1. What is the projected Compound Annual Growth Rate (CAGR) of the Polypropylene Additives?

The projected CAGR is approximately 7.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Polypropylene Additives

Polypropylene AdditivesPolypropylene Additives by Type (Antioxidants, UV Stabilizers, Thermal Stabilizers, Lubricants, Plasticizers, Flame Retardants, Others, World Polypropylene Additives Production ), by Application (Automotive, Coating, Packing, Textile and Fibers, Others, World Polypropylene Additives Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

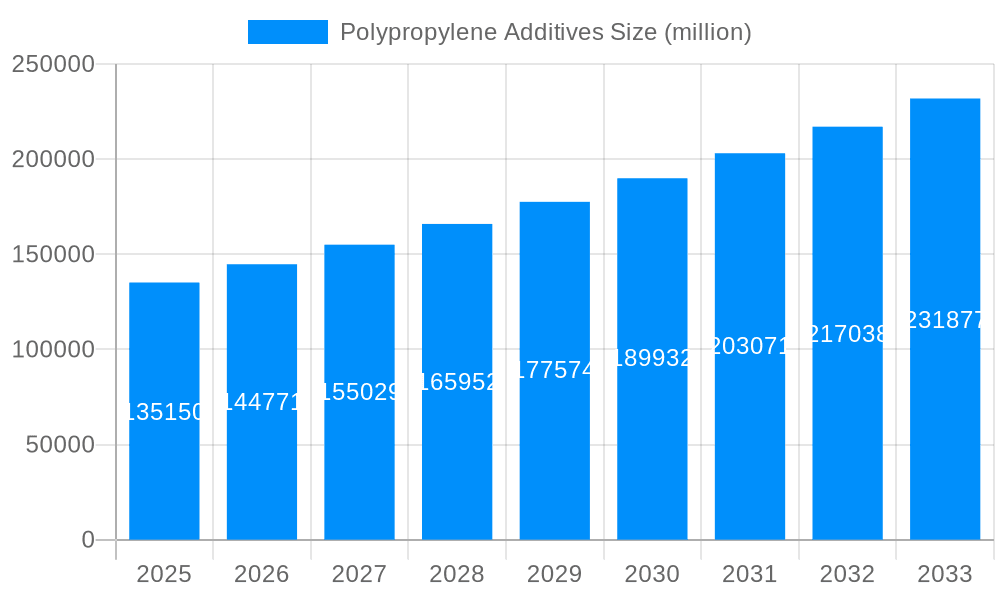

The global polypropylene (PP) additives market is poised for substantial growth, projected to reach an estimated $135.15 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.1% during the forecast period of 2025-2033. This robust expansion is primarily fueled by the escalating demand for enhanced polypropylene properties across diverse industrial applications. Key market drivers include the automotive sector's increasing reliance on lightweight yet durable plastics, the packaging industry's continuous innovation for improved product protection and shelf-life, and the textile and fibers industry's growing use of PP for its versatility and cost-effectiveness. Furthermore, advancements in additive formulations, offering superior UV stabilization, thermal resistance, and flame retardancy, are instrumental in meeting stringent regulatory requirements and performance expectations.

The market is segmented by type, with Antioxidants, UV Stabilizers, and Thermal Stabilizers emerging as critical components for extending the lifespan and enhancing the performance of PP. Lubricants and Plasticizers also play a significant role in improving processability and flexibility. Flame Retardants are gaining prominence due to safety regulations in construction and electronics. Geographically, Asia Pacific, led by China and India, is expected to dominate the market, driven by rapid industrialization and a burgeoning manufacturing base. North America and Europe remain significant markets, with a strong emphasis on high-performance and sustainable additive solutions. While the market offers significant opportunities, potential restraints include fluctuating raw material prices and the growing environmental concerns surrounding certain additive chemistries, prompting a shift towards more sustainable and eco-friendly alternatives.

Here is a unique report description on Polypropylene Additives, incorporating the requested elements:

This comprehensive report delves into the dynamic and expansive global Polypropylene Additives market, a sector projected to command billions of dollars in value. Spanning a critical study period from 2019 to 2033, with a focused examination on the Base and Estimated Year of 2025, and a detailed Forecast Period from 2025 to 2033, this analysis provides an in-depth understanding of market intricacies. We trace the historical trajectory from 2019 to 2024, identifying nascent trends and established patterns that shape this vital industry. Our exploration encompasses a granular breakdown of additive types including Antioxidants, UV Stabilizers, Thermal Stabilizers, Lubricants, Plasticizers, Flame Retardants, and 'Others', while also dissecting the immense World Polypropylene Additives Production and its intricate relation to key application segments such as Automotive, Coating, Packing, Textile and Fibers, and 'Others'. The report further scrutinizes industry-wide developments, offering a forward-looking perspective on opportunities and challenges.

The global Polypropylene Additives market is poised for significant expansion, projected to reach a valuation in the hundreds of billions of dollars by the forecast period's end. This growth is underpinned by an escalating demand for enhanced polypropylene (PP) performance across a multitude of applications, driven by evolving consumer preferences and stringent regulatory landscapes. During the study period of 2019-2033, particularly focusing on the estimated year of 2025 and extending through 2033, key trends indicate a shift towards high-performance additives that deliver superior protection and functionality to PP. Antioxidants, for instance, continue to be a cornerstone, with an increasing emphasis on synergistic blends that offer extended service life and prevent degradation in demanding environments, anticipating a market share in the tens of billions. UV stabilizers are also experiencing robust growth, fueled by the rising use of PP in outdoor applications such as automotive components and construction materials, where resistance to photodegradation is paramount. Thermal stabilizers are crucial for high-temperature processing and end-use applications, and their demand is expected to mirror the growth in industries like electronics and industrial manufacturing, contributing billions to the market. Lubricants and processing aids are essential for optimizing manufacturing efficiency and reducing energy consumption, a growing concern in the face of rising operational costs, securing a significant market segment in the billions. Plasticizers, though traditionally associated with PVC, are finding niche applications in flexible PP formulations, while flame retardants are experiencing renewed interest due to stricter safety regulations in consumer goods and building materials, both contributing billions. The "Others" category, encompassing a wide array of specialty additives, is likely to witness innovation-driven growth, as manufacturers seek tailored solutions for specific performance requirements. World Polypropylene Additives Production, an integral component of this market, is expected to see a steady increase in capacity and technological advancement to meet this burgeoning demand. The interplay between these additive types and their application in sectors like Packing (expected to represent a substantial portion of the market in the hundreds of billions), Automotive (also in the hundreds of billions), and Textile and Fibers (in the tens of billions) highlights the pervasive influence of polypropylene additives.

The Polypropylene Additives market is experiencing a powerful surge driven by several interconnected factors, collectively propelling its growth into the hundreds of billions of dollars over the study period of 2019-2033, with a strong emphasis on the 2025 base year and subsequent forecast. Foremost among these drivers is the intrinsic versatility and cost-effectiveness of polypropylene itself. As a lightweight, durable, and easily processable polymer, PP is increasingly substituting traditional materials like metal, glass, and wood across a vast spectrum of industries. This substitution trend, particularly in high-volume sectors like automotive and packaging, directly translates into a heightened demand for additives that can further enhance PP's performance to meet specific application requirements. For instance, the automotive industry's relentless pursuit of lightweighting to improve fuel efficiency and reduce emissions creates a significant need for PP components fortified with UV stabilizers for exterior parts and flame retardants for interior applications, contributing to market segments in the tens to hundreds of billions. Similarly, the burgeoning e-commerce and global trade landscape fuels the demand for robust and protective packaging solutions, where additives play a critical role in preserving product integrity during transit and storage, a sector representing hundreds of billions in potential market value. Furthermore, evolving consumer expectations for durability, aesthetic appeal, and safety are compelling manufacturers to invest in higher-performing PP grades. This necessitates the integration of advanced additives like scratch-resistant lubricants, UV absorbers for color retention, and flame retardants for enhanced fire safety, all contributing to the market's multi-billion dollar valuation. The World Polypropylene Additives Production is directly influenced by these end-user demands, with manufacturers striving to innovate and scale up production to meet the ever-growing needs of these dynamic sectors.

Despite the robust growth trajectory, the Polypropylene Additives market, projected to be worth hundreds of billions by 2033, faces several significant challenges and restraints that could temper its expansion. A primary concern revolves around the increasing scrutiny and regulation of certain chemical compounds used as additives. Environmental and health concerns associated with some traditional additives, such as certain types of plasticizers and flame retardants, are leading to stricter governmental policies and a growing preference for greener, bio-based, or less toxic alternatives. This necessitates substantial investment in research and development for new additive formulations, potentially impacting profitability and market entry for smaller players. The volatile pricing of raw materials, particularly petrochemical feedstocks, also poses a considerable challenge. Fluctuations in crude oil prices directly impact the cost of producing polypropylene and its associated additives, leading to price volatility in the final product and potentially hindering demand in price-sensitive applications. This can directly affect the market value, which is in the hundreds of billions, by introducing unpredictability. Furthermore, the complex and often fragmented supply chain for some specialty additives can lead to supply disruptions and extended lead times, impacting production schedules for end-users and potentially driving them to seek alternative materials or suppliers. The need for specialized knowledge and handling for certain advanced additives can also act as a barrier to widespread adoption, particularly in developing regions. The sheer scale of World Polypropylene Additives Production requires sophisticated logistics and quality control, which can be hampered by these challenges. Moreover, the ongoing development of alternative polymer materials or advancements in existing ones that reduce the need for certain additives could also present a long-term restraint. The successful navigation of these challenges will be crucial for sustained growth in this multi-billion dollar sector.

The global Polypropylene Additives market, a significant sector with projected values in the hundreds of billions of dollars by 2033, exhibits regional dominance and segment leadership driven by distinct industrial landscapes and regulatory frameworks.

Dominant Region/Country:

Dominant Segment (Type): Antioxidants

Within the diverse landscape of polypropylene additives, Antioxidants are projected to maintain their position as the dominant segment by value and volume, contributing a substantial portion of the hundreds of billions of dollars market. Their pervasive use across nearly all polypropylene applications makes them indispensable.

The Polypropylene Additives industry is fueled by several potent growth catalysts that promise sustained expansion into the hundreds of billions over the forecast period. The relentless drive towards lightweighting in the automotive sector, pushing for greater fuel efficiency and reduced emissions, directly translates into increased demand for high-performance polypropylene components, necessitating advanced additives like UV stabilizers and flame retardants. Furthermore, the burgeoning e-commerce and global logistics networks are amplifying the need for robust and protective packaging solutions, where additives are crucial for maintaining product integrity and extending shelf life. The increasing focus on sustainability and the circular economy is also a significant catalyst, driving the development and adoption of bio-based and recycled PP-compatible additives. As regulations concerning plastic usage and end-of-life management tighten, the demand for additives that enhance the recyclability and biodegradability of polypropylene will surge. The World Polypropylene Additives Production is expected to align with these trends, with manufacturers investing in capacity and innovation to cater to these evolving market dynamics.

This report offers unparalleled coverage of the Polypropylene Additives market, providing a deep dive into its complex ecosystem, valued in the hundreds of billions of dollars. We meticulously analyze the interplay of various additive types – Antioxidants, UV Stabilizers, Thermal Stabilizers, Lubricants, Plasticizers, Flame Retardants, and Others – and their impact on the World Polypropylene Additives Production. The report dissects key application segments including Automotive, Coating, Packing, and Textile and Fibers, detailing how additive technologies are shaping product performance and market demand. Our forward-looking analysis, spanning the Study Period (2019-2033) with a Base and Estimated Year of 2025 and a Forecast Period (2025-2033), identifies emerging trends, growth catalysts, and potential restraints. Industry developments, from technological breakthroughs to regulatory shifts, are comprehensively documented, offering a strategic roadmap for stakeholders. This report is an indispensable resource for manufacturers, suppliers, researchers, and investors seeking to navigate and capitalize on the dynamic opportunities within this multi-billion dollar global industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.1%.

Key companies in the market include BASF, Clariant, ADEKA, Cytec Industries, DuPont, AkzoNobel, Ferro Corporation, Croda, 3M, TCI Chemicals, Evonik, GreenMantra Technologies, Imerys, W.R. Grace, PolyOne, Ampacet, Tosaf, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Polypropylene Additives," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Polypropylene Additives, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.