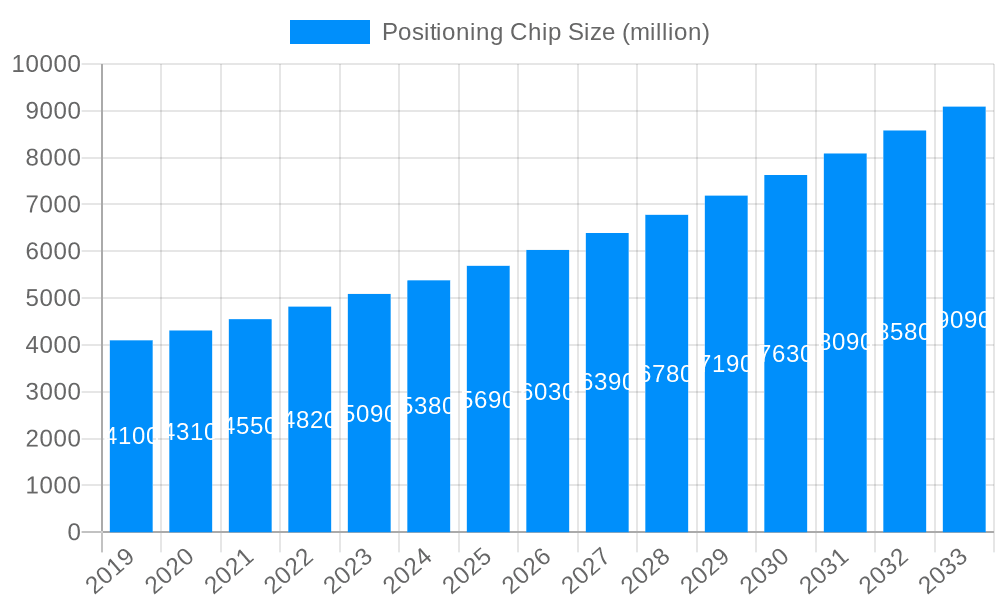

1. What is the projected Compound Annual Growth Rate (CAGR) of the Positioning Chip?

The projected CAGR is approximately 7.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Positioning Chip

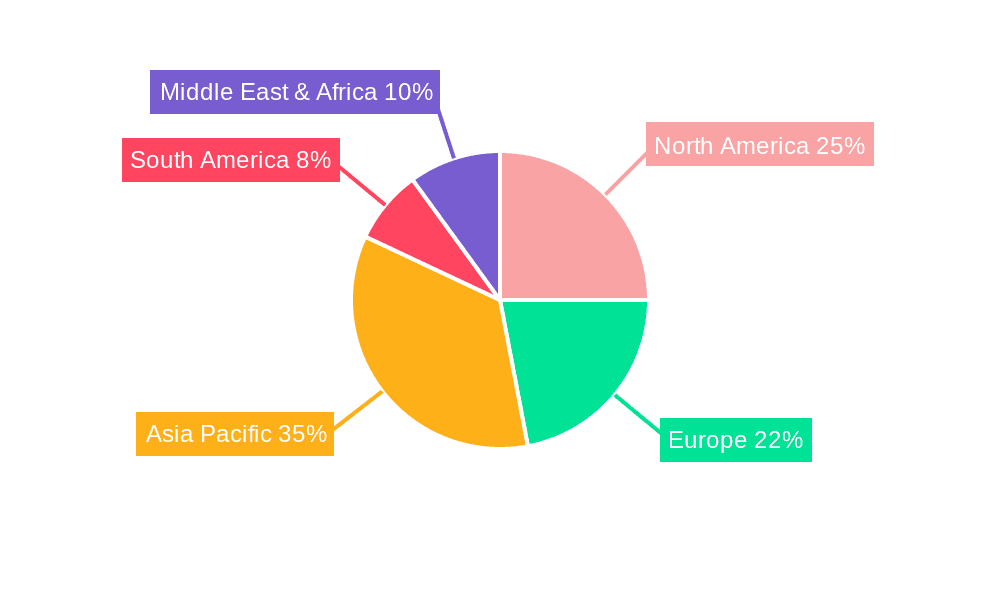

Positioning ChipPositioning Chip by Type (WIFI, Bluetooth, 4G and 5G, UWB, GNSS, Others), by Application (Indoor Positioning, Outdoor Positioning), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global positioning chip market is poised for robust expansion, projected to reach a significant valuation of approximately $6,374 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 7.7% anticipated to persist through 2033. This sustained growth trajectory is primarily fueled by the escalating demand for precise location-based services across a multitude of applications, ranging from autonomous vehicles and advanced navigation systems to the burgeoning Internet of Things (IoT) ecosystem. The proliferation of smartphones, wearables, and smart home devices, all reliant on accurate positioning capabilities, further underscores the market's upward momentum. Furthermore, the increasing adoption of 5G technology is expected to revolutionize positioning accuracy and latency, opening up new frontiers for innovation and market penetration in areas like augmented reality, industrial automation, and enhanced public safety initiatives.

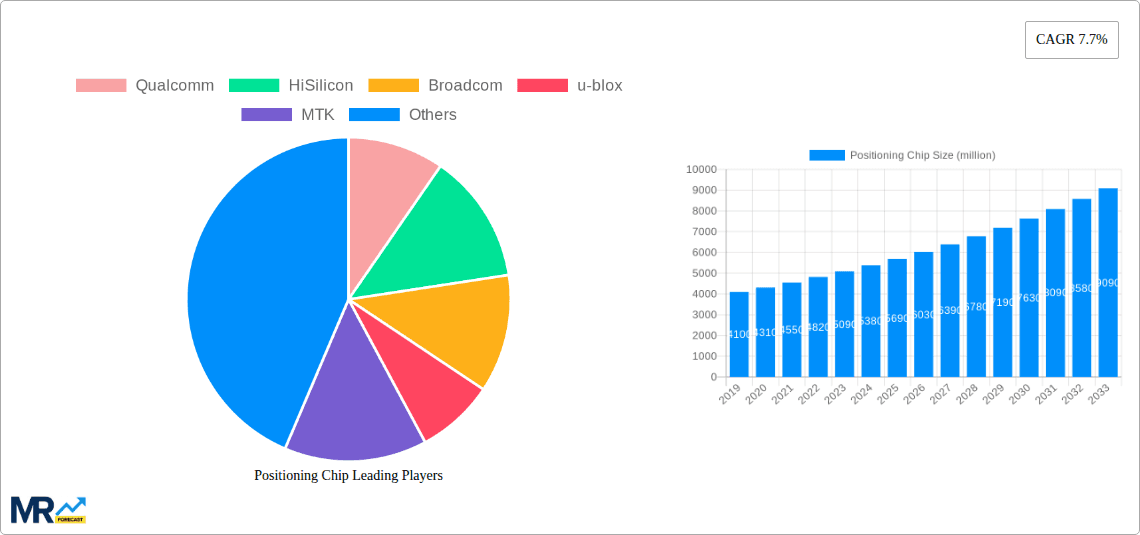

Several key trends are shaping the landscape of the positioning chip market. The integration of multiple positioning technologies, such as Wi-Fi, Bluetooth, 4G, 5G, Ultra-Wideband (UWB), and Global Navigation Satellite Systems (GNSS), within a single chip is becoming a critical differentiator, enabling enhanced accuracy and reliability in diverse environments. The growing emphasis on indoor positioning solutions, driven by applications like retail analytics, asset tracking in warehouses, and smart building management, represents a significant growth segment. Conversely, while the market is experiencing strong tailwinds, certain restraints such as the high cost of R&D for advanced positioning technologies and evolving regulatory frameworks for location data privacy could present moderate challenges. Key players like Qualcomm, Broadcom, and Sony are continuously investing in cutting-edge solutions to capitalize on these evolving market dynamics and maintain a competitive edge in this rapidly advancing sector.

The global positioning chip market is poised for robust expansion, projected to reach a staggering $25,000 million by 2033, exhibiting a compound annual growth rate (CAGR) of 18% from its estimated 2025 valuation of $10,000 million. This remarkable trajectory is underpinned by the escalating integration of location-aware technologies across a myriad of consumer, industrial, and automotive applications. The historical period (2019-2024) has witnessed a foundational growth driven by the widespread adoption of GNSS chips in smartphones and early forays into UWB for proximity sensing. The base year of 2025 marks a critical juncture where nascent technologies like UWB are maturing and gaining traction beyond early adopters, while 5G's positioning capabilities are beginning to be realized.

The forecast period (2025-2033) will be characterized by a significant diversification of positioning technologies. While GNSS will remain a cornerstone for outdoor navigation, its accuracy and reliability will be augmented by sensor fusion techniques and multi-constellation support. The emergence of high-accuracy indoor positioning systems, leveraging a blend of Wi-Fi RTT, Bluetooth AoA/AoD, and UWB, will unlock new application frontiers in retail, logistics, and smart buildings. The increasing demand for precise location data in autonomous vehicles and advanced driver-assistance systems (ADAS) will fuel the development of highly integrated and robust positioning solutions. Furthermore, the proliferation of IoT devices, from smart wearables to industrial sensors, will necessitate low-power, cost-effective positioning chips that can operate reliably in diverse environments. The interplay between these different positioning technologies, creating hybrid solutions for enhanced accuracy and ubiquitous coverage, will define the evolving landscape of the positioning chip market. The market's dynamism is further fueled by ongoing industry developments focused on miniaturization, improved power efficiency, and enhanced security features, ensuring the continued relevance and growth of positioning chips across the global technology ecosystem.

The significant growth in the positioning chip market is being propelled by an confluence of powerful trends. The relentless expansion of the Internet of Things (IoT) ecosystem is a primary driver. As billions of connected devices, ranging from smart home appliances and industrial sensors to agricultural monitors and asset trackers, come online, the need for precise location data becomes paramount for their functionality and management. From optimizing supply chains with real-time asset tracking to enabling smart city initiatives that manage traffic flow and public utilities, location awareness is becoming an intrinsic requirement.

Moreover, the burgeoning automotive sector, particularly the advancements in autonomous driving and connected car technologies, is a colossal catalyst. The safety and efficacy of self-driving vehicles are intrinsically linked to their ability to determine their precise location and navigate complex environments with unparalleled accuracy. This necessitates sophisticated positioning chips that can integrate data from multiple sources, including GNSS, inertial sensors, and even roadside infrastructure, to provide redundancy and enhance reliability. The consumer electronics market also continues to be a strong contributor, with smartphones, smartwatches, and augmented reality (AR)/virtual reality (VR) devices increasingly relying on advanced positioning capabilities for enhanced user experiences, from navigation and fitness tracking to immersive gaming and AR applications. This continuous innovation in end-user devices fuels the demand for smaller, more power-efficient, and more accurate positioning chips.

Despite the promising growth trajectory, the positioning chip market is not without its hurdles. One significant challenge lies in achieving consistent and reliable accuracy, especially in challenging environments. GNSS signals, while robust outdoors, are notoriously susceptible to degradation or complete blockage in urban canyons, dense foliage, and indoor settings. This necessitates the development of hybrid solutions that seamlessly integrate other technologies like Wi-Fi, Bluetooth, and UWB, which presents complexities in terms of chip integration, software development, and power management. The cost factor also plays a crucial role, particularly for mass-market applications and the vast array of low-cost IoT devices. While prices for basic GNSS chips have decreased significantly, advanced solutions incorporating multiple positioning technologies can still be prohibitively expensive for certain segments, hindering wider adoption.

Furthermore, power consumption remains a critical constraint, especially for battery-operated devices and large-scale IoT deployments where frequent charging or battery replacement is impractical. Developing highly energy-efficient positioning chips without compromising accuracy or performance is an ongoing technical challenge. Security and privacy concerns are also gaining prominence. As positioning data becomes more granular and pervasive, ensuring the secure transmission and storage of location information, and preventing unauthorized access or misuse, becomes paramount. Regulatory compliance across different regions regarding data privacy and the use of certain positioning technologies can also introduce complexities and potential restraints for market expansion. The ongoing R&D investment required to overcome these technical and economic barriers can also be a significant restraint for smaller players in the market.

The positioning chip market is witnessing a dynamic interplay of regional dominance and segment evolution, with Asia Pacific emerging as a powerhouse, particularly driven by China's expansive manufacturing ecosystem and burgeoning domestic demand for location-enabled devices. This region is projected to hold a significant market share throughout the study period.

Here are the key regions and segments poised for substantial influence:

Asia Pacific (APAC):

Segment Dominance: GNSS and Wi-Fi/Bluetooth Hybrid Solutions:

The positioning chip industry is fueled by several key growth catalysts. The rapid expansion of the IoT ecosystem, demanding location data for countless connected devices, is a primary driver. Advancements in 5G technology, promising enhanced accuracy and lower latency for location services, are opening new application avenues. The automotive sector's push towards autonomous driving and ADAS necessitates highly precise and reliable positioning solutions. Furthermore, the increasing consumer demand for location-aware applications in smartphones and wearables, coupled with the growing adoption of indoor positioning technologies like UWB and Wi-Fi RTT for improved user experiences, are continuously spurring innovation and market expansion.

This report provides an in-depth analysis of the global positioning chip market, meticulously covering the study period from 2019 to 2033, with the base year at 2025. It delves into the intricate market dynamics, identifying key growth catalysts that are propelling the industry forward. The report offers a detailed examination of the driving forces, such as the burgeoning IoT ecosystem and the rapid advancements in automotive technology, alongside a realistic appraisal of the challenges and restraints that market players may encounter, including accuracy limitations and power consumption concerns. It further highlights the segments and regions expected to dominate the market, providing actionable insights for strategic decision-making. With a comprehensive overview of leading players and significant industry developments, this report is an essential resource for stakeholders seeking to navigate and capitalize on the evolving positioning chip landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.7%.

Key companies in the market include Qualcomm, HiSilicon, Broadcom, u‑blox, MTK, Sony, TI, Nordic, UNISOC, Allystar Technology, Unicore Communications, Goke Microelectronics, Shenzhen Ferry Smart Co.,Ltd, Espressif Systems, Jingwei Technology.

The market segments include Type, Application.

The market size is estimated to be USD 6374 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Positioning Chip," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Positioning Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.