1. What is the projected Compound Annual Growth Rate (CAGR) of the Private and Public Clouds in the Financial Services?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Private and Public Clouds in the Financial Services

Private and Public Clouds in the Financial ServicesPrivate and Public Clouds in the Financial Services by Type (Platform as a Service (PaaS), Software as a Service (SaaS), Infrastructure as a Service (IaaS), Business Process as a Service (BPaaS), Others), by Application (Bank, Securities Company, Insurance Company, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

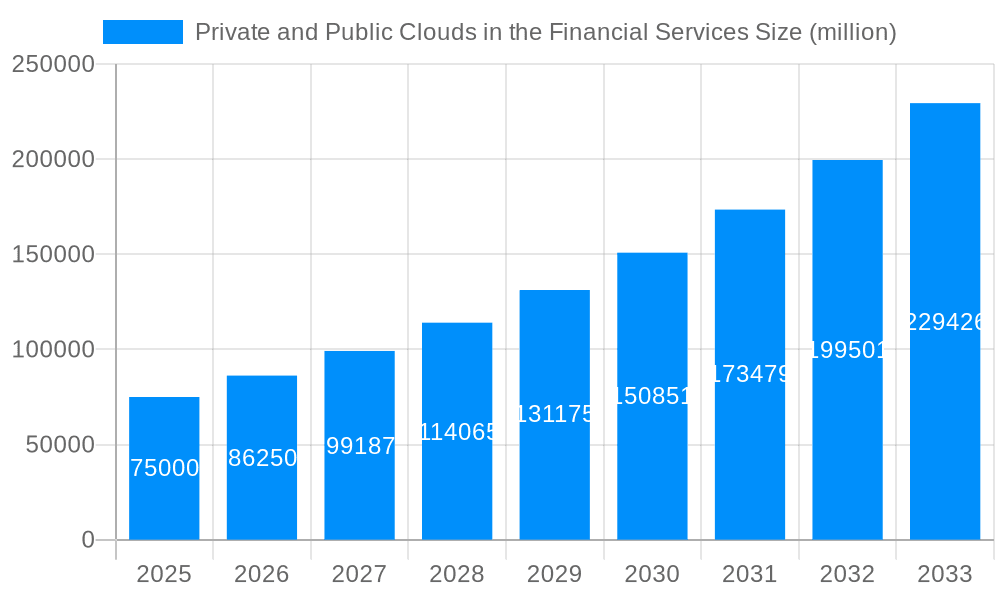

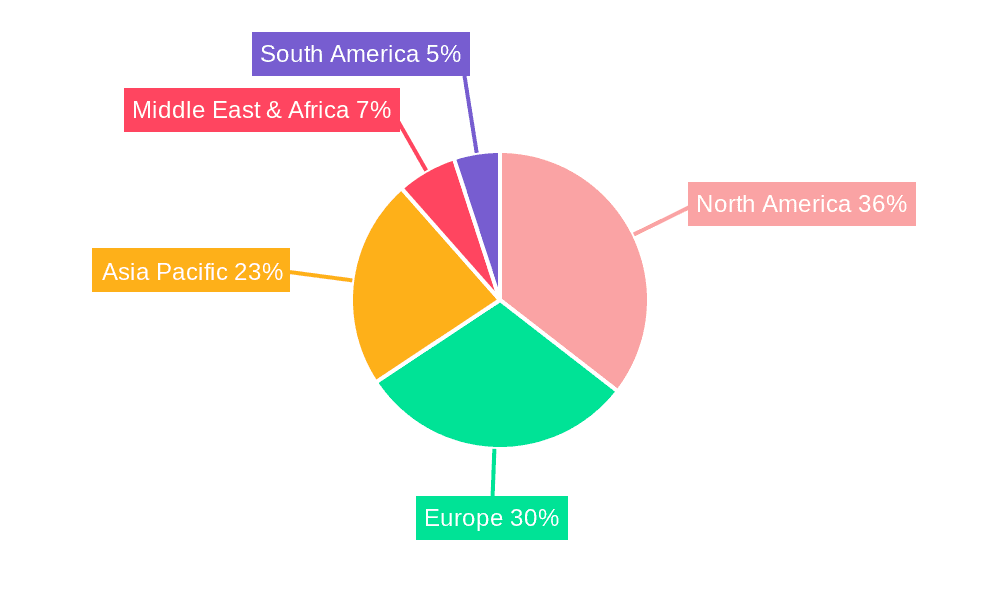

The global market for private and public cloud adoption within the financial services sector is experiencing robust growth, driven by the increasing need for enhanced security, scalability, and cost optimization. The shift towards digital transformation, regulatory compliance mandates, and the burgeoning demand for innovative financial products and services are key catalysts fueling this expansion. While the exact market size for 2025 requires further specification, a reasonable estimate, considering a plausible CAGR of 15% based on industry trends, could place it in the range of $60-80 billion. This growth is further segmented across various service models including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), and Business Process as a Service (BPaaS), with IaaS and SaaS currently dominating the market share. Leading technology providers such as AWS, Microsoft Azure, and Google Cloud Platform are intensely competing for market dominance, alongside specialized financial technology firms catering to the specific needs of banks, insurance companies, and securities firms. Geographic distribution shows North America and Europe as currently leading regions, although Asia Pacific is anticipated to exhibit significant growth in the coming years due to increasing digitalization and government initiatives promoting cloud adoption.

The restraints to wider adoption include concerns around data security and regulatory compliance, particularly given the sensitive nature of financial data. Legacy infrastructure within many financial institutions also poses a significant hurdle to seamless cloud migration. However, these challenges are being actively addressed through robust security protocols, advanced encryption techniques, and the development of hybrid cloud solutions that combine the benefits of both public and private clouds. The future of cloud adoption in the financial services industry will likely see a continued shift towards hybrid models that provide a balanced approach to security, scalability, and cost-effectiveness, ensuring a robust and resilient technological infrastructure for the sector's long-term success. The forecast period of 2025-2033 anticipates a sustained high growth trajectory, propelled by the ongoing evolution of financial technology and a heightened emphasis on digital innovation across the global financial landscape.

The global private and public cloud market within the financial services sector is experiencing explosive growth, projected to reach USD 200 billion by 2033. This surge is driven by several factors, including the increasing need for enhanced security, scalability, and cost-effectiveness in managing ever-growing data volumes and complex applications. The historical period (2019-2024) witnessed a steady adoption of cloud solutions, with a significant acceleration expected during the forecast period (2025-2033). By 2025 (estimated year), the market is anticipated to be valued at USD 100 billion, indicating a robust compound annual growth rate (CAGR). This growth is not uniform across all cloud deployment models. While public cloud adoption remains dominant due to its inherent flexibility and cost-efficiency, private clouds continue to hold a significant share, particularly for organizations with stringent regulatory compliance and data security requirements. The shift towards hybrid cloud deployments, combining the strengths of both public and private clouds, is also a prominent trend, allowing financial institutions to optimize their IT infrastructure for specific workloads and maintain a balance between agility and control. This trend is particularly noticeable in segments like banking, which requires strict data governance and regulatory compliance, but also needs the scalability of public cloud for peak periods or specific functions. The insurance sector too is leveraging cloud technology for risk assessment and claims processing. This report analyzes this dynamic market, offering insights into the key drivers, challenges, and opportunities shaping the future of cloud adoption in the financial services industry.

Several key factors are propelling the adoption of private and public cloud solutions within the financial services sector. Firstly, the ever-increasing volume and complexity of data necessitate scalable and cost-effective storage and processing solutions. Cloud computing provides the elasticity and flexibility to handle fluctuating workloads efficiently, minimizing capital expenditure and maximizing resource utilization. Secondly, the stringent regulatory requirements surrounding data security and compliance are driving the demand for robust cloud security features. Cloud providers are investing heavily in advanced security measures to meet these regulations, providing financial institutions with a more secure environment for sensitive data. Thirdly, the need for enhanced agility and innovation is pushing organizations to embrace cloud-based solutions that enable faster deployment of new applications and services. This translates to quicker time-to-market for new financial products and enhanced customer experience. Finally, the cost optimization offered by cloud computing is a significant driver. By moving to a pay-as-you-go model, financial institutions can reduce their IT infrastructure costs and optimize their spending based on actual usage. The ability to leverage cloud-based analytics and artificial intelligence further adds to the attractiveness of cloud solutions.

Despite the numerous advantages, the adoption of private and public clouds in the financial services sector faces several challenges. Security and compliance remain primary concerns. Financial institutions handle highly sensitive data, and ensuring its security in the cloud requires robust measures, including encryption, access control, and regular audits. Meeting regulatory requirements, such as GDPR and CCPA, adds complexity and increases compliance costs. Another challenge is the integration of legacy systems with cloud-based platforms. Many financial institutions rely on older systems that may not be easily integrated with newer cloud architectures, requiring significant investment in modernization efforts. Vendor lock-in is another potential concern, as migrating data and applications between cloud providers can be complex and expensive. The skills gap in cloud computing also poses a challenge, as financial institutions need skilled professionals to manage and operate their cloud environments effectively. Finally, cost optimization remains a balancing act. While cloud computing offers potential cost savings, uncontrolled usage can lead to unexpected expenses. Careful planning and management are essential to maximize the cost benefits of cloud adoption.

The North American market is expected to dominate the private and public cloud market in the financial services sector, driven by high cloud adoption rates and the presence of major technology providers and financial institutions. However, the Asia-Pacific region is projected to witness the fastest growth, fueled by increasing digitalization and a large and growing financial services sector.

IaaS Segment Dominance: The Infrastructure-as-a-Service (IaaS) segment is projected to hold a significant market share, driven by the increasing demand for scalable computing resources and cost-effective infrastructure solutions. Financial institutions are leveraging IaaS to consolidate their data centers, optimize IT operations, and enhance scalability. The ease of provisioning and flexibility of IaaS compared to traditional infrastructure are making it a preferred choice. This allows organizations to easily scale their infrastructure based on fluctuating demands, eliminating the need for over-provisioning and leading to cost optimization.

Banking Sector Leadership: The banking sector is anticipated to be the largest consumer of private and public cloud services. Banks are adopting cloud solutions across various applications, from core banking systems to customer relationship management (CRM) and fraud detection. The need for real-time transaction processing and the ability to handle vast amounts of customer data are key drivers of cloud adoption in this sector. Furthermore, banks need to handle strict regulatory compliance and sensitive financial data, making security a top priority in their cloud solutions.

Geographic Diversification: While North America holds a significant market share, the Asia-Pacific region is expected to show the most substantial growth rate. The rapid technological advancements and the expanding financial sector in countries like India, China, and Singapore are driving this growth. The need for improved infrastructure and greater efficiency is encouraging financial institutions in these regions to embrace cloud-based solutions rapidly. Europe also presents a significant market, largely driven by stringent data privacy regulations (like GDPR), which is accelerating the adoption of secure and compliant cloud solutions.

The increasing adoption of digital banking, the demand for enhanced cybersecurity measures, and the need for real-time data analytics are accelerating the growth of private and public cloud services within the financial services industry. Furthermore, government initiatives promoting digital transformation and the rising availability of skilled professionals are catalyzing this growth. These factors, coupled with the inherent cost efficiencies and scalability offered by cloud computing, ensure a continued upward trajectory for the market.

This report provides a comprehensive analysis of the private and public cloud market within the financial services sector, offering valuable insights into market trends, drivers, challenges, and opportunities. It includes detailed forecasts, competitive landscape analysis, and regional breakdowns, providing stakeholders with a thorough understanding of this dynamic and rapidly evolving market. The data presented covers a comprehensive study period from 2019 to 2033, with a base year of 2025 and an estimated year of 2025, offering a detailed projection of future market trends.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Alibaba Group, AWS, Eze Castle Integration, Fujitsu, Alphabet(Google), IBM, Jack Henry and Associates, Microsoft, Oracle, Rackspace, Dell Technologies(VMware), .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Private and Public Clouds in the Financial Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Private and Public Clouds in the Financial Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.