1. What is the projected Compound Annual Growth Rate (CAGR) of the Premium Spirit?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Premium Spirit

Premium SpiritPremium Spirit by Type (Vodka, Whiskey, Rum, Brandy, Other), by Application (Online, Offline), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

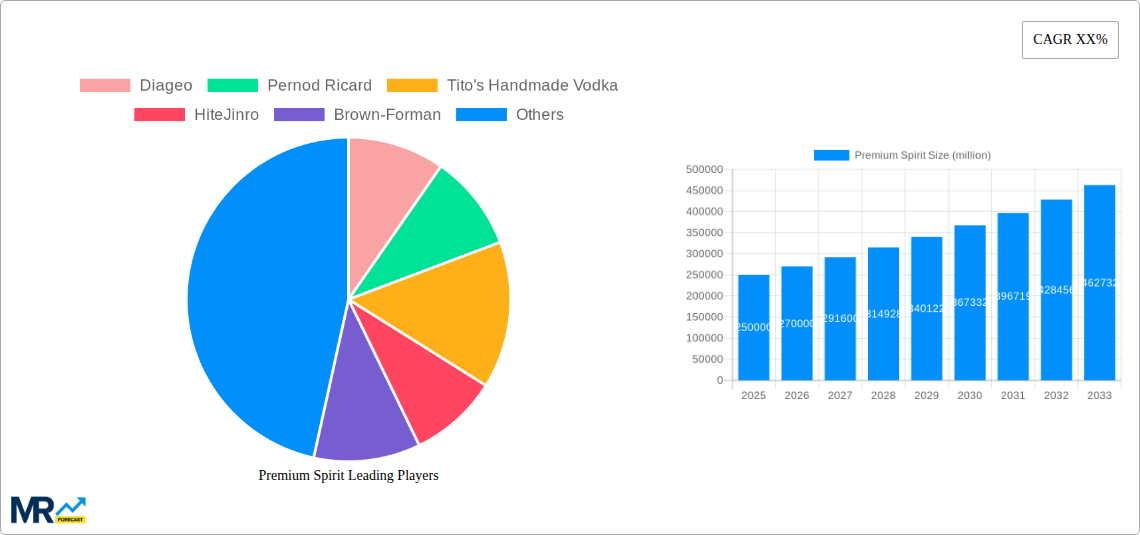

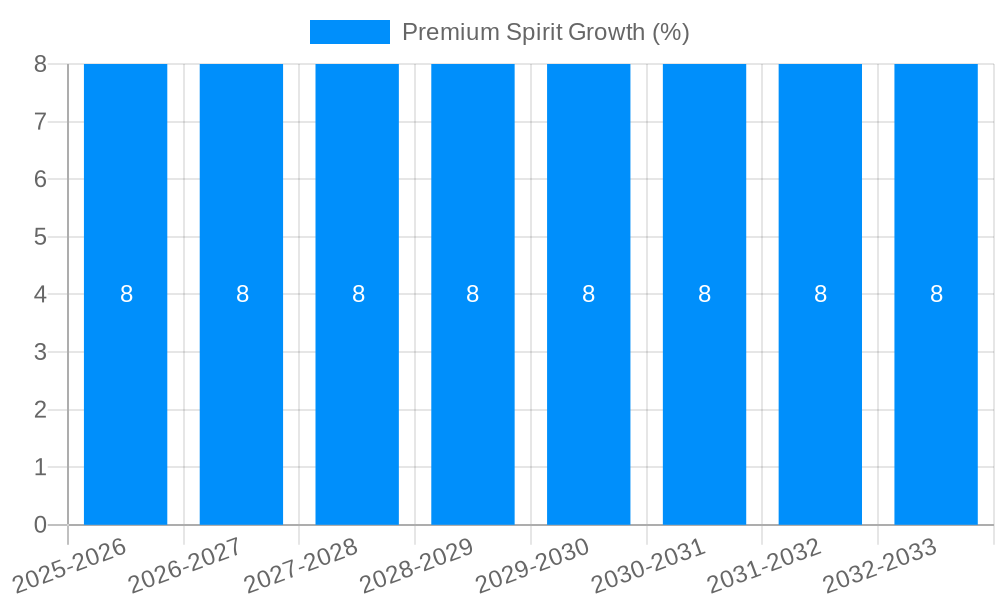

The global premium spirit market is poised for robust expansion, projected to reach an estimated USD 250 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 8% through 2033. This significant market valuation underscores the increasing consumer demand for high-quality, differentiated alcoholic beverages. The primary drivers fueling this growth include a burgeoning middle class with disposable income, a growing appreciation for craftsmanship and unique flavor profiles, and the pervasive influence of social media and celebrity endorsements that elevate the status of premium spirits. Consumers are increasingly seeking experiences rather than just products, leading them to explore a wider range of spirits, from artisanal vodkas and complex single malt whiskies to aged rums and sophisticated brandies. The rise of the "connoisseur" culture further fuels this trend, with consumers investing in premium selections for personal enjoyment and as status symbols. Furthermore, innovative marketing strategies and the expanding reach of online retail platforms are making these premium offerings more accessible to a global audience, contributing to sustained market momentum.

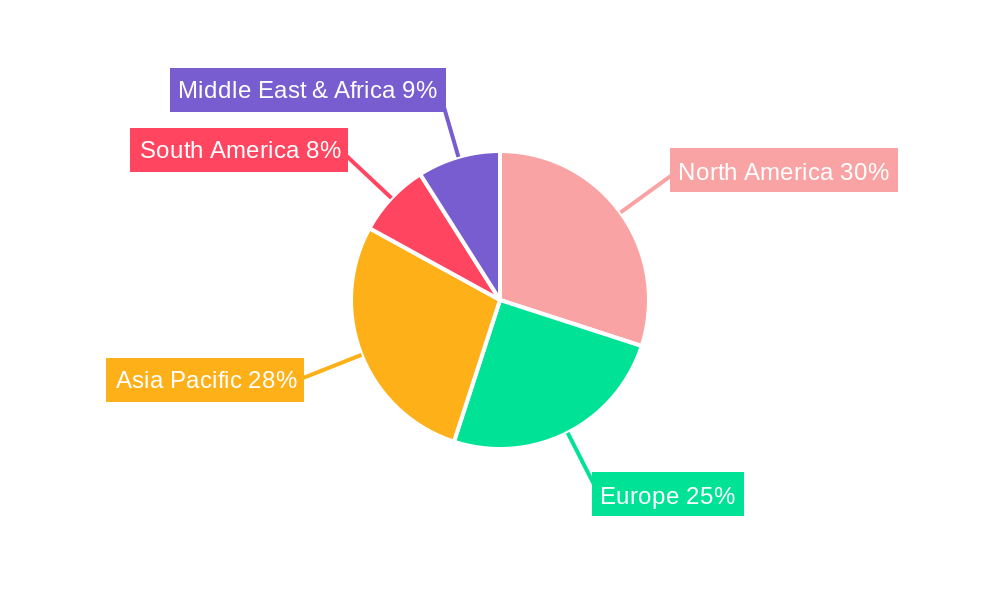

Several key trends are shaping the premium spirit landscape. The craft movement continues to gain traction, with smaller, independent distilleries producing unique and innovative spirits that appeal to consumers seeking authenticity and distinctiveness. This is complemented by a growing interest in sustainable and ethically sourced products, with consumers increasingly factoring in environmental and social responsibility when making purchasing decisions. The demand for ready-to-drink (RTD) premium cocktails is also on the rise, catering to convenience-seeking consumers who desire sophisticated beverage options without the need for at-home preparation. Geographically, the Asia Pacific region, particularly China and India, is emerging as a significant growth engine, driven by rapidly increasing disposable incomes and a burgeoning interest in Western luxury goods, including premium spirits. While the market is overwhelmingly positive, potential restraints include fluctuating raw material costs, stringent regulatory environments in certain regions, and evolving consumer preferences that require continuous adaptation from market players.

Here's a unique report description for "Premium Spirit," incorporating your specified values, companies, segments, and headings:

This comprehensive report delves deep into the dynamic and ever-evolving global premium spirit market, offering an in-depth analysis from the historical period of 2019-2024 through to an extensive forecast extending to 2033. Leveraging the Base Year of 2025, the report provides granular insights into market valuations, trends, and growth trajectories across key segments and regions. With an estimated market size of XX million USD in 2025, this study is poised to become an indispensable resource for stakeholders seeking to understand the nuances of this lucrative industry.

The global premium spirit market is experiencing a sustained surge, driven by a confluence of evolving consumer preferences, aspirational purchasing power, and a burgeoning appreciation for craftsmanship and provenance. XXX insights reveal a discernible shift towards experiential consumption, where consumers are increasingly prioritizing quality over quantity, seeking out spirits that offer a unique story, artisanal production methods, and superior taste profiles. This has led to a significant premiumization trend across all spirit categories, with consumers willing to invest more in brands that resonate with their values and lifestyle aspirations. The craft movement continues to be a powerful force, with independent distilleries and boutique brands gaining significant traction, challenging the dominance of established giants through innovation and hyper-local appeal. Furthermore, the health and wellness trend, surprisingly, is also influencing the premium spirit landscape. Consumers are gravitating towards spirits with perceived "natural" ingredients, lower sugar content, and a focus on organic or ethically sourced components. This manifests in a growing demand for artisanal gins, carefully curated vodkas, and a renewed interest in aged spirits where complexity and depth are valued. The digital transformation is another pivotal trend, with online sales channels becoming increasingly significant for premium spirits. E-commerce platforms and direct-to-consumer (DTC) strategies are empowering brands to reach a wider audience and offer exclusive products, further democratizing access to the premium market. The cocktail culture revival, fueled by social media and a resurgence of interest in mixology, is also a major driver, with consumers seeking high-quality ingredients to elevate their home bar experiences. This has fostered innovation in cocktail-ready spirits and a demand for unique flavor profiles. The report also identifies a growing interest in sustainable practices within the premium spirit industry, with consumers actively seeking brands that demonstrate environmental responsibility and ethical sourcing. This is becoming a critical differentiator, influencing purchasing decisions and brand loyalty.

The robust growth of the premium spirit market is underpinned by several powerful driving forces. A primary catalyst is the increasing disposable income and rising middle class, particularly in emerging economies, enabling a larger segment of the population to indulge in higher-priced, quality beverages. This demographic shift fuels the aspiration for premium products as symbols of success and refined taste. Secondly, the growing global tourism and cultural exchange expose consumers to diverse spirit traditions and sophisticated drinking cultures, fostering an appreciation for nuanced flavors and artisanal production. As travelers return home, they often seek to replicate these elevated experiences, driving demand for premium spirits encountered abroad. Furthermore, the ever-expanding digital landscape and social media influence play a crucial role. Influencers, online reviews, and visually appealing content are shaping consumer perceptions and driving discovery of new and established premium brands, making previously niche products accessible to a global audience. The craft revolution, with its emphasis on authenticity, heritage, and unique production processes, continues to captivate consumers who are fatigued by mass-produced alternatives and crave a tangible connection to the products they consume. This has led to a proliferation of smaller, innovative distilleries offering distinctive flavor profiles and compelling brand narratives. Finally, the increasing sophistication of marketing and branding strategies employed by leading companies effectively communicates the value proposition of premium spirits, highlighting craftsmanship, origin, and exclusive ingredients, thereby cultivating desire and justifying higher price points.

Despite its impressive growth trajectory, the premium spirit market is not without its challenges and restraints. Intense competition from both established heritage brands and agile new entrants necessitates continuous innovation and substantial marketing investment to maintain market share and consumer attention. The sheer volume of brands vying for consumer loyalty can lead to market saturation. Regulatory hurdles and fluctuating excise duties across different countries can impact pricing strategies and market accessibility, creating complex operational landscapes for global players. Stringent advertising restrictions in certain regions also pose a significant challenge to brand building and consumer outreach. Economic downturns and inflation can disproportionately affect the premium segment, as consumers may cut back on discretionary spending, opting for more affordable alternatives during periods of financial uncertainty. While premium spirits are somewhat resilient, severe economic contractions can still dampen demand. Supply chain disruptions and volatile raw material costs, exacerbated by global events, can impact production efficiency and profitability, potentially affecting the availability and price of key ingredients. The growing awareness of health concerns and responsible drinking initiatives also present a long-term challenge, requiring the industry to proactively promote moderation and develop products that align with evolving wellness trends without compromising on the premium experience. Lastly, counterfeiting and illicit trade of premium spirits remain persistent issues, undermining brand integrity and consumer trust, and requiring continuous vigilance and robust security measures.

The premium spirit market is characterized by regional dominance and segment leadership that are constantly evolving.

Several key factors are poised to accelerate the growth of the premium spirit industry. The increasing aspiration and "premiumization" trend among a growing global middle class is a fundamental driver, as consumers seek quality and status. The explosion of craft and artisanal spirits, offering unique flavors and compelling narratives, continues to captivate consumers seeking authenticity and novelty. Furthermore, the burgeoning cocktail culture and the rise of home mixology are creating sustained demand for high-quality spirits as essential ingredients. Finally, the strategic expansion of online sales channels and direct-to-consumer (DTC) models are enhancing accessibility and driving discovery for premium brands.

This report provides a holistic view of the global premium spirit market, meticulously analyzing its trajectory from 2019 to 2033. The study encompasses an in-depth examination of market size, growth drivers, and the competitive landscape. It delves into the nuanced consumer preferences and emerging trends that are shaping demand across key segments like Vodka, Whiskey, Rum, and Brandy. Furthermore, the report scrutinizes the impact of both online and offline sales channels, along with significant industry developments and technological advancements. With a robust forecast based on the estimated market size of XX million USD in 2025, stakeholders will gain actionable insights into regional market dynamics, strategic opportunities, and potential challenges, enabling informed decision-making for long-term success in this opulent and dynamic industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Diageo, Pernod Ricard, Tito's Handmade Vodka, HiteJinro, Brown-Forman, Bacardi Limited, Tanduay Distillers, Inc., Allied Blenders and Distillers Pvt. Ltd. (ABD), Guizhou Moutai Wine Co., Ltd., Alliance Global Group, Inc. (Emperador), Roust, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Premium Spirit," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Premium Spirit, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.