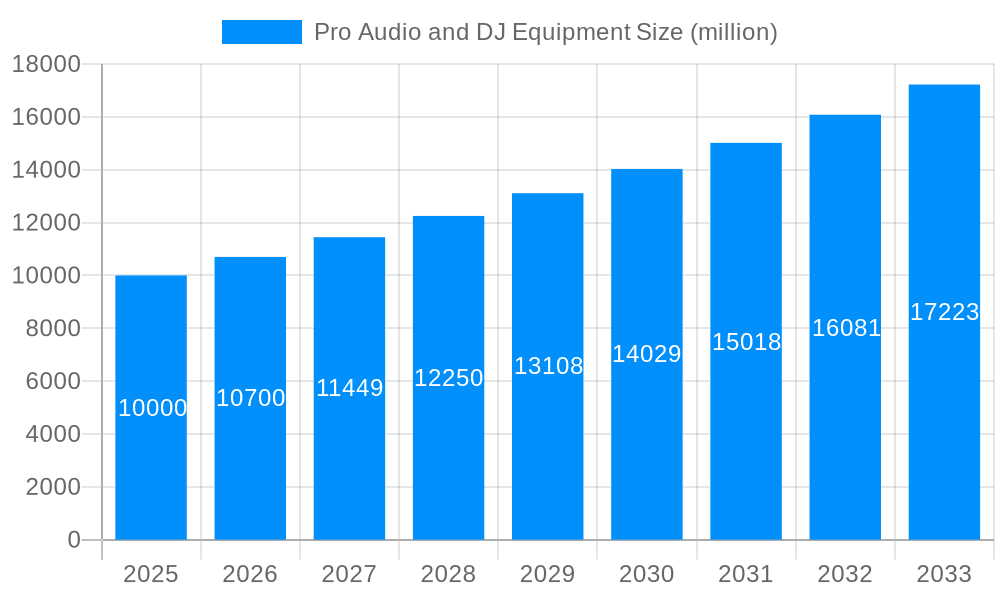

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pro Audio and DJ Equipment?

The projected CAGR is approximately 7.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pro Audio and DJ Equipment

Pro Audio and DJ EquipmentPro Audio and DJ Equipment by Application (Consumer, Pro Audio), by Type (Wireless Microphones, Mixers, Conference System, Wired Microphones, Ceiling Array Microphones, Content Creation Microphones), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The professional audio and DJ equipment market is poised for significant expansion, driven by the escalating demand for high-fidelity sound in live events, concerts, and festivals. The thriving electronic dance music (EDM) industry and the growth of professional streaming and podcasting further catalyze market development. Innovations in compact, versatile, and digitally integrated equipment are increasing adoption. The professionalization of smaller venues also elevates the need for advanced audio solutions. The global market is projected to reach $931.8 million by 2025, with a compound annual growth rate (CAGR) of 7.5%. Economic volatility and supply chain issues may present headwinds.

Key challenges include intense market competition, price sensitivity among smaller operators, and the market's reliance on the broader live events and economic landscape. Despite these factors, the long-term outlook is optimistic, supported by ongoing innovation, expanding applications in emerging media, and a persistent consumer demand for superior audio experiences. Market segments encompass microphones, mixers, speakers, headphones, and DJ controllers, serving diverse users from studios to individual artists. Industry leaders such as Sennheiser, Yamaha, and Shure maintain strong positions through brand equity and technological prowess, while new entrants introduce disruptive innovation and competitive pricing.

The global pro audio and DJ equipment market exhibited robust growth during the historical period (2019-2024), exceeding 100 million units sold annually by 2024. This surge is attributed to several converging factors, including the increasing popularity of live streaming and virtual events, the expansion of the professional audio and broadcasting sectors, and the continued rise of home studios. The market is witnessing a significant shift towards digital technologies, with the adoption of software-based mixing consoles, digital signal processors, and network-based audio solutions gaining momentum. Wireless microphone systems and portable audio interfaces have also seen a substantial uptake, fueled by the need for flexible and easily manageable audio solutions across diverse applications. The demand for high-quality audio experiences in various sectors – from live music events and corporate presentations to podcasts and online gaming – remains a crucial driver for market expansion. Furthermore, advancements in audio technology, such as immersive audio formats and sophisticated noise cancellation features, continue to add appeal to both professional and consumer-grade products. While the overall market has been dominated by established players, we are also witnessing the emergence of innovative startups offering affordable and technologically advanced solutions, increasing the overall competitiveness and driving further innovation. The estimated market size for 2025 surpasses 120 million units, promising continued expansion throughout the forecast period (2025-2033). The forecast projects the market to reach nearly 180 million units by 2033, driven by consistent demand across diverse sectors and technological advancements.

Several key factors are propelling the growth of the pro audio and DJ equipment market. The rise of live streaming and virtual events during and following the pandemic created a massive demand for high-quality audio equipment for both professional broadcasters and individual content creators. The professional audio and broadcasting sectors themselves are experiencing significant expansion, particularly in emerging economies, leading to increased investment in advanced audio technologies. The home studio market continues to flourish, with both hobbyists and professional musicians investing in high-quality equipment for recording and music production. Technological advancements, such as the development of more compact and portable equipment, enhanced wireless capabilities, and improved digital audio processing, are making professional-grade audio equipment more accessible and appealing to a wider audience. Finally, the increasing emphasis on immersive audio experiences, including surround sound and 3D audio, is pushing the development and adoption of advanced audio technologies, further fueling market growth. These factors combined paint a picture of a continuously expanding market primed for significant growth in the coming years.

Despite the significant growth potential, the pro audio and DJ equipment market faces certain challenges. The high cost of professional-grade equipment can be a significant barrier to entry for many aspiring professionals and hobbyists. Competition from cheaper, lower-quality products, particularly from emerging markets, also poses a threat to established players. The market is also sensitive to economic fluctuations. During periods of economic uncertainty, investment in professional audio equipment may be reduced, impacting overall market growth. Furthermore, maintaining technological advancements and staying ahead of the curve is crucial for companies in this fast-paced industry. Rapid technological change can render existing equipment obsolete quickly, requiring continuous investment in research and development. Finally, the complexity of professional audio systems can be a barrier to entry for some users, potentially limiting the adoption of certain technologies.

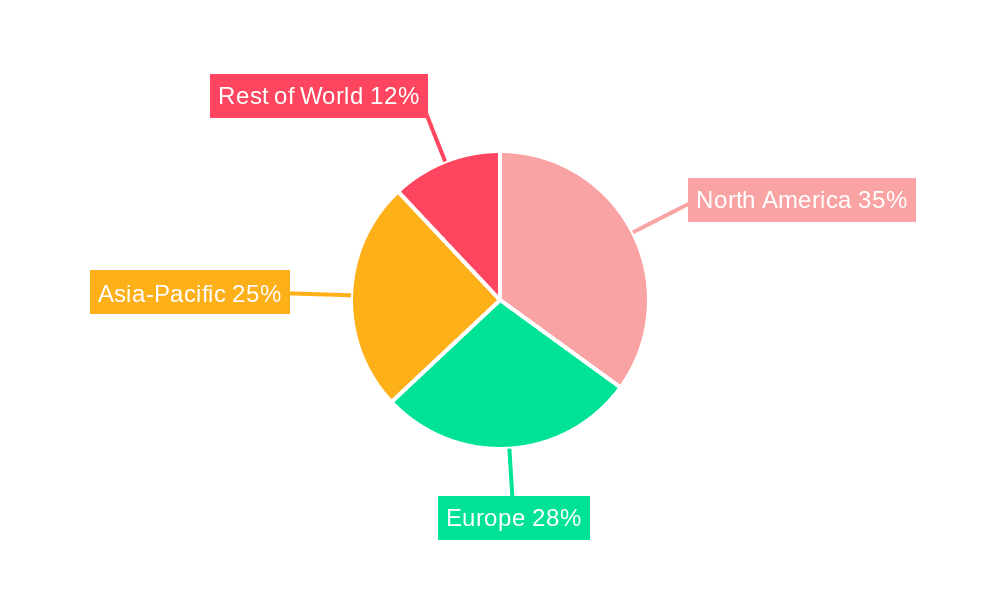

North America: Remains a dominant market due to strong demand from the entertainment, broadcasting, and corporate sectors. The region's high disposable income and advanced technological infrastructure contribute significantly to market growth. The professional audio market in North America is also characterized by the adoption of cutting-edge technologies, creating demand for high-end products. The extensive network of professional sound engineers and technicians also contributes to increased demand for sophisticated equipment.

Europe: Demonstrates consistent growth, driven by a robust live music industry and significant investment in broadcasting infrastructure. The region sees significant adoption of professional audio equipment across various sectors, including corporate events, religious services, and educational institutions.

Asia-Pacific: Experiences rapid expansion, fueled by substantial growth in the live entertainment industry and the increasing adoption of audio technology in developing countries. This region has witnessed the expansion of home studios and online content creation, also boosting market growth. Several key countries in the Asia-Pacific region have already become major manufacturing hubs for pro audio equipment, contributing to the cost competitiveness of products globally.

Live Sound Segment: Remains the largest segment, driven by the continuous growth of live music events and concerts globally. The increasing investment in advanced audio systems for live performances boosts demand.

Studio Recording Segment: Displays substantial growth, fueled by an increase in independent artists and content creators who record their own music or podcasts. The availability of affordable recording equipment contributes to this segment's expansion.

Broadcast Segment: Continues to be an important segment due to increasing investments in broadcast technology and media companies' need for high-quality audio equipment for television and radio production.

The pro audio and DJ equipment industry benefits from several growth catalysts, including the increasing adoption of digital technologies, the rise of immersive audio experiences, and the growing demand for high-quality audio across various applications. Furthermore, the expansion of the home studio market, the proliferation of live streaming, and advancements in wireless technology all contribute to the market's continuous expansion.

This report provides a comprehensive overview of the pro audio and DJ equipment market, including detailed analysis of market trends, driving forces, challenges, key players, and future growth prospects. It offers valuable insights for businesses operating in this sector, investors, and anyone interested in understanding the dynamics of this rapidly evolving market. The report is based on extensive market research, data analysis, and expert interviews, ensuring accurate and reliable information for decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.5%.

Key companies in the market include Sennheiser, Yamaha, Audio-Tehcnica, Shure, AKG, Blue, Lewitt Audio, Sony, Takstar, MIPRO, Allen&heath, TOA, Wisycom, Beyerdynamic, Lectrosonic, Line6, Audix, DPA, Rode, Shoeps, Electro Voice, Telefunken, Clock Audio, Biamp, Symetrix, QSC, Polycom, Extron, Crestron, BSS, .

The market segments include Application, Type.

The market size is estimated to be USD 931.8 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Pro Audio and DJ Equipment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pro Audio and DJ Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.