1. What is the projected Compound Annual Growth Rate (CAGR) of the PTFE Heat Shrink Tubing?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

PTFE Heat Shrink Tubing

PTFE Heat Shrink TubingPTFE Heat Shrink Tubing by Application (Wire and Cable, Electronic Equipment, Automotive, Medical, Industrial, Other), by Type (Shrink Ratio 4:1, Shrink Ratio 2:1, World PTFE Heat Shrink Tubing Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

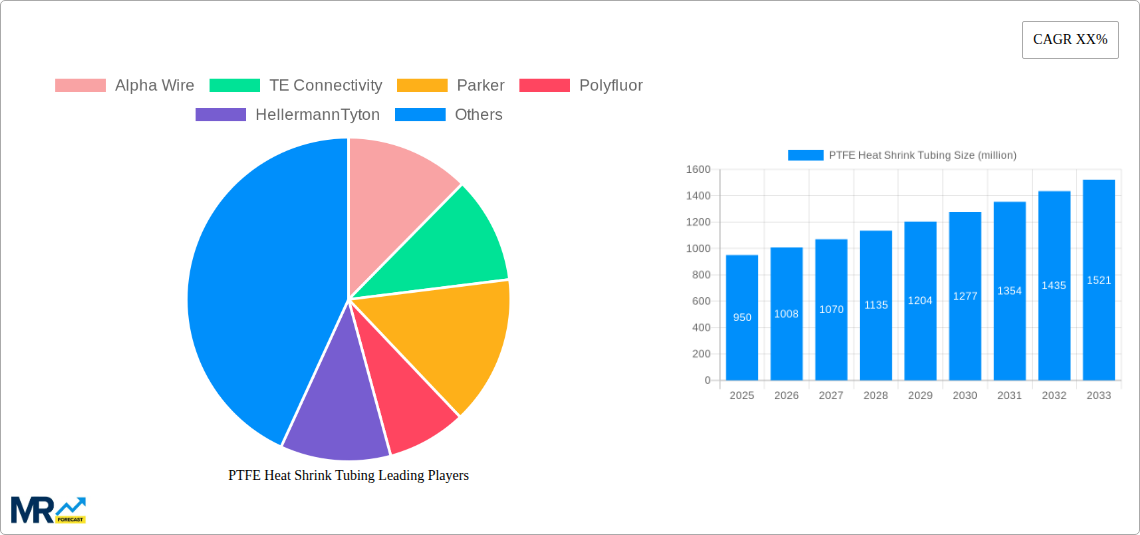

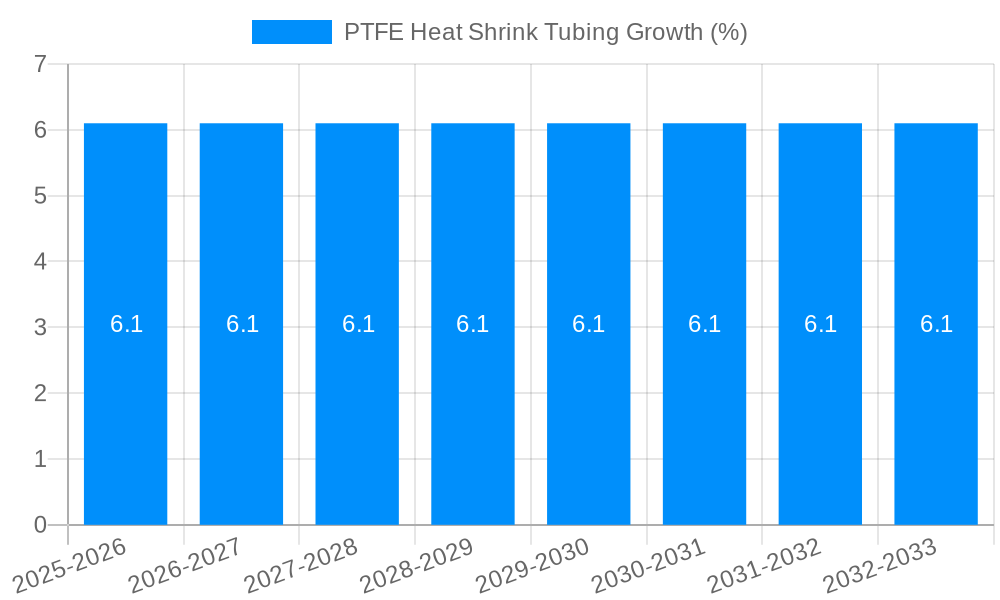

The global PTFE Heat Shrink Tubing market is poised for significant expansion, projected to reach an estimated USD 950 million by the end of 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.2% throughout the forecast period of 2025-2033. This growth trajectory is primarily fueled by the increasing demand for high-performance insulation and protection solutions across diverse industries. Key drivers include the expanding electronics sector, which relies heavily on PTFE's exceptional dielectric strength and chemical resistance for wire and cable applications, as well as its indispensable role in automotive and aerospace components where reliability under extreme conditions is paramount. The medical industry also contributes significantly to market demand, leveraging PTFE's biocompatibility and sterilizability for critical medical devices and tubing. Furthermore, the inherent properties of PTFE, such as its wide operating temperature range and excellent chemical inertness, make it a preferred choice in harsh industrial environments, further bolstering market growth.

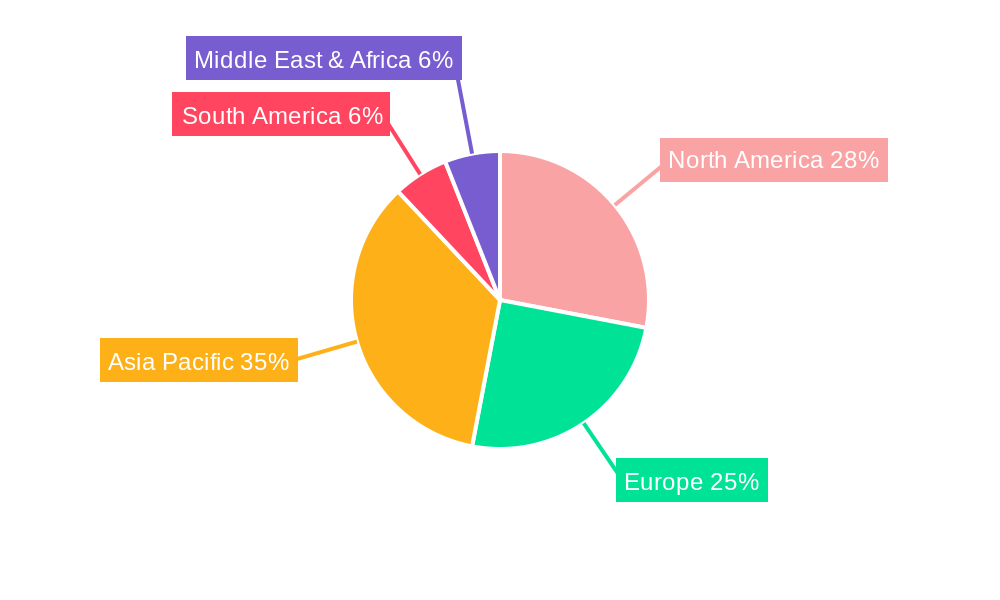

The market is characterized by several evolving trends, including the development of specialized PTFE tubing with enhanced flexibility and higher shrink ratios, such as 4:1, catering to intricate applications. Innovations in manufacturing processes are also contributing to improved product quality and cost-effectiveness. However, the market faces certain restraints, notably the relatively high cost of raw materials compared to alternative materials, which can impact adoption in price-sensitive segments. Geopolitical factors and supply chain complexities can also pose challenges. Despite these limitations, the increasing adoption of advanced manufacturing techniques and the continuous innovation by leading companies such as TE Connectivity, Parker, and Saint-Gobain are expected to overcome these hurdles and sustain the market's upward momentum. The Asia Pacific region, led by China and India, is anticipated to be a major growth engine due to rapid industrialization and a burgeoning electronics manufacturing base, while North America and Europe will continue to be significant markets driven by established industrial and medical sectors.

Here's a comprehensive report description on PTFE Heat Shrink Tubing, incorporating your specified requirements:

The global PTFE Heat Shrink Tubing market is poised for significant expansion, driven by an increasing demand for high-performance insulation and protection solutions across diverse industrial sectors. During the Study Period of 2019-2033, with a Base Year of 2025 and an Estimated Year also 2025, the market has witnessed a consistent upward trajectory, fueled by technological advancements and the growing adoption of specialized materials. The Historical Period of 2019-2024 laid a strong foundation, characterized by the escalating need for robust wire and cable management, particularly in the burgeoning electronics and automotive industries. The unique properties of PTFE, including its exceptional chemical inertness, high-temperature resistance, and low coefficient of friction, make it an indispensable material for demanding applications where conventional alternatives falter. The market is anticipated to see a substantial Compound Annual Growth Rate (CAGR) throughout the Forecast Period of 2025-2033, reflecting the increasing sophistication of manufacturing processes and the stringent regulatory requirements for safety and reliability. Innovations in extrusion and expansion technologies are leading to the development of more precise and cost-effective PTFE heat shrink tubing, widening its applicability. For instance, the demand for specialized tubing with specific dielectric strengths, flame retardancy, and flexibility is on the rise, prompting manufacturers to invest in research and development. Furthermore, the medical sector's reliance on biocompatible and sterilizable materials for critical applications continues to be a major growth driver. The increasing complexity of medical devices and the need for advanced cable protection in surgical environments directly translate into higher demand for high-quality PTFE heat shrink tubing. The evolving landscape of the industrial sector, with its emphasis on automation and extreme operating conditions, also contributes to the sustained growth of this market. From aerospace to oil and gas, the need for reliable insulation and protection in harsh environments is paramount, positioning PTFE heat shrink tubing as a preferred choice. The trend towards miniaturization in electronics, while challenging for some materials, actually presents an opportunity for specialized PTFE tubing that can provide highly effective insulation in compact designs. This nuanced demand, coupled with a growing awareness of the long-term cost benefits of using durable PTFE solutions, underpins the optimistic market outlook.

The robust growth of the PTFE Heat Shrink Tubing market is propelled by a confluence of critical factors that underscore its indispensable role in modern industries. Foremost among these is the escalating demand for high-performance insulation and protection solutions, particularly in environments where extreme temperatures, corrosive chemicals, and mechanical stress are prevalent. PTFE’s inherent properties, such as its exceptional chemical resistance, wide operating temperature range (from -200°C to +260°C), and non-stick surface, make it the material of choice for applications that cannot afford compromise. The burgeoning electronics sector, with its relentless drive towards miniaturization and increased power density, requires insulation that can effectively manage heat and prevent electrical short circuits. PTFE heat shrink tubing provides a reliable and compact solution for protecting intricate wiring harnesses and sensitive components. Similarly, the automotive industry, with its increasing electrification and the introduction of advanced driver-assistance systems (ADAS), necessitates highly durable and reliable wire protection. The tubing’s ability to withstand vibration, abrasion, and exposure to automotive fluids further solidifies its position. The medical industry's stringent requirements for biocompatibility, sterilizability, and chemical inertness for devices and instruments also significantly contributes to the market’s expansion. As medical technology advances, the demand for sophisticated and safe material solutions like PTFE heat shrink tubing escalates. Furthermore, the growing emphasis on safety regulations and product longevity across various industrial segments, from aerospace to energy, compels manufacturers to adopt materials that offer superior protection and a reduced risk of failure. The increasing complexity of industrial machinery and the need for reliable operation in harsh conditions further amplify the demand for robust insulation solutions.

Despite its compelling advantages, the PTFE Heat Shrink Tubing market is not without its hurdles, which can temper its growth trajectory. One of the primary restraints is the inherent cost of raw PTFE material. Compared to more conventional polymers, PTFE commands a premium price due to its complex manufacturing process and specialized properties. This higher initial cost can be a significant deterrent for price-sensitive applications or for industries operating on tighter margins, prompting them to seek more economical alternatives where feasible. Additionally, while PTFE offers excellent high-temperature resistance, its mechanical strength, particularly at elevated temperatures, can be a limiting factor in certain highly demanding structural applications. In scenarios requiring significant load-bearing capabilities at extreme heat, designers might need to consider composite materials or reinforced solutions. The processing of PTFE also presents its own set of challenges. Extruding and expanding PTFE into precise tubing requires specialized equipment and expertise, which can lead to higher manufacturing overheads. This can translate into longer lead times for custom orders and potentially limited scalability for some manufacturers. Furthermore, while PTFE is chemically inert, its compatibility with certain aggressive chemical environments, especially under prolonged exposure or at very high concentrations, still warrants careful consideration and testing for specific applications. The environmental impact of fluoropolymer production and disposal is another growing concern. While efforts are being made towards more sustainable manufacturing practices, the perception of PTFE as a persistent organic pollutant (POP) in some regulatory circles can influence market adoption and drive the search for greener alternatives. The complex supply chain for raw PTFE can also be susceptible to disruptions, leading to potential price volatility and availability issues, which can create uncertainty for end-users.

The global PTFE Heat Shrink Tubing market demonstrates a dynamic interplay of regional dominance and segment leadership. Geographically, North America is anticipated to hold a significant market share, driven by its well-established electronics, automotive, and aerospace industries, which are early adopters of high-performance materials. The strong regulatory framework in countries like the United States emphasizes product safety and reliability, fostering the demand for advanced insulation solutions like PTFE heat shrink tubing. Significant investments in research and development within these sectors further fuel the adoption of specialized tubing.

Asia Pacific, particularly countries like China, Japan, and South Korea, represents a rapidly growing market. This region's burgeoning manufacturing base, especially in electronics and automotive production, coupled with increasing disposable incomes and a growing middle class, translates into substantial demand for consumer electronics and vehicles, both of which heavily utilize PTFE heat shrink tubing. The region's aggressive expansion in medical device manufacturing also plays a crucial role. Furthermore, the increasing focus on industrial automation and infrastructure development in countries like India contributes to the rising demand for robust industrial components.

In terms of segmentation, the Wire and Cable application segment is projected to be a dominant force in the market. The ever-increasing complexity of wiring in modern electronics, automotive systems, and industrial machinery necessitates highly effective and reliable insulation and protection. PTFE heat shrink tubing, with its superior dielectric strength, chemical resistance, and ability to withstand extreme temperatures, is ideally suited for safeguarding critical electrical connections against environmental factors, abrasion, and electrical interference. This segment benefits from the continuous innovation in electrical and electronic devices, where denser wiring looms and higher power transmission require advanced containment solutions.

Another significant segment poised for considerable growth and potential dominance is Medical. The stringent biocompatibility requirements, need for sterilization resistance (including gamma, steam, and EtO), and chemical inertness in medical devices, surgical tools, and diagnostic equipment make PTFE heat shrink tubing an indispensable component. From catheters and endoscopes to implantable devices and laboratory equipment, the reliability and safety offered by PTFE tubing are paramount. The global aging population and the continuous advancements in medical technology, leading to more sophisticated and minimally invasive procedures, are key drivers for this segment's expansion.

The Shrink Ratio 4:1 type is also expected to witness substantial demand. This higher shrink ratio offers greater flexibility in covering irregularly shaped components or accommodating larger variations in wire diameters, making it a versatile choice for a wide array of applications. The ability to shrink significantly while maintaining its protective properties makes it a preferred option for complex assemblies and tight spaces.

World PTFE Heat Shrink Tubing Production is characterized by concentrated manufacturing hubs, with leading players strategically located to serve major industrial centers. The production is heavily influenced by the availability of raw PTFE and the advanced manufacturing capabilities required for extrusion and expansion processes. Companies are continually investing in optimizing their production lines to enhance efficiency, reduce waste, and meet the growing global demand.

Several key growth catalysts are fueling the expansion of the PTFE Heat Shrink Tubing industry. The continuous evolution of the electronics sector, with its push for miniaturization, higher performance, and increased reliability in devices ranging from smartphones to advanced computing systems, necessitates superior insulation and protection, which PTFE heat shrink tubing readily provides. Furthermore, the electrification of vehicles, including the burgeoning electric vehicle (EV) market, demands highly durable and high-temperature resistant solutions for battery packs, charging systems, and complex wiring harnesses, directly boosting demand. The expanding healthcare industry, driven by an aging global population and advancements in medical technology, creates a consistent need for biocompatible, sterilizable, and chemically inert materials for a wide range of medical devices and equipment.

This comprehensive report provides an in-depth analysis of the global PTFE Heat Shrink Tubing market, offering crucial insights for stakeholders. The study meticulously examines market dynamics, including the driving forces behind its expansion and the challenges that may impede its growth. It delves into the intricate details of production volumes, technological advancements, and the competitive landscape, with an estimated 2025 market value that is projected to reach significant figures within the millions. The report covers the Study Period from 2019 to 2033, with a detailed focus on the Base Year and Estimated Year of 2025, and the Forecast Period of 2025-2033, building upon the Historical Period of 2019-2024. It highlights key regions and segments poised for dominance, offering strategic guidance for market players. The report also identifies crucial growth catalysts and leading companies, providing a holistic view of the industry's present state and future potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Alpha Wire, TE Connectivity, Parker, Polyfluor, HellermannTyton, Qualtek, Panduit, Saint-Gobain, Adtech, Teflon, Tef-Cap, McMaster, Zeus, Leoflon, Chukoh Chemical, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "PTFE Heat Shrink Tubing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the PTFE Heat Shrink Tubing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.