1. What is the projected Compound Annual Growth Rate (CAGR) of the Precious Metal Products?

The projected CAGR is approximately 2.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Precious Metal Products

Precious Metal ProductsPrecious Metal Products by Application (Industrial Sector, Consumer Sector, The Financial Sector), by Type (Gold, Silver, Platinum Group Metals), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

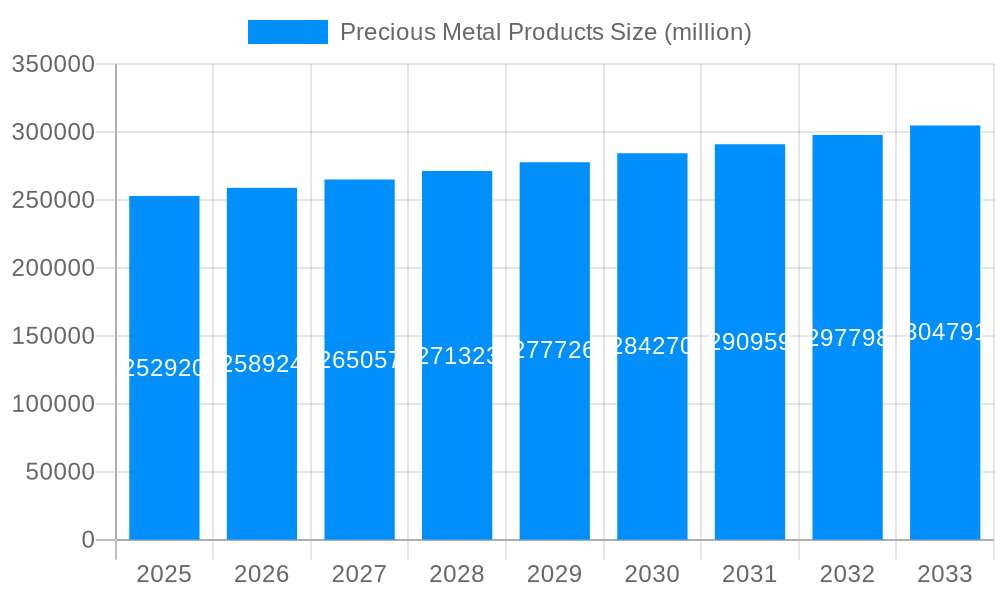

The global precious metal products market, valued at $313.89 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 2.4% from 2025 to 2033. This growth is driven by several key factors. Increasing industrial demand, particularly in electronics and automotive sectors for gold, silver, and platinum group metals (PGMs), fuels market expansion. The consumer sector, with its persistent appetite for jewelry and investment-grade precious metals, contributes significantly to market value. Furthermore, the financial sector's utilization of gold and silver as safe-haven assets during economic uncertainty further bolsters market demand. Geographic distribution reveals a diversified market landscape, with North America and Asia Pacific representing major consumer and production hubs. However, fluctuating geopolitical landscapes and raw material prices pose challenges, potentially affecting production costs and market stability.

Segment-wise, the industrial sector's application of precious metals in various high-tech applications is a significant driver. Gold's use in electronics and its investment appeal continues to bolster its market share. Similarly, silver's applications in solar energy and industrial catalysis contribute to its strong presence. The platinum group metals find widespread use in automotive catalytic converters, impacting their market demand trajectory. Competition among major players like AngloAmerican, Newmont Corporation, and Barrick Gold, among others, remains intense, fostering innovation and efficiency in production and supply chains. Future growth hinges on technological advancements, sustainable mining practices, and evolving global economic conditions. Strategic partnerships and mergers & acquisitions could further consolidate market share and drive innovation in the years to come.

The global precious metal products market, encompassing gold, silver, and platinum group metals (PGMs), exhibited dynamic trends between 2019 and 2024. The market witnessed fluctuating growth influenced by several macroeconomic factors, including global economic uncertainty, inflation rates, and shifts in investor sentiment. The historical period (2019-2024) showed a mixed performance across different precious metals. While gold experienced periods of strong growth driven by safe-haven demand during times of economic instability, silver's performance was more closely tied to industrial demand fluctuations. The PGM market, significantly driven by the automotive industry, experienced a degree of volatility reflecting changes in vehicle production and the adoption of emission control technologies. The estimated market value for 2025 sits at a significant figure in the millions, reflecting the sustained importance of these metals in diverse applications. Looking ahead to the forecast period (2025-2033), the market is projected to experience steady growth, driven by several factors analyzed in detail within this report, including increasing industrial demand, sustained investment interest, and technological advancements in various sectors. The base year for this analysis is 2025, providing a crucial benchmark for future projections. A deeper dive into the consumption value, segmented by application (industrial, consumer, financial) and metal type (gold, silver, PGMs), reveals a nuanced picture of market dynamics across geographical regions. Specific insights regarding the performance of major market players and the impact of key industry developments are detailed in subsequent sections of this report. This analysis provides a comprehensive overview of the precious metal products market, offering valuable insights for investors, industry stakeholders, and anyone seeking a clearer understanding of this crucial sector.

Several key factors are propelling growth within the precious metal products market. Firstly, persistent global economic uncertainty and inflation are fueling safe-haven demand for gold, driving significant investment inflows. Secondly, the industrial sector's increasing reliance on precious metals in various applications, particularly in electronics, automotive catalysts, and medical devices, is a major driver of market expansion. The rise of renewable energy technologies also presents a significant opportunity, with PGMs playing a vital role in fuel cell technologies and other clean energy solutions. Further growth is being spurred by the burgeoning jewelry and consumer goods sectors, where precious metals remain highly valued for their aesthetic appeal and durability. The financial sector's utilization of precious metals, specifically gold, as a hedge against inflation and currency fluctuations continues to contribute to market demand. Technological advancements leading to enhanced extraction techniques and improved refining processes also contribute to the overall market expansion by increasing supply efficiency and affordability. Finally, increased investment in exploration and mining activities, driven by attractive pricing and potential returns, adds another layer of growth potential to the global precious metal products market. These interwoven factors collectively underpin the positive forecast for the industry.

Despite the positive growth outlook, the precious metals market faces several challenges. Price volatility, influenced by macroeconomic factors and speculative trading, poses a significant risk to both producers and consumers. Geopolitical instability in major producing regions can disrupt supply chains and create uncertainties in production and distribution. Environmental regulations aimed at reducing the environmental impact of mining activities impose higher operational costs and potentially limit production capacity. Fluctuations in industrial demand, particularly in sectors like automotive manufacturing and electronics, can affect the demand for certain precious metals, particularly PGMs and silver. Competition from alternative materials and technological substitutes can also place downward pressure on prices and market share for traditional precious metal applications. Furthermore, the increasing focus on ethical sourcing and responsible mining practices imposes greater scrutiny on the industry's environmental and social performance, potentially impacting the cost and availability of precious metals from certain sources. These challenges necessitate a proactive and adaptive approach from market players to navigate the complexities of the precious metal landscape successfully.

The global precious metals market displays significant regional variations in both consumption and production.

China: Remains a dominant force in both gold consumption (jewelry, investment) and production. Its substantial population and growing affluence continue to drive high demand, while its extensive mining operations solidify its position as a major producer.

India: Displays consistently high gold consumption, primarily fueled by cultural traditions and investment demand. However, it relies heavily on imports to meet its considerable demand.

North America (USA & Canada): Significant producers of gold, silver, and PGMs, particularly Canada with its substantial mining sector. The region also displays strong investment demand for gold and usage of PGMs in the automotive industry.

South Africa: A historically important gold producer, still maintains a substantial presence, although production has fluctuated in recent years.

Segment Dominance:

Gold: The gold market remains dominant in terms of overall value, driven by sustained investment demand, jewelry consumption, and its role as a safe-haven asset. Its continued importance in both the financial and consumer sectors solidifies its leading position. This is further amplified by the increasing demand for gold in the technology sector, particularly in electronics applications.

Investment Demand: This segment is particularly crucial. The considerable investment in gold Exchange Traded Funds (ETFs) and other gold-backed investment vehicles significantly impact gold pricing and overall market value. Central banks’ growing accumulation of gold reserves also impacts market dynamics.

The paragraph below explains why these regions and segments are projected to remain dominant: The dominance of these regions and segments is anticipated to continue throughout the forecast period due to a combination of factors including established infrastructure, strong consumer demand (particularly in Asia), consistent industrial requirements (especially concerning PGMs), and ongoing financial investment in gold as a safe-haven asset. These trends are unlikely to change substantially within the next decade, leading to continued growth and influence from these key players in the precious metals industry.

Several factors are poised to accelerate growth in the precious metals sector. These include the increasing use of precious metals in advanced technologies (e.g., 5G infrastructure, electric vehicles), rising global demand for jewelry and other consumer goods, and the ongoing need for safe-haven investments amidst economic uncertainty. Further technological advancements in mining and refining, enhancing efficiency and reducing environmental impact, will contribute to a more sustainable and prosperous market. Government initiatives promoting responsible sourcing and ethical mining practices, while posing challenges, also contribute to the sector's long-term viability and positive image.

This report provides a comprehensive analysis of the precious metal products market, offering detailed insights into market trends, driving forces, challenges, key players, and future growth prospects. The analysis incorporates historical data, current market estimations, and future projections, providing a robust and insightful overview of this dynamic sector. The information provided is intended to assist investors, businesses, and researchers in navigating the complexities of the precious metal market and making informed decisions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.4%.

Key companies in the market include AngloAmerican, Newmont Corporation, Barrick, NORNICKEL, Sibanye Gold Limited, AngloGold Ashanti Limited, Polyus Gold International, China National Gold Group Co., Ltd., Kinross Gold Corporation, Newcrest Mining Limited, Gold Fields Limited, Agnico Eagle Mines Ltd, Polymetal International Plc, Fresnillo, Shandong Gold Group.

The market segments include Application, Type.

The market size is estimated to be USD 313890 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Precious Metal Products," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Precious Metal Products, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.