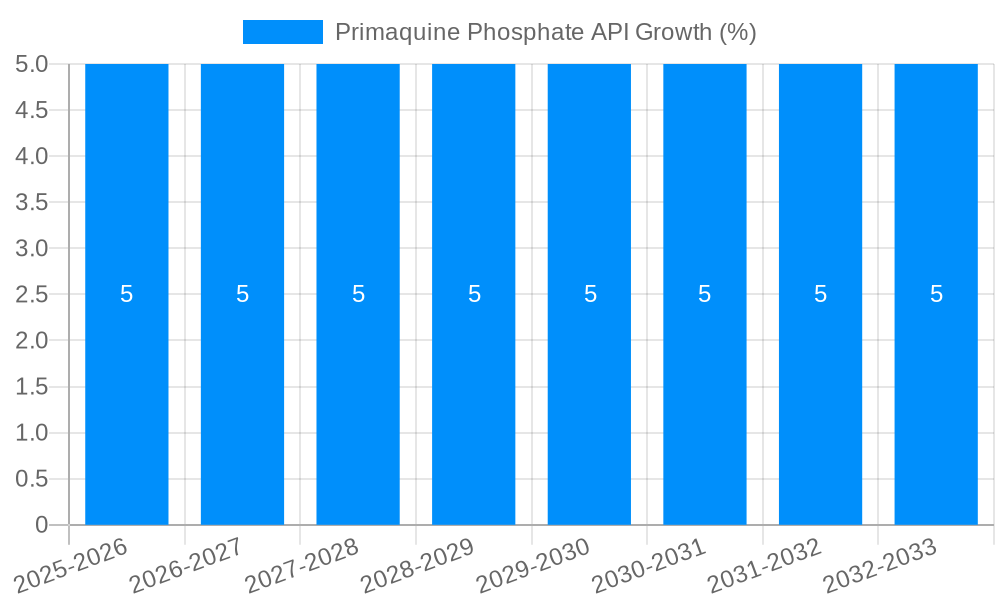

1. What is the projected Compound Annual Growth Rate (CAGR) of the Primaquine Phosphate API?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Primaquine Phosphate API

Primaquine Phosphate APIPrimaquine Phosphate API by Type (Purity Above 98%, Purity Below 98%), by Application (Tablet, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

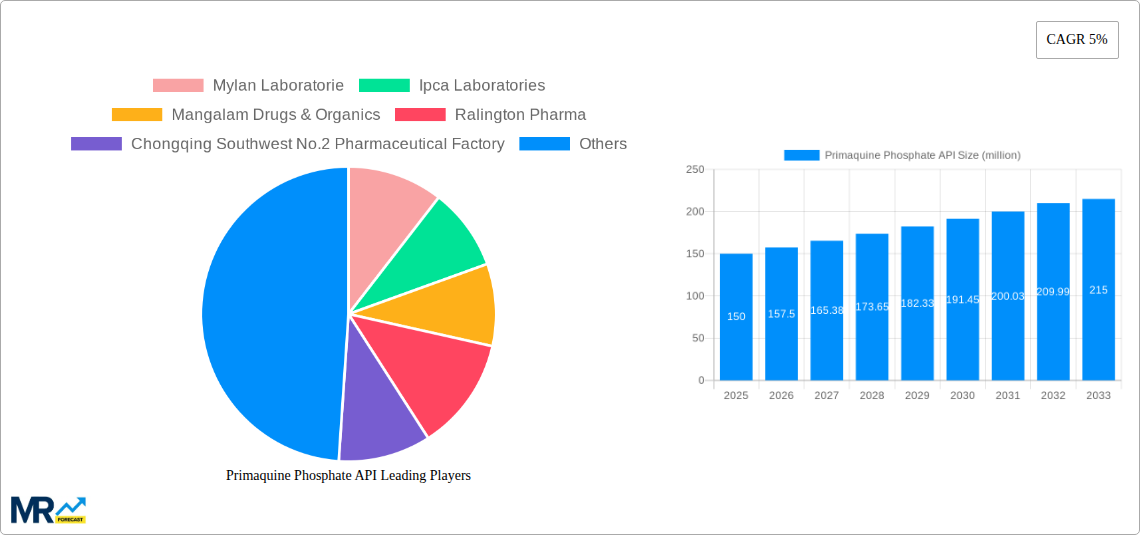

The Primaquine Phosphate API market is poised for significant expansion, driven by the persistent global burden of malaria and other parasitic infections. With an estimated market size of approximately $150 million in 2025, growing at a Compound Annual Growth Rate (CAGR) of 5%, this segment is projected to reach around $215 million by 2033. A primary driver for this growth is the continuous need for effective antimalarial treatments, particularly in endemic regions across Africa, Asia, and South America. The increasing prevalence of drug-resistant malaria strains further fuels research and development for novel or improved Primaquine Phosphate formulations, solidifying its role in comprehensive malaria eradication strategies. Furthermore, the expanding healthcare infrastructure in developing nations and government initiatives aimed at disease control and prevention are expected to boost demand for this critical pharmaceutical ingredient.

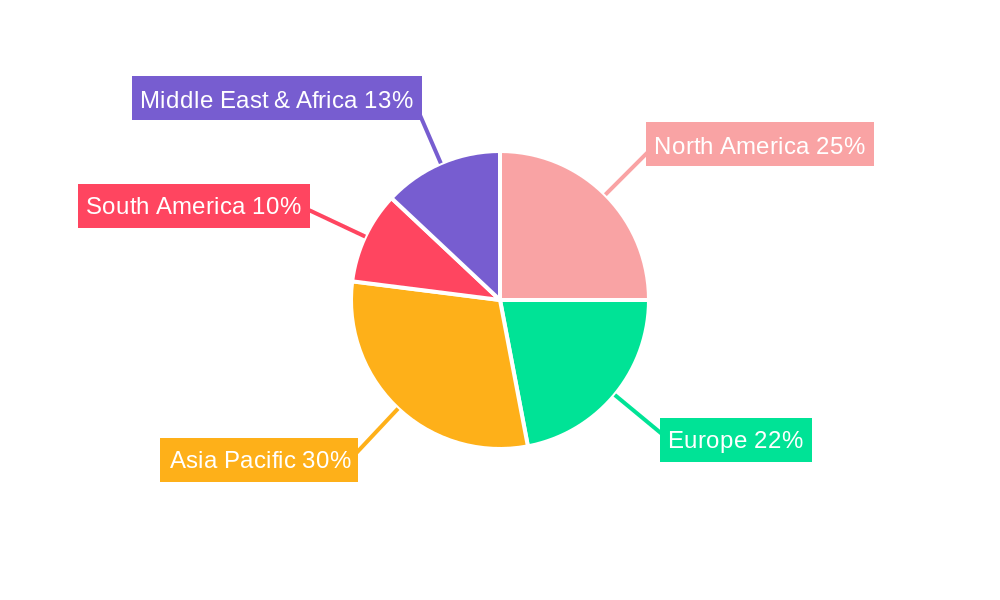

The market is segmented by purity, with Purity Above 98% holding a dominant share due to its superior efficacy and regulatory acceptance in pharmaceutical applications, especially for tablet formulations. While 'Purity Below 98%' caters to specific research or less critical applications, the demand leans heavily towards higher purity grades for human therapeutics. Key restraints include the stringent regulatory landscape governing API manufacturing and potential fluctuations in raw material costs. However, emerging economies, particularly in Asia Pacific (China and India), are emerging as manufacturing hubs, leveraging cost advantages and a growing skilled workforce. North America and Europe represent substantial markets due to advanced healthcare systems and high awareness, while significant growth is anticipated in regions with high malaria prevalence like parts of South America and the Middle East & Africa. Strategic collaborations and advancements in manufacturing processes are expected to define the competitive landscape.

Here's a unique report description for Primaquine Phosphate API, incorporating your specified elements:

XXX paints a comprehensive picture of the Primaquine Phosphate API market, projecting robust growth and dynamic shifts throughout the study period of 2019-2033. The market, currently valued in the million unit range, is poised for significant expansion, driven by the persistent global burden of malaria and the critical role of Primaquine Phosphate in its treatment and prevention of relapses. Our analysis, anchored by the Base Year of 2025, reveals a market characterized by evolving purity demands and a strong emphasis on pharmaceutical-grade Active Pharmaceutical Ingredients (APIs). The Estimated Year of 2025 serves as a crucial inflection point, with the Forecast Period of 2025-2033 expected to witness considerable value creation and increased production volumes. Historical data from 2019-2024 underscores the foundational trends, including fluctuating raw material costs and incremental capacity expansions by key manufacturers. We anticipate a steady upward trajectory in demand for Primaquine Phosphate API, particularly as global health initiatives aimed at malaria eradication gain further traction. The market's maturity is reflected in the increasing scrutiny on API quality and compliance with stringent regulatory standards. Furthermore, advancements in synthesis processes and a growing focus on supply chain resilience will define the evolving landscape. The interplay between disease prevalence, healthcare investments, and manufacturing capabilities will be central to understanding the market's future performance.

The Primaquine Phosphate API market is experiencing sustained momentum fueled by a confluence of critical factors. Foremost among these is the unrelenting global prevalence of malaria, a disease that continues to claim hundreds of thousands of lives annually, particularly in tropical and subtropical regions. Primaquine Phosphate remains an indispensable component in the arsenal against this parasitic infection, especially for its efficacy in eradicating the dormant liver stages of Plasmodium vivax and Plasmodium ovale, thereby preventing relapses that contribute significantly to the disease burden. International health organizations and national governments are intensifying their malaria control programs, which directly translates into a consistent demand for essential antimalarial APIs like Primaquine Phosphate. Furthermore, ongoing research and development efforts aimed at enhancing treatment regimens and addressing emerging drug resistance patterns often reinforce the utility and demand for established APIs. The expansion of healthcare infrastructure in endemic regions, coupled with increased access to essential medicines, also plays a pivotal role in driving market growth.

Despite the promising growth trajectory, the Primaquine Phosphate API market is not without its inherent challenges and restraints. One significant hurdle is the potential for supply chain disruptions, which can arise from geopolitical instability, raw material sourcing complexities, or unforeseen manufacturing issues. The specialized nature of API production requires meticulous quality control and adherence to stringent regulatory frameworks, and any deviation can lead to production delays or product rejection. Another area of concern is the potential for adverse drug reactions and the careful management of treatment protocols, which necessitates ongoing pharmacovigilance and education for healthcare professionals. While Primaquine Phosphate is effective, its use is associated with a risk of hemolytic anemia in individuals with Glucose-6-Phosphate Dehydrogenase (G6PD) deficiency, requiring pre-screening. This requirement, while a safety measure, can add a layer of complexity to its widespread application and may influence prescribing patterns. Furthermore, the development of alternative antimalarial treatments, though still in nascent stages for the radical cure of P. vivax, could pose a long-term competitive threat.

The Primaquine Phosphate API market is characterized by a concentration of demand and production in specific regions, with Asia Pacific emerging as a dominant force, particularly in terms of manufacturing capacity and growing consumption.

Dominant Segment: Purity Above 98%.

Dominant Region: Asia Pacific.

The Primaquine Phosphate API industry is propelled by several key growth catalysts. The persistent global burden of malaria, particularly Plasmodium vivax, remains the primary driver, demanding continuous supply for radical cure. Global health initiatives and government-backed malaria control programs, with their focus on eliminating the disease, directly boost demand. Furthermore, increasing investments in pharmaceutical R&D aimed at improving antimalarial drug efficacy and addressing resistance patterns indirectly support the market by reinforcing the importance of established APIs. The growing healthcare infrastructure in endemic regions, coupled with enhanced access to essential medicines, further amplifies consumption.

This comprehensive report delves into the intricate dynamics of the Primaquine Phosphate API market, providing an exhaustive analysis from 2019 to 2033, with 2025 serving as the Base and Estimated Year. The study meticulously examines market segmentation, categorizing by Purity Above 98% and Purity Below 98%, as well as by application segments including Tablets and Others. It further dissects key industry developments and identifies the leading manufacturers like Mylan Laboratorie, Ipca Laboratories, Mangalam Drugs & Organics, Ralington Pharma, and Chongqing Southwest No.2 Pharmaceutical Factory. The report offers critical insights into market trends, driving forces, challenges, and future growth prospects, empowering stakeholders with actionable intelligence for strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Mylan Laboratorie, Ipca Laboratories, Mangalam Drugs & Organics, Ralington Pharma, Chongqing Southwest No.2 Pharmaceutical Factory, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Primaquine Phosphate API," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Primaquine Phosphate API, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.