1. What is the projected Compound Annual Growth Rate (CAGR) of the R404 Refrigerant?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

R404 Refrigerant

R404 RefrigerantR404 Refrigerant by Type (Purity 99%, Purity 99.5%, Other), by Application (Commercial, Industrial, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

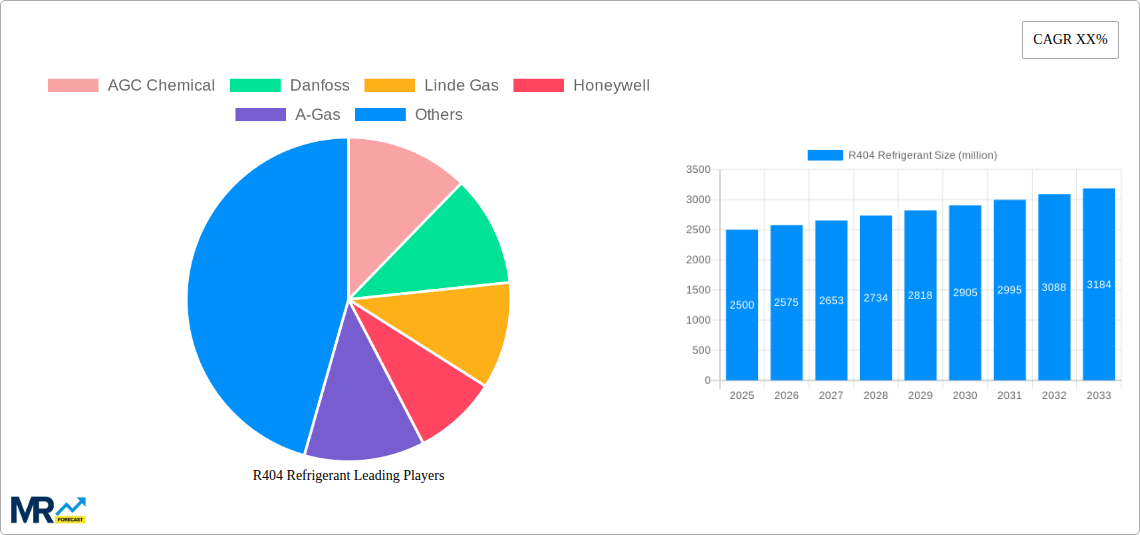

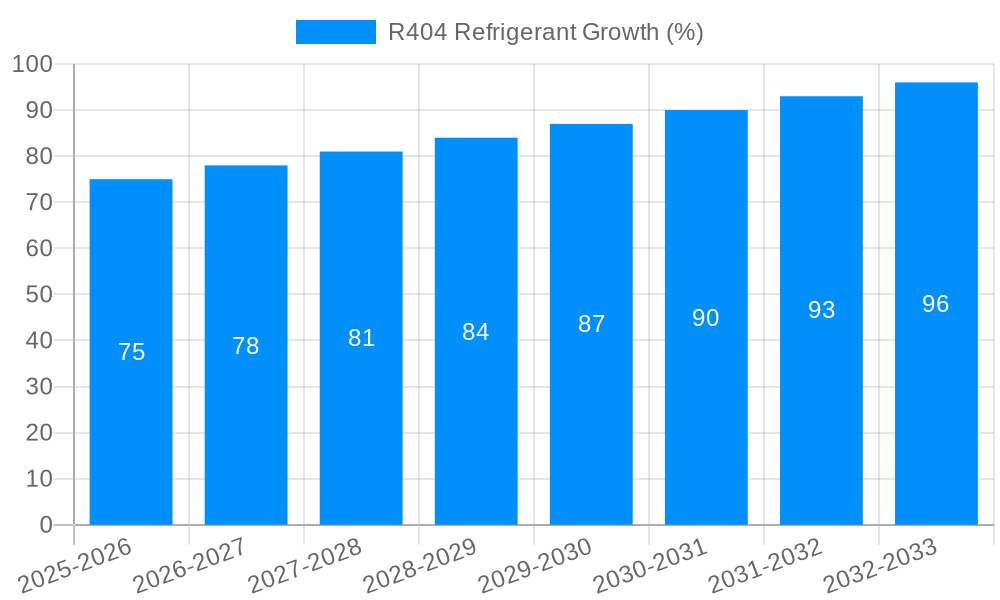

The R404A refrigerant market, while facing headwinds from stricter environmental regulations, continues to demonstrate resilience driven by its established presence in existing refrigeration systems. The market, estimated at $2.5 billion in 2025, is projected to experience a Compound Annual Growth Rate (CAGR) of 3% between 2025 and 2033. This moderate growth reflects a cautious approach by industry players navigating the transition to more environmentally friendly alternatives. Key drivers include the large installed base of equipment utilizing R404A, particularly in commercial refrigeration and industrial applications, and the relatively low cost compared to some newer refrigerants. However, significant restraints exist due to its high Global Warming Potential (GWP), leading to increasing regulatory pressure and phasing out in several regions. This pressure is prompting a gradual shift toward lower-GWP refrigerants like R448A and R449A, though the transition remains gradual due to retrofitting costs and operational complexities. Market segmentation reveals a strong presence of major players such as AGC Chemicals, Danfoss, and Linde Gas, who are strategically adapting to changing market conditions through innovation and diversification of their refrigerant portfolios. Regional analysis would indicate strong market concentration in developed economies with extensive existing infrastructure reliant on R404A, gradually tapering off in favour of greener options in regions with stricter regulations.

The competitive landscape is dynamic, with established players focusing on providing efficient and compliant solutions alongside new entrants offering eco-friendly alternatives. Significant investments in research and development are aimed at developing refrigerants with lower environmental impact while retaining the operational efficiency of R404A. Successful strategies involve promoting efficient retrofits and servicing of existing R404A systems while actively marketing greener replacements and integrating sustainable practices throughout the supply chain. The future trajectory will be shaped by the interplay between regulatory changes, technological advancements, and consumer demand for sustainable and cost-effective cooling solutions. The long-term outlook suggests a gradual decline in R404A market share as more sustainable alternatives gain broader adoption, but the market will persist for some time given the significant existing infrastructure dependent on the refrigerant.

The global R404A refrigerant market, valued at approximately $XXX million in 2024, is projected to reach $YYY million by 2033, exhibiting a CAGR of ZZZ% during the forecast period (2025-2033). This growth, however, is a complex picture shaped by both opportunities and challenges. While the refrigerant continues to find application in existing refrigeration systems, particularly in the commercial sector, its high global warming potential (GWP) is driving a significant shift towards more environmentally friendly alternatives. The historical period (2019-2024) witnessed a steady, albeit slowing, growth trajectory for R404A, primarily fueled by its established presence and performance characteristics in various applications. However, stringent environmental regulations, particularly in developed nations, are progressively limiting its use, leading to a more nuanced market outlook. The base year for our analysis is 2025, reflecting the current transition phase within the industry. The estimated market value for 2025 reflects a consolidation phase, with growth primarily driven by the need to maintain existing systems rather than new installations. The forecast period will see a slower growth rate than previously observed, largely determined by the adoption of replacement refrigerants and the phasing out of R404A in specific sectors. The report provides a detailed breakdown of this complex market dynamics, considering regional variations, segment-specific trends, and the competitive landscape.

Despite facing increasing regulatory pressure, several factors continue to propel the R404A refrigerant market, albeit at a reduced pace. Firstly, its existing installed base remains substantial, particularly in the commercial refrigeration sector (supermarkets, cold storage facilities). Replacing these systems is a costly and time-consuming undertaking, resulting in continued demand for R404A for maintenance and repairs. Secondly, R404A offers established performance characteristics, including efficiency and reliability, which remain attractive to some operators, especially in regions with less stringent environmental regulations. This is particularly true in emerging economies where the cost of transitioning to alternative refrigerants might outweigh the benefits. Furthermore, the immediate availability and established supply chains for R404A continue to offer a degree of competitive advantage in the short-term. The continued operation of older systems, along with the need for ongoing maintenance and repair services, acts as a significant driver of the refrigerant demand, particularly within the commercial sector. However, this driving force is anticipated to weaken considerably over the forecast period due to the accelerating adoption of environmentally friendly alternatives.

The primary challenge confronting the R404A refrigerant market is its high GWP, placing it squarely at odds with global environmental regulations aimed at reducing greenhouse gas emissions. The EU F-Gas Regulation and similar initiatives in other countries are progressively phasing out high-GWP refrigerants, including R404A, imposing quotas and restrictions on their use. This is leading to significant uncertainty for manufacturers and end-users, impacting investment decisions and driving the market towards alternative solutions. Moreover, the increasing awareness among consumers and businesses about environmental sustainability is adding pressure on companies to adopt more eco-friendly practices. This shift in consumer preferences is further amplified by the potential for carbon taxes and other regulatory measures that could increase the operating costs associated with R404A-based systems. Finally, the availability of increasingly efficient and environmentally friendly alternatives poses a strong competitive threat to R404A, driving market share erosion in both new installations and retrofits.

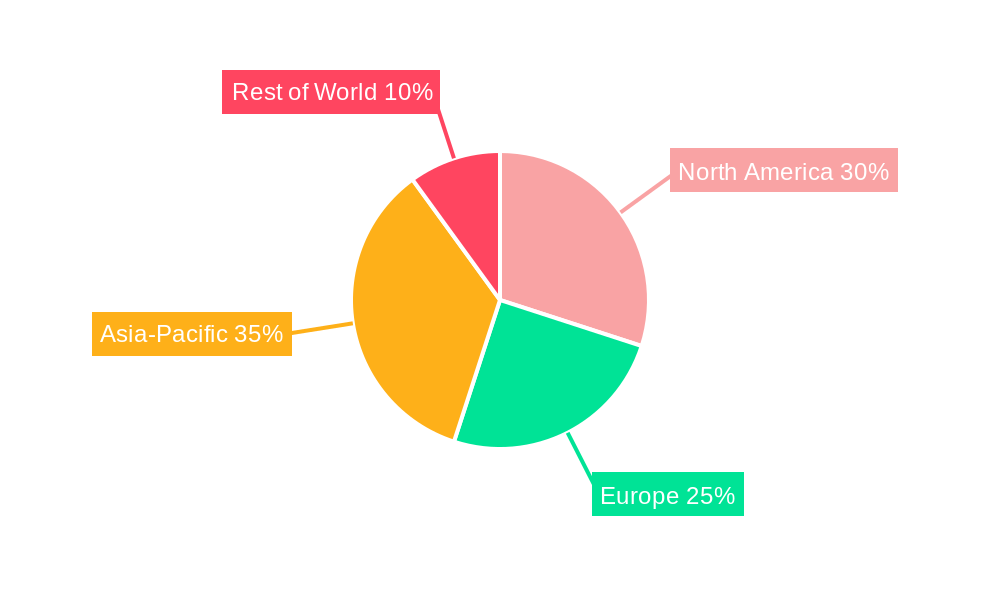

The report identifies several key regions and segments showing significant activity within the R404A refrigerant market.

Commercial Refrigeration: This segment continues to be the largest consumer of R404A, primarily due to the extensive installed base in supermarkets, cold storage warehouses, and other large-scale refrigeration systems. The high initial cost of replacing these systems contributes to the continued reliance on R404A, especially in regions with less stringent environmental regulations. However, this segment is expected to gradually transition to more environmentally friendly options as regulations become more stringent and cost-effective alternatives emerge.

Developing Economies: Regions with less developed regulatory frameworks and lower awareness regarding environmental impact exhibit a higher continued use of R404A. The lower cost compared to newer, more sustainable alternatives makes it attractive in these markets, particularly for new installations. However, the rapid economic growth and increasing environmental awareness in many developing economies suggest that this trend will be short-lived, with a growing adoption of sustainable solutions in the long term.

North America & Europe: While still having a presence, these regions are showing a significant decline in R404A usage due to stringent environmental regulations and early adoption of alternative refrigerants. The high cost of compliance with the F-Gas regulations is pushing businesses towards a quicker transition. Retrofit projects and new installations are increasingly utilizing low-GWP alternatives.

Asia-Pacific: This region presents a mixed picture, with some countries showing significant R404A consumption, while others are quickly adopting environmentally friendly refrigerants. The varying levels of regulatory enforcement and economic development across the Asia-Pacific region contribute to this diversity.

Despite the challenges, certain factors could contribute to some continued growth in the R404A market, albeit limited and temporary. These include the need for maintenance and repairs in existing systems, and the continued use in regions with limited regulatory oversight and lower awareness of sustainability issues. However, it is crucial to highlight that these are short-term catalysts; the long-term trend unequivocally points towards the decline of R404A due to its high GWP and the increasing availability and cost-effectiveness of sustainable alternatives.

This report offers a comprehensive overview of the R404A refrigerant market, providing detailed insights into market trends, driving forces, challenges, and key players. It incorporates both historical data and future projections, offering a valuable resource for stakeholders seeking to understand the evolving landscape of this critical industry sector and make informed strategic decisions amidst a rapidly shifting regulatory and technological environment. The report’s granular analysis of regional variations and market segments provides a clear picture of the opportunities and threats impacting the R404A market in the coming years.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include AGC Chemical, Danfoss, Linde Gas, Honeywell, A-Gas, Chemours, Zhejiang Sanmei Chemical, JinHua Slihe Chemical, Zhejiang Juhua, Zhejiang BingEr New Type Refrigerant.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "R404 Refrigerant," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the R404 Refrigerant, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.