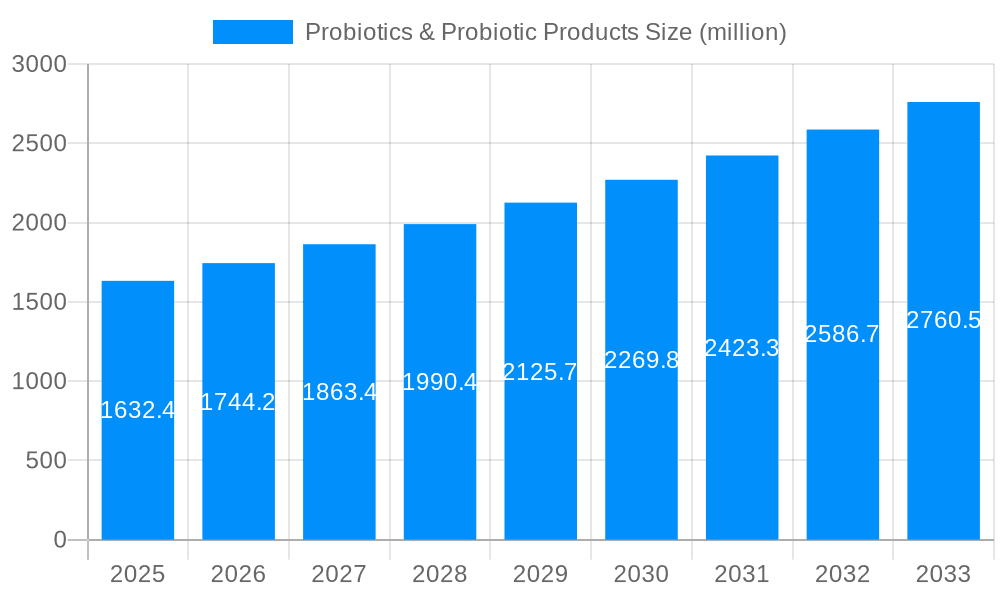

1. What is the projected Compound Annual Growth Rate (CAGR) of the Probiotics & Probiotic Products?

The projected CAGR is approximately 6.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Probiotics & Probiotic Products

Probiotics & Probiotic ProductsProbiotics & Probiotic Products by Type (Bifidobacterium, Lactobacillus, Others), by Application (Food & Beverage, Drugs, Dietary Supplements, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

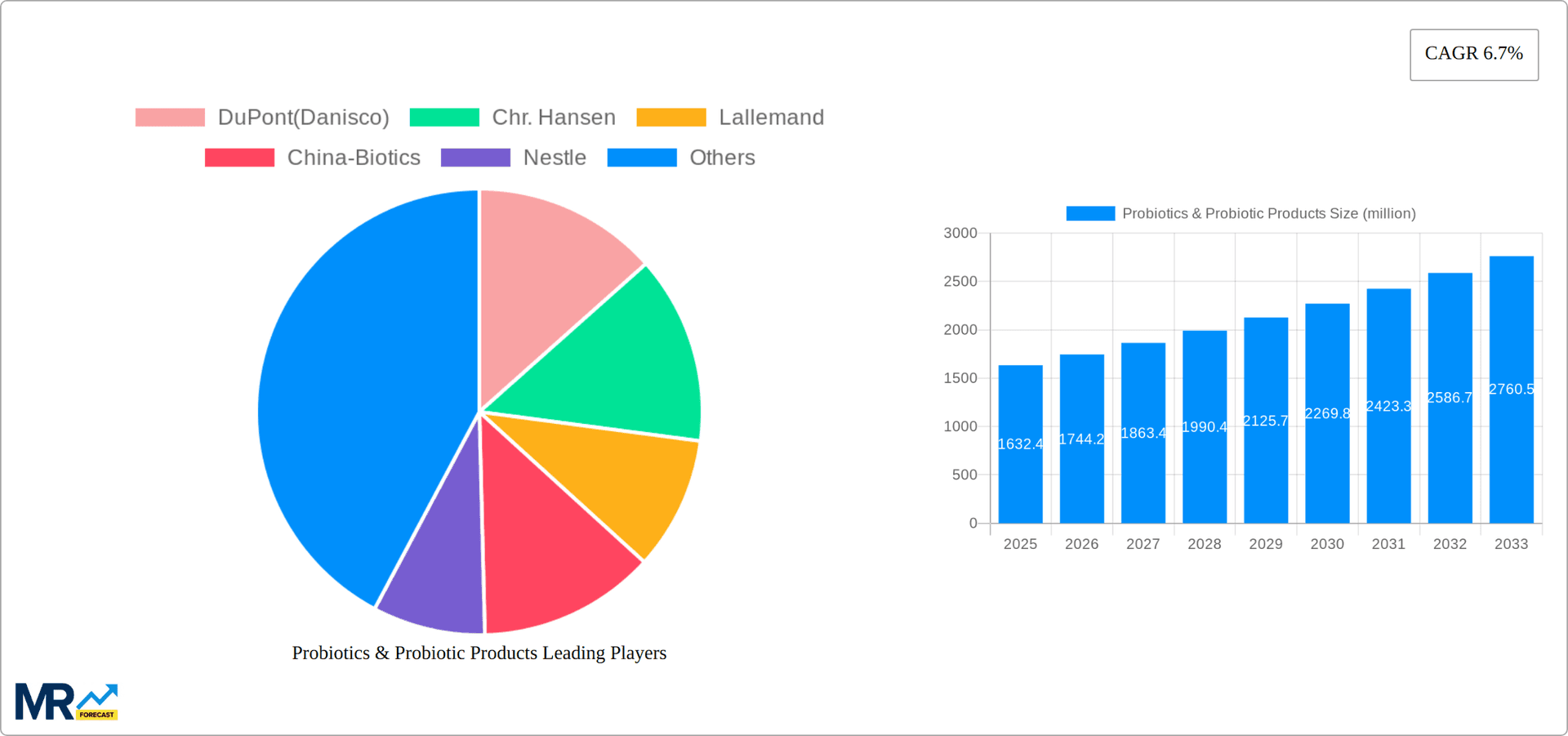

The global probiotics and probiotic products market is experiencing robust growth, projected to reach $1632.4 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.7% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing consumer awareness of gut health and its connection to overall wellness is a major factor. The rising prevalence of digestive disorders and the growing demand for natural health solutions further contribute to market growth. Furthermore, the expanding research and development efforts leading to innovative product formulations, such as targeted probiotics for specific health conditions, are fueling market expansion. The market's diverse product portfolio, encompassing dietary supplements, functional foods (yogurt, fermented beverages), and pharmaceuticals, contributes to its broad appeal and growth potential. Major players like DuPont (Danisco), Chr. Hansen, and Nestle are heavily invested in research, product innovation, and global market expansion, reinforcing the market's competitive landscape.

Despite the positive growth trajectory, the market faces certain restraints. The high cost of probiotic strains and the stringent regulatory requirements for approval can limit entry for smaller companies. Moreover, maintaining the viability and efficacy of probiotics throughout the product shelf life poses a consistent challenge. However, ongoing technological advancements in probiotic encapsulation and delivery systems are actively addressing this challenge. The future market growth will be significantly influenced by effective marketing and educational campaigns that raise consumer understanding of the various health benefits associated with probiotic consumption. The segment with the highest growth rate will likely be functional foods, given their growing popularity and widespread accessibility compared to more specialized probiotic supplements. Geographical expansion into developing markets presents a significant opportunity for market expansion, particularly in regions with rising health consciousness and disposable incomes.

The global probiotics and probiotic products market experienced robust growth throughout the historical period (2019-2024), exceeding an estimated value of $XX billion in 2025. This surge is primarily driven by increasing consumer awareness of gut health's crucial role in overall well-being. The rising prevalence of digestive disorders, coupled with the growing popularity of functional foods and beverages, significantly boosted demand for probiotic-enriched products. Furthermore, the expanding research base highlighting the positive impact of probiotics on immunity, mental health, and even weight management has fueled market expansion. This positive trend is expected to continue into the forecast period (2025-2033), with projections indicating a compound annual growth rate (CAGR) of XX% leading to a market valuation exceeding $YY billion by 2033. Consumers are actively seeking natural and preventative healthcare solutions, leading to a significant shift towards incorporating probiotics into their daily routines. This market is also being fueled by innovation in product formats, including novel delivery systems and enhanced efficacy formulations, catering to a wider consumer base with varying dietary preferences and health goals. Key market insights reveal a strong preference for dairy-based probiotics, yet the non-dairy segment is gaining momentum, reflecting the increasing demand for vegan and plant-based options. The market also showcases a notable regional disparity, with developed nations in North America and Europe exhibiting higher per capita consumption compared to emerging economies in Asia-Pacific, although the latter demonstrates substantial growth potential. The competitive landscape is characterized by both established industry giants and emerging players, prompting continuous product innovation and strategic partnerships to consolidate market share.

Several key factors are propelling the growth of the probiotics and probiotic products market. The escalating awareness among consumers regarding the gut-brain axis and its influence on overall health is a major driver. Scientific evidence increasingly links gut microbiota to various health conditions, including irritable bowel syndrome (IBS), inflammatory bowel disease (IBD), and even mental health disorders like anxiety and depression. This understanding pushes consumers towards proactive gut health management through probiotic consumption. The rising prevalence of chronic diseases, such as obesity and diabetes, further fuels demand for preventative and supportive healthcare measures, with probiotics recognized as a valuable tool. The increasing availability of diverse probiotic products in various forms, including yogurt, dietary supplements, and functional foods, significantly enhances market accessibility. Moreover, the expanding research and development activities in the field of probiotics, leading to the discovery of new strains and improved formulations with enhanced efficacy, contributes to market expansion. Furthermore, the growing adoption of personalized medicine approaches, allowing for tailored probiotic recommendations based on individual gut microbiome profiles, presents a significant growth opportunity. The increasing investment by key players in research, marketing, and product innovation further strengthens the market's trajectory.

Despite the significant market potential, the probiotics industry faces several challenges. One major hurdle is the lack of stringent regulatory frameworks globally, leading to inconsistencies in product quality, labeling, and efficacy claims. This can erode consumer confidence and hinder market growth. The variability in probiotic strain efficacy and the complexities of conducting robust clinical trials present significant hurdles in establishing clear-cut evidence of benefit for specific health conditions. The shelf life and stability of live probiotic cultures during storage and transit pose challenges for maintaining product quality and potency. Furthermore, the cost associated with research, development, and rigorous quality control measures can limit market penetration, especially in developing economies. The high cost of certain probiotic strains and the need for specialized production processes further restrict widespread access. Finally, consumer education and awareness campaigns are vital in addressing misconceptions and misinformation surrounding probiotic benefits, ensuring responsible consumption and fostering trust in the industry.

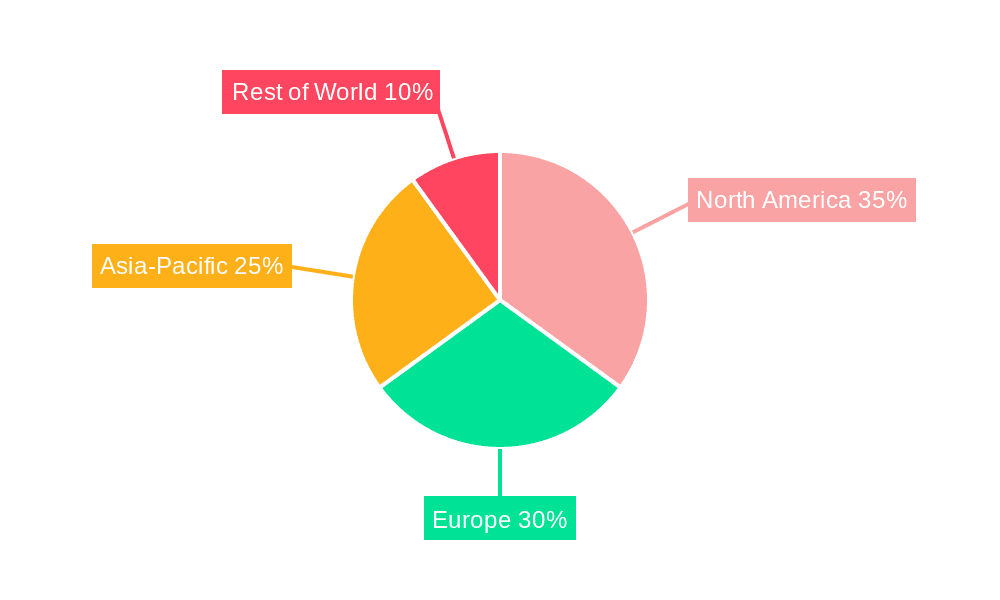

North America: This region holds a significant market share due to high consumer awareness, strong regulatory frameworks (although needing improvement), and substantial disposable income supporting premium probiotic products. The established healthcare infrastructure also fosters a conducive environment for market expansion.

Europe: Similar to North America, Europe enjoys a considerable market share, with high consumer spending on health and wellness products. The region’s focus on functional foods and beverages boosts the demand for probiotic-enriched options. However, stringent regulations also pose challenges.

Asia-Pacific: This region exhibits the fastest growth rate, driven by the rising middle class, increasing disposable income, and a growing awareness of health and wellness. However, inconsistencies in regulatory frameworks and varying levels of consumer education need addressing.

Segments: The dairy-based probiotics segment currently holds the largest market share due to established consumer acceptance and widespread availability. However, the non-dairy segment is witnessing remarkable growth driven by veganism and lactose intolerance. The dietary supplements segment is also growing, offering convenient and targeted probiotic delivery.

The paragraph emphasizes the regional disparities, highlighting the contrasting maturity levels of different markets. The high per capita consumption in developed nations is contrasted with the significant growth potential of emerging economies, where increasing disposable income and health consciousness are driving increased demand. The competitive intensity varies across regions, with established players dominating certain markets while innovative startups emerge in others. The report also notes the ongoing diversification of product formats and delivery systems to better cater to diverse consumer preferences and lifestyle choices.

Several factors are catalyzing the growth of the probiotics industry. The growing consumer understanding of the gut microbiome's role in overall health is a primary driver, encouraging proactive health management. Technological advancements are improving probiotic strain efficacy and stability, while the expanding range of product formats expands market reach. Moreover, increased scientific research and clinical validation build trust and broaden consumer acceptance. Finally, strategic collaborations between research institutions and industry players fuel innovation and accelerate market expansion.

This report provides a detailed analysis of the probiotics and probiotic products market, covering market size, trends, drivers, challenges, key players, and future growth prospects. The report includes forecasts for the period 2025-2033, offering valuable insights for businesses operating in this dynamic sector. It delves into the competitive landscape, analyzing the strategies adopted by leading players to secure market share and examining emerging trends, such as personalization and novel delivery systems. The report also offers an in-depth analysis of regional variations in market dynamics, allowing for a targeted approach to market entry and growth strategies. By combining quantitative data with qualitative insights, the report aims to provide a comprehensive understanding of the market's present state and future potential.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.7%.

Key companies in the market include DuPont(Danisco), Chr. Hansen, Lallemand, China-Biotics, Nestle, Danone, Probi, BioGaia, Yakult, Novozymes, Valio, Glory Biotech, Ganeden, Morinaga Milk Industry, Sabinsa, Greentech, Bioriginal, Biosearch Life, UAS Laboratories, Synbiotech, .

The market segments include Type, Application.

The market size is estimated to be USD 1632.4 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Probiotics & Probiotic Products," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Probiotics & Probiotic Products, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.