1. What is the projected Compound Annual Growth Rate (CAGR) of the Professional Sports Camera?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Professional Sports Camera

Professional Sports CameraProfessional Sports Camera by Type (Ultra HD, HD, World Professional Sports Camera Production ), by Application (Online, Offline, World Professional Sports Camera Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

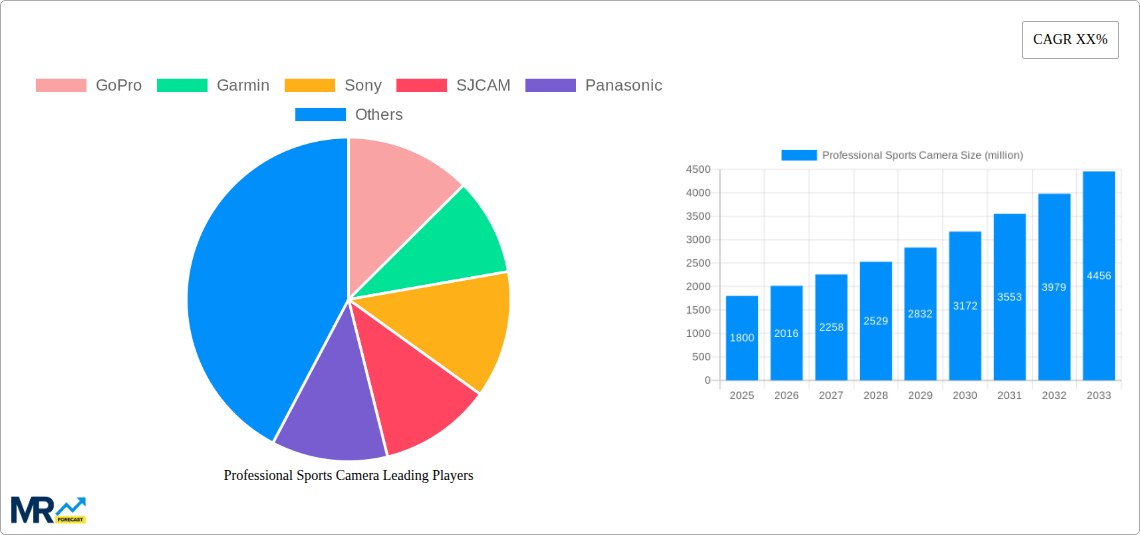

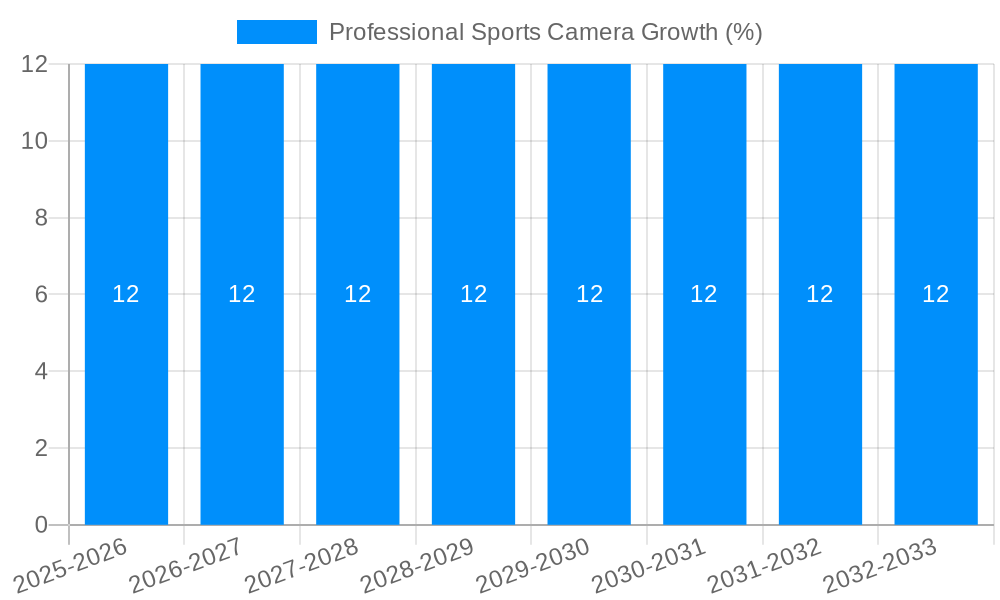

The global professional sports camera market is projected for substantial growth, driven by an estimated market size of $1.8 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 12% through 2033. This robust expansion is fueled by the increasing demand for high-definition and ultra-high-definition video content from professional sports organizations, broadcasters, and content creators worldwide. The proliferation of e-sports, the growing popularity of action sports, and the continuous innovation in camera technology, including advanced stabilization, wider field-of-view, and enhanced durability, are key drivers. Furthermore, the integration of AI-powered features for automated content creation and analysis is also contributing significantly to market adoption. The widespread use of these cameras in both online streaming platforms and traditional broadcast channels underscores their integral role in delivering immersive sporting experiences to a global audience.

The market landscape for professional sports cameras is characterized by intense competition among established players and emerging brands, including GoPro, Garmin, Sony, and DJI, who are actively investing in research and development to introduce cutting-edge products. Key trends include the miniaturization of cameras, improvements in battery life, and the development of wireless connectivity solutions for seamless data transfer. However, certain factors may present challenges. The high initial cost of professional-grade equipment and the rapid pace of technological obsolescence can act as restraints for some market segments. Additionally, the need for specialized technical expertise for operation and post-production can be a barrier to entry for smaller entities. Despite these potential hurdles, the overarching trend towards richer, more dynamic sports coverage, coupled with the expanding reach of digital media, ensures a promising future for the professional sports camera market. The market is segmented by type into Ultra HD and HD cameras, with Ultra HD expected to dominate due to its superior visual quality, and by application into Online and Offline usage, both of which are crucial for different broadcast and content distribution strategies.

This report offers an in-depth analysis of the global professional sports camera market, meticulously examining its trajectory from the historical period of 2019-2024, the base year of 2025, and projecting its growth through the forecast period of 2025-2033. The study period spans from 2019 to 2033, providing a holistic view of market dynamics. We anticipate a significant expansion in production, with world professional sports camera production poised to reach tens of millions of units annually by the end of the forecast period. The report delves into key segments such as Ultra HD and HD cameras, and applications encompassing both online and offline consumption, offering actionable insights for stakeholders.

The professional sports camera market is experiencing a profound transformation driven by technological advancements, evolving consumer demands, and the burgeoning content creation ecosystem. XXX The integration of advanced imaging technologies, such as higher resolution sensors, enhanced image stabilization, and superior low-light performance, is not just an upgrade but a fundamental shift, enabling capturing the raw intensity and nuanced drama of athletic events like never before. Ultra HD resolution, particularly 4K and increasingly 8K, is rapidly becoming the standard, offering unparalleled detail and clarity that is critical for professional broadcasting, cinematic sports documentaries, and immersive fan experiences. Furthermore, the miniaturization and ruggedization of these devices have made them indispensable tools for athletes themselves, allowing for authentic, in-the-moment perspectives. The proliferation of high-speed data transfer capabilities and enhanced connectivity features is facilitating seamless integration into broadcast workflows, enabling live streaming and real-time analysis. Beyond technical specifications, there's a growing trend towards cameras with AI-powered features, such as intelligent subject tracking and automated editing, which streamline the production process and democratize high-quality content creation. The market is also witnessing a diversification of form factors, with specialized cameras designed for specific sports and action scenarios, catering to niche yet significant demand. This evolution is fundamentally reshaping how sports are captured, consumed, and experienced, moving beyond static broadcasts to dynamic, multi-faceted storytelling. The demand for smaller, lighter, and more versatile cameras continues to rise, as these devices are crucial for capturing action from unique and challenging angles that were previously inaccessible. The integration of advanced features like advanced image stabilization, improved battery life, and greater water and shock resistance further solidifies their utility in extreme sports environments.

The remarkable growth of the professional sports camera market is underpinned by several potent driving forces that are reshaping the landscape of sports content creation and consumption. The insatiable global appetite for live sports and engaging sports-related content is a primary catalyst. As sports leagues and organizations continue to expand their reach, the demand for high-quality, immersive visual storytelling to engage a global audience escalates. This fuels the need for robust, versatile camera solutions capable of capturing every moment of the action with exceptional clarity and dynamism. The democratization of content creation, powered by social media platforms and streaming services, has also played a pivotal role. Athletes, independent filmmakers, and even amateur enthusiasts are increasingly investing in professional-grade sports cameras to produce and share their own narratives, creating a parallel ecosystem of content that complements traditional media. Furthermore, advancements in imaging technology, particularly in resolution, frame rates, and low-light performance, are consistently pushing the boundaries of what is possible, encouraging early adoption by professionals seeking a competitive edge. The increasing adoption of these cameras for training and performance analysis by athletes and coaching staff is another significant driver, offering invaluable data and insights through high-definition, multi-angle recordings. The growing trend of esports also contributes to this market, with specialized cameras needed to capture the intense on-screen action and player reactions.

Despite the robust growth trajectory, the professional sports camera market is not without its hurdles and restraints. The high cost of cutting-edge professional sports cameras and their associated accessories can be a significant barrier to entry for smaller production houses, independent creators, and athletes with limited budgets. This premium pricing, while justified by advanced features and durability, restricts market penetration in certain segments. Rapid technological obsolescence is another concern; the pace of innovation means that expensive equipment can quickly become outdated, necessitating continuous investment to stay current with industry standards. This necessitates careful strategic planning for businesses and individuals alike. The complexity of advanced features and software integration also presents a challenge. While beneficial for professionals, the steep learning curve associated with some of these technologies can deter less technically inclined users, requiring substantial training and support. Moreover, the market is susceptible to the cyclical nature of the sports industry and economic downturns. Significant sporting events and leagues are often the primary drivers of demand, and any disruption to these can have a ripple effect on camera sales. The intense competition among established players and the emergence of new entrants also puts pressure on pricing and profit margins. Finally, the need for specialized infrastructure, such as high-speed storage, editing suites, and robust data management systems, to effectively utilize the massive amounts of data generated by these cameras adds to the overall cost and complexity of deployment.

The Ultra HD segment of the World Professional Sports Camera Production market is set to exhibit unparalleled dominance, driven by its inherent technological superiority and the escalating demand for hyper-realistic visual experiences across various sports. As the industry standard shifts, the need for cameras capable of capturing content in 4K, 8K, and beyond will only intensify. This segment is particularly strong in regions with well-established broadcast infrastructure and a high concentration of professional sports leagues and media organizations.

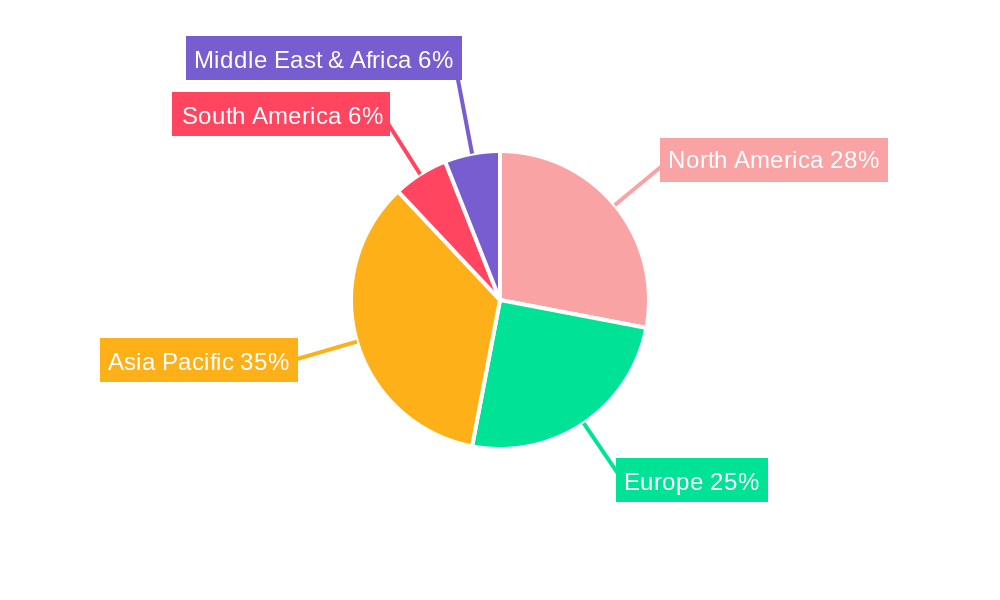

North America and Europe are poised to be the leading regions in this market.

Asia-Pacific is projected to be the fastest-growing region, fueled by increasing disposable incomes, a burgeoning sports fan base, and significant investments in sports infrastructure and broadcasting. Countries like China, Japan, and South Korea are witnessing a rapid adoption of advanced technologies in their media and sports sectors, making the Ultra HD segment a key growth area.

Within the Ultra HD segment, the applications for Online consumption are particularly influential in shaping market dominance. The explosion of online streaming platforms, social media video content, and dedicated sports websites has created an insatiable demand for high-resolution footage. Broadcasters and content creators are increasingly prioritizing Ultra HD to cater to audiences who expect the best visual quality on their connected devices, from smart TVs to high-resolution mobile screens. This symbiotic relationship between Ultra HD technology and online content delivery solidifies its position as the dominant segment in the global professional sports camera market.

The professional sports camera industry is experiencing robust growth fueled by several key catalysts. The escalating demand for immersive and engaging fan experiences, driven by the rise of streaming platforms and social media, compels sports organizations and broadcasters to invest in higher-quality capture technology. Advancements in miniaturization and durability make these cameras more versatile for extreme sports and unique aerial perspectives, opening new content avenues. The increasing use of cameras for athlete performance analysis and training provides a steady, high-value demand stream. Furthermore, the expanding esports market necessitates specialized camera solutions, broadening the overall market scope.

This comprehensive report provides an in-depth analysis of the global professional sports camera market, spanning from historical trends to future projections. It meticulously examines market size, segmentation, key drivers, challenges, and regional dynamics. The report leverages extensive primary and secondary research, including expert interviews and proprietary data, to deliver actionable insights. It covers key companies, emerging technologies, and the evolving landscape of sports content creation and consumption. Stakeholders will gain a holistic understanding of market opportunities, competitive strategies, and potential investment avenues within this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include GoPro, Garmin, Sony, SJCAM, Panasonic, RICOH, iON, Contour, Polaroid, Drift Innovation, Amkov, DJI, Xiaomi, Olympus, Toshiba.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Professional Sports Camera," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Professional Sports Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.