1. What is the projected Compound Annual Growth Rate (CAGR) of the Portable Home Air Purifiers?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Portable Home Air Purifiers

Portable Home Air PurifiersPortable Home Air Purifiers by Type (Less than 20 Sqm, 20-50 Sqm, 50-80 Sqm, Above 80 Sqm, World Portable Home Air Purifiers Production ), by Application (Living Room, Bed Room, Kitchen, Others, World Portable Home Air Purifiers Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

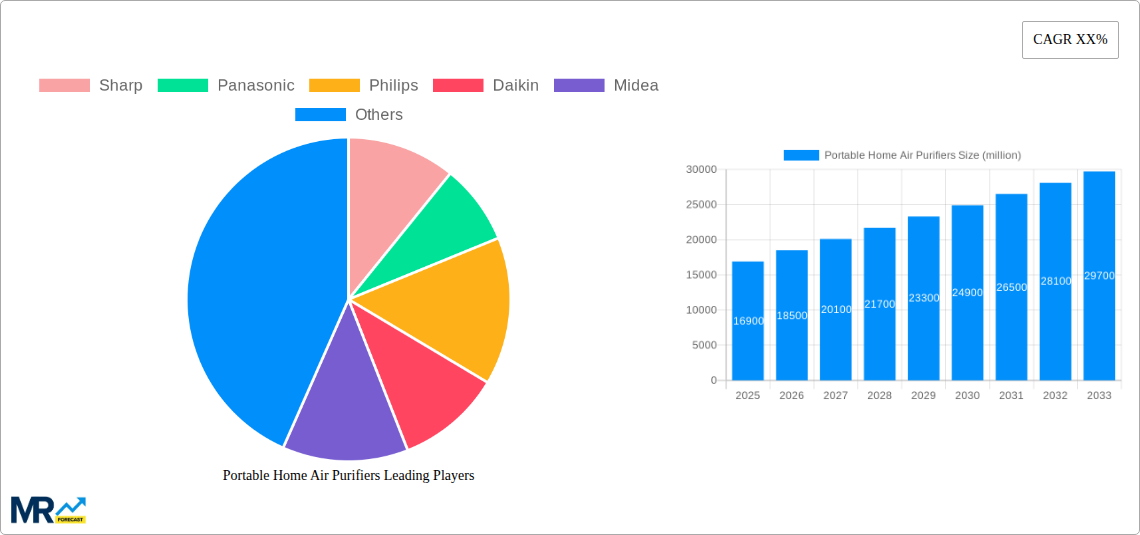

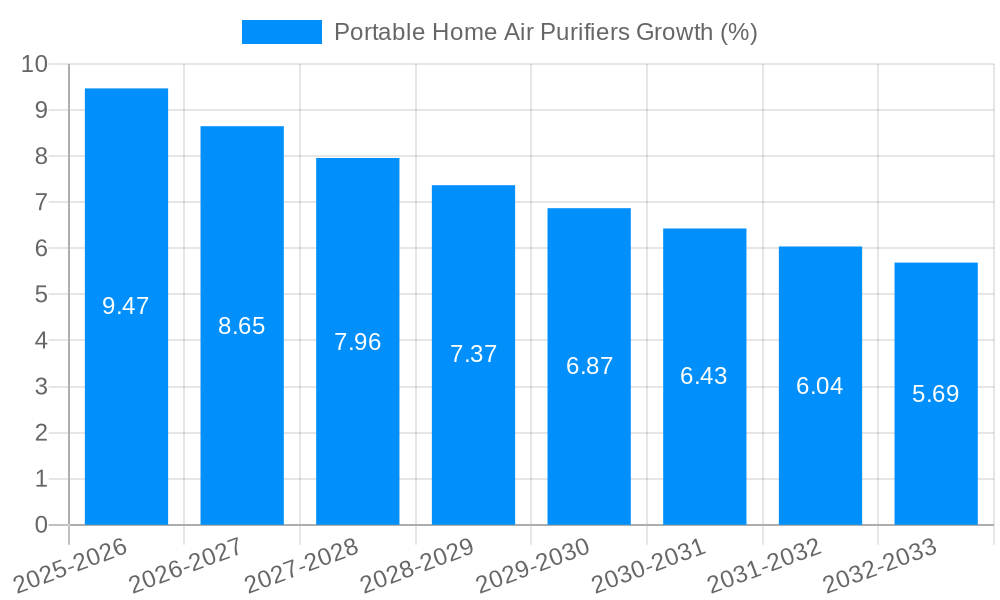

The global portable home air purifier market is poised for significant expansion, with a projected market size of $16,900 million by 2025. Driven by escalating concerns over indoor air quality, rising prevalence of respiratory ailments, and increasing awareness of the health benefits associated with cleaner air, the market is expected to witness robust growth. The increasing urbanization, coupled with a surge in disposable incomes in emerging economies, further fuels the demand for compact and efficient air purification solutions. Technological advancements leading to smarter, more energy-efficient, and aesthetically pleasing designs are also key contributors to market penetration. The rising trend of health and wellness consciousness among consumers globally is a primary driver, prompting individuals to invest in home environments that promote well-being. Furthermore, the growing adoption of smart home ecosystems also presents an opportunity for connected and app-controlled air purifiers, enhancing user convenience and market appeal.

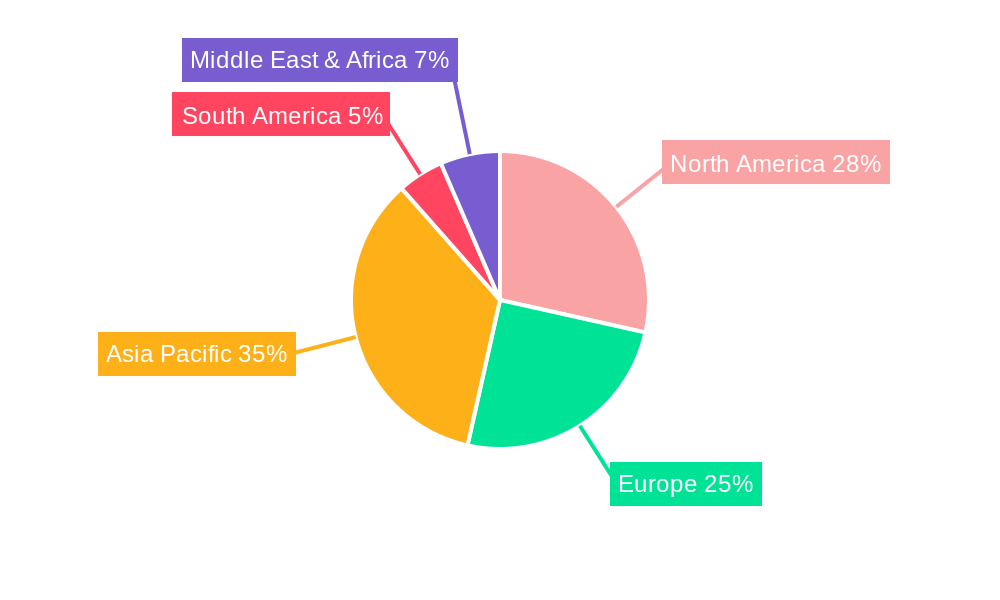

The market is segmented by type, with units below 20 Sqm and those between 20-50 Sqm currently dominating, catering to the needs of individual rooms and smaller living spaces. The application segment is led by living rooms and bedrooms, reflecting the primary areas where consumers seek to improve air quality. Geographically, the Asia Pacific region, particularly China and India, is emerging as a dominant force, driven by rapid industrialization, high population density, and increasing disposable incomes. North America and Europe remain significant markets, characterized by high consumer awareness and stringent air quality regulations. While the market benefits from strong growth drivers, potential restraints include high initial costs of advanced units and fluctuating raw material prices, which could impact affordability. However, the continuous innovation from leading players like Sharp, Panasonic, Philips, and Daikin is expected to mitigate these challenges by introducing a wider range of products to suit diverse consumer needs and budgets.

The global portable home air purifier market is experiencing an unprecedented surge, driven by a confluence of factors that are fundamentally reshaping consumer priorities and technological advancements. Our comprehensive analysis, spanning the historical period of 2019-2024 and projecting through to 2033 with a base year of 2025, reveals a market poised for substantial expansion, with production figures estimated to reach tens of millions of units annually. The primary catalyst for this growth is the escalating awareness surrounding air quality, both indoors and outdoors. Concerns over respiratory illnesses, allergies, and the pervasive impact of pollutants such as PM2.5, VOCs, and allergens are compelling an increasing number of households to invest in air purification solutions. Furthermore, the rise of smart home technology has seamlessly integrated portable air purifiers into the connected living ecosystem, offering enhanced convenience and control through mobile applications and voice commands. This technological convergence not only simplifies user experience but also opens up new avenues for data-driven insights into indoor air quality, fostering proactive health management. The product landscape itself is undergoing a significant evolution, with manufacturers innovating to offer more compact, energy-efficient, and aesthetically pleasing designs that complement modern home décor. The demand for purifiers capable of effectively tackling specific pollutants, such as those exacerbating asthma or allergies, is also on the rise, leading to the development of specialized filtration systems. The "less than 20 Sqm" segment, catering to individual rooms and smaller apartments, has historically held a dominant position due to its affordability and targeted application. However, the trend is shifting towards larger capacity units (20-50 Sqm and 50-80 Sqm) as consumers seek to purify larger living spaces and open-plan homes. The "Living Room" application segment remains a key driver, reflecting the central role these spaces play in family life and the desire for a healthier environment in areas of high occupancy. The increasing urbanization and the associated rise in indoor pollution levels further solidify the long-term growth trajectory of this market, with production expected to climb steadily from tens of millions in the historical period to potentially over 80 million units by 2033.

The robust growth of the portable home air purifier market is underpinned by a powerful confluence of societal, health-related, and technological drivers. Foremost among these is the escalating global concern for indoor air quality, amplified by a heightened understanding of its direct impact on human health. The persistent presence of pollutants like fine particulate matter (PM2.5), volatile organic compounds (VOCs) emitted from household products, and common allergens such as pollen, dust mites, and pet dander are increasingly recognized as significant contributors to respiratory ailments, allergies, and compromised immune systems. This growing health consciousness, particularly among individuals with pre-existing conditions and families with young children, is translating into a tangible demand for effective air purification solutions. Concurrently, the rapid advancement and integration of smart home technology have revolutionized the user experience for portable air purifiers. The ability to monitor, control, and schedule purification cycles remotely via smartphone applications and voice assistants offers unparalleled convenience and personalization. This seamless integration with the broader smart home ecosystem not only enhances user engagement but also provides valuable real-time data on indoor air quality, empowering consumers to make informed decisions about their environment. Furthermore, the product innovation pipeline is a critical driving force. Manufacturers are continuously investing in research and development to create more efficient, quieter, and aesthetically appealing purifiers. This includes the development of advanced multi-stage filtration systems, energy-efficient designs to reduce operational costs, and sleek, unobtrusive aesthetics that blend harmoniously with interior design trends. The growing trend of smaller living spaces and urban density also contributes, as portable units offer a practical and cost-effective solution for improving air quality in confined environments.

Despite the overwhelmingly positive market trajectory, the portable home air purifier sector is not without its hurdles. One significant challenge revolves around consumer education and awareness, particularly in emerging markets. While awareness is growing, a segment of the population may still underestimate the impact of indoor air pollution on their health or perceive air purifiers as a luxury rather than a necessity. Bridging this knowledge gap requires sustained marketing efforts and educational campaigns that highlight the tangible health benefits and long-term cost-effectiveness of investing in air purification. Another restraint lies in the initial cost of purchase and ongoing maintenance expenses. While the market is diversifying to include more affordable options, high-end models with advanced features and multi-stage filtration systems can represent a considerable upfront investment for some households. The recurring cost of replacing filters, which is essential for maintaining optimal performance, also adds to the total cost of ownership and can be a deterrent for budget-conscious consumers. Furthermore, the perceived effectiveness and the actual performance of some portable air purifiers can be a point of contention. Consumers may have unrealistic expectations about the purification capabilities of smaller units or may not fully understand the nuances of CADR (Clean Air Delivery Rate) and room coverage. Misleading marketing claims or a lack of standardized performance metrics can lead to consumer disappointment. Intense competition within the market, with numerous established players and new entrants vying for market share, also presents challenges. This often leads to price wars and pressure on profit margins, necessitating continuous innovation and differentiation to maintain a competitive edge. Lastly, energy consumption is an ongoing consideration. While efforts are being made to develop more energy-efficient models, the continuous operation of air purifiers, especially in larger spaces, can contribute to household electricity bills, which can be a concern in regions with high energy costs.

The global portable home air purifier market is characterized by significant regional variations and segment dominance, with Asia Pacific and the "20-50 Sqm" Type segment poised to lead the charge in the coming years.

Asia Pacific: A Hotbed of Growth

The "20-50 Sqm" Type Segment: The Sweet Spot for Demand

While other regions like North America and Europe are mature markets with a strong existing consumer base and high adoption rates, the sheer demographic growth, rapid industrialization, and increasing health consciousness in Asia Pacific, coupled with the practical utility and balanced offerings of the "20-50 Sqm" segment, position them as the dominant forces in the portable home air purifier market during the study period.

The portable home air purifier industry's growth is significantly catalyzed by the rising global health consciousness, particularly concerning respiratory health and allergies, driven by increasing awareness of indoor air pollutants like PM2.5 and VOCs. The rapid advancement and widespread adoption of smart home technology, enabling remote control and real-time air quality monitoring, are enhancing user convenience and product appeal. Furthermore, continuous innovation in filtration technologies, leading to more efficient, quieter, and energy-saving purifiers, is expanding the market's reach. Government initiatives promoting cleaner air and stricter environmental regulations also play a crucial role in stimulating demand.

This report offers an exhaustive examination of the global portable home air purifier market, providing critical insights for stakeholders. Spanning the historical period of 2019-2024 and projecting through 2033 with 2025 as the base and estimated year, it delves into production volumes, expected to reach tens of millions of units annually by 2033. The analysis encompasses key segments like Type (Less than 20 Sqm to Above 80 Sqm) and Application (Living Room, Bed Room, Kitchen, Others), highlighting market dominance and growth trends. We explore driving forces such as health consciousness and smart technology integration, alongside challenges like cost and consumer education. Furthermore, the report identifies key regions and countries poised for significant market expansion and details vital industry developments and leading manufacturers, offering a complete understanding of the market's present and future landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sharp, Panasonic, Philips, Daikin, Midea, Coway, Smartmi, Electrolux, IQAir, Amway, Whirlpool, Honeywell, Yadu, Samsung, Austin, Blueair, Boneco, Broad, .

The market segments include Type, Application.

The market size is estimated to be USD 16900 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Portable Home Air Purifiers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Portable Home Air Purifiers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.