1. What is the projected Compound Annual Growth Rate (CAGR) of the Polyurethane Foam Catalyst?

The projected CAGR is approximately 4.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Polyurethane Foam Catalyst

Polyurethane Foam CatalystPolyurethane Foam Catalyst by Application (Flexible Polyurethane Foam, Rigid Polyurethane Foam, Semi-rigid Polyurethane Foam), by Type (Reactive Amine Catalysts, Non-reactive Amine Catalysts), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

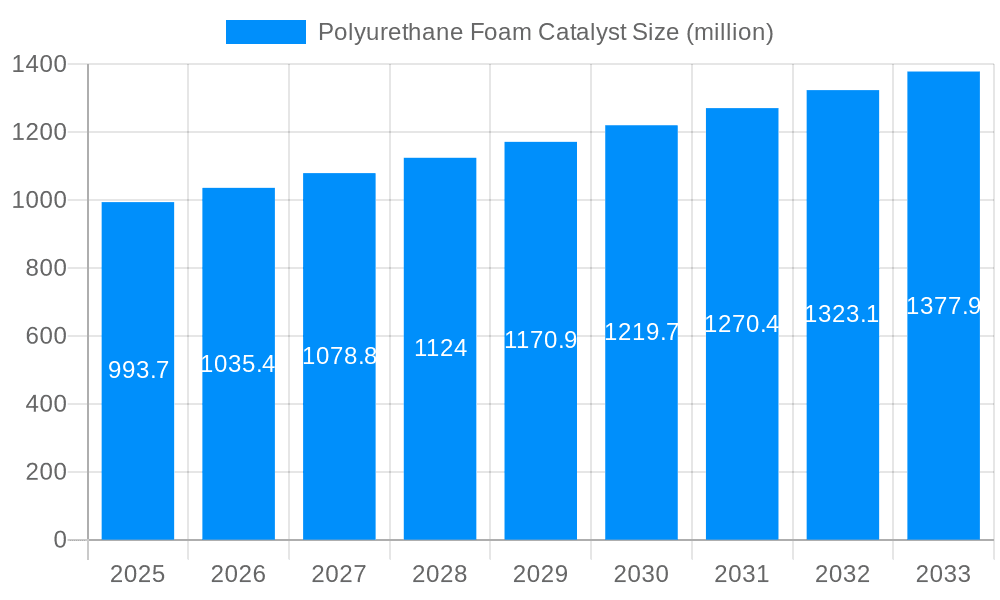

The global Polyurethane Foam Catalyst market is poised for significant expansion, currently valued at approximately $993.7 million in the base year of 2025. This growth is projected to continue at a steady Compound Annual Growth Rate (CAGR) of 4.2% throughout the forecast period from 2025 to 2033. This sustained growth is fueled by the increasing demand for polyurethane foams across a wide spectrum of industries. Flexible polyurethane foams, crucial for applications in furniture, bedding, and automotive seating, are experiencing robust adoption due to rising consumer spending and advancements in comfort technologies. Similarly, the demand for rigid polyurethane foams, vital for insulation in construction and appliances, is being propelled by global initiatives focused on energy efficiency and sustainability. Semi-rigid polyurethane foams, finding use in automotive interiors and sporting goods, also contribute to this upward trajectory. The market's dynamic nature is shaped by key trends such as the development of advanced, low-emission catalysts that meet stringent environmental regulations, and the growing preference for bio-based and recycled polyurethane materials.

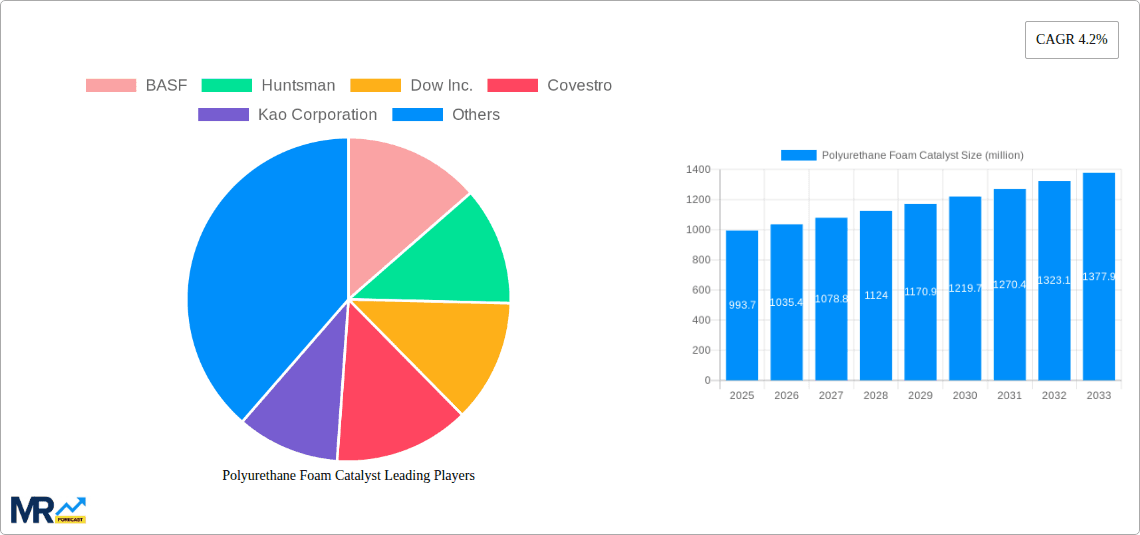

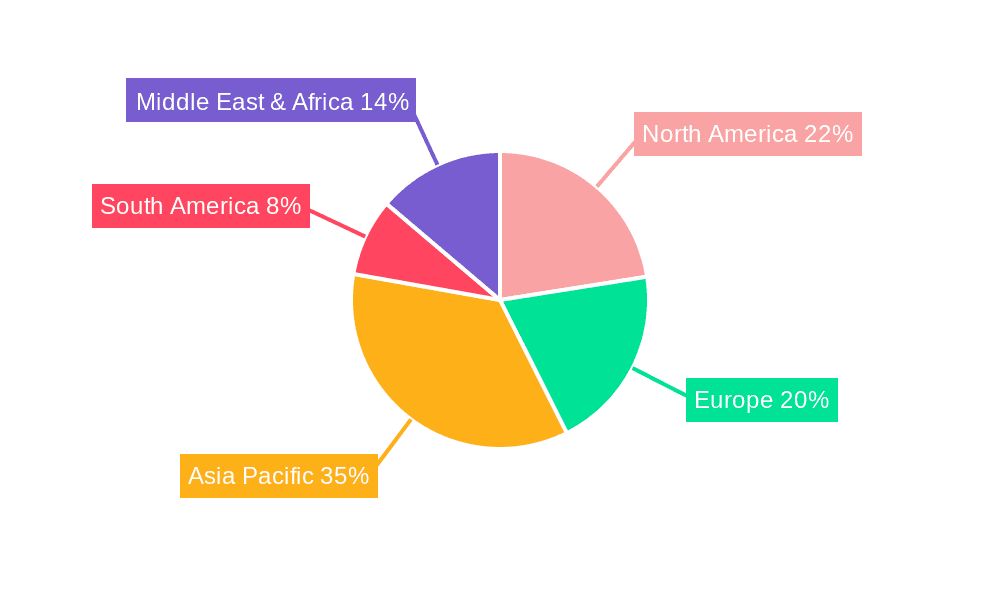

Despite the positive outlook, certain restraints may influence the market's pace. Fluctuations in raw material prices, particularly those linked to petrochemicals, can impact manufacturing costs and ultimately affect pricing strategies. Furthermore, the development and adoption of alternative materials in specific applications, while less prevalent, represent a potential competitive pressure. The market landscape is characterized by the presence of major global players like BASF, Huntsman, Dow Inc., and Covestro, alongside a host of specialized companies, fostering both innovation and competitive pricing. Regionally, Asia Pacific, led by China and India, is expected to be a dominant force, driven by rapid industrialization and a burgeoning manufacturing sector. North America and Europe, with their established automotive and construction industries and a strong focus on eco-friendly solutions, will also remain crucial markets for polyurethane foam catalysts.

The global polyurethane foam catalyst market is poised for significant expansion, with an estimated valuation reaching approximately USD 2.5 million by 2025 and projected to surge to over USD 3.8 million by the end of the forecast period in 2033. This robust growth trajectory is underpinned by a confluence of factors, including increasing demand from burgeoning end-use industries and ongoing technological advancements that enhance catalyst efficiency and sustainability. Over the historical period of 2019-2024, the market demonstrated steady progress, fueled by the widespread adoption of polyurethane foams in diverse applications ranging from insulation in construction and appliances to cushioning in furniture and automotive seating. The base year of 2025 marks a pivotal point, from which the market is expected to accelerate its growth, driven by innovations in catalyst formulations that address environmental concerns and performance requirements.

The study period from 2019 to 2033 encapsulates a dynamic evolution within the polyurethane foam catalyst landscape. Key market insights reveal a discernible shift towards catalysts that offer reduced volatile organic compound (VOC) emissions and improved processing characteristics. Reactive amine catalysts, for instance, are gaining traction due to their ability to be chemically incorporated into the polymer matrix, thereby minimizing their migration and subsequent environmental impact. Non-reactive amine catalysts, while still holding a significant market share, are facing increasing scrutiny and regulatory pressure, prompting manufacturers to develop more environmentally benign alternatives. Furthermore, the market is witnessing a growing emphasis on specialized catalysts tailored for specific foam types, such as those optimized for high-resilience flexible foams or energy-efficient rigid foams. The increasing sophistication of polyurethane foam applications, particularly in areas like lightweight automotive components and advanced insulation systems, necessitates catalysts that provide precise control over reaction kinetics and foam morphology, further stimulating market development. The intricate interplay between application requirements, regulatory landscapes, and technological innovation will continue to shape the trends and growth patterns of the polyurethane foam catalyst market throughout the forecast period.

The polyurethane foam catalyst market is experiencing a vigorous upward momentum driven by several key factors. Foremost among these is the escalating global demand for polyurethane foams themselves. These versatile polymers are integral to a vast array of industries, including construction, automotive, furniture, and appliances. The construction sector, in particular, is a significant consumer, leveraging rigid polyurethane foams for their exceptional insulation properties, which contribute to energy efficiency and reduced carbon footprints. Similarly, the automotive industry's drive towards lighter vehicles to improve fuel economy and reduce emissions translates into increased demand for polyurethane foams in seating, interior components, and structural elements. The furniture and bedding industries also rely heavily on flexible polyurethane foams for comfort and durability. This pervasive demand across multiple, robust sectors directly translates into a higher requirement for the catalysts that enable the efficient and controlled production of these foams.

Moreover, evolving environmental regulations and a growing consumer preference for sustainable products are acting as powerful catalysts for innovation in the polyurethane foam catalyst sector. Manufacturers are increasingly pressured to develop and utilize catalysts that minimize VOC emissions and offer a reduced environmental impact throughout their lifecycle. This has spurred research and development into new catalyst chemistries and formulations, such as low-emission and bio-based catalysts. The pursuit of enhanced performance characteristics in polyurethane foams, including improved mechanical strength, flame retardancy, and acoustic properties, also fuels the demand for advanced catalyst solutions that can precisely control the foaming process. As industries strive for higher performance and greater sustainability, the role of specialized and eco-friendly catalysts becomes paramount, thereby propelling market growth.

Despite the promising growth trajectory, the polyurethane foam catalyst market faces several inherent challenges and restraints that could temper its expansion. One of the most significant hurdles is the increasing stringency of environmental regulations worldwide. Many traditional amine catalysts release VOCs, which are harmful to air quality and human health. As regulatory bodies tighten emission standards, manufacturers are compelled to invest heavily in research and development to create compliant, low-VOC or VOC-free catalysts. This transition can be costly and time-consuming, potentially slowing down the adoption of new catalyst technologies for smaller manufacturers or those with limited R&D budgets. The need to reformulate existing polyurethane systems to accommodate new catalyst types also adds to the complexity and cost of market entry or expansion for end-users.

Furthermore, the volatility of raw material prices, particularly those derived from petrochemicals, poses a continuous challenge. The production of polyurethane foams and their catalysts is intricately linked to the supply and pricing of key feedstocks like isocyanates and polyols. Fluctuations in crude oil prices can directly impact the cost of these raw materials, leading to price instability for catalysts. This uncertainty can make long-term planning difficult for both catalyst manufacturers and foam producers, potentially leading to cautious investment and slower market growth. The highly competitive nature of the market, with numerous established players and emerging regional manufacturers, also exerts downward pressure on profit margins, making it challenging for companies to recoup significant R&D investments. Finally, the technical expertise required for developing and optimizing catalyst systems for specific applications can be a barrier to entry for new players and a constraint for existing ones looking to diversify their product portfolios.

The Rigid Polyurethane Foam segment, particularly within the Asia Pacific region, is expected to be a dominant force in the global polyurethane foam catalyst market. This dominance is driven by a powerful combination of robust industrial growth, increasing demand for energy-efficient solutions, and supportive government initiatives.

In the Asia Pacific region, countries like China, India, and Southeast Asian nations are experiencing unprecedented economic development. This growth translates directly into a booming construction sector, with significant investments in infrastructure, residential buildings, and commercial complexes. Rigid polyurethane foam is a material of choice for insulation in these applications due to its superior thermal performance, lightweight nature, and structural integrity. As a result, the demand for catalysts that facilitate the efficient production of high-quality rigid foams is exceptionally high. The expanding manufacturing base for appliances, such as refrigerators and freezers, further bolsters the demand for rigid polyurethane foam for insulation purposes.

The Rigid Polyurethane Foam segment's dominance is further accentuated by the global emphasis on energy conservation and sustainability. Governments worldwide are implementing stricter building codes and energy efficiency standards, mandating the use of advanced insulation materials. Rigid polyurethane foam, with its excellent R-value, plays a crucial role in meeting these requirements, thereby driving the demand for the catalysts that enable its production. This trend is particularly pronounced in developed economies within Asia Pacific and is rapidly gaining momentum in emerging economies as well.

Within the rigid foam application, the Reactive Amine Catalysts are expected to witness substantial growth and dominance. This is primarily due to their ability to offer enhanced performance characteristics and environmental benefits. Reactive amine catalysts chemically bond with the polyurethane matrix, leading to reduced emissions of volatile organic compounds (VOCs). This characteristic is becoming increasingly critical as regulatory bodies across the globe impose stringent limits on VOC emissions. Furthermore, reactive catalysts often provide better control over the foaming process, leading to more consistent foam density, cell structure, and improved mechanical properties, all of which are desirable in rigid foam applications for insulation and structural purposes. The ability of reactive amine catalysts to offer both performance and environmental compliance makes them the preferred choice for many leading manufacturers of rigid polyurethane foam.

The growth in rigid polyurethane foam applications, driven by energy efficiency mandates and expanding construction activities, coupled with the increasing preference for environmentally responsible reactive amine catalysts, positions both the segment and the region as key dominators of the polyurethane foam catalyst market. The presence of major players like BASF, Huntsman, Dow Inc., Covestro, and Zhejiang Wansheng in the Asia Pacific region further solidifies its leading position in terms of both production and consumption of polyurethane foam catalysts.

Several factors are acting as significant growth catalysts for the polyurethane foam catalyst industry. The increasing global focus on sustainability and energy efficiency is a primary driver, leading to a higher demand for advanced insulation materials like rigid polyurethane foam. As regulations tighten on VOC emissions, there is a burgeoning market for low-emission and environmentally friendly catalysts, stimulating innovation and investment in this area. Furthermore, the expansion of end-use industries, particularly construction and automotive, across emerging economies, fuels the overall demand for polyurethane foams, thereby increasing the consumption of catalysts.

A comprehensive report on the polyurethane foam catalyst market would delve into the intricate details of market dynamics, technological advancements, and future projections. It would analyze the interplay between various catalyst types, such as reactive and non-reactive amine catalysts, and their suitability for different foam applications, including flexible, rigid, and semi-rigid polyurethane foams. The report would meticulously examine the influence of key players like BASF, Huntsman, and Dow Inc. on market trends, alongside emerging regional manufacturers. Moreover, it would provide in-depth insights into the historical performance from 2019-2024 and forecast future growth to 2033, with a base year estimation of 2025, offering a thorough understanding of market opportunities and challenges.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.2%.

Key companies in the market include BASF, Huntsman, Dow Inc., Covestro, Kao Corporation, Umicore N.V, Momentive, Evonik, Tosoh, LANXESS, Air Products, King Industries, Shepherd Chemical Company, Zhejiang Wansheng, Dajiang Chemical, .

The market segments include Application, Type.

The market size is estimated to be USD 993.7 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Polyurethane Foam Catalyst," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Polyurethane Foam Catalyst, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.