1. What is the projected Compound Annual Growth Rate (CAGR) of the Prescription Vials and Bottles?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Prescription Vials and Bottles

Prescription Vials and BottlesPrescription Vials and Bottles by Type (Glass Vials and Bottles, Plastic Vials and Bottles, World Prescription Vials and Bottles Production ), by Application (Pharmaceuticals, Nutraceutical Products, Aromatherapy, Others, World Prescription Vials and Bottles Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

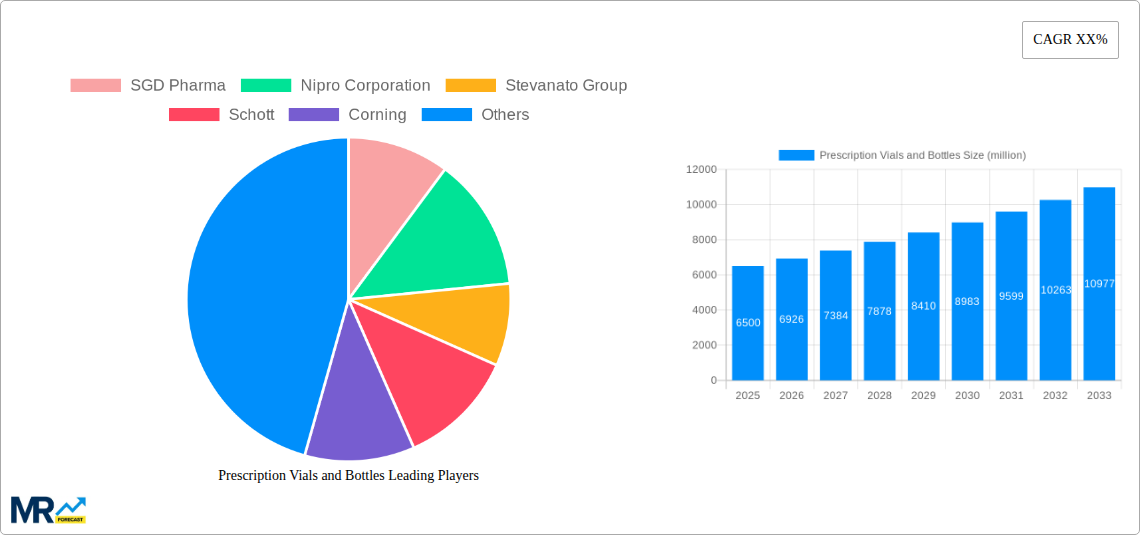

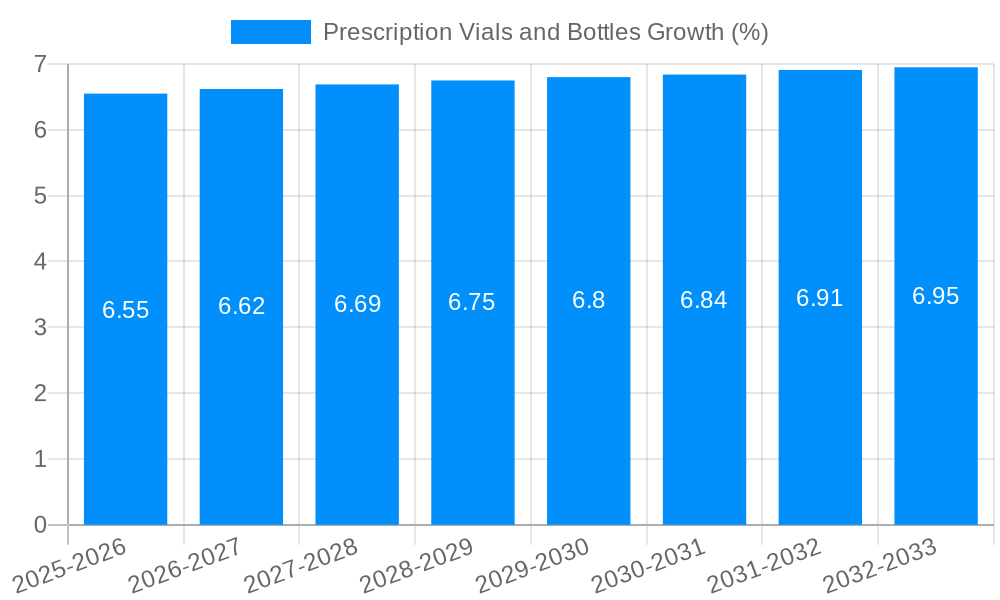

The global prescription vials and bottles market is poised for significant expansion, projected to reach an estimated USD 6,500 million by 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025-2033. The burgeoning pharmaceutical industry, driven by an aging global population and the increasing prevalence of chronic diseases, is the primary engine behind this demand. Enhanced healthcare access in emerging economies further bolsters market growth, as does the rising importance of nutraceuticals and aromatherapy products, which increasingly rely on secure and compliant packaging solutions. Advancements in material science, leading to the development of more durable, tamper-evident, and sustainable vial and bottle options, are also contributing to market dynamism. The market is characterized by a strong emphasis on regulatory compliance, with manufacturers investing in sterile production environments and materials that ensure product integrity and patient safety.

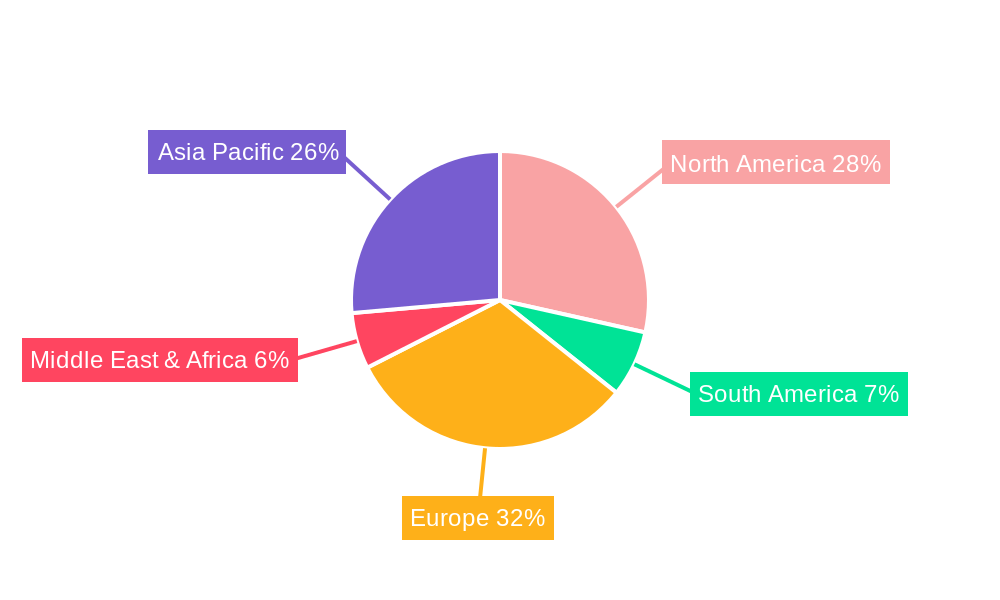

Navigating the market landscape presents both opportunities and challenges. Key drivers include the consistent demand from the pharmaceutical sector for safe and reliable drug packaging, alongside the expanding applications in nutraceuticals and aromatherapy. However, the market faces restraints such as fluctuating raw material costs, particularly for glass and specialized plastics, which can impact pricing and profitability. Intense competition among established players like Schott, Gerresheimer, and SGD Pharma, alongside the emergence of new entrants, necessitates continuous innovation in product design, material efficiency, and sustainable practices. The market segments, comprising glass and plastic vials and bottles, are experiencing distinct growth trajectories. While glass vials offer superior inertness and aesthetic appeal, plastic alternatives are gaining traction due to their lighter weight, shatter-resistance, and cost-effectiveness. Regional dynamics reveal North America and Europe as mature markets with high demand for quality packaging, while Asia Pacific exhibits the most rapid growth potential due to its expanding pharmaceutical manufacturing base and increasing healthcare expenditure.

This report delves into the dynamic global market for prescription vials and bottles, offering an in-depth analysis of trends, driving forces, challenges, and future growth prospects. Spanning the historical period of 2019-2024, the base and estimated year of 2025, and extending to a comprehensive forecast period of 2025-2033, this study provides crucial insights for stakeholders within the pharmaceutical packaging ecosystem. We examine production volumes in the millions of units, covering key segments and applications, and profile leading industry players alongside significant market developments.

The global prescription vials and bottles market is experiencing a notable surge in demand, driven by a confluence of factors that underscore the critical role of secure and reliable pharmaceutical packaging. Throughout the historical period of 2019-2024, the market witnessed a steady increase in production, projected to have reached approximately 15,000 million units by the end of 2024. This growth is intrinsically linked to the expanding pharmaceutical industry, fueled by an aging global population, a rise in chronic diseases, and increasing healthcare access in emerging economies. Furthermore, the heightened focus on patient safety and drug integrity has necessitated the adoption of advanced packaging solutions that offer enhanced tamper-evidence and child-resistance. The COVID-19 pandemic, while initially presenting supply chain disruptions, ultimately amplified the demand for pharmaceutical packaging as vaccine and drug production ramped up. This surge in demand is expected to continue its upward trajectory, with projections indicating a market size exceeding 22,000 million units by 2025, and further growth to over 30,000 million units by the end of the forecast period in 2033. The market is characterized by a bifurcation in material preferences, with both glass and plastic vials and bottles holding significant market share. Glass vials and bottles, prized for their inertness and premium feel, are dominant in the packaging of high-value injectables and sensitive formulations, accounting for an estimated 7,500 million units of production in 2025. Conversely, plastic vials and bottles, offering advantages in terms of cost-effectiveness, lighter weight, and shatter resistance, are widely used for oral solid dosage forms and over-the-counter medications, representing approximately 8,000 million units in 2025. Innovation in material science and design is continuously shaping this landscape, with a growing emphasis on sustainable and eco-friendly packaging options. The increasing adoption of advanced manufacturing techniques, such as precision molding and sterilization technologies, further contributes to the market's evolution.

The expansion of the global prescription vials and bottles market is propelled by a powerful synergy of demographic shifts, scientific advancements, and regulatory mandates. The most significant driver is the ever-growing global population coupled with an increasing life expectancy, which directly translates into a higher demand for pharmaceuticals. As the world's population ages, the prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer escalates, necessitating a continuous supply of prescription medications, each requiring secure and compliant packaging. Furthermore, advancements in pharmaceutical research and development have led to the introduction of novel drug formulations, including biologics and personalized medicines, many of which require specialized packaging like sterile vials to maintain their efficacy and stability. The expanding healthcare infrastructure, particularly in developing nations, is also a crucial catalyst, as increased access to medical services means a greater volume of prescriptions being dispensed. Regulatory bodies worldwide are increasingly stringent regarding pharmaceutical packaging standards. Requirements for child-resistant closures, tamper-evident seals, and material inertness to prevent drug-container interactions are becoming universal, pushing manufacturers to invest in compliant and high-quality packaging solutions. This regulatory push, in essence, ensures patient safety and product integrity, thereby solidifying the demand for robust prescription vials and bottles. The rise of the nutraceutical and aromatherapy sectors, while smaller in scale compared to pharmaceuticals, also contributes to the overall market growth, as these industries increasingly adopt similar packaging solutions for their products.

Despite the robust growth trajectory, the prescription vials and bottles market is not without its significant challenges and restraints that necessitate careful navigation by industry players. Foremost among these is the intense price sensitivity prevalent across a substantial portion of the pharmaceutical packaging market, particularly for generic drugs and over-the-counter medications. Manufacturers are constantly under pressure to reduce costs, which can lead to a preference for lower-cost materials and designs, sometimes at the expense of enhanced features or premium aesthetics. Supply chain disruptions, exacerbated by global events and geopolitical uncertainties, pose another considerable challenge. Fluctuations in the availability and pricing of raw materials, such as specialized glass or polymers, can impact production schedules and profitability. The complexity of global logistics and the need for specialized transportation for sensitive pharmaceutical products further add to these supply chain vulnerabilities. Moreover, stringent and evolving regulatory landscapes, while a driver for quality, can also be a restraint. The process of obtaining approvals for new packaging materials or designs can be time-consuming and expensive, particularly for smaller manufacturers. Environmental concerns and the increasing demand for sustainable packaging solutions present both an opportunity and a challenge. While manufacturers are encouraged to adopt eco-friendly materials and recycling initiatives, the development and implementation of such solutions can involve significant upfront investment and may not always be cost-competitive with traditional materials. Lastly, the threat of counterfeit pharmaceuticals necessitates the continuous development of advanced anti-counterfeiting measures integrated into packaging, adding another layer of complexity and cost to the manufacturing process.

The global prescription vials and bottles market is characterized by a pronounced dominance of specific regions and segments, each contributing significantly to overall production and consumption.

Dominant Segments:

Pharmaceuticals Application: This segment overwhelmingly dictates the market's trajectory, accounting for an estimated 90% of the total production volume in 2025, translating to approximately 20,700 million units. The sheer scale of the global pharmaceutical industry, driven by healthcare needs and drug development, makes it the primary consumer of prescription vials and bottles. The increasing prevalence of chronic diseases, an aging population, and the continuous launch of new drugs all contribute to this sustained demand. Within pharmaceuticals, the packaging of oral solid dosage forms (tablets and capsules) represents a significant portion, alongside the crucial and high-value market for injectable drugs requiring sterile glass vials. The stringent quality and safety requirements of the pharmaceutical industry ensure a consistent and growing need for reliable and compliant packaging solutions.

Plastic Vials and Bottles Type: While glass holds its niche, plastic vials and bottles are set to dominate the market in terms of sheer volume, projected to account for approximately 55% of the total production in 2025, estimated at around 12,650 million units. This dominance is driven by their inherent advantages: cost-effectiveness, lighter weight which reduces shipping costs, and superior shatter resistance compared to glass. They are widely adopted for the packaging of a vast array of oral medications, vitamins, supplements, and over-the-counter drugs. Innovations in plastic materials, such as advanced polymers offering better barrier properties and chemical inertness, are further enhancing their appeal and expanding their applications. The growing demand for child-resistant and tamper-evident plastic closures also solidifies their market leadership.

Dominant Region:

While North America leads, other regions like Europe and Asia-Pacific are rapidly growing. Europe benefits from a well-established pharmaceutical sector and a strong emphasis on quality and sustainability. Asia-Pacific, particularly China and India, is witnessing rapid growth due to increasing healthcare expenditure, a burgeoning generic drug market, and a growing manufacturing base for packaging materials. However, North America's combination of a mature market, high demand, and innovation leadership firmly establishes its dominance in the prescription vials and bottles landscape.

The prescription vials and bottles industry is poised for sustained growth, propelled by several key catalysts. The escalating global demand for pharmaceuticals, driven by an aging population and the rise of chronic diseases, forms the bedrock of this expansion. Simultaneously, advancements in drug discovery and the development of new therapeutic modalities, particularly biologics and injectables, necessitate sophisticated and sterile packaging solutions like specialized vials. Furthermore, a growing emphasis on patient safety and regulatory compliance worldwide, mandating features like child-resistant closures and tamper-evident seals, continuously drives innovation and upgrades in packaging design. The increasing adoption of nutraceutical and aromatherapy products also contributes to this growth, diversifying the application base.

This comprehensive report offers an unparalleled deep dive into the global prescription vials and bottles market, providing critical intelligence for stakeholders. It meticulously analyzes historical data from 2019-2024, presents detailed estimates for 2025, and extends to a robust forecast period through 2033, covering production volumes in the millions of units. The report dissects key market trends, identifies the primary driving forces behind market expansion, and critically examines the challenges and restraints that could impede growth. It offers in-depth insights into dominant regions and segments, highlighting the strategic importance of areas like North America and applications such as Pharmaceuticals and the Plastic Vials and Bottles segment. Furthermore, it details growth catalysts, profiles leading industry players, and documents significant recent developments. This holistic approach ensures that readers gain a thorough understanding of the market's present landscape and future trajectory, empowering informed strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include SGD Pharma, Nipro Corporation, Stevanato Group, Schott, Corning, Gerresheimer, Clarke Container, Pacific Vial Manufacturing, Piramal Glass, Berry Global, Acme Vial and Glass, Kishore Group, Rx Systems, Ningbo Shengshide Packaging.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Prescription Vials and Bottles," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Prescription Vials and Bottles, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.