1. What is the projected Compound Annual Growth Rate (CAGR) of the Protein Microarray Chip?

The projected CAGR is approximately 6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Protein Microarray Chip

Protein Microarray ChipProtein Microarray Chip by Type (Analytical Microarrays, Functional Protein Microarrays, Reverse Phase Protein Microarray, World Protein Microarray Chip Production ), by Application (Hospital, Scientific Research Institutions, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

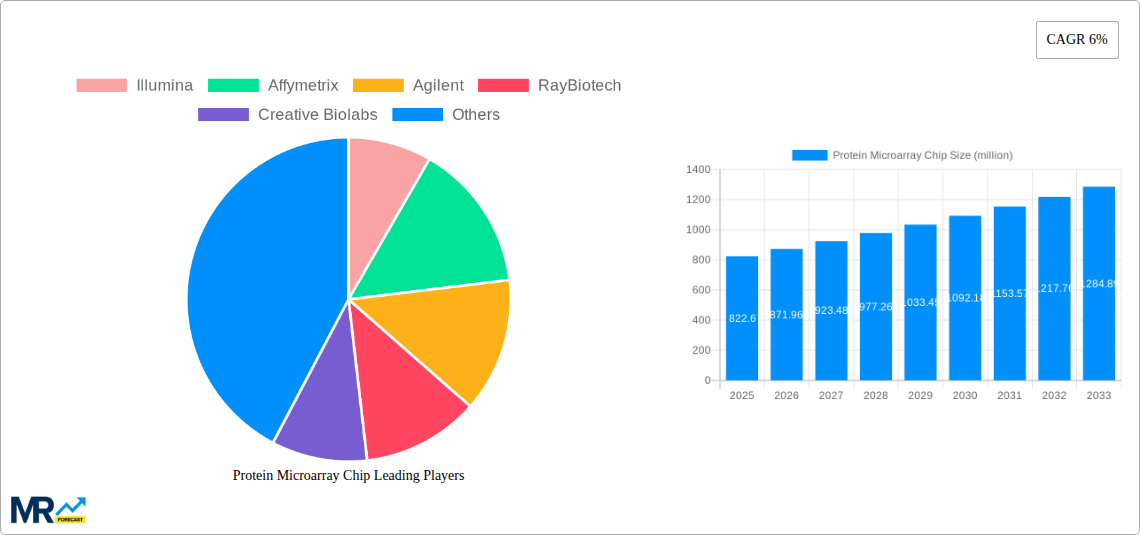

The global protein microarray chip market is poised for significant expansion, projected to reach an estimated $822.6 million by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 6% throughout the forecast period (2025-2033). This growth is underpinned by several compelling drivers, primarily the increasing demand for advanced diagnostics and personalized medicine. Protein microarrays are instrumental in identifying biomarkers for various diseases, accelerating drug discovery and development, and facilitating high-throughput screening of protein-protein interactions. The rising prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions further fuels the need for sophisticated diagnostic tools, positioning protein microarrays as a critical technology in healthcare. Advancements in microarray fabrication technologies, including improved sensitivity, specificity, and miniaturization, are also contributing to market growth. Furthermore, the growing adoption of these chips in scientific research institutions for fundamental biological studies and target validation is a key contributor.

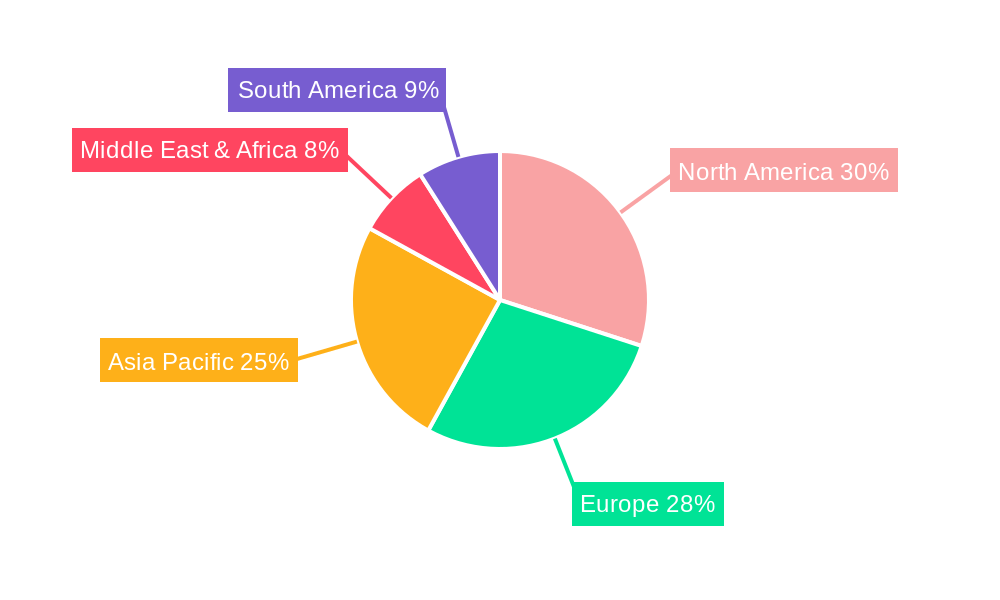

The market segmentation reveals a diverse landscape, with Analytical Microarrays expected to dominate due to their extensive use in research and diagnostics. Functional Protein Microarrays and Reverse Phase Protein Microarrays are also witnessing substantial uptake, driven by their specific applications in understanding cellular signaling pathways and disease progression. Geographically, Asia Pacific is emerging as a high-growth region, propelled by increasing healthcare investments, a burgeoning research ecosystem, and a large patient population in countries like China and India. North America and Europe currently hold significant market shares, owing to well-established healthcare infrastructures, strong R&D activities, and the presence of leading market players. However, restraints such as the high cost of development and manufacturing, coupled with the need for specialized expertise, could pose challenges. Despite these hurdles, the overarching trend points towards continued innovation and market penetration, driven by the indispensable role of protein microarrays in advancing biological understanding and improving patient outcomes.

This report provides an in-depth analysis of the global Protein Microarray Chip market, offering a detailed examination of market trends, driving forces, challenges, regional dynamics, key players, and significant developments. With a study period spanning from 2019 to 2033 and a base year of 2025, the report leverages data from the historical period (2019-2024) to offer robust forecasts for the estimated year 2025 and the forecast period (2025-2033). The market is projected to witness substantial growth, driven by advancements in diagnostics, drug discovery, and personalized medicine.

The global Protein Microarray Chip market is experiencing a transformative surge, anticipated to reach hundreds of millions in value by 2025 and continue its upward trajectory throughout the forecast period. A significant insight into this market is the increasing adoption of protein microarrays in diagnostic applications, particularly for the early detection of complex diseases such as cancer and neurodegenerative disorders. The ability of these chips to simultaneously analyze a large number of protein biomarkers from minimal sample volumes is revolutionizing the diagnostic landscape, moving towards more personalized and precise healthcare solutions. Furthermore, the integration of advanced bioinformatics tools and machine learning algorithms with protein microarray data is unlocking deeper insights into disease mechanisms and drug responses. This synergistic approach is enabling researchers and clinicians to identify novel therapeutic targets and develop more effective treatment strategies. The market is also seeing a growing trend towards the development of high-throughput, automated protein microarray platforms, which are crucial for large-scale screening and clinical trials. The demand for custom-designed protein microarrays is also on the rise, as research institutions and pharmaceutical companies require specialized arrays tailored to their specific project needs, further indicating a maturing and diversifying market. The increasing investment in proteomics research, fueled by governmental and private funding initiatives aimed at understanding the human proteome, is another key trend propelling the market forward. The development of novel antibody-based arrays, aptamer-based arrays, and phage display arrays is expanding the utility of protein microarrays across a wider range of applications, from basic research to clinical diagnostics and drug development. The growing emphasis on precision medicine, which relies heavily on the identification of specific molecular signatures, is acting as a strong tailwind for the protein microarray chip market. As the scientific community gains a more profound understanding of the intricate roles proteins play in health and disease, the demand for sophisticated tools like protein microarrays will only intensify, promising a future where personalized diagnostics and therapeutics become increasingly accessible. The projected market value in the coming years is expected to surpass the low millions and reach into the tens and hundreds of millions, reflecting the growing confidence and investment in this technology.

The protein microarray chip market is being propelled by a confluence of powerful driving forces, chief among them being the accelerating pace of advancements in diagnostics and therapeutics. The inherent capability of protein microarrays to detect and quantify a vast array of biomarkers simultaneously from small biological samples positions them as indispensable tools for early disease detection, prognosis, and monitoring of treatment efficacy. This precision in biomarker profiling is a cornerstone of personalized medicine, a paradigm shift that increasingly relies on tailoring medical interventions to individual patient characteristics. The growing global burden of chronic diseases, including cardiovascular ailments, diabetes, and cancer, is also a significant catalyst, driving the demand for more efficient and accurate diagnostic technologies, for which protein microarrays are ideally suited. Furthermore, the burgeoning field of proteomics research, which aims to comprehensively study the entire set of proteins expressed by an organism, is continuously unearthing novel protein biomarkers associated with various disease states. This expanding knowledge base directly translates into a greater need for protein microarray platforms capable of profiling these newly identified targets. The pharmaceutical industry's unwavering commitment to drug discovery and development, particularly in identifying novel drug targets and understanding drug mechanisms of action, further fuels market growth. The ability of protein microarrays to facilitate high-throughput screening and validation of drug candidates is invaluable in this R&D-intensive sector. Moreover, the increasing integration of artificial intelligence and machine learning in analyzing complex proteomic datasets generated by microarrays is unlocking unprecedented insights, accelerating research timelines and improving the accuracy of diagnostic and prognostic predictions. The rising investments in life sciences research and development globally, coupled with favorable government policies supporting innovation in healthcare technologies, are creating a fertile ground for the expansion of the protein microarray chip market.

Despite its promising growth trajectory, the protein microarray chip market is not without its challenges and restraints that could temper its expansion. One of the primary hurdles is the inherent complexity and high cost associated with the development and manufacturing of sophisticated protein microarray chips. The intricate processes involved in antibody production, immobilization techniques, and assay development require significant expertise and investment, contributing to the overall expense of these platforms. Consequently, the high initial cost can be a deterrent for smaller research institutions and laboratories with limited budgets, thereby restricting broader adoption. Another significant challenge lies in the standardization of protocols and data analysis across different platforms and laboratories. The lack of universal standards can lead to variability in results, making inter-laboratory comparisons and reproducibility difficult, which is critical for clinical validation and regulatory approval. Furthermore, the sensitivity and specificity of some protein detection assays can still be a concern, especially when dealing with low-abundance proteins or complex biological matrices. Ongoing research and development are focused on overcoming these limitations, but it remains a persistent challenge. The lengthy validation process for new diagnostic assays, particularly those intended for clinical use, can also act as a restraint, delaying market entry for innovative protein microarray-based diagnostics. Regulatory hurdles and the need for rigorous clinical trials to prove efficacy and safety add to the time and expense involved. The availability of alternative technologies, such as mass spectrometry-based proteomics, which offer different strengths and capabilities, also presents a competitive challenge, albeit protein microarrays excel in high-throughput screening and specific biomarker quantification. Finally, the need for highly skilled personnel to operate and interpret data from protein microarray experiments can limit adoption in settings with a shortage of trained professionals.

The protein microarray chip market is poised for significant growth across various regions and segments. Among the key regions, North America is expected to continue its dominance in the global market, driven by its robust healthcare infrastructure, substantial investments in research and development, and a high prevalence of chronic diseases. The presence of leading academic institutions and numerous biotechnology companies in countries like the United States fosters a conducive environment for innovation and adoption of advanced technologies like protein microarrays. Europe, with its strong focus on life sciences research and increasing governmental support for healthcare advancements, is also a significant player, closely following North America. Asia Pacific, however, is projected to witness the most rapid growth during the forecast period. This surge is attributed to the expanding healthcare expenditure, a growing awareness of advanced diagnostic techniques, and increasing government initiatives to promote domestic biotechnology industries in countries such as China and India. The increasing outsourcing of research and development activities by Western pharmaceutical companies to Asian contract research organizations (CROs) also contributes to this growth.

Within the segmentations, Analytical Microarrays are anticipated to hold a commanding market share. These arrays are crucial for basic research, drug discovery, and diagnostics, where the precise identification and quantification of specific proteins and their interactions are paramount. The ability of analytical microarrays to interrogate a wide range of protein targets simultaneously makes them invaluable for understanding complex biological pathways and disease mechanisms. Their application in disease biomarker discovery and validation for early diagnosis and prognosis further solidifies their leading position.

Scientific Research Institutions will represent the largest application segment driving the demand for protein microarray chips. These institutions are at the forefront of exploring new scientific frontiers, discovering novel biomarkers, and developing innovative therapeutic strategies. The extensive use of protein microarrays in academic research for proteomics studies, target identification, and basic biological investigations underpins their dominant role. The continuous pursuit of knowledge and the need for sophisticated tools to unravel the complexities of biological systems ensure a sustained demand from this sector. The market value within this segment alone is projected to reach into the millions annually.

Furthermore, the Reverse Phase Protein Microarray (RPPA) segment is experiencing robust growth. RPPA technology, which involves analyzing proteins directly from cell lysates or tissue homogenates, offers advantages in studying post-translational modifications and signaling pathways. This makes it particularly valuable in cancer research and drug development for understanding protein activation states and therapeutic responses. The increasing focus on targeted therapies and personalized medicine is further boosting the adoption of RPPA for biomarker profiling. The global production of protein microarray chips is estimated to be in the millions of units annually, with a significant portion catering to research and diagnostic applications. The production capacity and technological advancements in manufacturing processes are crucial for meeting the escalating demand.

The protein microarray chip industry is experiencing a significant growth spurt driven by several key catalysts. The escalating demand for personalized medicine, which necessitates the identification of individual protein profiles for tailored treatments, is a primary growth driver. Furthermore, the continuous innovation in proteomics research, leading to the discovery of new protein biomarkers for various diseases, fuels the need for advanced protein microarray platforms. The increasing prevalence of chronic diseases globally also necessitates more efficient and accurate diagnostic tools, a role protein microarrays are well-suited to fulfill. Investments in drug discovery and development by pharmaceutical and biotechnology companies, seeking to identify novel therapeutic targets and understand drug mechanisms, are also contributing significantly to market expansion.

This report offers a comprehensive and multi-faceted analysis of the protein microarray chip market, ensuring that stakeholders gain a holistic understanding of its dynamics. Beyond market size and forecasts, the report delves into the intricate interplay of technological advancements, regulatory landscapes, and emerging application areas. It provides granular insights into the strengths and weaknesses of various protein microarray technologies, aiding in informed decision-making for research, development, and investment. The competitive intelligence provided on leading players, including their strategic initiatives and market positioning, is invaluable for understanding the competitive terrain. Furthermore, the report explores the potential impact of future trends, such as the increasing integration of artificial intelligence and machine learning, on the market's evolution, offering a forward-looking perspective. The detailed regional analysis highlights growth opportunities and challenges in key geographical markets, empowering businesses to tailor their strategies effectively. The extensive coverage aims to equip researchers, manufacturers, investors, and policymakers with the critical information needed to navigate and capitalize on the evolving protein microarray chip landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6%.

Key companies in the market include Illumina, Affymetrix, Agilent, RayBiotech, Creative Biolabs, Thermo Fisher Scientific, Creative BioMart, Macrogen, OriGene Technologies, CD Genomics, .

The market segments include Type, Application.

The market size is estimated to be USD 822.6 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Protein Microarray Chip," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Protein Microarray Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.