1. What is the projected Compound Annual Growth Rate (CAGR) of the Protecting Unnatural Amino Acids?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Protecting Unnatural Amino Acids

Protecting Unnatural Amino AcidsProtecting Unnatural Amino Acids by Type (FMOC, BOC, Others, World Protecting Unnatural Amino Acids Production ), by Application (Drug, Health Care Products, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

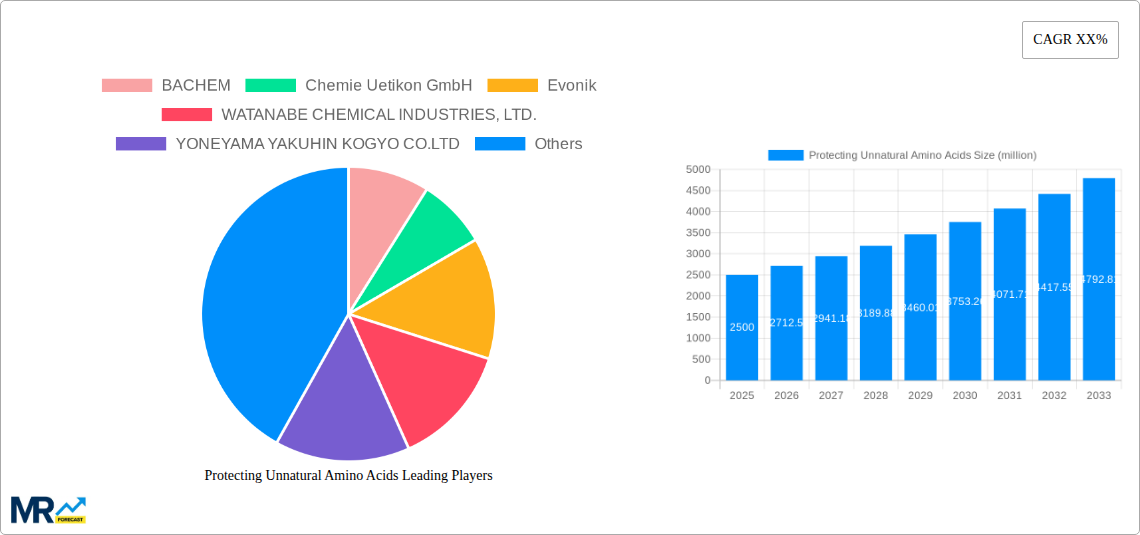

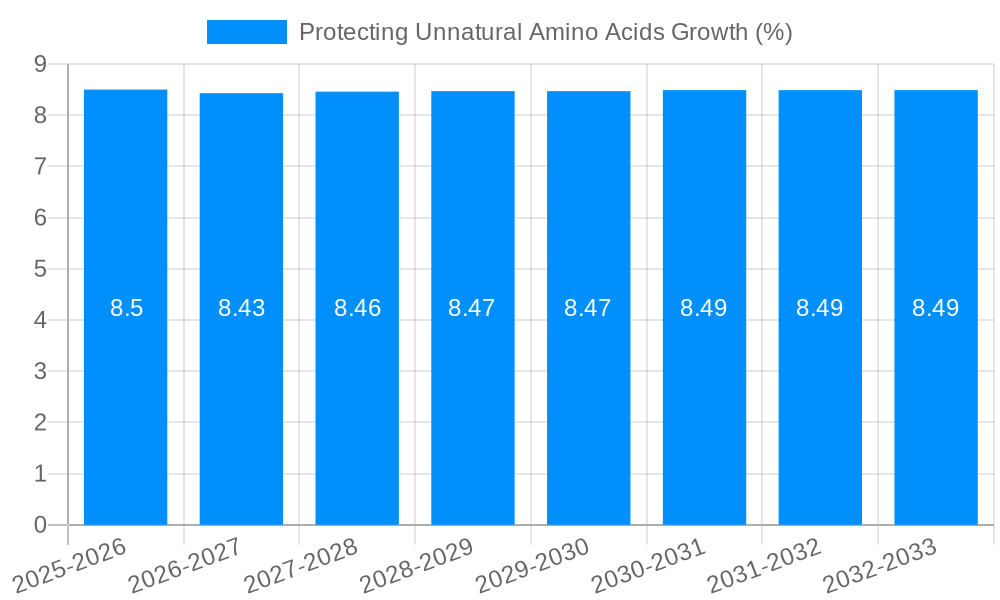

The global market for Protecting Unnatural Amino Acids is poised for significant expansion, driven by the increasing demand for novel therapeutics and advanced healthcare products. With an estimated market size of $2,500 million in 2025, the sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This robust growth is primarily fueled by the burgeoning pharmaceutical industry's reliance on these specialized amino acids for developing peptide-based drugs, antibodies, and other complex biomolecules. The trend towards personalized medicine and the continuous research into new drug targets further bolster the demand. Furthermore, the increasing application of unnatural amino acids in diagnostics, advanced materials, and as research tools contributes to the market's upward trajectory. The market is broadly segmented into FMOC, BOC, and Other types, with FMOC and BOC dominating due to their established use in peptide synthesis. Applications span across drugs, healthcare products, and other research-intensive sectors, with drug development being the largest contributor.

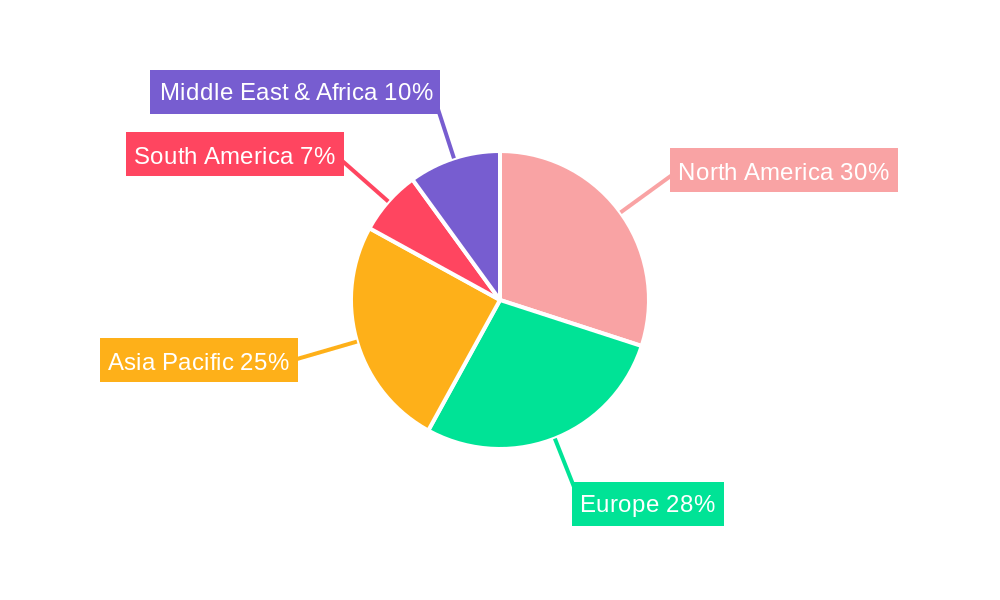

The market's potential is further amplified by ongoing research and development activities aimed at discovering and synthesizing new classes of unnatural amino acids with unique properties. These innovations are critical for overcoming limitations of natural amino acids and expanding therapeutic possibilities. However, challenges such as the high cost of production and synthesis, stringent regulatory approvals for novel compounds, and the complexity of research and development can act as restraints. Geographically, Asia Pacific, led by China and India, is emerging as a key growth region due to its expanding biopharmaceutical manufacturing capabilities and substantial investments in R&D. North America and Europe remain dominant markets, owing to their established pharmaceutical ecosystems and high expenditure on healthcare innovation. Key players like BACHEM, Evonik, and GL Biochem (Shanghai) Ltd. are actively involved in expanding their production capacities and portfolio to cater to the growing global demand for protecting unnatural amino acids.

This comprehensive report delves into the intricate world of protecting unnatural amino acids, a critical area within the burgeoning field of advanced chemical synthesis and pharmaceutical development. Unnatural amino acids (UAAs), with their unique side chains and functionalities, offer unparalleled opportunities for designing novel therapeutics, advanced materials, and sophisticated biotechnological tools. The protection of these specialized amino acid building blocks is paramount to ensuring their controlled incorporation into complex molecular structures, thereby enabling groundbreaking scientific and industrial advancements.

Study Period: 2019-2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025-2033 Historical Period: 2019-2024

The market for protecting unnatural amino acids is experiencing a robust upward trajectory, driven by escalating demand from the pharmaceutical and biotechnology sectors for more targeted and effective drug delivery systems, peptide therapeutics, and protein engineering applications. As research into novel drug modalities intensifies, the need for precisely engineered building blocks like UAAs, with their unique chemical properties, becomes indispensable. This report will provide an in-depth analysis of market trends, examining the interplay of technological advancements, regulatory landscapes, and emerging applications that shape this dynamic sector. We will explore the production volumes, projected to reach tens of millions of units by the forecast period, and the diversified applications spanning pharmaceuticals, healthcare products, and other specialized industries. This detailed analysis will equip stakeholders with the strategic insights necessary to navigate this evolving market, identify lucrative opportunities, and anticipate future industry developments.

The global market for protecting unnatural amino acids is currently exhibiting a pronounced expansion, a trend underpinned by the relentless pursuit of innovation within the pharmaceutical and biotechnology industries. As drug discovery pipelines increasingly embrace peptide-based therapeutics, protein engineering, and the development of novel diagnostic agents, the demand for specialized and precisely functionalized amino acid building blocks, particularly unnatural amino acids (UAAs), has surged. The protection strategies employed for these UAAs are not merely a preparatory step but a crucial determinant of their successful integration into complex biomolecules, influencing their stability, efficacy, and targeted delivery. Current market insights reveal a significant shift towards more sophisticated protection chemistries that offer improved orthogonality, higher yields, and reduced side reactions. The World Protecting Unnatural Amino Acids Production is projected to see substantial growth, potentially reaching several tens of millions of units annually by the end of the forecast period. This expansion is directly correlated with the increasing complexity and scale of UAA-based research and development projects globally. Furthermore, the market is witnessing a growing emphasis on sustainable and environmentally friendly protection methodologies, aligning with broader industry trends towards green chemistry. The adoption of these advanced protection techniques is critical for unlocking the full potential of UAAs in developing next-generation therapeutics for a wide array of diseases, including cancer, metabolic disorders, and infectious diseases. The evolution of UAA synthesis and protection is closely intertwined with advancements in solid-phase peptide synthesis (SPPS) and liquid-phase synthesis, with the market responding to demands for both high-purity bulk chemicals and custom-synthesized specialized derivatives. The increasing investment in research and development by key market players, coupled with strategic collaborations and acquisitions, is further fueling innovation and market penetration. The projected growth indicates a sustained demand for these vital chemical intermediates, solidifying their importance in the modern landscape of drug development and bio-manufacturing.

The rapid ascent of the protecting unnatural amino acids market is propelled by a confluence of powerful driving forces, primarily rooted in the relentless innovation within the life sciences. The burgeoning field of peptide therapeutics, with its promise of highly targeted and potent treatments for a myriad of diseases, stands as a cornerstone driver. Unnatural amino acids are instrumental in enhancing the pharmacological profiles of peptides, improving their stability against enzymatic degradation, and enabling novel modes of action. Consequently, the demand for protected UAAs for peptide synthesis is soaring. Furthermore, the advancements in protein engineering, where UAAs are incorporated to introduce specific functionalities, create biosensors, or modify protein structures for therapeutic or industrial applications, are significantly contributing to market growth. The expanding application of UAAs in drug discovery for areas such as oncology, neurodegenerative diseases, and autoimmune disorders, where traditional small molecules often fall short, is creating a substantial need for their protected derivatives. The increasing sophistication of synthetic biology and the development of novel bioconjugation strategies also rely heavily on the precise control offered by protected UAAs. Moreover, the growing emphasis on personalized medicine and the development of tailored therapeutic agents further amplify the requirement for a diverse and readily available supply of protected unnatural amino acids. The overall market volume for World Protecting Unnatural Amino Acids Production is anticipated to witness an upward surge, potentially reaching millions of units by 2025, reflecting this escalating demand across various advanced research and development initiatives.

Despite the promising growth trajectory, the protecting unnatural amino acids market faces several inherent challenges and restraints that could temper its expansion. A primary hurdle is the inherent complexity and cost associated with the synthesis and purification of many unnatural amino acids and their subsequent protection. The specialized reagents and multi-step synthetic pathways often involved lead to higher production costs compared to standard amino acids, potentially limiting accessibility for certain research endeavors or large-scale manufacturing. The development and optimization of robust, scalable, and orthogonal protection strategies for a vast array of UAA structures remain an ongoing challenge. Ensuring the compatibility of protecting groups with downstream synthetic processes and their facile removal without compromising the integrity of the UAA or the final biomolecule is critical. Furthermore, regulatory scrutiny surrounding the manufacturing and use of novel chemical entities, including UAAs and their derivatives, can introduce significant lead times and compliance burdens for market entrants and established players alike. The availability of a consistent and high-quality supply chain for specialized raw materials required for UAA synthesis and protection can also pose a constraint, particularly for niche UAAs. Lastly, the relatively nascent stage of some UAA applications means that market adoption and large-scale commercialization are still in development, creating a degree of market uncertainty. The overall World Protecting Unnatural Amino Acids Production might experience fluctuations due to these factors, though the overall trend remains positive.

The global landscape of protecting unnatural amino acids is characterized by regional strengths and segment-specific dominance, with both factors intricately linked.

Key Dominating Segments:

Type: FMOC and BOC: These two protecting groups, Fluorenylmethyloxycarbonyl (FMOC) and tert-Butyloxycarbonyl (BOC), are foundational in peptide synthesis and consequently dominate the protecting unnatural amino acids market.

Application: Drug: The pharmaceutical industry is undeniably the largest and most significant application segment driving the demand for protecting unnatural amino acids.

Key Dominating Regions/Countries:

The interplay between these dominating segments and regions creates a dynamic market where demand for specific protection types is closely tied to the application focus and geographical R&D strengths. The overall World Protecting Unnatural Amino Acids Production is thus a reflection of these interconnected market forces.

Several key growth catalysts are propelling the protecting unnatural amino acids industry forward. The escalating research and development in peptide therapeutics, driven by their high specificity and reduced side effects compared to traditional drugs, is a primary catalyst. Advances in protein engineering, enabling the design of novel proteins with enhanced functionalities for diagnostics, therapeutics, and industrial enzymes, also create substantial demand. The increasing use of UAAs in the development of targeted drug delivery systems, such as antibody-drug conjugates (ADCs), further fuels market expansion. Furthermore, the growing number of synthetic biology applications, where UAAs are incorporated to create designer proteins and novel biomaterials, acts as a significant growth driver. The continuous innovation in synthetic methodologies for producing a wider array of UAAs and developing more efficient and orthogonal protection strategies also contributes to market growth by increasing accessibility and reducing costs.

This report offers an exhaustive examination of the protecting unnatural amino acids market, providing unparalleled insights for stakeholders across the value chain. It delves into the intricate market dynamics, dissecting the interplay of technological advancements, evolving research trends, and diverse application needs. The report meticulously analyzes the growth catalysts, including the burgeoning peptide therapeutics sector and advancements in protein engineering, while also critically assessing the challenges and restraints that shape market expansion. A granular breakdown of market segmentation by type (FMOC, BOC, Others) and application (Drug, Health Care Products, Other) allows for a targeted understanding of demand drivers. Furthermore, the report highlights key regional markets and countries poised for dominance, supported by robust data and expert analysis. The inclusion of leading players and significant recent and forecasted developments offers a comprehensive overview of the competitive landscape and future trajectory of the industry. This report is an indispensable resource for companies seeking to capitalize on the immense opportunities within the rapidly evolving world of protecting unnatural amino acids, projecting the World Protecting Unnatural Amino Acids Production to reach significant volumes.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BACHEM, Chemie Uetikon GmbH, Evonik, WATANABE CHEMICAL INDUSTRIES, LTD., YONEYAMA YAKUHIN KOGYO CO.LTD, VARSAL, CPC Scientific, Omizzur Biotech, Matrix Innovation, GL Biochem (Shanghai) Ltd, ZY BIOCHEM, TACHEM, Enlai Biotechnology, anhuabio, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Protecting Unnatural Amino Acids," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Protecting Unnatural Amino Acids, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.