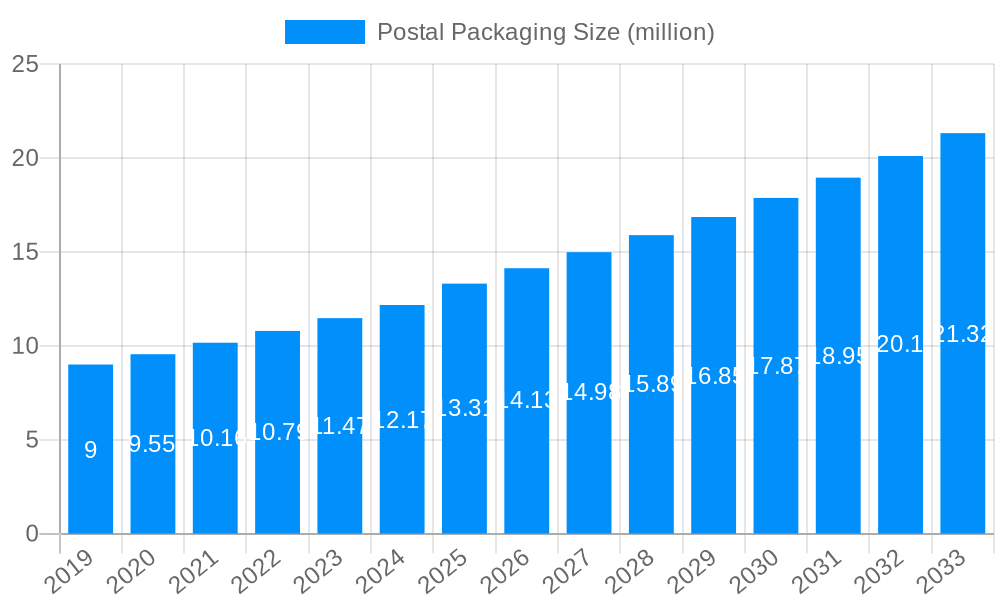

1. What is the projected Compound Annual Growth Rate (CAGR) of the Postal Packaging?

The projected CAGR is approximately 14.81%.

Postal Packaging

Postal PackagingPostal Packaging by Application (Institutional/Commercial, Household), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global Postal Packaging market is poised for robust expansion, projected to reach a valuation of $13.31 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.2% through 2033. This significant growth is primarily fueled by the escalating volume of e-commerce transactions, which necessitate efficient and protective packaging solutions for seamless delivery. The convenience of online shopping, coupled with the increasing global reach of online retailers, has created an insatiable demand for specialized postal packaging. Furthermore, a growing consumer consciousness regarding sustainable packaging alternatives is driving innovation and adoption of eco-friendly materials such as recycled paper, biodegradable plastics, and compostable options. This trend is not only addressing environmental concerns but also appealing to a broader customer base. The market is segmented into two key applications: Institutional/Commercial, catering to businesses and shipping companies, and Household, serving individual consumers.

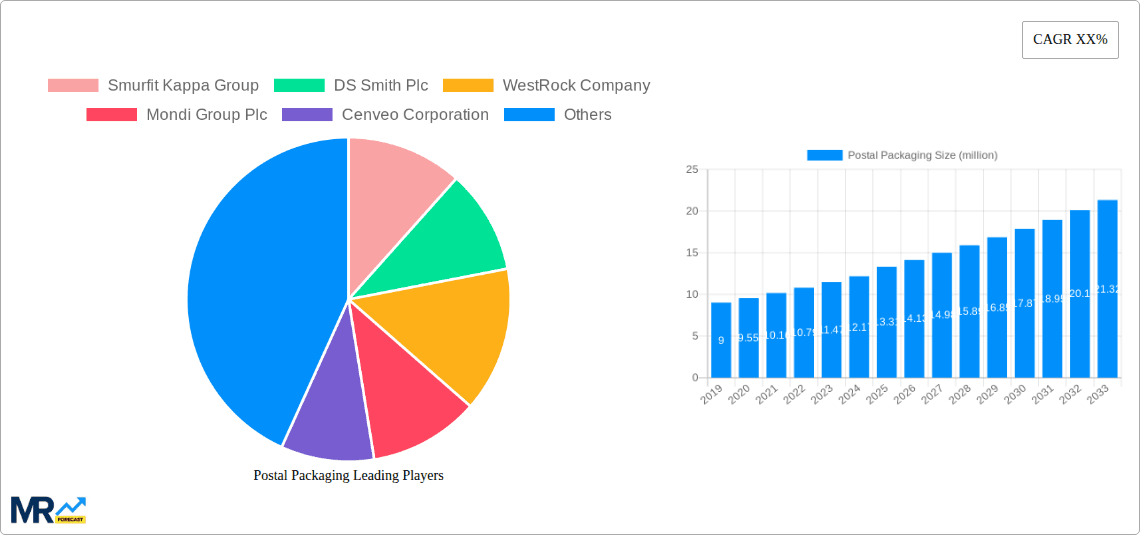

The market's trajectory is further bolstered by technological advancements in packaging design, leading to lighter, more durable, and cost-effective solutions. Innovations in printing technology also enable enhanced branding opportunities for businesses on their postal packaging. However, the industry faces certain restraints, including the fluctuating costs of raw materials, particularly paper pulp and plastics, which can impact profit margins. Supply chain disruptions, as experienced in recent years, also pose a challenge to consistent production and timely delivery. Despite these hurdles, the overarching digital shift and the continuous expansion of global trade networks are expected to sustain the upward momentum of the Postal Packaging market. Key players like Smurfit Kappa Group, DS Smith Plc, and WestRock Company are at the forefront, investing in R&D and strategic expansions to capitalize on these evolving market dynamics and meet the growing demand for effective and sustainable postal packaging solutions.

The global postal packaging market is poised for significant expansion, projected to reach XXX billion by 2033. This robust growth is underpinned by a confluence of evolving consumer behaviors and an accelerating shift towards e-commerce. During the historical period of 2019-2024, the market demonstrated steady resilience, weathering initial economic uncertainties. The base year of 2025 marks a pivotal point, with the estimated market value reflecting a strong foundation for the ensuing forecast period of 2025-2033. Key market insights reveal a pronounced trend towards sustainable and eco-friendly packaging solutions. Consumers are increasingly demanding recyclable, biodegradable, and compostable materials, driving innovation and investment in these areas. This conscious consumerism, coupled with stringent environmental regulations, is reshaping the raw material landscape for postal packaging, favoring paper-based products over plastics. Furthermore, the rise of direct-to-consumer (DTC) models across various industries, from apparel to electronics, necessitates specialized and often customized packaging to enhance unboxing experiences and ensure product integrity during transit. The proliferation of smaller, more frequent shipments is also influencing packaging design, leading to a greater demand for lightweight, modular, and efficiently sized solutions that minimize shipping costs and environmental impact. The integration of smart technologies, such as QR codes and RFID tags, is also gaining traction, offering enhanced traceability, inventory management, and consumer engagement opportunities. As the market matures, a focus on cost-effectiveness without compromising on quality and sustainability will be paramount. The strategic expansion of fulfillment centers and logistics networks, particularly in emerging economies, will further fuel the demand for diverse postal packaging formats. The report will delve deeply into these trends, quantifying their impact and providing granular insights into regional variations and segment-specific evolutions within the XXX billion postal packaging market.

Several powerful forces are collectively propelling the growth of the postal packaging market. Foremost among these is the relentless expansion of e-commerce. The convenience of online shopping has become deeply ingrained in consumer habits globally, leading to a sustained surge in parcel volumes. This necessitates a constant supply of robust, protective, and aesthetically pleasing packaging to facilitate the secure delivery of goods directly to consumers' doorsteps. The ongoing digital transformation across industries further amplifies this trend, as businesses increasingly rely on online channels for sales and distribution. Complementing this is the growing consumer awareness and preference for sustainable packaging. Environmental consciousness is no longer a niche concern; it is a significant purchasing driver. Consumers are actively seeking out brands that utilize eco-friendly materials, pushing manufacturers to innovate with recycled content, biodegradable options, and reduced packaging waste. This demand is further reinforced by government regulations aimed at curbing plastic pollution and promoting circular economy principles, creating a favorable regulatory environment for sustainable postal packaging. Additionally, the rise of the "unboxing experience" has transformed packaging from a mere protective shell into a crucial brand touchpoint. Companies are investing in innovative designs and materials that enhance the perceived value of their products and foster customer loyalty, further stimulating demand for specialized postal packaging solutions.

Despite the robust growth trajectory, the postal packaging market faces several significant challenges and restraints that could temper its expansion. One of the primary hurdles is the escalating cost of raw materials, particularly paper pulp and corrugated board. Fluctuations in commodity prices, coupled with supply chain disruptions, can directly impact production costs and profit margins for packaging manufacturers. This price volatility can also translate to higher costs for end-users, potentially leading them to seek more economical, albeit less sustainable, alternatives. Another critical challenge is the growing pressure to achieve true end-to-end sustainability. While there is a clear demand for eco-friendly packaging, the infrastructure for widespread collection, sorting, and effective recycling of all packaging materials is still developing. Ensuring the recyclability and compostability of all packaging components, and educating consumers on proper disposal methods, remains a complex undertaking. Furthermore, the intense competition within the packaging industry can lead to price wars and squeezed margins, making it difficult for smaller players to compete. Stringent regulations, while driving innovation, can also impose significant compliance costs on businesses. Finally, the inherent need for durability and protection in postal packaging often clashes with the desire for minimal material usage. Balancing these competing requirements to create packaging that is both protective and environmentally responsible, while remaining cost-effective, presents an ongoing challenge.

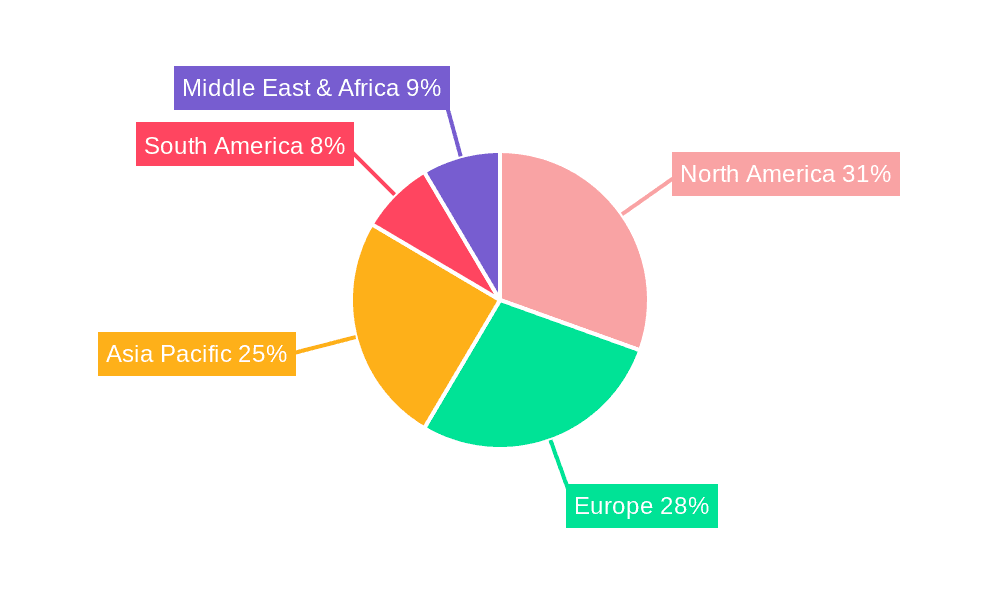

The postal packaging market's dominance is intricately linked to a combination of key regions and specific application segments, with the Institutional/Commercial application poised for substantial growth, particularly within the Asia-Pacific region.

Dominating Segments and Regions:

Institutional/Commercial Application: This segment encompasses a vast array of businesses, including e-commerce retailers, manufacturers, wholesalers, and service providers that rely heavily on shipping goods. The exponential growth of online retail across all product categories, from fast fashion to electronics and pharmaceuticals, directly fuels the demand for postal packaging within this segment. As businesses increasingly adopt direct-to-consumer (DTC) models, the need for secure, branded, and efficient packaging solutions for individual shipments escalates. This segment benefits from the continuous innovation in packaging design to enhance brand visibility, improve the unboxing experience, and ensure product protection during transit. The increasing complexity of supply chains and the global reach of many commercial entities further necessitate specialized packaging that can withstand diverse environmental conditions and handling procedures.

Asia-Pacific Region: This region is anticipated to be the most significant growth engine for the global postal packaging market. Several factors contribute to this dominance:

While Household applications, primarily driven by direct-to-consumer shipments and subscription box services, will also see considerable growth, the sheer volume and commercial impetus within the Institutional/Commercial segment, coupled with the demographic and economic dynamism of the Asia-Pacific region, solidify their positions as the key drivers of market dominance. The synergy between these dominant forces – the continuous demand from businesses and the unparalleled growth of the e-commerce ecosystem in Asia-Pacific – will sculpt the future landscape of the global postal packaging market for the foreseeable future, with the market value escalating significantly in the coming years.

Several potent growth catalysts are fueling the expansion of the postal packaging industry. The unparalleled and sustained growth of e-commerce, with its ever-increasing parcel volumes, remains the primary driver. This is complemented by the growing consumer and regulatory push towards sustainable and eco-friendly packaging solutions, fostering innovation in recyclable, biodegradable, and compostable materials. The rise of the direct-to-consumer (DTC) model across diverse sectors, emphasizing brand experience, also necessitates enhanced and customized packaging. Furthermore, technological advancements in automation and smart packaging, offering improved traceability and efficiency, are creating new opportunities for market growth and differentiation.

This comprehensive report offers an in-depth analysis of the global postal packaging market, providing invaluable insights for stakeholders across the value chain. It meticulously examines market size, historical trends, and future projections, with a projected market value of XXX billion by 2033. The report delves into the key driving forces, such as the relentless growth of e-commerce and the increasing demand for sustainable solutions. Conversely, it also addresses the challenges and restraints, including raw material cost volatility and the complexities of achieving true end-to-end recyclability. A significant portion of the report is dedicated to identifying the key regions and segments poised for market dominance, with a detailed focus on the Institutional/Commercial application and the burgeoning Asia-Pacific region. Furthermore, the report highlights crucial growth catalysts and provides an exhaustive list of leading industry players. Crucially, the report details significant market developments and technological advancements expected to shape the sector's future, offering a forward-looking perspective on innovations and strategic shifts within the postal packaging landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.81% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 14.81%.

Key companies in the market include Smurfit Kappa Group, DS Smith Plc, WestRock Company, Mondi Group Plc, Cenveo Corporation, Rengo Co. Ltd., Neenah, Inc., Bong Group, Papier-Mettler KG, PolyPAK Packaging, United Envelope, Victor Envelope Company, Tampa Envelope Manufacturing Co., Inc, Envelope 1, JBM Company, Royal Envelope, Elite Envelopes & Graphics Inc., WB Packaging Ltd., Poly Postal Packaging Ltd., GWP Group, DuPont.

The market segments include Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Postal Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Postal Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.