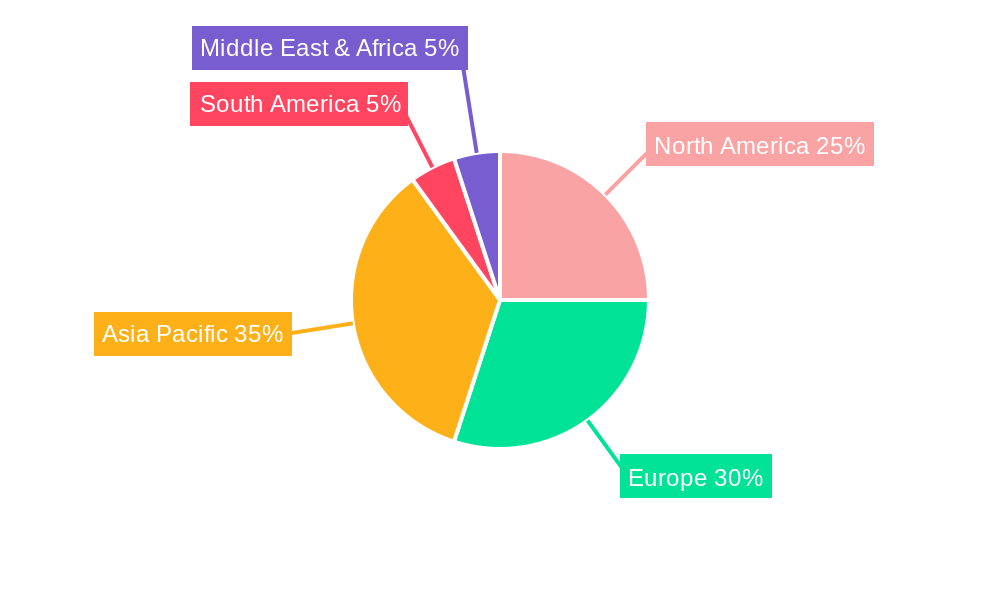

The R449A refrigerant market is poised for significant dominance by certain regions and segments, driven by a combination of regulatory pressures, economic growth, and the prevalence of specific industries.

North America and Europe: These regions are expected to lead the market in terms of R449A adoption and demand.

Asia-Pacific: While currently experiencing a faster growth rate in terms of adoption, Asia-Pacific is also projected to become a dominant force in the R449A market by the end of the Forecast Period: 2025-2033.

The R449A refrigerant industry's growth is significantly catalyzed by the accelerating global push towards sustainability and stricter environmental regulations. The continuous phase-down of high-GWP refrigerants, driven by international agreements like the Kigali Amendment, directly fuels demand for R449A as a viable, lower-GWP alternative. Advancements in technology, leading to improved system efficiency when using R449A, also act as a strong catalyst, offering both environmental and economic benefits to end-users by reducing energy consumption and operational costs.

This report offers a holistic view of the R449A refrigerant market, providing a deep dive into its competitive landscape, technological advancements, and future projections. It meticulously analyzes the market dynamics from the Historical Period: 2019-2024 through to the Forecast Period: 2025-2033, with detailed segment analysis. The report quantifies market opportunities and challenges, offering strategic insights into segments like Commercial Refrigeration and Industrial Refrigeration, and product specifications such as Purity ≥99.5%. Stakeholders can leverage this comprehensive coverage to make informed decisions regarding investment, product development, and market entry, aiming for a market valuation in the hundreds of millions by 2025.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.4% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.4%.

Key companies in the market include Chemours, National Refrigerants Ltd, Linde Gas, Nippon Gases, Hexagon Gas, A-Gas, Tazzetti, Zhejiang Cfreon Chemical, .

The market segments include Application, Type.

The market size is estimated to be USD 122.4 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "R449A Refrigerant," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the R449A Refrigerant, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.