1. What is the projected Compound Annual Growth Rate (CAGR) of the Polypropylene Corrugated Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Polypropylene Corrugated Packaging

Polypropylene Corrugated PackagingPolypropylene Corrugated Packaging by Type (Boxes, Shelf Bins, Trays, Others, World Polypropylene Corrugated Packaging Production ), by Application (Food & Beverages, Automotive, Pharmaceutical, Cosmetics & Personal Care, Household, Electronics & Electricals, Others, World Polypropylene Corrugated Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

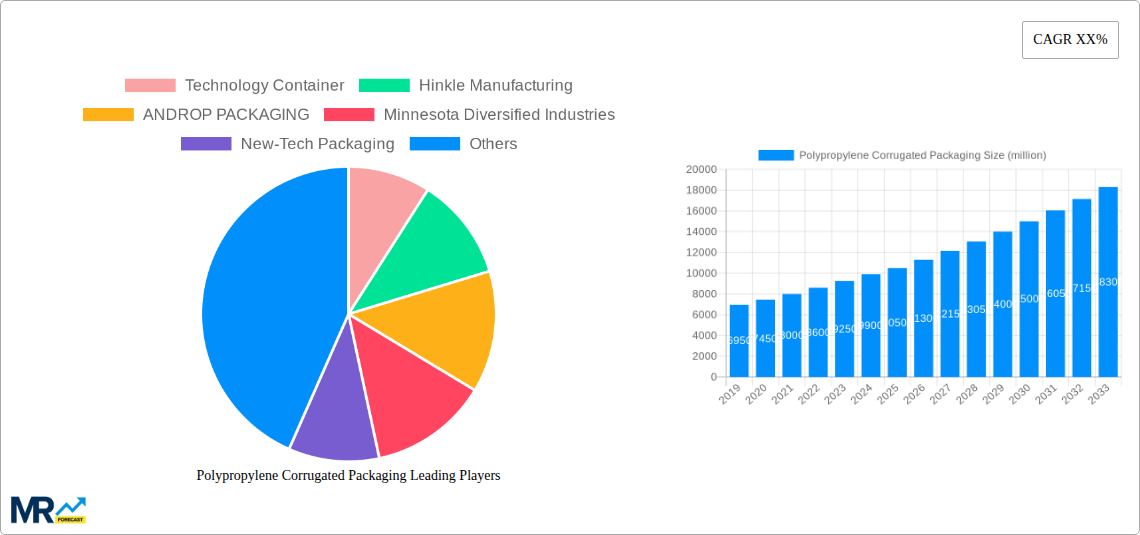

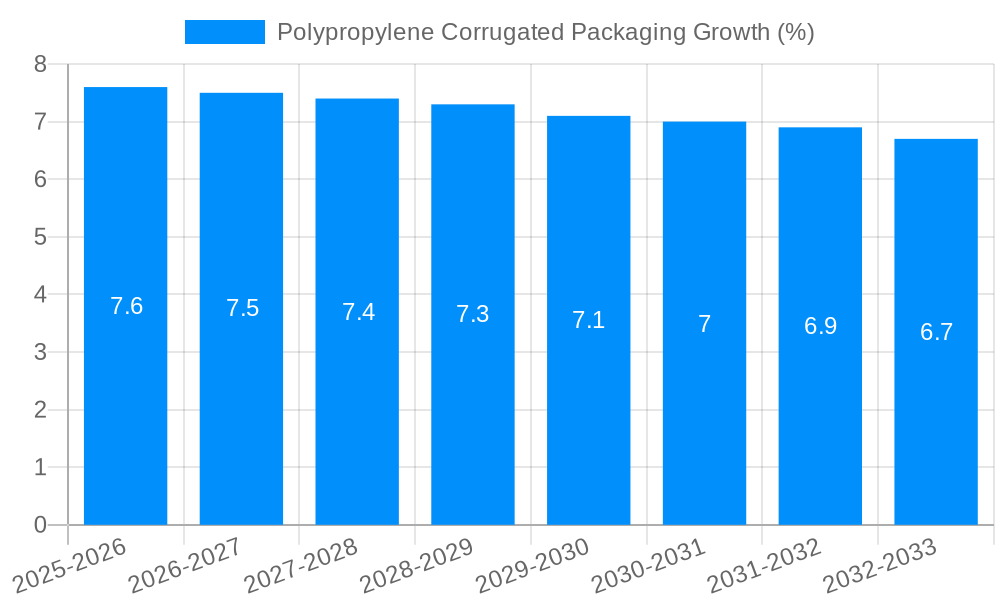

The global polypropylene corrugated packaging market is experiencing robust growth, poised to reach an estimated market size of USD 10,500 million in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This expansion is primarily fueled by the inherent advantages of polypropylene corrugated packaging, including its lightweight nature, durability, moisture resistance, and recyclability, making it an increasingly attractive alternative to traditional materials like cardboard and wood. Key drivers include the burgeoning e-commerce sector, which demands efficient and protective packaging solutions for a vast array of products, and the growing emphasis on sustainable packaging practices across industries. Furthermore, the pharmaceutical and food & beverage sectors are significant contributors, leveraging the hygienic and protective qualities of polypropylene corrugated packaging for sensitive goods. The "Others" segment for both Type and Application, encompassing emerging uses and niche markets, is also expected to witness considerable growth, indicating innovation and diversification within the industry.

The market is characterized by several significant trends. The increasing adoption of advanced manufacturing techniques for polypropylene corrugated packaging, leading to customized solutions and enhanced product performance, is a notable trend. Furthermore, a growing preference for reusable and returnable packaging solutions, driven by environmental regulations and corporate sustainability initiatives, is shaping market dynamics. However, the market also faces certain restraints. Fluctuations in the price of raw materials, specifically polypropylene resin, can impact production costs and profitability. Additionally, while sustainable, the initial investment in specialized manufacturing equipment for polypropylene corrugated packaging can be a barrier for some smaller players. The competitive landscape is dynamic, with established players like Technology Container, Hinkle Manufacturing, and ANDROP PACKAGING vying for market share alongside emerging companies, all focusing on product innovation and expanding their geographical reach to capitalize on regional demand, particularly in the high-growth Asia Pacific region.

This comprehensive report delves into the dynamic world of Polypropylene Corrugated Packaging, offering an in-depth analysis of market trends, growth drivers, challenges, and future projections. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, and a detailed forecast period from 2025 to 2033, this report leverages historical data from 2019-2024 to provide a robust understanding of market evolution. The report aims to equip stakeholders with critical insights into the global production, segmentation by type and application, and key industry developments within this rapidly expanding sector.

The global Polypropylene Corrugated Packaging market is experiencing a significant surge, projected to reach an impressive figure in the millions of units by 2025 and continue its upward trajectory through 2033. This growth is underpinned by a confluence of factors, primarily the increasing demand for sustainable and durable packaging solutions across a multitude of industries. Polypropylene corrugated sheets, with their inherent strength, lightweight nature, and resistance to moisture and chemicals, are proving to be a superior alternative to traditional cardboard and paper-based packaging. The emphasis on reducing environmental impact is a paramount trend, pushing manufacturers to adopt materials that are not only recyclable but also offer extended reusability. This aligns perfectly with the properties of polypropylene, which can be recycled multiple times without significant degradation in quality. Furthermore, the versatility of polypropylene corrugated packaging allows for customization in terms of size, shape, and printing, making it an attractive option for branding and product differentiation. The "Others" category within packaging types, encompassing specialized inserts, protective layering, and custom-designed solutions, is also showing robust growth as businesses seek tailored packaging to meet unique logistical and product protection needs. The millions of units being produced annually reflect this widespread adoption, driven by a conscious shift towards more efficient and eco-friendly packaging. The evolving e-commerce landscape further fuels this demand, necessitating robust and resilient packaging capable of withstanding the rigors of shipping and handling, a role polypropylene corrugated packaging excels in. Innovations in manufacturing processes are also contributing to the trend, enabling higher production volumes and cost efficiencies, which in turn makes polypropylene corrugated packaging more accessible to a broader market. The ability to create lightweight yet strong containers is also a key factor in reducing transportation costs and carbon footprints, a growing concern for global supply chains. The report will meticulously analyze these prevailing trends, providing quantitative data and qualitative insights into the market's future direction, with projections for millions of units reflecting the scale of this expansion. The growing awareness among consumers and businesses alike regarding the lifecycle impact of packaging materials is a significant behavioral shift that directly benefits polypropylene corrugated packaging. This proactive approach to material selection is not merely a fad but a fundamental change in how packaging is perceived and utilized in the modern economy. The report will quantify this impact with detailed projections.

Several powerful forces are propelling the growth of the Polypropylene Corrugated Packaging market, driving its expansion beyond the millions of units already in circulation. At the forefront is the escalating global emphasis on sustainability and environmental responsibility. Governments, regulatory bodies, and consumers are increasingly demanding packaging solutions that minimize environmental impact, and polypropylene corrugated packaging, with its recyclability and reusability, fits this demand perfectly. Its lightweight nature significantly reduces transportation costs and associated carbon emissions, making it an attractive choice for logistics-intensive industries. The inherent durability and resistance to moisture, chemicals, and impact offer superior product protection compared to traditional materials, leading to reduced product damage and waste, which indirectly contributes to sustainability goals and cost savings for businesses. This enhanced product protection is particularly crucial in sectors like Food & Beverages and Pharmaceuticals, where integrity and safety are paramount. The versatility of polypropylene corrugated packaging, allowing for custom designs, printing, and various forms such as Boxes, Shelf Bins, and Trays, caters to the diverse needs of different industries and applications, fostering its widespread adoption. The burgeoning e-commerce sector, with its ever-increasing volumes of shipped goods, necessitates packaging that is robust enough to withstand transit. Polypropylene corrugated packaging's strength-to-weight ratio makes it an ideal solution for online retailers looking to ensure their products reach customers in pristine condition. Furthermore, technological advancements in manufacturing have led to more efficient production processes, lowering costs and increasing availability, making this packaging solution more accessible to a wider range of businesses, further pushing the millions of units produced higher. The increasing disposable incomes in emerging economies are also contributing to higher consumption across various sectors, indirectly boosting the demand for packaging materials.

Despite its impressive growth trajectory, the Polypropylene Corrugated Packaging market faces several challenges and restraints that could temper its expansion beyond the current millions of units. One of the primary hurdles is the relatively higher initial cost of polypropylene corrugated sheets compared to conventional cardboard or paper-based packaging. While its reusability and durability offer long-term cost savings, the upfront investment can be a deterrent for small and medium-sized enterprises (SMEs) with tighter budgets. The perceived complexity of recycling processes for polypropylene, though improving, can also be a concern for some waste management infrastructures. Establishing robust collection and reprocessing systems on a global scale requires significant investment and coordination. Moreover, certain niche applications may still require specialized barrier properties or specific aesthetic qualities that traditional materials might offer more readily or cost-effectively. While polypropylene can be treated or modified, this can add to its overall cost and complexity. Competition from other emerging sustainable packaging materials, such as biodegradable plastics or advanced fiber-based solutions, also poses a potential restraint. As these alternatives mature, they may offer compelling propositions for specific market segments. Fluctuations in the price of raw materials, particularly crude oil, which is a primary feedstock for polypropylene, can impact production costs and ultimately the pricing of the finished packaging. This price volatility can create uncertainty for manufacturers and end-users, potentially slowing down adoption rates. The limited availability of specialized machinery for processing corrugated polypropylene in certain regions could also act as a bottleneck for widespread market penetration, despite the overall demand in millions of units. Furthermore, consumer perception and awareness regarding the recyclability and environmental benefits of polypropylene corrugated packaging are not uniform across all markets, requiring ongoing educational efforts to fully realize its potential.

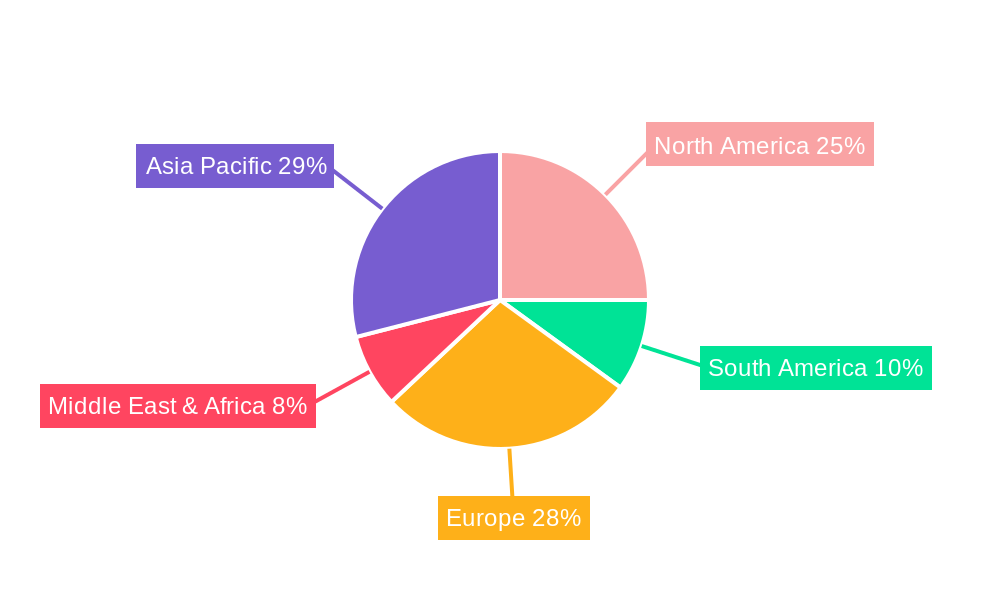

The global Polypropylene Corrugated Packaging market, already a significant player measured in millions of units, is poised for dominance by specific regions and product segments due to a unique interplay of economic, environmental, and industrial factors.

Dominant Regions/Countries:

Asia-Pacific: This region is expected to lead the market in terms of production and consumption.

North America: The mature markets of the United States and Canada exhibit strong demand driven by a well-established industrial infrastructure and a high level of environmental consciousness.

Europe: Characterized by stringent environmental regulations and a strong commitment to circular economy principles, Europe is another critical region.

Dominant Segments:

Type: Boxes: This segment is projected to hold the largest market share and exhibit significant growth.

Application: Food & Beverages: This sector represents a major application area for polypropylene corrugated packaging.

Application: Automotive: The automotive sector is a significant consumer of polypropylene corrugated packaging.

The Polypropylene Corrugated Packaging industry is propelled by several key growth catalysts. The escalating global focus on sustainability and the circular economy is paramount, driving demand for recyclable and reusable packaging solutions. Polypropylene's inherent durability, moisture resistance, and lightweight nature translate into reduced product damage and lower transportation costs, enhancing operational efficiency for businesses. The expanding e-commerce sector, necessitating robust packaging for transit, further fuels adoption. Moreover, ongoing technological advancements in manufacturing are leading to improved production efficiency and cost-effectiveness, making this packaging option more accessible. The increasing demand from diverse end-use industries like Food & Beverages and Automotive, seeking reliable and protective packaging, also acts as a significant growth catalyst, contributing to the millions of units produced annually.

This report offers a comprehensive examination of the Polypropylene Corrugated Packaging market, meticulously analyzing the global production of millions of units and forecasting its trajectory through 2033. It delves into market segmentation by type (Boxes, Shelf Bins, Trays, Others) and application (Food & Beverages, Automotive, Pharmaceutical, Cosmetics & Personal Care, Household, Electronics & Electricals, Others). The report meticulously outlines the key trends shaping the industry, identifies the primary growth catalysts, and critically assesses the challenges and restraints that influence market dynamics. Furthermore, it highlights significant industry developments and provides an exhaustive list of leading players. This detailed coverage ensures stakeholders gain a profound understanding of the market's current state and future potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Technology Container, Hinkle Manufacturing, ANDROP PACKAGING, Minnesota Diversified Industries, New-Tech Packaging, GWP Correx, Amatech, CoolSeal USA, Kiva Container, Caprihans India, CLPG Packaging Industries, Classic Enterprises, Shish Industries.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Polypropylene Corrugated Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Polypropylene Corrugated Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.