1. What is the projected Compound Annual Growth Rate (CAGR) of the Processed Meat Emulsifier?

The projected CAGR is approximately 6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Processed Meat Emulsifier

Processed Meat EmulsifierProcessed Meat Emulsifier by Application (Sausage, Beef, Pork, Other), by Type (Warm Process, Cold Process, World Processed Meat Emulsifier Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

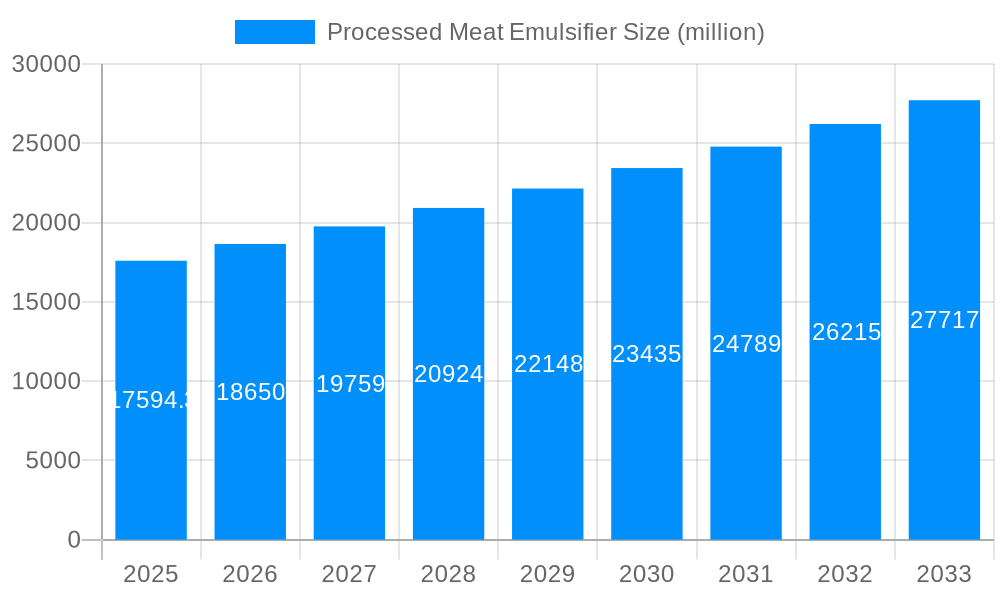

The global processed meat emulsifier market is poised for robust growth, projected to reach an estimated $17,594.3 million by 2025. This expansion is driven by a consistent Compound Annual Growth Rate (CAGR) of 6%, indicating a healthy and sustained upward trajectory. The increasing consumer demand for convenience, ready-to-eat food products, and particularly processed meat items like sausages, beef, and pork, is a primary catalyst. Emulsifiers play a crucial role in enhancing the texture, stability, and shelf-life of these products, making them indispensable ingredients for manufacturers. Furthermore, advancements in food processing technologies and the growing adoption of efficient processing methods, such as warm processing, contribute to market expansion. The market's dynamism is further fueled by innovation in emulsifier formulations designed to meet evolving consumer preferences for healthier, cleaner-label products.

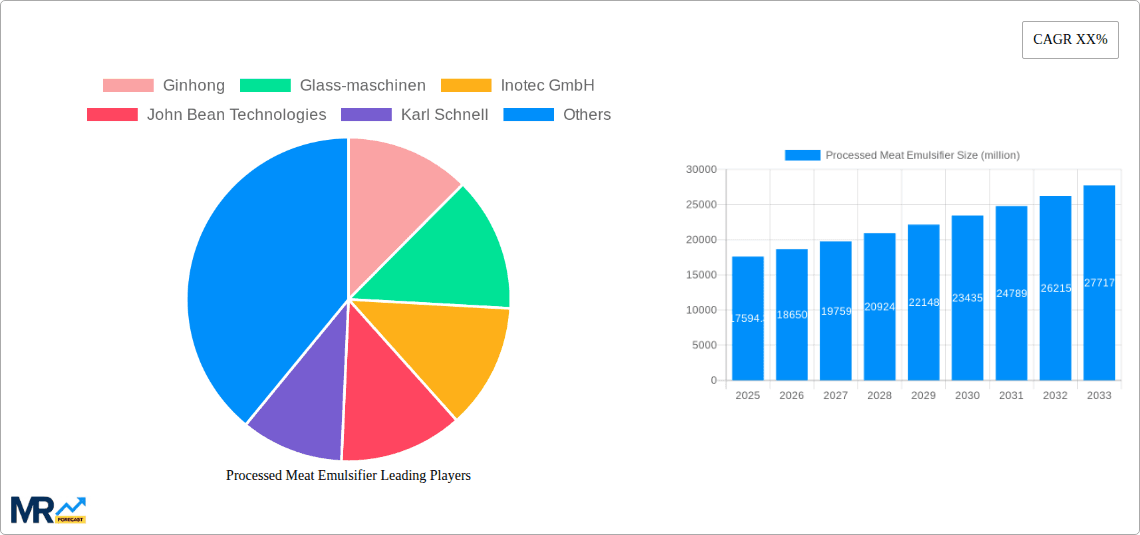

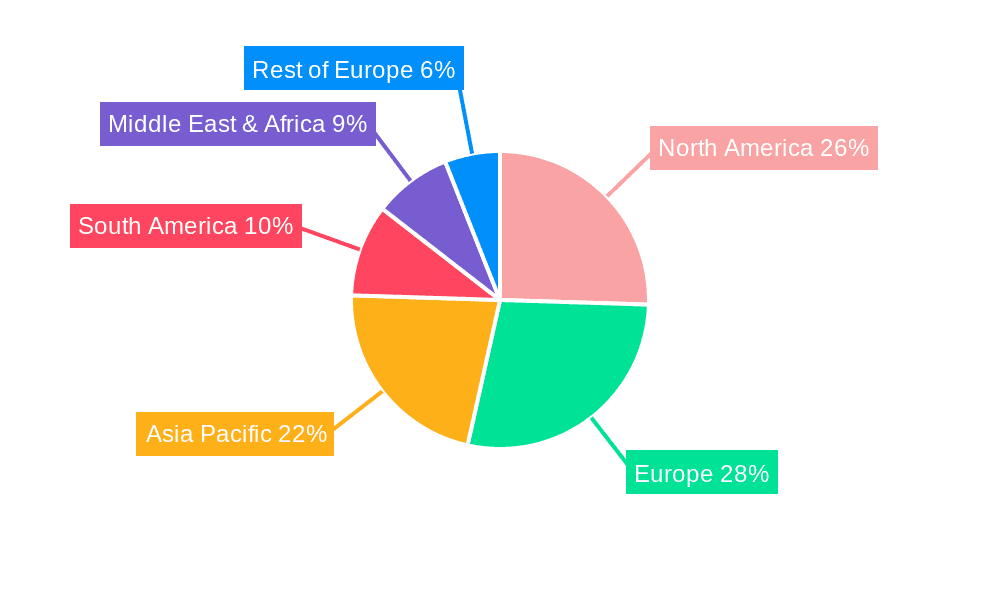

The competitive landscape of the processed meat emulsifier market features a blend of established global players and specialized regional manufacturers, all vying for market share through product innovation, strategic partnerships, and geographical expansion. Key segments within the market include applications like sausages, beef, and pork, with "Other" applications also demonstrating potential. The dominant types of emulsifiers are warm process, cold process, and world process, each catering to specific manufacturing needs and product characteristics. Geographically, North America and Europe are anticipated to remain significant markets, owing to their well-established processed meat industries and high per capita consumption. However, the Asia Pacific region, with its rapidly growing population, increasing disposable incomes, and a burgeoning middle class, presents substantial growth opportunities. The market's future is characterized by a continuous drive towards efficiency, quality improvement, and the development of novel emulsifier solutions that align with global food safety standards and consumer well-being trends.

Here's a report description on Processed Meat Emulsifiers, incorporating your specified details and structure:

The global processed meat emulsifier market is poised for substantial growth, projected to reach a valuation exceeding USD 800 million by the end of the forecast period in 2033. This upward trajectory is underpinned by a confluence of evolving consumer preferences, technological advancements in food processing, and a persistent demand for convenience food products. During the historical period of 2019-2024, the market witnessed steady expansion, driven by increasing urbanization and a growing middle class in emerging economies, who are increasingly adopting Western dietary habits that often include processed meat products. The base year, 2025, sets a crucial benchmark for understanding the current market landscape, with estimates suggesting a continued positive momentum leading into the forecast period.

The intrinsic function of emulsifiers in processed meats – to stabilize fat and water mixtures, improve texture, enhance mouthfeel, and extend shelf-life – remains their primary value proposition. As manufacturers strive to optimize product quality and consistency while managing costs, the reliance on advanced emulsification technologies is set to intensify. Furthermore, the market is observing a distinct shift towards higher-quality, minimally processed options, which, while seemingly counterintuitive to the "processed meat" label, necessitates sophisticated emulsification techniques to achieve desired sensory attributes without relying heavily on artificial additives. This trend is particularly evident in premium sausage and beef product categories.

The influence of sustainability and clean-label trends is also subtly shaping the emulsifier landscape. While traditional synthetic emulsifiers continue to hold a significant market share, there is a growing interest in naturally derived emulsifiers and processing methods that minimize energy consumption. This dual focus on performance and perceived health benefits is driving innovation and research into novel emulsification solutions. The market's dynamic nature is further highlighted by the segmentation based on processing type, with both Warm Process and Cold Process applications demonstrating distinct growth patterns, catering to different product requirements and consumer demands. The World Processed Meat Emulsifier Production is thus a complex interplay of established demands and emerging innovations.

The processed meat emulsifier market is experiencing a robust expansion primarily fueled by the ever-increasing global demand for processed meat products. As populations grow and urbanization continues its relentless march, the consumption of convenient and ready-to-eat food options, including sausages, burgers, and other processed meat preparations, has surged. This surge directly translates into a higher demand for emulsifiers, which are indispensable ingredients for achieving the desired texture, stability, and appearance of these products. Furthermore, technological advancements in food processing equipment, particularly by leading manufacturers like Marel, Stephan Machinery, and Seydelmann, are enabling more efficient and sophisticated emulsification processes, thereby supporting larger production volumes and higher quality outputs.

The rising disposable incomes in developing nations are also a significant propellant. Consumers with increased purchasing power are more likely to opt for a wider variety of processed meat products, thereby expanding the addressable market for emulsifier manufacturers. Moreover, the inherent functional benefits of emulsifiers – their ability to bind fat and water, prevent separation, and improve the overall sensory experience of processed meats – make them crucial for manufacturers aiming to deliver consistent and appealing products to the market. This intrinsic value, coupled with ongoing research and development by companies like John Bean Technologies and Karl Schnell to create more effective and specialized emulsifiers, continues to drive market growth. The industry's ability to adapt to evolving consumer tastes, such as the demand for reduced fat or cleaner labels, also contributes to the sustained demand for innovative emulsification solutions.

Despite the positive growth outlook, the processed meat emulsifier market is not without its hurdles. A significant challenge stems from the increasing consumer awareness and demand for "clean-label" products. This trend puts pressure on manufacturers to reduce or replace synthetic emulsifiers with natural alternatives, which can sometimes be more expensive or less effective in certain applications. The complexity of achieving desired product characteristics with natural emulsifiers, particularly in established product categories like traditional sausages, can lead to reformulation challenges and increased production costs, acting as a restraint on the widespread adoption of solely natural solutions. Regulatory scrutiny surrounding food additives, including emulsifiers, also presents a challenge. While currently not a major bottleneck, evolving regulations could necessitate costly adjustments in product formulations or manufacturing processes.

The volatile nature of raw material prices, which can impact the cost-effectiveness of producing certain emulsifiers, poses another constraint. Fluctuations in the cost of vegetable oils, proteins, or other components used in emulsifier manufacturing can create pricing instability and affect profit margins for both emulsifier producers and their clients in the processed meat industry. Furthermore, the market is highly competitive, with numerous players vying for market share. This intense competition can lead to price wars and a squeeze on profitability, particularly for smaller manufacturers. The capital-intensive nature of sophisticated emulsification equipment, often supplied by companies like Glass-maschinen and Inotec GmbH, can also be a barrier to entry for new players, although it also signifies high standards for existing ones. Finally, negative consumer perceptions surrounding processed meats themselves, often fueled by health concerns, can indirectly dampen the demand for all ingredients associated with them, including emulsifiers.

The Sausage application segment is projected to be a dominant force in the global processed meat emulsifier market throughout the study period of 2019-2033. This dominance is attributed to several interconnected factors, including deeply ingrained cultural consumption patterns, the versatility of sausages as a convenience food, and the critical role emulsifiers play in their production. In regions like Europe, particularly Germany, and North America, sausages are a staple food with a long history and diverse culinary traditions. The sheer volume of sausage production globally, encompassing a wide array of types from breakfast links to artisanal varieties, inherently translates into a substantial demand for emulsifiers. Manufacturers rely heavily on these ingredients to achieve the characteristic smooth texture, consistent fat distribution, and stable emulsion that consumers expect in their sausages.

Within the sausage segment, both Warm Process and Cold Process types will contribute significantly to market growth.

The ongoing innovation in sausage formulations, including the development of reduced-fat or plant-based alternatives that still aim to mimic traditional meat textures, further necessitates the sophisticated use of emulsifiers. Companies like Ginhong and Maschinenfabrik LASKA provide advanced processing equipment that caters to the specific needs of sausage production, thereby supporting the emulsifier market. The global nature of sausage consumption, with its presence across numerous countries and cultures, solidifies its position as a leading segment. Other applications such as Beef and Pork, while significant, are often processed into different forms where emulsifier requirements might be less pronounced or more specialized compared to the broad and consistent demand within the sausage category.

The processed meat emulsifier industry is being propelled by several key growth catalysts. The relentless global demand for convenient and affordable protein sources, driven by population growth and urbanization, directly fuels the processed meat sector and, consequently, the need for emulsifiers. Technological advancements in food processing machinery, exemplified by innovations from companies like VICTUS International GmbH, are enabling more efficient and large-scale production, further boosting emulsifier consumption. Moreover, the continuous drive by food manufacturers to improve product quality, texture, and shelf-life in their processed meat offerings necessitates the use of advanced emulsification techniques.

This comprehensive report offers an in-depth analysis of the global processed meat emulsifier market, meticulously covering the period from 2019 to 2033, with a keen focus on the base year of 2025 and the forecast period from 2025-2033. It delves into the intricate market dynamics, identifying key trends and pivotal growth drivers such as the escalating demand for convenient food products and advancements in processing technologies. The report also scrutinizes the challenges and restraints that could potentially impede market expansion, including regulatory hurdles and evolving consumer preferences for clean-label products. Furthermore, it highlights dominant market segments like the sausage application and explores the crucial roles of both warm and cold processing types in shaping market demand. Strategic insights into the production landscape, leading companies, and significant industry developments are meticulously detailed, providing stakeholders with a holistic understanding of the market's past, present, and future trajectory, with projections reaching over USD 800 million.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6%.

Key companies in the market include Ginhong, Glass-maschinen, Inotec GmbH, John Bean Technologies, Karl Schnell, Marel, Maschinenfabrik LASKA, Pacific Food Machinery, Roser Group, Seydelmann, Stephan Machinery, VICTUS International GmbH.

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Processed Meat Emulsifier," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Processed Meat Emulsifier, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.